As Netflix prepares to release its latest earnings report, Parrot Analytics has unveiled new data highlighting an increasingly competitive international streaming market, with new platforms gaining demand share at the expense of Netflix.

Netflix is still the dominant player in the worldwide streaming game, but its global and US digital original demand share have shrunk to record lows in Q1 2021 due to rising competition from the likes of Disney+, Apple TV+, HBO Max, and more.

Nevertheless, total global demand for Netflix original content continues to grow, a good sign for continued subscriber growth.

The service also accounted for 7 of the top 10 most in-demand digital original series worldwide in Q1 2021, and had the most in-demand digital original in the US, with Cobra Kai.

Total Demand: Netflix Rising, But Competitors Rising Faster

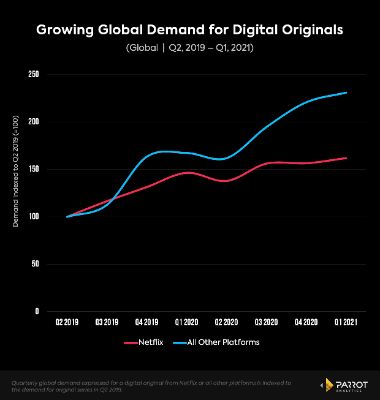

The clearest leading indicator of subscriber growth is growth in total demand for original content.

In this regard, Netflix looks good, as the total global demand for its original content has grown 62% over the last two years (Q2 2019 to Q1 2021).

However, total global demand for original content on all other platforms grew 131% over the same time period, which helps explain the following data about Netflix's global and US demand share.

Global Digital Originals Demand Share: Lowest Ever for Netflix

Netflix’s global digital original demand share hit its lowest quarterly number ever, barely cracking a majority at 50.2% in Q1 2021 - down from its 53.5% demand share for the full year 2020.

This is a landmark event, considering the platform’s entrenched dominance in the industry, and the fact that just two years ago (Q1 2019) its global demand share was at 64.6%.

Netflix’s declining demand share highlights the rapid maturation of the worldwide and US streaming markets since 2019.

It’s also a testament to the remarkable success of the many new entrants to the Streaming Wars over the last 18 months in creating in-demand original content and carving out a niche at the expense of Netflix.

Most notable has been the surge of Disney+, moving up to 6.0% worldwide demand share for Q1 2021 from just 3.6% share for the full year 2020, largely on the back of its two new Marvel series.

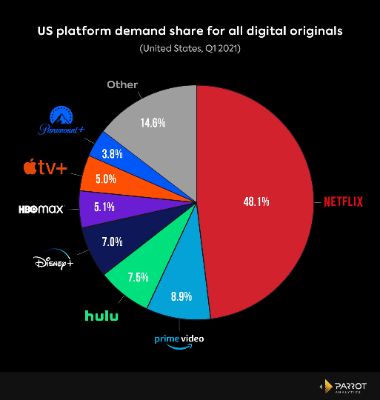

US Digital Originals Demand Share: Netflix Below 50%

For the second straight quarter, Netflix’s digital original demand share has fallen below a majority in the US, another sharp decline from two years ago when the streamer had 63.1% US demand share in Q1 2019.

Netflix’s US share of digital original demand has been on a downward trajectory each month this quarter, ending with a 47.6% share in March in the US.

Disney+’s trajectory has followed an almost inverse path from Netflix, up each month in Q1. It has risen to 7.0% US digital original demand share, up from 5.4% for full year 2020.

Q1 of course saw the debut of Disney+’s highly anticipated slate of Marvel content, including the full run of smash hit WandaVision, and the first two episodes of The Falcon And The Winter Soldier.

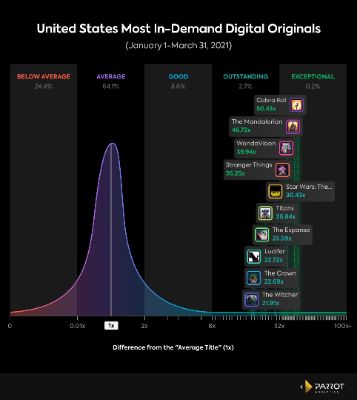

Most In-Demand Digital Originals (US Q1 2021)

Despite all the headlines and attention for Disney+’s tentpole Marvel series, Netflix's Cobra Kai was the most in-demand digital original series in the US for Q1 2021.

Because Disney+ has dominated the entertainment news cycle with a series of back to back to back streaming hits (The Mandalorian S2, WandaVision, TFATWS) it is easy to forget that Netflix released Cobra Kai’s most successful season to date at the beginning of January.

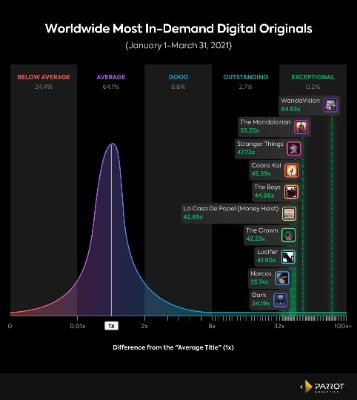

Most In-Demand Digital Originals (Global Q1 2021)

While Cobra Kai was not the most in-demand digital original globally in Q1 and Disney+ originals dominated the top of the charts, Netflix has strength in numbers. 7 of the top 10 original series globally in Q1 were Netflix originals (compared to 5 in the top 10 in the US).

Netflix’s increasing emphasis on producing and promoting non-US and non-English language originals (particularly Dark and La Casa de Papel) is clearly paying off with global audiences.

This is seen in Netflix having more digital originals in the global top ten, and in Netflix having a higher global digital original demand share (50.2%) than its US demand share (48.1%).

Pacific Islands Forum Fisheries Agency: Honiara Summit 2025 Outcomes

Pacific Islands Forum Fisheries Agency: Honiara Summit 2025 Outcomes ChildFund NZ: Urgent Support For Ukrainian Children In 2025

ChildFund NZ: Urgent Support For Ukrainian Children In 2025 Colin Peacock, RNZ: Defending Media Against Defunding

Colin Peacock, RNZ: Defending Media Against Defunding UNICEF: Haiti - Massive Surge In Child Armed Group Recruitment

UNICEF: Haiti - Massive Surge In Child Armed Group Recruitment Climate Action Network: CAN Renews Call For The Release Of Egyptian-British Prisoner Of Conscience Alaa Abdel El-Fattah

Climate Action Network: CAN Renews Call For The Release Of Egyptian-British Prisoner Of Conscience Alaa Abdel El-Fattah Stefan Wolff & Tetyana Malyarenko, The Conversation: Raised Voices And Angry Scenes At The White House As Trump Clashes With Zelensky Over The ‘Minerals Deal’

Stefan Wolff & Tetyana Malyarenko, The Conversation: Raised Voices And Angry Scenes At The White House As Trump Clashes With Zelensky Over The ‘Minerals Deal’