...To Protect Against "Systemic Risk"

FIDELITY: Hold "Physical Cash”, “Including Gold and Silver” To Protect Against "Systemic Risk";

- Hold physical cash “including

gold and silver” says manager in one of largest mutual

fund and financial services groups in the world

-

"Systemic risk" threat to deposits says respected Fidelity

fund manager

- Record global debt unlikely to be

sustained by higher interest rates

- Banks may not be

prepared for "shock" of defaults

- Guarantees to

depositors unlikely to be honoured

- Savers and investors

should hold “physical currencies” “including precious

metals”

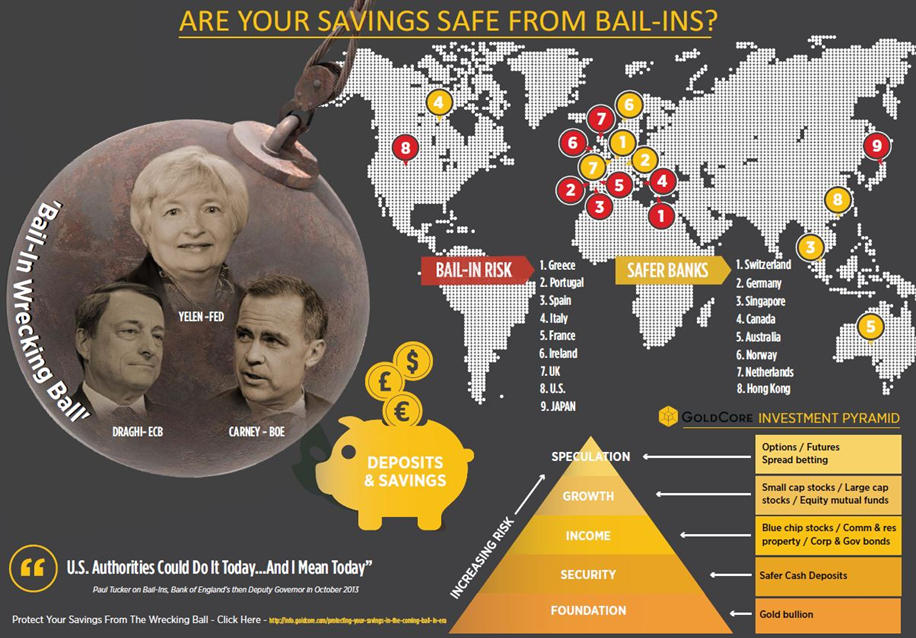

A fund manager for one of the largest mutual fund and investment groups in the world, Fidelity, has warned investors and savers to have an allocation to “physical cash,” “including precious metals” to protect against "systemic risk".

Ian Spreadbury, who oversees the investment of over £4 billion of clients money in bond markets for Fidelity told Telegraph Money

“Systemic risk is in the system and as an investor you have to be aware of that.”

He believes that the record debt that has been ballooning since the crisis of '08 due to interest rates being forced down to near zero by central banks. This debt, particularly where mortgages are concerned, would likely become unsustainable if, and when, rates rise to realistic levels.

“We have rock-bottom rates and QE is still going on – this is all experimental policy and means we are in uncharted territory.”

He points out that in such an environment banks would be unable to sustain the losses caused by defaults on unserviceable debt which would lead to a systemic crisis.

Spreadbury is not the first high profile financial expert to warn of an impending systemic crisis. We recently covered how Stephen King, chief economist at the world's third largest bank HSBC, likened the global economy to the Titanic. Andrew Wilson, Goldman Sachs Asset Management’s chief executive in Europe recently gave similar warnings.

Spreadbury highlights that the £85,000 guarantee to UK depositors by the Financial Services Compensation Scheme is largely unfunded and that the government has said it will not intervene to rescue failing banks in the future - leaving deposits to be bailed-in.

ENDS

World Vision: 3.5 Million Displaced Following Myanmar Earthquake And Ongoing Internal Conflict

World Vision: 3.5 Million Displaced Following Myanmar Earthquake And Ongoing Internal Conflict World Butchers Challenge: World’s Top Butchers From 14 Nations Go Knife-to-Knife In Paris

World Butchers Challenge: World’s Top Butchers From 14 Nations Go Knife-to-Knife In Paris Save The Children: ‘It Was Terrifying’ - Children Prepare To Spend Myanmar New Year Festival In Shelters Following Earthquake

Save The Children: ‘It Was Terrifying’ - Children Prepare To Spend Myanmar New Year Festival In Shelters Following Earthquake Global Forest Coalition: Global NGOs Call On International Maritime Org To Reject Biofuels And Commit To Truly Clean Energy

Global Forest Coalition: Global NGOs Call On International Maritime Org To Reject Biofuels And Commit To Truly Clean Energy Australian Catholic University: Principals Navigate Growing Challenges As Anxiety, Depression Increase And Violence, Workloads Intensify

Australian Catholic University: Principals Navigate Growing Challenges As Anxiety, Depression Increase And Violence, Workloads Intensify SNAP: Survivors Deliver Vos Estis Lux Mundi Complaints Against Six Cardinals To Vatican Secretary Of State Parolin

SNAP: Survivors Deliver Vos Estis Lux Mundi Complaints Against Six Cardinals To Vatican Secretary Of State Parolin