No Major G7 Stock Index Aligned With Paris Climate Goals

New research by CDP and the United Nations Global

Compact on behalf of the Science Based Targets initiative

calls on the largest G7 companies to take ambitious climate

action

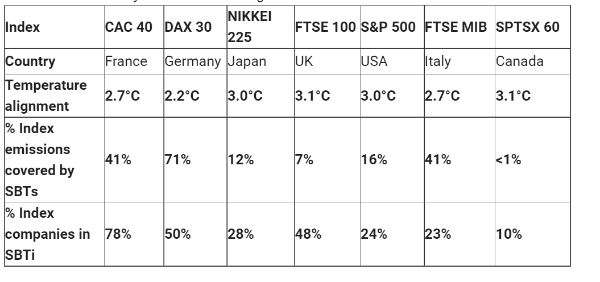

- No major G7 stock indexes are currently on a 2°C pathway, much less the 1.5°C that is so urgently needed. Four of the seven indexes are on dangerous temperature pathways of 3°C or above.

- G7 indexes with a higher share of emissions covered by science-based targets (SBTs) result in lower overall temperature ratings. 71% of Germany’s DAX 30 companies’ emissions are covered by SBTs, resulting in the lowest index temperature rating of 2.2°C, while less than 1% of Canada’s SPTSX 60 companies are covered by SBTs, resulting in the joint-highest temperature rating of 3.1°C.

- Companies with science-based targets are already cutting emissions at scale - and today’s research calls on all businesses to take immediate action to align with a 1.5°C pathway. SBTi identifies four key levers that governments, investors and businesses can use to unlock breakthrough climate action through science-based targets.

London and New York, June 2021.

New research from the

Science Based Targets initiative (SBTi), a body enabling

businesses to set ambitious emissions reduction targets,

reveals that none of the G7’s leading stock

indexes are currently aligned with a 1.5°C or 2°C

pathway1 and calls on the largest listed G7

companies to urgently increase climate

action.

In the lead up to the G7 Summit, the analysis shows that the G7 countries’ leading indexes2 are on an average temperature pathway of 2.95°C,3 according to their constituents’ current corporate climate ambitions. Stock indexes, composed of stocks of the most significant companies listed on a country’s largest exchange, are vital benchmarks to understand market trends.

The report, prepared by CDP and the UN Global Compact on behalf of the SBTi, finds that four of the seven indexes are on dangerous temperature pathways of 3°C or above. Notably, fossil fuels are a key contributor to the emissions of all seven indexes, making up 70% of Canada’s SPTSX 60 3.1°C temperature rating and almost 50% of Italy’s FTSE MIB 2.7°C rating.

Lila Karbassi, Chief of Programmes, UN Global Compact and SBTi Board Chair, said: “G7 companies have the potential to cause a ‘domino effect’ of positive change across the wider global economy. This report highlights the urgent need for markets and investors to deliver on the goals of the Paris Agreement. As the G7 meets this week, Governments must go further to incentivize ambitious science-based target setting.”

Aligning investment with

1.5°C

G7 ministers responsible for climate and

environment recently urged businesses and investors to align

their portfolios with the Paris Agreement goals and set

science-based net zero targets by 2050 at the latest.

Passive investing currently makes up around 40% of US and

20% of European funds, but passive investors are warned that

just 19% of listed companies in these seven leading indexes

have climate targets aligned with the Paris

Agreement.

The UK government plans to reduce emissions by 78% by 2035, in line with a 1.5°C pathway. Encouragingly, the SBTi finds that 35 of the FTSE 100 companies have already committed to align with 1.5°C. However, despite significant progress in the adoption of science-based climate targets among FTSE companies, some of the largest emitters still do not have ambitious climate targets, resulting in an overall index temperature rating of 3.1°C (see Fig.1).

Despite the findings, momentum for climate action in G7 countries is growing. Of all corporate greenhouse gas emissions reduction targets disclosed to CDP in 2020, 64% of targets were set by companies headquartered in G7 countries. Overall, 2020 was a milestone year for climate commitments, with the annual rate of adoption of science-based targets doubling in 2020 versus 2015-2019.

Alberto Carrillo Pineda, Director of science-based targets at CDP and a Steering Committee Member at the SBTi, said:"Ignoring climate science is like continuing smoking despite knowing the risks. Climate and environmental breakdown is the biggest health, economic and societal challenge of our time - it requires immediate action from the world’s largest companies. Today’s findings highlight vital progress, but show there’s more to be done to incentivize firms to set science-based climate targets and accelerate the pathway to net-zero.”

Urgent climate

action

Today’s report also identifies

four urgent climate actions for financial institutions,

corporate actors, investors and governments. Firstly,

businesses and governments must collaborate to harness the

“ambition loop”, a positive feedback cycle in which

private sector action and government policies reinforce one

another, such as the recent Executive

Order on Climate-Related Financial Risk by the US

Government that introduced a requirement for major federal

suppliers to set science-based targets.

Secondly, corporations must work to decarbonise supply chains by engaging with suppliers. Thirdly, investors should embed science-based targets into sustainability-linked bonds and climate financial standards.

Finally, financial institutions should aim to create a domino effect in all sectors of the economy through setting portfolio-level science-based targets and engagement with underlying assets. One such example is the CDP Science-Based Targets campaign, which coordinates global financial institutions to engage the world's highest impact companies to set 1.5°C-aligned science-based targets.

In the midst of a growing number of net zero commitments that aren’t always backed up by short-term action, science-based targets are answering the need for nearer term, 2030 plans, through interim targets towards a net-zero future.

Firms are encouraged to join the 570 companies already signed up to the SBTi’s Business Ambition for 1.5°C campaign to make their critical contribution to limiting the worst impacts of climate change ahead of the COP26 conference in Glasgow.

The full report, ‘Taking the Temperature: Assessing and scaling-up climate ambition in the G7 business sector’ can be accessed on the SBTi website.

Fig. 1 - The temperature alignment of G7 stock indexes and percentage of Index company emissions covered by science-based targets.

1 Based on disclosed target information, each company is assigned a temperature rating. Public targets were translated into temperature ratings via the CDP-WWF temperature rating methodology. This method endorsed by the SBTi to assess portfolio alignment of temperature ratings provides a science based approach to assess targets not validated by the Science Based Targets initiative. Those validated by the SBTi are translated into a temperature rating (2C, well-below 2C, 1.5C) as part of the approval process.

If the company does not have an approved SBT or has not disclosed a target via CDP, the company is given a default temperature rating of 3.2C. This rating is based on 2100 warming projections based on current pledges. The analysis focuses only on mid term targets - GHG reduction targets with target years between 2025 and 2035 - given the urgency to halve emissions by 2030. The temperature rating takes into account emissions from the listed companies’ own operations and across their value chains (scopes 1+2+3).

2 Germany’s DAX 30, France’s CAC 40, Italy’s FTSE MIB, UK’s FTSE 100, Japan’s NIKKEI 225, Canada’s SPTSX 60 and US’s S&P 500.

3 Weighted average of the G7 index temperature ratings is 2.95°C

About the

Science Based Targets initiative

The Science

Based Targets initiative mobilizes companies to set

science-based targets and boost their competitive advantage

in the transition to a zero-carbon economy. It is a

collaboration between CDP, the United Nations Global

Compact, World Resources Institute (WRI) and the World Wide

Fund for Nature (WWF) and one of the We Mean Business

Coalition commitments. The initiative defines and promotes

best practice in science-based target setting, offers

resources and guidance to reduce barriers to adoption, and

independently assesses and approves companies’

targets.

www.sciencebasedtargets.org

@sciencetargets

CNS: Will All Children Be Born Free Of HIV, Syphilis And Hepatitis-B By 2030?

CNS: Will All Children Be Born Free Of HIV, Syphilis And Hepatitis-B By 2030? Save The Children: Sudan - One Child Every 10 Seconds Forced To Flee Their Home Since Conflict Began Two Years Ago

Save The Children: Sudan - One Child Every 10 Seconds Forced To Flee Their Home Since Conflict Began Two Years Ago People with Disability Australia - PWDA: People With Disability Invisible In Election Debates And Housing Promises

People with Disability Australia - PWDA: People With Disability Invisible In Election Debates And Housing Promises East West Center: NZ Deputy Prime Minister Recounts Longstanding US-NZ Relationship In The Pacific

East West Center: NZ Deputy Prime Minister Recounts Longstanding US-NZ Relationship In The Pacific Global Jews for Palestine: Jewish Organisations' Passover Statement, After 40 Days Of Starvation

Global Jews for Palestine: Jewish Organisations' Passover Statement, After 40 Days Of Starvation APEC: Stronger Immunization Policies Needed As Vaccine Confidence Falls

APEC: Stronger Immunization Policies Needed As Vaccine Confidence Falls