Gold Bullion Demand Surges

Gold Bullion Demand Surges - Perth Mint and U.S. Mint Cannot Meet Demand

- Perth Mint sees

surge in demand and cannot keep up with demand

- “Our

biggest restriction is the amount of unrefined gold we’re

getting in from producers”

- Very high demand for Perth

Mint coins, bars coming from Asia, U.S. and Europe

- U.S.

Mint sees highest sales of gold coins in over 2 years

-

U.S. Mint restrictions on silver coins due to very high

demand

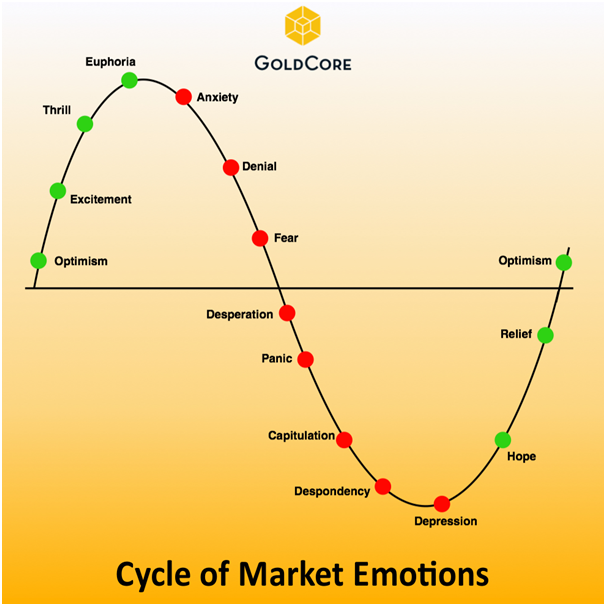

- Gold sentiment has moved from despondency to

depression (see chart)

- Current negative sentiment

despite strong demand is good contrarian

indicator

Depressed prices have led to the usual market response, a surge in physical demand for coins and bars globally.

Treasurer for the Perth Mint, Nigel Moffatt has said that the mint has seen a surge in demand for physical gold since the price dropped below $1,100 per ounce.

In an interview on Bloomberg’s “First Up” show he said “Our biggest restriction is the amount of unrefined gold we’re getting in from producers”, adding, “everything we get in is going straight out the door as soon as we refine it.”

He does not see the price of gold dropping a whole lot further given the cost of production, although he believes that we may see a fall to $1000 before the price moves upwards again. It now costs on average around $1,000 to mine one ounce of gold.

On July 7 The U.S. Mint was forced to suspend sales having exhausted its inventory which suggests there was either a shortage in physical silver blanks or of physical silver bullion that makes the blanks. However, they have placed restrictions on sales and sales remain “allocated” to wholesalers in order to maintain some supply.

There has been an unprecedented barrage of negative publicity towards gold in recent weeks. This negativity is not supported in any way by the activity in the markets for physical gold where shortages are showing up despite falling prices.

We believe this to be a good contrarian indicator that gold’s recent bout of weakness is drawing to a close and that the bull market may be set to resume once the current period of weakness runs its course and the forces of supply and demand reassert themselves.

Shortages, delays in delivery and rising premiums suggest that the long awaited short squeeze may be developing.

ENDS

UNICEF Aotearoa NZ: Myanmar Earthquake A Further Blow For Millions Of Children

UNICEF Aotearoa NZ: Myanmar Earthquake A Further Blow For Millions Of Children Greenpeace: 'Desperate And Deceitful'- Deep Sea Mining Frontrunner Turns Its Back On Pacific Nations

Greenpeace: 'Desperate And Deceitful'- Deep Sea Mining Frontrunner Turns Its Back On Pacific Nations 350.org: Australia Announces Election Dates, Pacific Islanders Rally To Vote For Climate

350.org: Australia Announces Election Dates, Pacific Islanders Rally To Vote For Climate UNICEF Aotearoa NZ: Global Aid Funding Cuts - 14 Million Children At Increased Risk Of Severe Malnutrition And Death

UNICEF Aotearoa NZ: Global Aid Funding Cuts - 14 Million Children At Increased Risk Of Severe Malnutrition And Death Oxfam Aotearoa: Humanitarian Operations In Gaza Severely Hampered; Famine Risks Increasing

Oxfam Aotearoa: Humanitarian Operations In Gaza Severely Hampered; Famine Risks Increasing UN News: Migrant Deaths In Asia Hit Record High In 2024, UN Data Reveals

UN News: Migrant Deaths In Asia Hit Record High In 2024, UN Data Reveals