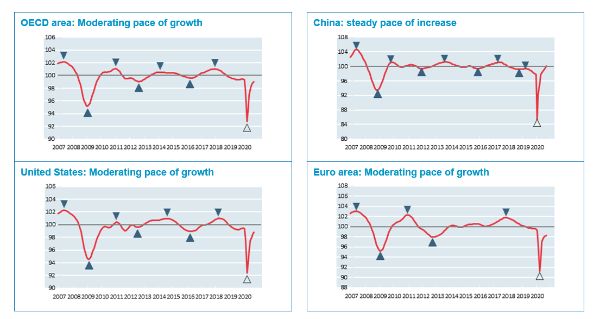

CLIs Point To A Continued Moderation In Growth Prior To The Recent Tightening Of COVID-19 Restrictions

Even before the recent tightening of COVID-19 restrictions in many major economies, CLIs compiled for October 2020 pointed to a continued deceleration in the pace of improvement in the OECD as a whole and across most major economies.

Whilst some expectation of these recent measures will have been anticipated in this month’s CLI estimates, their full impact will only be picked-up in next month’s CLI estimates.

Prior to the introduction of recent COVID-19 containment measures, CLIs for October in the United States, Japan, Canada, Germany, Italy and the euro area continued to increase but at a slower pace. In France, the CLI continued to stabilise, while in the United Kingdom the CLI contracted for the second straight month, potentially reflecting heightened uncertainty over the prospect of no trade deal with the EU at the end of the transition period. In all major OECD economies, the CLIs continued to point to below trend GDP.

Among major emerging economies, the CLIs for India and Brazil continued to increase but a slower pace. In China, on the other hand, the CLI for October, for the manufacturing sector, continued to increase at a steady pace, while in Russia the CLI stabilised.

As always, the magnitude of the CLI should be regarded as an indication of the strength of the signal rather than as a direct measure of the degree of growth in economic activity.

See the full release and accompanying notes.

The above graphs show country specific composite leading indicators (CLIs solid line, left axis and the relative month-on-month growth rate, right axis). Turning points of CLIs tend to precede turning points in economic activity relative to trend by six to nine months. The horizontal line at 100 represents the trend of economic activity. Shaded triangles mark confirmed turning-points of the CLI. Blank triangles mark provisional turning-points that may be reversed.

Global Jews for Palestine: Jewish Organisations' Passover Statement, After 40 Days Of Starvation

Global Jews for Palestine: Jewish Organisations' Passover Statement, After 40 Days Of Starvation APEC: Stronger Immunization Policies Needed As Vaccine Confidence Falls

APEC: Stronger Immunization Policies Needed As Vaccine Confidence Falls 350.org: Indigenous Groups From The Pacific, Brazil & Canada Hand Demands To COP30 Presidency To End Fossil Fuels

350.org: Indigenous Groups From The Pacific, Brazil & Canada Hand Demands To COP30 Presidency To End Fossil Fuels Conservation International: Conservation International Expedition Reveals Ecosystem Recovery In Tokelau

Conservation International: Conservation International Expedition Reveals Ecosystem Recovery In Tokelau UN Special Procedures - Human Rights: UN Expert Urges States To Finance Inclusive And Sustainable Development, Not A War Economy

UN Special Procedures - Human Rights: UN Expert Urges States To Finance Inclusive And Sustainable Development, Not A War Economy Amnesty International Aotearoa NZ: Global - Recorded Executions Highest Since 2015

Amnesty International Aotearoa NZ: Global - Recorded Executions Highest Since 2015