Analysis: WarnerMedia-Discovery Poised To Challenge Disney For Audience Demand Supremacy [Parrot Analytics]

As the dust settles on the year’s biggest media merger news, Parrot Analytics has taken a look at how the future WarnerMedia-Discovery combined company will stack up against the competition in the race for audience demand and consumer attention.

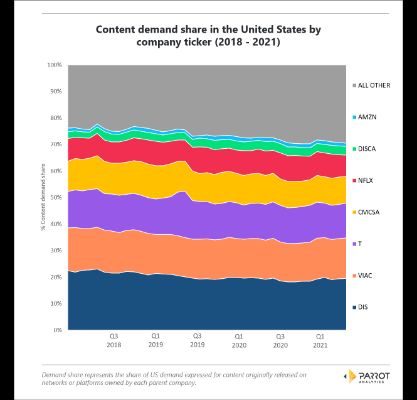

Corporate Demand Share Pre-Merger

- The total demand for content originally available on a Disney property was the largest of all corporate demand shares. Disney has consistently had the lead in this race.

- In this scenario, Disney held a 4.3% share advantage over second place ViacomCBS for the last month of available data.

- AT&T (WarnerMedia) was in third place - ahead of Comcast - while Discovery was in a distant sixth.

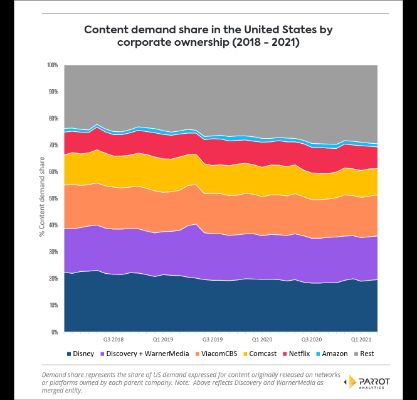

Corporate Demand Share Post-Merger

- The new WarnerMedia-Discovery entity is poised to be in second place (16.4%) behind only Disney (19.6%) in US cross platform audience demand. This pushes Disney’s lead over the competition down to just 3.2%.

- ViacomCBS (15.3%) had been in second place before the merger was announced, but is now relegated to third.

- No other company comes within 5% of ViacomCBS.

While the merger makes tons of sense from a cultural standpoint, more importantly it will allow WarnerMedia and Discovery to join forces, leap over ViacomCBS, and close the gap with Disney in the increasingly competitive battle for audience demand and consumer attention in the United States and around the world.

UN News: ICC Issues Arrest Warrants For Netanyahu, Gallant And Hamas Commander

UN News: ICC Issues Arrest Warrants For Netanyahu, Gallant And Hamas Commander RNZ: Samoan Local Upset With Lack Of Manawanui Updates

RNZ: Samoan Local Upset With Lack Of Manawanui Updates Pacific Whale Fund: Groundbreaking Whale Rights Law Inspired By Māori King's Legacy To Be Unveiled In London

Pacific Whale Fund: Groundbreaking Whale Rights Law Inspired By Māori King's Legacy To Be Unveiled In London UN News: United States Vetoes Gaza Ceasefire Resolution At Security Council

UN News: United States Vetoes Gaza Ceasefire Resolution At Security Council Climate Action Network: COP29 ANALYSIS - G20 Declaration And Climate Finance

Climate Action Network: COP29 ANALYSIS - G20 Declaration And Climate Finance UN News: Haiti - Over 20,000 Flee As Gang Violence Spurs Mass Displacement

UN News: Haiti - Over 20,000 Flee As Gang Violence Spurs Mass Displacement