Huge Majority Think Lump Sum Payment Will Be Effective, Will Spend It Mostly On Basics

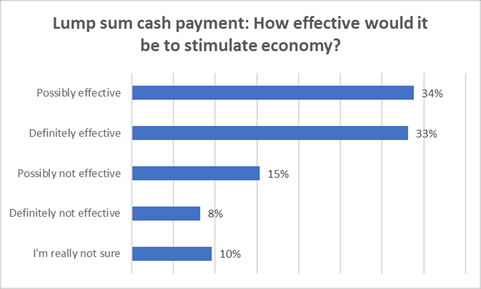

67% of New Zealanders think a lump sum cash payment paid to everyone will be an effective way of stimulating the economy.

A Horizon Research survey finds 23% think it will not be effective.

The results mean an estimated 2,405,200 adults think a lump sum payment will be effective, while around 841,300 think it will not be.

10% are not sure if it will be effective.

How much:

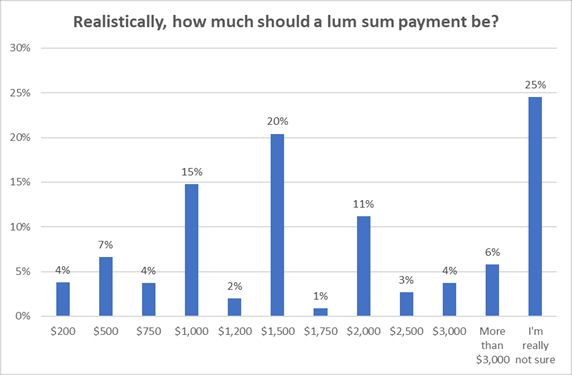

When it comes to how much should be paid as a lump sum, however, 25% are not sure.

Peak support is at 20% for a $1,500 payment.

Around half of adults support a payment of between $1,000 and $2,000.

4% say $200, 4% say $3000 and 6% say more than $3000.

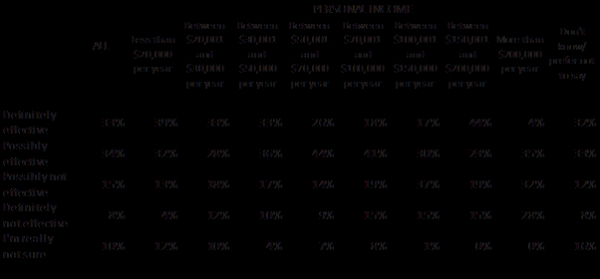

Personal income

There is a majority view across all income groups that a lump sum cash payment will be effective, except among those with annual incomes of $200,000 or more. 39% of this group think it will be effective, 60% think it will not be.

71% of those on incomes of $20,000 or less a year believe it will be effective, 70% of those with incomes of between $50,001 and $70,000 a year (which includes most earning the average wage).

How effective would paying a cash lump sum to every person in New Zealand be to stimulate the New Zealand economy? (Results by personal income):

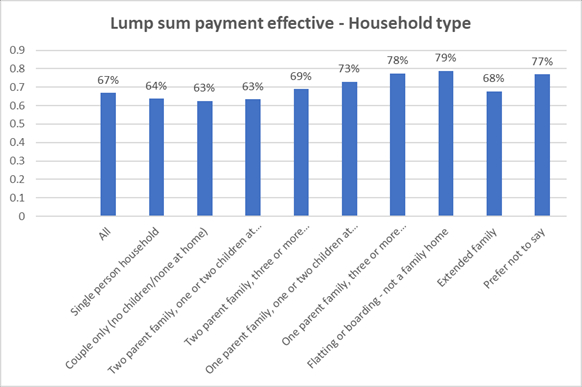

Households

By household type, the view that a lump sum payment would be an effective way of stimulating the economy is highest at 79% among those who are flatting and boarding, followed by

- One parent families with three or more children (78%)

- One parent families with one or two children at home (73%)

- Two parent families with three or more children at home (69%), and

- Extended families (68%).

Those below the overall effectiveness result of 67%, include

- Couple only households with no children at home (the largest household type) 63%

- Two parent families with one or two children at home (63%)_, and

- Single person households (64%).

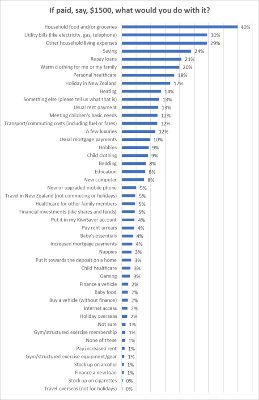

How a lump sum payment of $1,500 would be spent

If a lump sum payment of $1,500 were paid most New Zealanders will spend it on household food or groceries (40%), utility bills (30%) and other household living expenses (29%).

Perhaps in a reflection of jobs lost and working hour reductions as a direct result of COVID-19, 24% would save it.

Among the most selected ways to spend it are warm clothes for me or my family (20%), personal health care (18%), heating (14%), paying rents(13%) and meeting children’s basic needs (12%).

However, 17% said they would spend at least part of any lump sum payment on taking a holiday in New Zealand. This may reflect other Horizon Research results which find that large numbers want to take a domestic holiday in the 12 months after restrictions are eased to allow this, and around 89% want to visit friends and relatives when allowed.

2% say they will use it to finance a vehicle, 1% to finance a new loan, and 1% to stock up on alcohol.

Some economists supporting a lump sum cash payment as a way to stimulate the economy argue most of the money would be spent on basics. The survey supports this view.

Note, respondents could select more than one item and the result reflects the range of spending, not sole spending on a single item.

Results are from an April 28-30 survey of 1,150 members of Horizon’s specialist online research panels representing the New Zealand adult population at the 2018 Census. At a 95% confidence level, the maximum margin of error is +/- 2.9% overall. Detailed results are available from Horizon Research.

www.horizonpoll.co.nz

Gordon Campbell: On The Clash Between Auckland Airport And Air New Zealand

Gordon Campbell: On The Clash Between Auckland Airport And Air New Zealand Fire and Emergency NZ: Check Your Smoke Alarms When Clocks Go Back This Sunday

Fire and Emergency NZ: Check Your Smoke Alarms When Clocks Go Back This Sunday NZ Government: Repeal Of 7AA Puts Child Wellbeing First

NZ Government: Repeal Of 7AA Puts Child Wellbeing First NZ Government: Reducing Ambiguity About What Is Reasonably Practicable For Health And Safety Compliance

NZ Government: Reducing Ambiguity About What Is Reasonably Practicable For Health And Safety Compliance Office of the Speaker: New Zealand Parliamentarians Attend 150th IPU Assembly

Office of the Speaker: New Zealand Parliamentarians Attend 150th IPU Assembly RNZRSA: RNZRSA Supports Willie Apiata VC's Stand To Drive Change To Veterans’ Support Act

RNZRSA: RNZRSA Supports Willie Apiata VC's Stand To Drive Change To Veterans’ Support Act Diane McCarthy - LDR: War Hero Willie Apiata Entrusts MP With Victoria Cross Medal

Diane McCarthy - LDR: War Hero Willie Apiata Entrusts MP With Victoria Cross Medal