Improper Manoeuvres at Harken During the Bush Era

NOTE: From http://www.harvardwatch.org. See also accompanying Press Release… Harvard's Enron-Style Partnership With Harken

New Evidence Regarding Improper Financial Manoeuvres at Harken Energy During the Bush Era

A HARVARDWATCH MEMO

October, 2002

THE HARKEN ANADARKO PARTNERSHIP

In 1990—when George W. Bush held four high-level positions at Harken Energy Company as a director, a member of the audit committee, a member of the restructuring committee, and a company consultant—Harken and its largest shareholder, Harvard University, created the Harken Anadarko Partnership (HAP).

The partnership allowed Harvard to subsidize covertly Harken's struggling business by effectively shouldering a large percentage of the company's loss-generating assets and debts. This maneuver transformed the public perception of Harken’s financial state: the company's reported losses and liabilities were drastically reduced over the next two years. These brighter financial figures allowed Harken's stock price to temporarily reverse its precipitous decline and reach its historical high in 1991, indicating that the Anadarko partnership misled investors about the future profitability of the company.

With its insider access to information about the performance of HAP and Harken’s long-term sustainability, Harvard used this bubble as an opportunity to sell 1.6 million Harken shares.

HAP bears striking resemblance to the partnerships Bush has condemned at Enron: it was controlled by and transparent only to Harken insiders, and likely was used to artificially brighten the company's business prospects. With Harken meeting minutes revealing that Bush gave his personal approval of the creation of HAP, he should now face serious questions about the propriety of such maneuvers.

BUSH, HARKEN, AND HARVARD: THE PARTNERSHIP

• Bush served as a director of Harken from October, 1986, when Harken bought his failing oil company, until his resignation in October, 1993. He sat on Harken's audit committee from the 1980s until he resigned, was paid up to $120,000 a year as a consultant, and received a company loan of over $180,000 in order to buy Harken stock.1

• In December 1990, Harken shifted its substantial domestic operations into an offthe- books partnership owned by Harken and its largest shareholder, Harvard University. 2 Harvard contributed $64.5 million worth of property. Harken contributed drilling operations valued at $26.1 million, which also carried $20 million of bank debt and liabilities. Harken held a 16% interest in the Harken Anadarko Partnership (HAP); Harvard owned the remaining 84%.3 The actual operation remained under Harken’s control, however. From 1990 until 1993 the Harvard-run HAP paid Harken about $1 million per year to operate the partnership's oil and gas

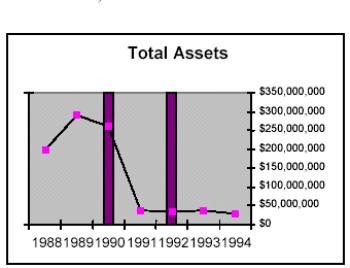

1 Harken Energy Corp., SEC Proxy Statement. Document date 1/28/91, filing date 1/31/91, p.7, 17, 23.2 See Figure 1. Harken’s assets fell dramatically at precisely the time this partnership began—indicating that Harken shifted an enormous amount of their operations into HAP. For Harken’s statement of its new international priorities, see Harken Energy Corporation, SEC Form 10-K. Document date 12/31/92, filing date 05/03/93, p.3.

3 Harken Energy Corp., SEC Proxy Statement. Document date 05/01/91, filing date 06/07/91, p.22-23.

properties.4 Additionally, Harken reported contract drilling revenues of $1.3 million and well servicing fees totaling $2.2 million in 1991.5 Any portion of these revenues could have been paid by Harvard, through HAP, for operations related to the partnership.

• Bush was a witting participant in the creation of HAP and gave it his personal approval. According to notes from the August 29, 1990, special meeting of Harken's board, Bush motioned "to approve the Company continuing its discussion and review of [the partnership] and authorized management to proceed in negotiations with [Harvard] toward formulating a letter of intent to be subsequenly presented to the Board outlining the specific terms of this transaction for its consideration."6

• This was not the first unorthodox collaboration between Harvard and Harken. Harvard had invested heavily in Harken in 1986—within 30 days of Bush joining the company7—and soon owned nearly one third of the company’s equity.8 Harvard representatives sat on Harken’s board of directors from 1987 until 20009, and had seats on its executive and compensation committees.10 Moreover, Harvard’s Harken directors—Michael Eisenson and Donald Beane—both directly held 10,000 Harken shares, a clear conflict of interest that contravenes industry standards for institutional investors.11 Finally, Harvard and another major shareholder loaned Harken $46 million in May, 1990, to help it escape from a severe liquidity crisis. It's unclear how much of the loan came from Harvard.12

THE UPSHOT: EFFECTS OF HAP ON HARKEN

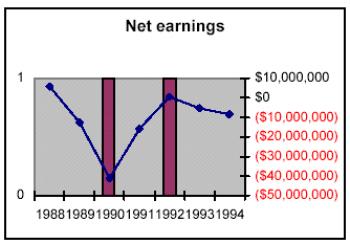

• Prior to the formation of HAP in late 1990, Harken was in deep financial trouble.It had recently accumulated massive debt; net earnings were in deep in the negative and falling; and Harken's stock price had plummeted to $1.25 in late 1990 from a recent high of $6.13

• The creation of HAP had a considerable positive effect on Harken’s reported financial figures while not substantively affecting who controlled the relevant properties.

4 See Harken Energy's proxy statements from 1990 to 1993.5 Harken Energy Corp., SEC Form 10-K. Document date 12/31/93, filing date 3/30/94, p.13/15.

6 Harken Energy Corp., Minutes of a Special Meeting of the Board of Directors Held August 29, 1990.

(Obtained by the Center for Public Integrity by FOIA request; see www.public-i.org.) 7 The Boston Globe, July 19, 2002. "Report Says that Harken Sought Influence in Buying Bush Firm," by Michael Kranish, p.A3. Also see The Boston Globe, July 18, 2002. "Harvard Fund Pouted Millions Into Bush- Connected Oil Firm," by Michael Kranish, p.A12.

8 Supra note 1, p.2.

9 Michael Eisenson resigned from Harken's board in 2000. See Canada NewsWire, March 16, 2000. "Harken Appoints Mr. Larry G. Akers to the Board and Offers Bolivar Block Update." 10 Supra note 1, p.3-4. Also see the minutes of Harken's board meetings, available at www.public-i.org.

11 Supra note 3, p.4-6.

12 Harken Energy Corp., SEC Form 10-K. Document date 12/31/91, filing date 5/11/92, p.3-4, 31.

13 See Figure 5.

The period from 1990 to 1992, when Harken put assets behind the veil of HAP, was the only period from 1988 to 1994 that Harken’s net earnings increased.

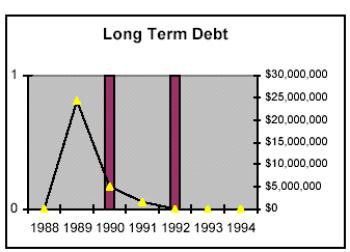

Due to the massive transfer of assets and liabilities to the partnership, Harken’s longterm debt fell dramatically in 1990 and continued to decline over the next two years.14 As a result, Harken's interest expense decreased to $230,000 during 1991, a 92 percent decline from 1990.15

• Following the transfer of Harken's assets and debts into HAP, Harken experienced the largest increase in its stock price for the 6-year period between 1988 to 1994. Harken’s stock reached its highest ever closing price, over $8 a share, in 1991.16

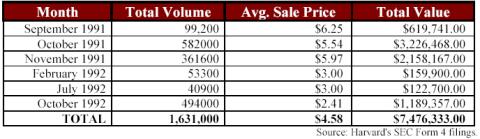

• Harvard sold off over 1.6 million shares of Harken stock during this period of inflated stock price. Between September 26, 1991 and October 20, 1992—when Harken's stock price appears to have been inflated by the formation of HAP—Harvard unloaded a large fraction of its Harken holdings by executing over 60 insider transactions.17

CLOSING THE DEAL: HARKEN EXITS HAP AND CABOT RELIEVES HARVARD OF THE PROPERTIES

• Between 1990 and 1993, Harken received multiple payments from Harvard in deals that shifted the partnership entirely onto Harvard. In May 1991, Harvard had lent Harken about $1.5 million at an interest rate of 12% annually. On August 31, 1991, the maturity date for the loan, Harvard agreed to extinguish the principal and all interest in exchange for 4% of Harken's stake in HAP—which was at the time generating significant losses.18 In December of 1992, Harvard paid Harken $2.65 million in cash for its remaining 12% share in HAP—a share that in 1991 generated a $3 million loss for Harken.19 Harken recognized this sale as a gain of $1,449,000 for itself, and reported that “as a result of this gain, operating profit for Harken's exploration and production operations was $2,872,000 during 1992”—the profit on the sale to Harvard accounting for more than half of that operating profit.20

• Following Harken's exit from HAP, its earnings and stock price fell again. Soon after Harken's 1992 sale of its remaining 12% share in HAP, Harken's net earnings turned south again. By early 1993, its stock price was on a downward spiral from which it would never fully recover.21

14 See Figures 3 and 4. Harken Energy’s SEC Form 10-K from 1992 and 1994, as well as note 14.15 PR Newswire, March 30, 1992, "Harken Announced 1991 Results," by Harken Energy.

16 See Figure 5.

17 See Figure 6.

18 Supra note 3.

19 Supra note 15.

20 Harken Energy Corp., SEC S-3 A00. Document date 8/8/95, filing date 8/8/95, p.7/10.

21 See Figure 5.

• In May 1993, Harvard sold its property from HAP to the Cabot Oil and Gas Corporation in what Cabot calls the “Harvard Acquisition.” Cabot Oil and Gas, which was spun off by the chemical giant Cabot Corporation in 1991 was founded by the Cabot family, whose members—including Walter Cabot, who headed Harvard Management Company from its founding in 1974 until 1991, and former Harvard Treasurer Paul Cabot—have wielded unparalleled influence in Harvard’s financial management structure for over a century. In exchange for the Anadarko properties, Harvard received 692,439 shares of $3.125 convertible Cabot Oil & Gas preferred stock, with a stated value of $34.6 million.22

HOW THE PARTNERSHIP MISLED THE PUBLIC

• Because the partnership was not required to report its finances, the details of Harken’s oil and gas operations in the Anadarko Basin were hidden from the public's view. As Harken stated in one of its proxy statements, "As a result [of the partnership], Harken no longer reflects direct oil and gas operating revenues, expenses or depreciation and amortization in its statement of operations." 23

• Harken's debt-loaded properties in the Anadarko region, while nominally removed from Harken's hands in 1990, stayed within the total control of Harken insiders. After all, the partnership consisted of Harken and its largest shareholder, Harvard, which had two of its own men sitting on Harken's board.

• The immediate and drastic improvement of Harken's financial figures following the creation of HAP indicates that its function was to allow Harvard covertly to prop up Harken's ailing business. The large debt payments and operating losses connected to Harken's Anadarko properties did not disappear with the formation of HAP in late 1990; rather, the bulk of it was shouldered by Harvard via its large stake in the partnership. Instead of overtly transferring money to Harken, a move that may have revealed the extent of Harken's troubles, Harvard effectively absorbed many of Harken's expenses, giving Harken the false appearance of strong business prospects.

• Harken may have further taken advantage of the partnership's lack of transparency to receive payoffs from Harvard through additional operational fees amounting to millions in revenue for Harken. The diffculty in verifying whether Harvard was offering potentially inflated compensation to Harken for these services is precisely the pitfall of a partnership like HAP.

22 Cabot Oil and Gas Corporation, SEC Form 10-K. Document date 12/31/93, filing date 3/30/94, p.4. Also see Bloomberg News, March 31, 1993. "Federal Trade Commission Grants Federal Antitrust Clearances March 31."23 Harken Energy Corp., SEC Proxy Statement. Document date 1/15/93, filing date 3/10/94, p.16.

KEY QUESTIONS FOR HARKEN, HARVARD, AND GEORGE W. BUSH

• By transferring Harken’s major assets to a partnership owned and operated by company insiders, did Harken mislead investors by removing failing and depreciating assets from its books while retaining control over their allocation?

As a member of Harken’s audit committee, what did Bush know?

• Did the HAP partnership forestall a liquidity crisis that threatened to embarrass Harvard University and George W. Bush, the company’s two most prominent insiders?

• What explains the intensity of Harvard’s commitment to Harken over the period of Bush’s involvement in the company? Why would Harvard, an institution with no experience in the management of energy concerns, agree to absorb the major debts and assets of Harken Energy, a company on a downward spiral? Did insider information prompt Harvard’s sale of 1.6 million shares in the wake of HAP’s formation?

• Were Harken’s assets and debts properly valued as they were transferred from Harken to HAP and during the time in which they remained in HAP? Did the Bush-led Harken audit committee ever verify the value of those assets? What accounts for the substantially diminished price at which HAP’s assets were eventually purchased by Cabot Oil & Gas?

• How much total money did Harken receive from HAP in operating and management fees during the life of the partnership?

GRAPHS AND TABLES

Figure 1. Harken’s total assets from 1988 to 1994. In 1990, Harken transferred assets into HAP. (The period from 1990 to 1992, while Harken was involved in HAP, is indicated by the vertical bars.)

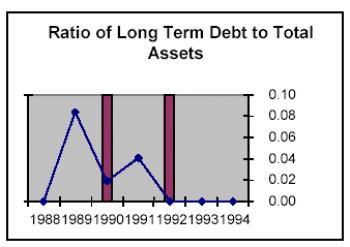

Figure 2. Harken’s ratio of

long term debt to total assets.

Figure 3. Harken’s long term

debt, increasing until the formation of HAP, when it fell

dramatically.

Figure 4. Harken’s net

earnings, which were falling until the formation of

HAP.

Figure 5. Harken’s stock’s

closing price.

Figure 6. Harvard's sales of

Harken stock during the life of

HAP.

PROFILES OF THE KEY PLAYERS

Harken Anadarko Partnership (HAP)

The off-balance-sheet partnership created by Harken and Harvard in late 1990 that absorbed Harken’s debt-loaded and loss-generating domestic operations, thereby transforming its reported earnings figures. Harken eventually sold its stake in HAP to Harvard in late 1992; Harvard sold the partnership's assets to Cabot Oil & Gas Corp. in 1993.

George W. Bush

A Harken board member from 1986, when his failing Spectrum 7 was purchased by Harken, until 1993. As a director and member of Harken's audit committee, Bush oversaw the creation of HAP, as well as Harken's sale of Aloha Petroleum to company insiders—a deal that the SEC found in violation of accounting rules. Bush received an M.B.A. from the Harvard Business School in 1982.

Harvard Management Company (HMC)

The entity that invests more than $15 billion of the Harvard endowment. HMC is wholly owned by the Harvard Corporation, the university’s seven-member governing board. Harvard Management is estimated to have lost tens of millions of dollars in its involvement with Harken.

Aeneas Venture Corporation

The wholly-owned affiliate of the Harvard Management Company that invested heavily in Harken Energy within 30 days of Bush joining the company. Aeneas co-founded the Harken Anadarko Partnership with HEXCO, a wholly-owned subsidiary of Harken Energy.

Michael R. Eisenson

A former partner at HMC, and former vice president of Aeneas and member of its investment committee. Eisenson was a director at Harken from 1987 until 2000, serving on its executive and compensation committees. Eisenson now heads Charlesbank Capital Partners, a spinoff of Harvard Management that manages Harvard Unviersity’s extensive real estate holdings and investments.

Donald D. Beane

Former Partner and Chief Operating Officer of Harvard Management Company, as well as a former vice president of Aeneas. Beane sat on Harken's board and audit committee alongside George W. Bush from 1986 until 1992, and was a director at E-Z Serve, a Harken spinoff, from 1990 to 1998.

Cabot Oil & Gas Corporation (COG)

Purchased the assets of the Harken Anadarko Partnership in 1993; the partnership was wholly owned by Harvard at the time. The Cabot family, whose members were large shareholders and directors of COG, has wielded unparalleled influence in Harvard's financial management structure for over a century.

Walter M. Cabot

President of Harvard Management and Aeneas at the beginning of Harvard's involvement in Harken. Cabot, a founder of HMC in 1974, left Harvard in 1991.

Robert G. Stone, Jr.

Senior Fellow of the Harvard Corporation, the University’s seven-member governing board, until a few months ago, though he remains a director of HMC. Stone oversaw Harvard’s involvement in Harken and HAP. A fellow Texas oilman, he has been a significant contributor to the Bush family’s political efforts.

ENDS

KidsRights: KidsRights Index 2025 Now Available

KidsRights: KidsRights Index 2025 Now Available CNS: We Can Do Better So That All People With HIV Live Healthy Normal Lifespans

CNS: We Can Do Better So That All People With HIV Live Healthy Normal Lifespans John Divinagracia, IMI: The Evolution Of Mankind’s First Voice - How Drums Shape The Human Story

John Divinagracia, IMI: The Evolution Of Mankind’s First Voice - How Drums Shape The Human Story Deep Sea Mining Campaign: New Report Exposes Impossible Metals’ Claims As Scientifically Baseless

Deep Sea Mining Campaign: New Report Exposes Impossible Metals’ Claims As Scientifically Baseless Pacific Whale Fund: First Māori Voice Opens UN Oceans Conference, Pushing For Marine Legal Rights

Pacific Whale Fund: First Māori Voice Opens UN Oceans Conference, Pushing For Marine Legal Rights International AIDS Society: IAS Announces Rio De Janeiro As Host City For AIDS 2026

International AIDS Society: IAS Announces Rio De Janeiro As Host City For AIDS 2026