As Walt Disney reports its first quarter earnings today, I'm pleased to share with you our topline SVOD and industry commentary, as well as specific charts that point to Disney's streaming success:

- Disney+ Originals drove demand share in Q1, pointing to further Disney+ gains in Q2.

- Disney (DIS) commands the largest corporate share of US audience demand for TV series.

- Series available on a Disney platform account for a greater share of demand than any other platform

- Franchise synergy strengthens US audience attention for Disney series

Q1 2021 has been a pivotal quarter for the streaming portion of Disney’s business with the Marvel franchise engine finally firing up on the small screen. Below is a look at how demand for the Disney library of content stacks up, as well as demand for content available on other streaming platforms.

Disney+ Originals drove demand share this quarter, point to further Disney+ gains in Q2

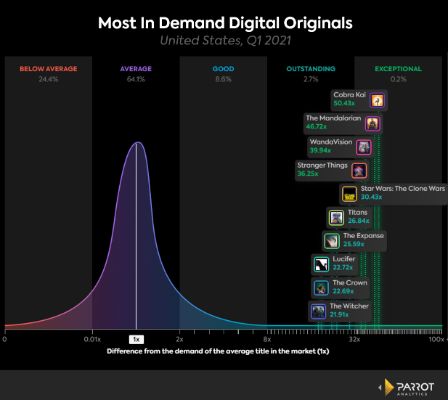

Disney has proven its ability to produce mega-hits. The share of demand for Disney+ has primarily been driven by the massive amount of audience attention these shows attract. Q1 was a success for Disney+ originals, with the platform holding 3 of the 10 most in-demand digital originals in the USA.

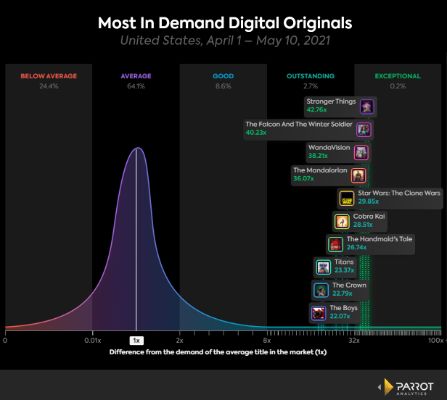

While Disney+ had a successful Q1, demand indicators point to Q2 being an even stronger quarter for the entertainment giant’s streaming business. Fully half of the 10 most in-demand original series in the second quarter so far are from Disney+ or Hulu.

Meanwhile, the return of The Handmaid’s Tale this quarter should give a bump to Hulu's audience demand share. The quarter is not yet over either. Star Wars: The Bad Batch is still growing in demand and the highly anticipated Loki is due to be released in June. The growing dominance of Star Wars and Marvel series should boost Disney+’s appeal for new and existing subscribers alike.

Disney (DIS) commands the largest single share of US audience attention:

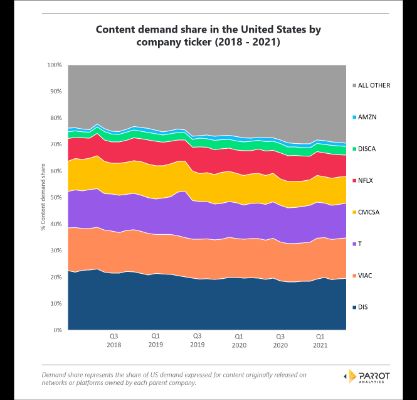

- The total demand for content originally available on a Disney property was the largest of all corporate demand shares. Disney has consistently had the lead in this race.

- Disney’s corporate demand share saw a bump at the end of 2020, driven by enormous demand for The Mandalorian.

- There has been growing demand for content owned by other companies (not broken out and marked as “All Other” in the chart). This is driven in part by non-legacy media companies beginning to produce in-demand content, for example Apple.

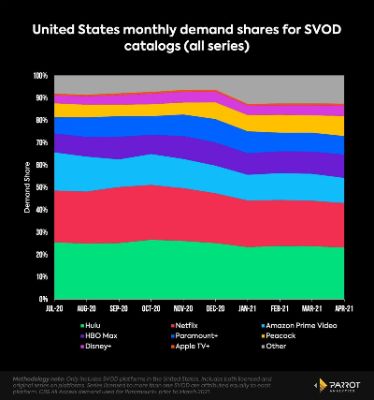

Series available on a Disney platform account for a greater share of demand than any other platform:

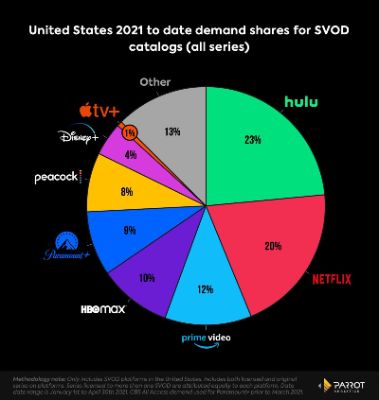

- In the US SVOD market Disney is in an interesting position juggling two major platforms - Hulu and Disney+.

- The large amount of highly in-demand library/licensed content available on the Hulu platform leads it to have the largest slice of demand for SVOD services in 2021 so far.

- Disney’s majority ownership of Hulu combined with the market’s appetite for the much newer Disney+ service means the company is the largest entity in the US SVOD market, based on US audience demand.

Overall US SVOD market commentary:

- Over 2021 to date, the full Netflix catalog of original and licensed series accounts for around 20% of US demand for SVOD services. Netflix consistently has the highest demand share for SVOD original series in the US, typically around 40-50%. However, the ongoing loss of licensed content to competitors reclaiming content for their own services may explain the downward trend for the overall Netflix demand share.

- Apple TV+ typically has around 4-5% of the demand share for US digital original series, but their originals-only strategy leads to less than 1% share of demand of the overall US SVOD market.

- The HBO Max streaming service seems to occupy the same niche as the HBO cable channel, with a smaller number of highly demanded premium series. This now includes tentpole superhero original series from the DC Universe service, which merged into HBO Max early in 2021. This strategy has secured a comfortable 10% demand share, placing it just ahead of Paramount+ so far this year.

- The market is continually changing as new services launch, with many recent SVODs concentrating on specialist niches. This increase in competition can be seen in the growth of demand for the “Other” category over time in the below chart.

Franchise synergy strengthens US audience demand for Disney series

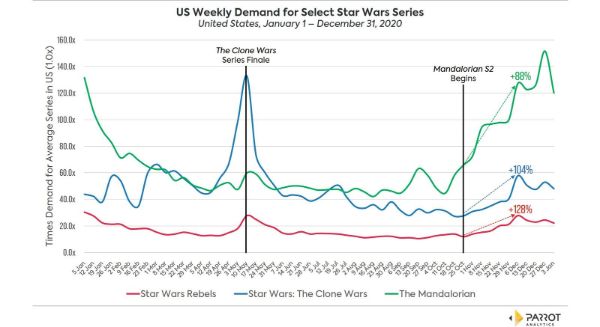

Disney+ has been cementing its position in the streaming wars not only by producing hits but by expertly leveraging the power of franchises to boost demand for their broader catalog.

In the latest season of The Mandalorian they actively created crossover opportunities with other series in the Star Wars universe. A fan favorite character, Ashoka Tano, made a surprise appearance in The Mandalorian and caused demand to surge for both The Mandalorian and Star Wars: The Clone Wars. Moreover, this character has her own spinoff series planned, showing that Disney only intends on further strengthening the connections between its shows in the Star Wars universe. Presumably a similar strategic vision is in place for the expanding and already intertwined Marvel universe.

COP29: Statement From COP29 Presidency

COP29: Statement From COP29 Presidency UN News: ICC Issues Arrest Warrants For Netanyahu, Gallant And Hamas Commander

UN News: ICC Issues Arrest Warrants For Netanyahu, Gallant And Hamas Commander RNZ: Samoan Local Upset With Lack Of Manawanui Updates

RNZ: Samoan Local Upset With Lack Of Manawanui Updates Pacific Whale Fund: Groundbreaking Whale Rights Law Inspired By Māori King's Legacy To Be Unveiled In London

Pacific Whale Fund: Groundbreaking Whale Rights Law Inspired By Māori King's Legacy To Be Unveiled In London UN News: United States Vetoes Gaza Ceasefire Resolution At Security Council

UN News: United States Vetoes Gaza Ceasefire Resolution At Security Council Climate Action Network: COP29 ANALYSIS - G20 Declaration And Climate Finance

Climate Action Network: COP29 ANALYSIS - G20 Declaration And Climate Finance