New Must Read Report and Must See Charts on Gold

New Must Read Report and Must See Charts on Gold

- “Gold remains in secular bull

market”

- System is addicted to unsustainable debt

-

Persistent deflationary forces threaten system

-

Monetary authorities to take increasingly risky measures to

engender inflation

- Debt based monetary system is crux

of problem

- “All available means” deployed to

prevent global government bond bubble from bursting

-

Aversion to owning any gold whatsoever displays “ignorance

of monetary history”

- Gold’s qualities as store of

value and medium of exchange to be “rediscovered”

-

“Gold price target of USD 2,300” in three

years

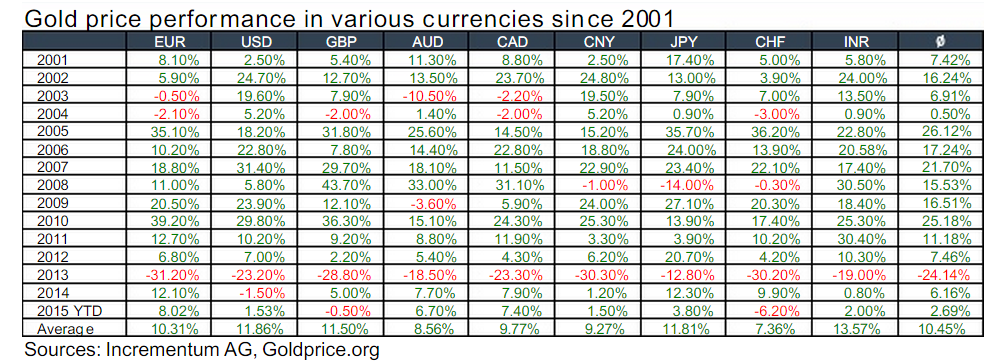

The bull market in gold remains intact and may soon reassert itself according to asset managersIncremental in their must read yearly “In Gold We Trust” report.

“We are firmly convinced that gold remains in a secular bull market that is close to making a comeback” the report states.

Incrementum list the most important

arguments in favor of diversifying into gold:

Global

debt levels are currently 40% higher than in 2007

The

systemic desire for rising price inflation is

increasing

Opacity of the financial system – volume

of outstanding derivatives by now at USD 700 trillion, the

bulk of which consists of interest rate derivatives

Concentration risk - “too big to fail” risks are

significantly higher than in 2008

Gold benefits from

periods of deflation, rising rates of price inflation and

systemic instability

Gold is a financial asset that

has no counterparty risk

The persistent deflationary pressures we have witnessed since 2011 caused by “widespread, chronic over-indebtedness” threaten the system which requires ever more borrowing to bring cash into being to pay down interest on existing debt.

Relative to the monetary base, the gold price is currently at an all time low. In our opinion, this is a temporary anomaly, which we believe provides an extraordinarily favorable buying opportunity.

Gold’s position is assured because of the total reliance of our debt-based monetary system on unsustainable inflation. The report states that “we have all become guinea pigs of an unprecedented attempt at re-inflation.” QE and negative interest rates “are a direct consequence of a systemic addiction to inflation.”

ENDS

World Vision: 3.5 Million Displaced Following Myanmar Earthquake And Ongoing Internal Conflict

World Vision: 3.5 Million Displaced Following Myanmar Earthquake And Ongoing Internal Conflict World Butchers Challenge: World’s Top Butchers From 14 Nations Go Knife-to-Knife In Paris

World Butchers Challenge: World’s Top Butchers From 14 Nations Go Knife-to-Knife In Paris Save The Children: ‘It Was Terrifying’ - Children Prepare To Spend Myanmar New Year Festival In Shelters Following Earthquake

Save The Children: ‘It Was Terrifying’ - Children Prepare To Spend Myanmar New Year Festival In Shelters Following Earthquake Global Forest Coalition: Global NGOs Call On International Maritime Org To Reject Biofuels And Commit To Truly Clean Energy

Global Forest Coalition: Global NGOs Call On International Maritime Org To Reject Biofuels And Commit To Truly Clean Energy Australian Catholic University: Principals Navigate Growing Challenges As Anxiety, Depression Increase And Violence, Workloads Intensify

Australian Catholic University: Principals Navigate Growing Challenges As Anxiety, Depression Increase And Violence, Workloads Intensify SNAP: Survivors Deliver Vos Estis Lux Mundi Complaints Against Six Cardinals To Vatican Secretary Of State Parolin

SNAP: Survivors Deliver Vos Estis Lux Mundi Complaints Against Six Cardinals To Vatican Secretary Of State Parolin