Disney In 2024: Same Questions, More Urgency For Bob Iger And Team [Parrot Analytics]

When assessing the state of Disney in February 2023, Parrot Analytics wrote the following:

- “Some of the questions facing this century-old institution include: whether to shutter linear channels, whether to license content to competitors to juice revenue, where to debut animated movies, what happens to ESPN, and what to do about Hulu. To mention nothing of certain activist investor demands. ”

The more things change…

In February 2024 the same outstanding questions largely linger for Disney and CEO Bob Iger, whose triumphant return 14 months ago is now an all too distant memory.

On the bright side, until a merger of competitors happens, Disney will remain the market leader in corporate demand share — a proxy for both long-term streaming success, and short-term licensing revenue potential.

Disney has the fundamental scale and content demand to handle the coming years of tumult better than its legacy media peers, but it must finally address the above issues to placate Wall Street and its shareholders.

Password Crackdown & Hulu

While Disney bought out Comcast’s Hulu stake, it remains to be seen how much of an impact this will have on expanding Disney’s streaming efforts. The Magic Kingdom can look to its competitors to chart the right path for subscriber growth.

Last year Warner Bros. Discovery combined most Discovery+ content onto the rebranded Max platform, while also keeping Discovery+ as a standalone app. Subscriber growth for WBD has stalled since then, but the company did turn a slight DTC profit the last two quarters, aided by the lack of productions during the strikes.

If further mixing or combining the platforms doesn’t help, Disney’s ramped up password crackdown should have a positive impact on subscriber growth, if consumer response to Netflix cracking down is any indication.

Disney boasts the second-most global streaming subscribers, but it is still roughly 110M short of market-leading Netflix, and this crackdown will be the ultimate test to see if Disney streaming is as sticky and necessary to consumers as Netflix.

Sports: Joint Venture, ESPN & NBA

The future of live sports is one of 2024’s biggest questions for the industry. Disney’s just-announced sports streaming collaboration with WBD and Fox is the most significant industry initiative to address this, but the joint venture requires more details for further analysis.

Disney stands at the forefront of the future of sports as the owner of ESPN, and one of two rights holders — alongside WBD — that will be renegotiating NBA rights in the coming months.

Disney and WBD are the favorites to hold onto the linear rights, with a big tech player like Amazon Prime Video, Apple, or possibly Netflix getting a slice of the pie as well. The total rights package is expected to fetch anywhere from 2-3x the current one. How much the legacy companies are willing to pony up remains questionable — especially when the relatively young NBA audience is less likely to pay for linear television.

ESPN’s prospects raise even more questions — Will Disney spin it off? Finally go full DTC? Accept ownership stakes from the majors leagues it covers? If the last year has taught us anything, all options are on the table.

Creative Reset?

Disney’s powerhouse franchises that led it to box office and cultural dominance over the past two decades — Marvel, Lucasfilm and Pixar — are all at a crossroads.

Marvel and Pixar movies have underperformed at the box office, and demand data shows plateauing audience demand for new MCU and Star Wars series.

Disney+’s global share of streaming original demand has now ticked down for four consecutive quarters, and the platform has now trailed Apple TV+ in US originals for three consecutive quarters.

As powerful as Jedi and superheroes are within their own respective worlds, neither yet has the ability to counteract the overwhelming force of audience fatigue.

Corporate Demand Share

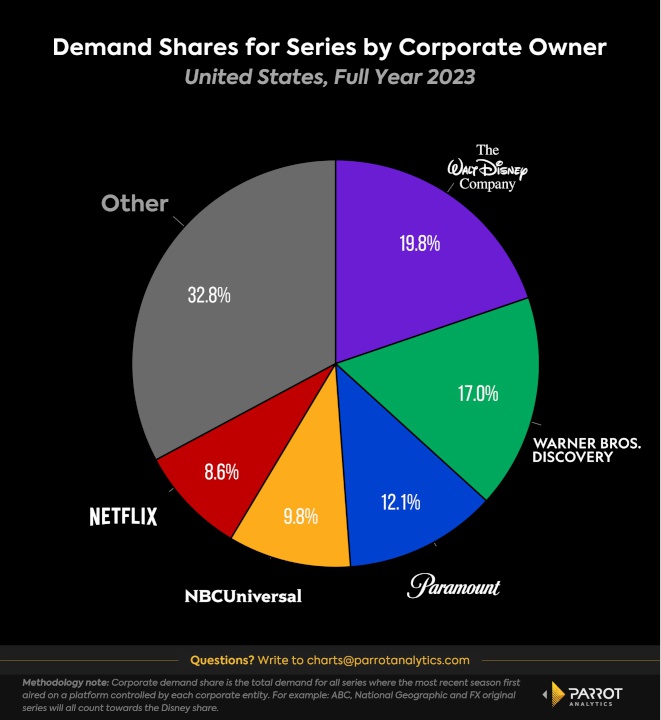

- Corporate demand share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their own platforms, and can effectively help value a conglomerate’s legacy and library content in aggregate.

- As industry M&A speculation ramps up, it’s worth noting that any combination of Disney’s three legacy media competitions — Warner Bros. Discovery, Paramount Global, and NBCUniversal — would leapfrog Disney for number one in corporate demand share should they join forces.

- All

four legacy media brands lost corporate demand share in

2023, a telling sign of their collective challenges moving

forward. The changes for the top five US media corporations

from 2022 to 2023 were:

- Netflix: 8.4% to 8.6% (+0.2%)

- Paramount Global: 12.2% to 12.1% (-0.1%)

- Disney: 20.2% to 19.8% (-0.4%)

- NBCUniversal: 10.2% to 9.8% (-0.4%)

- Warner Bros. Discovery: 18.0% to 17.0% (-1.0%)

On Platform Demand Share

- While demand for original content drives subscription growth, library content is key for customer retention, and catalog demand is a good indicator of which SVODs consumers are most likely to use as a default ‘streaming home.’

- Netflix (18.1%) has a sizable lead over the field, but a full combination of the some of the trailing platforms — such as Disney+ and Hulu (24.7%), or Max and Paramount+ (23.8%) should Warner Bros. Discovery and Paramount merge — would overtake Netflix as the top streamer for all content demand.

- Disney+ and Hulu fully combined (24.7%) would easily beat out Netflix, and would edge out potential Max-Paramount+ (23.8%) or Max-Peacock (24.4%) combinations for the total catalog demand category, showing the potential value of fully buying out Comcast previous stake in the platform.

- However, Disney+ and Hulu combinations would also require reinvigorated interest in some of the company’s biggest brands.

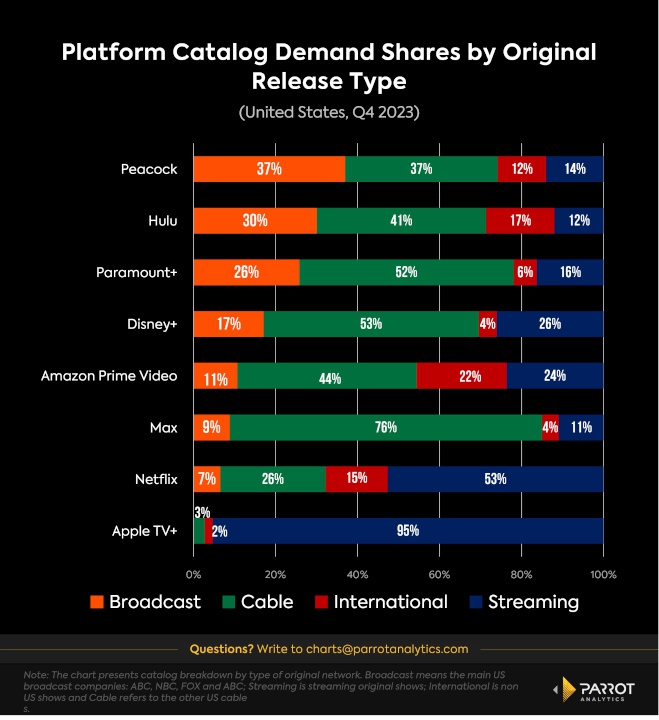

Demand by Release Type

- Streaming original content accounts for a fraction of the overall TV demand for most major streamers, showing why many legacy companies are now re-opening up their libraries to licensing deals after trying to build up walled gardens earlier this decade.

- Hulu is the second-least reliant SVOD on demand for streaming programming, and the second-most reliant on broadcast — evidence of its status as the go to home for many next-day broadcast series.

- Even thought Disney+ is home to some of the most in-demand streaming originals in the industry — largely from the MCU and Star Wars franchises — a full 74% percent of demand for TV on the platform is for linear original programming.

The Commonwealth: Commonwealth Health Ministers Unite For Bold Action On Sustainable Health Financing

The Commonwealth: Commonwealth Health Ministers Unite For Bold Action On Sustainable Health Financing Greenpeace: Greenpeace Analysis Reveals Almost Half A Million Blue Sharks Caught As ‘Bycatch’ In Central And Western Pacific In 2023

Greenpeace: Greenpeace Analysis Reveals Almost Half A Million Blue Sharks Caught As ‘Bycatch’ In Central And Western Pacific In 2023 The Independent Panel: Ellen Johnson Sirleaf and Helen Clark Applaud Historic Pandemic Agreement

The Independent Panel: Ellen Johnson Sirleaf and Helen Clark Applaud Historic Pandemic Agreement Burness: First-Ever Gathering - Hundreds Of Indigenous Leaders From Forest Nations To Meet Ahead Of COP30

Burness: First-Ever Gathering - Hundreds Of Indigenous Leaders From Forest Nations To Meet Ahead Of COP30 UNICEF: Statement On The Reported Killing Of 45 Children In The Gaza Strip In Recent Days

UNICEF: Statement On The Reported Killing Of 45 Children In The Gaza Strip In Recent Days UN News: ‘We Are Still Waiting For Our Loved Ones’ - Families Of The Abducted Speak Out

UN News: ‘We Are Still Waiting For Our Loved Ones’ - Families Of The Abducted Speak Out