Narrowing The Gender Gap In Access To Digital Finance Can Help Women To Thrive

By Rhea Crisologo Hernando

Digital inclusion and wider

access to financial services empower

women.

Financial

inclusion in the APEC region started out as an immediate

policy response to the 2008 Global Financial Crisis and

evolved into an important component of the region’s

inclusive growth strategy, particularly as a key

enabler of economic participation by opening up

opportunities for people to earn a living and

invest.

The COVID-19 pandemic, marked by

movement restrictions to curb the spread of the virus,

accelerated the shift to digitalization and increased the

global uptake of digital financial

services.

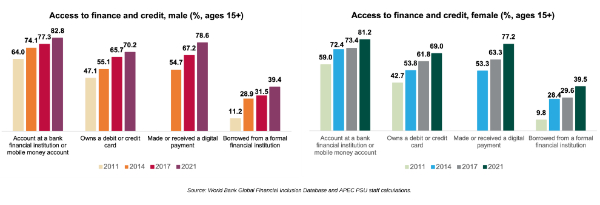

In APEC, data from the

2021 World Bank Global Financial Inclusion Index show that

the pandemic expanded access to and use of digital financial

services, particularly among women. Around 77 percent of the

region’s female population aged 15 years old and above

made or received a digital payment in 2021. This represented

a surge of 14 percent from 2017— a higher rate compared to

the increase in usage by men at about 11 percent within a

five-year period.

Increased

engagement in digital transactions reflect women’s wider

access to financial services as well as digital inclusion.

Moreover, making and/or receiving digital payments can pave

the way towards ownership accounts at formal financial

institutions or usage of mobile money services. Indeed, the

percentage of the population in APEC who reported having an

account at a bank or another type of financial institution,

or a mobile money account, has grown substantially since

2011. Similarly, more women and men owned a debit or credit

card in 2021, the most recent data available, relative to

other years.

The proportion of women conducting

everyday transactions online has also increased

significantly amid the pandemic. For example, the percentage

of women in the region using a mobile phone or the internet

to pay bills went up to 48 percent in 2021 from 32.5 percent

in 2017, equivalent to an increase of 15.5 percentage

points. In addition, there were more women (about 65

percent) using a mobile phone or the internet to buy

something online in 2021 when compared to both the 2017

level and the percentage of men conducting the same

transactions.

In terms of borrowing from

a formal financial institution, it is interesting to observe

that: one, slightly more women than men borrowed in 2021 and

two, the percentage of women borrowers jumped by 10 percent

amid the pandemic from the level in 2017—more than the

magnitude of the increase for men during the same comparable

period. These developments reflect how financial services

are becoming more inclusive nowadays, which are helping

advance women’s economic

opportunities.

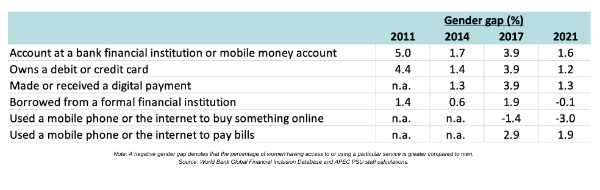

Greater inclusiveness in

financial services has been critical to narrow considerably

the gender gap in access to financial accounts and services

within the APEC region. For example, the gender

gap in account ownership at a bank or its equivalent has

fallen to 1.6 percentage points in 2021 from as much as 5

percentage points a decade ago. Debit or credit card

ownership follows the same trend. Women are also starting to

close the gap relative to men in terms of access to and use

of digital financial services—from 3.9 percent in 2017 to

1.3 percent in 2021. There is also a noticeable narrowing of

the gender gap in the use of a mobile phone or the internet

to pay bills while the percentage of women buying something

online has outpaced men in both years.

The

ease of access and usage of digital financial services

encourages the shift to formalization of account ownership

and conduct of daily transactions online, providing a

crucial pathway towards improved financial and digital

inclusion. The emerging trend shows that more women in the

APEC region have benefitted from digital financial services

and opened formal accounts amid the pandemic, contributing

to a significant narrowing of gender gap in these areas.

Access to a bank or mobile money account is essential for

women to be able to engage in available economic

opportunities such as entrepreneurship, contribute to

household income and have an equal voice in family

decisions, and remain out of

poverty.

Closing the gender gap in

financial services is an important step forward towards

women’s empowerment. However, this needs to be

complemented by reducing gaps in women’s access to

education and skills development, participation in labor

markets, and representation in leadership roles, both in the

public and private sector, among others. Closing the gender

inequality in access and opportunities empowers women to

participate equally and fully in economic, financial and

social undertakings.

#

Rhea Crisologo

Hernando is a senior researcher at the APEC Policy Support

Unit.

Greenpeace: The Deep Sea Mining Industry Is Crumbling And Desperate

Greenpeace: The Deep Sea Mining Industry Is Crumbling And Desperate UN News: Europe Grapples With Highest Number Of Measles Cases In More Than 25 Years

UN News: Europe Grapples With Highest Number Of Measles Cases In More Than 25 Years Polar Research and Policy Initiative: Comments On The Joint Statement By Greenland's Party Leaders In Response To Trump's Rhetoric On The Annexation Of Greenland

Polar Research and Policy Initiative: Comments On The Joint Statement By Greenland's Party Leaders In Response To Trump's Rhetoric On The Annexation Of Greenland Médecins Sans Frontières: MSF Briefs UN Security Council On Sudan - A Catastrophic 'War On People'

Médecins Sans Frontières: MSF Briefs UN Security Council On Sudan - A Catastrophic 'War On People' New Zealand Defence Force: New Zealand-Led Task Force Makes $NZ375-million Drug Bust In The Middle East

New Zealand Defence Force: New Zealand-Led Task Force Makes $NZ375-million Drug Bust In The Middle East ICHRP: ICHRP Welcomes Duterte’s Arrest - A Landmark Step Towards Justice

ICHRP: ICHRP Welcomes Duterte’s Arrest - A Landmark Step Towards Justice