World Rankings: Competitiveness and austerity - the divorce?

[New Zealand results summary: NewZealand.pdf]

IMD RELEASES ITS 25TH ANNIVERSARY WORLD COMPETITIVENESS RANKINGS

Embargoed until 00:01 local time, May 30, 2013

Competitiveness and

austerity: the divorce?

The good performance

of the US (1), Switzerland (2), Hong Kong (3), Sweden (4)

and even Japan (24) – while the euro zone stagnates –

calls austerity into question

(Plus a

historical perspective on winners and losers over

time)

LAUSANNE,

SWITZERLAND (May 30, 2013)): IMD, a top-ranked

global business school based in Switzerland, today announced

its 25th anniversary world competitiveness rankings. In

addition to ranking 60 economies for 2013, the IMD World

Competitiveness Center also looks at the winners and losers

since its creation.

Professor Stephane Garelli, director of the IMD World Competitiveness Center, said: "While the euro zone remains stalled, the robust comeback of the US to the top of the competitiveness rankings, and better news from Japan, have revived the austerity debate. Structural reforms are unavoidable, but growth remains a prerequisite for competitiveness. In addition, the harshness of austerity measures too often antagonizes the population. In the end, countries need to preserve social cohesion to deliver prosperity."

Highlights of the 2013 ranking

The US has regained

the No. 1 spot in 2013, thanks to a rebounding financial

sector, an abundance of technological innovation and

successful companies.

China (21) and Japan (24) are also increasing their competitiveness. In the case of Japan, Abenomics seems to be having an initial impact on the dynamism of the economy.

In Europe, the most competitive nations include Switzerland (2), Sweden (4) and Germany (9), whose success relies upon export-oriented manufacturing, diversified economies, strong small and medium enterprises (SMEs) and fiscal discipline. Like last year, the rest of Europe is heavily constrained by austerity programs that are delaying recovery and calling into question the timeliness of the measures proposed.

The BRICS economies have enjoyed mixed fortunes. China (21) and Russia (42) rose in the rankings, while India (40), Brazil (51) and South Africa (53) all fell. Emerging economies in general remain highly dependent on the global economic recovery, which seems to be delayed.

In Latin America, Mexico (32) has seen a small revival in its competitiveness that now needs to be confirmed over time and by the continuous implementation of structural reforms.

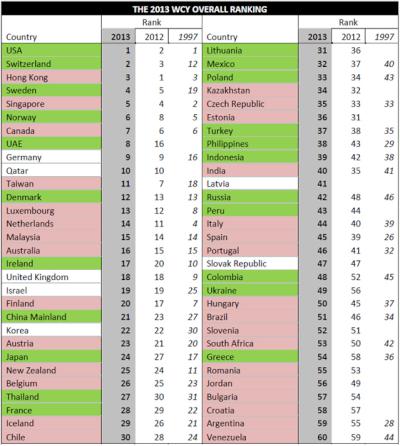

Note: Countries that rose in the 2013 rankings are in green. Those that fell are in pink. Nations with a “blank” in the 1997 column were not ranked in that year. Latvia is ranked for the first time in 2013. Between 1997-2013 some nations may have risen and then fallen (e.g. Ireland) or surged ahead recently (e.g. Mexico). Others may have fallen largely by being bypassed by newcomers (e.g. Brazil).

A 25th anniversary perspective on World Competitiveness

In 1989,

the IMD World Competitiveness Yearbook had a split ranking.

The most competitive advanced economies were Japan,

Switzerland and the Netherlands. Among emerging markets,

Singapore, Hong Kong and Malaysia led the way. Globalization

had not yet kicked in. China, Russia and several other

nations (some of which did not exist back then) were not

included.

By 1997, the world of competitiveness had become increasingly global, and IMD first produced a unified ranking including both advanced and emerging economies. Here are the countries that have risen and fallen the most since then:

| Winners since 1997

(+ 5 or more ranks): China, Germany, Israel,

Korea, Mexico, | Losers since 1997 (- 5 or more

ranks) Argentina, Brazil, Chile, Finland,

France, |

Winners:

• The US, Singapore and Canada, although not in the “winners” list, have very stable and enduring competitiveness models that rely on long-term advantages such as technology, education and advanced infrastructure.

• In Europe, Switzerland, Sweden and Germany share the same recipe for success: exports, manufacturing, diversification, competitive SMEs and budget discipline.

• In Asia, China’s success has had a pull effect on the region’s competitiveness, prompting many Asian economies to redirect their exports from the US and Europe to other emerging markets.

• Mexico and Poland are seeing a revival in competitiveness that will need to be confirmed over time.

Losers:

• Europe has lost ground and accounts for more than half of the “losers” since 1997.

• The UK and France in particular are losing their dominant position and competitive clout, while The Netherlands, Luxembourg and Finland need to adapt their competitiveness models to a changing environment.

• In Southern Europe Italy, Spain, Portugal and Greece are all lagging behind. They did not diversify their industry enough or control public spending and are now facing austerity programs.

• The fate of Ireland and Iceland shows that competitiveness needs to be sustainable, and that uncontrolled fast expansion can also lead to disaster.

• Latin America has been disappointing, with larger economies such as Chile, Brazil, Argentina and Venezuela all losing ground and being challenged by the emerging competitiveness of Asian nations.

Professor Garelli added: “Generalizations are, however, misleading. True, Europe’s competitiveness is declining, but Switzerland, Sweden, Germany and Norway are shining successes. Latin America is disappointing, but there are great global companies all over that region. Brazil, Russia, India, China and South Africa are immensely different in their competitiveness strategies and performance, but the BRICS remain lands of opportunities.”

“In the end, the golden rules of competitiveness are simple: manufacture, diversify, export, invest in infrastructure, educate, support SMEs, enforce fiscal discipline, and above all maintain social cohesion,” concluded Professor Garelli.

The IMD World Competitiveness Center is a part of IMD

IMD is a top-ranked business school. We

are the experts in developing global leaders through

high-impact executive education. Why IMD? We are 100%

focused on real-world executive development. We offer Swiss

excellence with a global perspective. And we have a

flexible, customized and effective approach (www.imd.org).

Published since 1989, the World Competitiveness Yearbook is

recognized as the leading annual report on the

competitiveness of nations

ENDS

[New Zealand results

summary: NewZealand.pdf]

Palestine Forum of New Zealand: A Message To Pope Leo XIV

Palestine Forum of New Zealand: A Message To Pope Leo XIV Pacific Islands FFA: Ten Years Together - Celebrating Regional Solidarity Through The NTSA

Pacific Islands FFA: Ten Years Together - Celebrating Regional Solidarity Through The NTSA ITUC: The Greatest Threat To Democracy In 80 Years - Stop The Billionaire Coup

ITUC: The Greatest Threat To Democracy In 80 Years - Stop The Billionaire Coup Save The Children: A Third Of 5-Year-Olds Will Be Spared Unprecedented Lifetime Exposure To Dangerous Heat If World Meets 1.5°C Temperature

Save The Children: A Third Of 5-Year-Olds Will Be Spared Unprecedented Lifetime Exposure To Dangerous Heat If World Meets 1.5°C Temperature Access Now: NSO To Pay $168 Million In Damages To WhatsApp For Pegasus Spyware Hacking

Access Now: NSO To Pay $168 Million In Damages To WhatsApp For Pegasus Spyware Hacking NIWA: New Study Reveals Climate Change Is Already Impacting The Andes

NIWA: New Study Reveals Climate Change Is Already Impacting The Andes