Digital Currency Can't Replace Physical Cash

An Australian Central Bank Digital Currency can't replace physical banknotes and coins because Australians don't trust digital dollars.

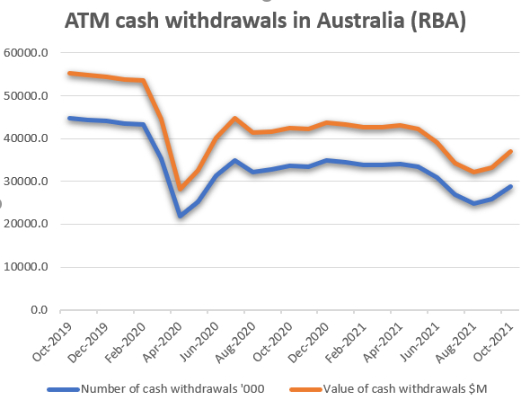

The latest RBA data (released this week) shows the number (and value) of ATM withdrawals is increasing and the total value of banknotes on issue in Australia has at an all-time record high of $101,519 billion, up $65 million in a week.

"ATM cash withdrawals are up as lockdowns are easing and the amount of physical cash on issue is at an all-time high," said Jason Bryce spokesperson for the CashWelcome.org industry campaign.

"In uncertain times, Australians trust what is real much more than anything digital.

"Other nations are working on protecting the public's right to access and use physical cash and Australia needs to focus on this as well."

The Reserve Bank of NZ has announced a process to investigate protecting the cash economy. The US Congress will consider a bill - The Payment Choice Act - to mandate cash acceptance at retail points of sale. The European Union has a long-standing policy that all member state citizens must be able to use physical Euro cash to make purchases.

"Cashless transactions attract fees, surcharges and carry information that can be sold or used against the consumer's best interests," said Mr Bryce.

"No digital currency or payment system is completely reliable or safe from outages, power blackouts and hackers.

"Some Australians will never be able to use and access digital dollars and they will be largely excluded if the government lets the cash system wither and die.

"Australians want to use cash, because it is easy for budgeting, private and free to use at all points of sale.

"The public wants to know if they are still going to be able to access cash from a local bank branch or ATM.

"The public wants to know if they are still going to be able to use cash to buy food and essentials."

Gordon Campbell: On The New Pope, And The Israeli Attack On Peter Davis

Gordon Campbell: On The New Pope, And The Israeli Attack On Peter Davis New Zealand Labour Party: Labour Asks Why Govt Is Silent On Gaza

New Zealand Labour Party: Labour Asks Why Govt Is Silent On Gaza Transport Accident Investigation Commission: Near-Collision Highlights Safety Lessons For All Busy, Unattended Aerodromes

Transport Accident Investigation Commission: Near-Collision Highlights Safety Lessons For All Busy, Unattended Aerodromes Green Party: Wildlife Law Change A Deep Betrayal Of Public Trust

Green Party: Wildlife Law Change A Deep Betrayal Of Public Trust NZCTU: Unions Launch Petition To Protect Pay Equity

NZCTU: Unions Launch Petition To Protect Pay Equity Greenpeace: Greenpeace Slams PM’s Science Pick - 'Polluters Are Running The Show'

Greenpeace: Greenpeace Slams PM’s Science Pick - 'Polluters Are Running The Show' NZ Government: PM’s Science Prizes Celebrate Excellence

NZ Government: PM’s Science Prizes Celebrate Excellence