MANA Movement says tax cut on GST must be first priority

MANA Movement says tax cut on GST must be first priority

“If Prime Minister John Key has money available for tax cuts then cutting GST must be the first priority”, said MANA Movement Economic Justice Spokesperson John Minto.

“GST is a nasty tax on low-income families”, said Minto.

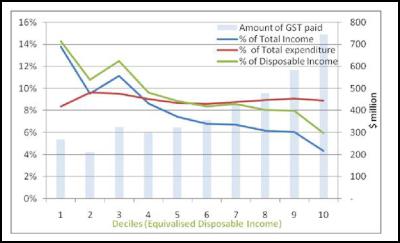

“People in the lowest-income 10% of New Zealanders pay 14% of their income on GST while the top 10% of income earners pay less than 5% of their income on GST.”

“The following graph shows just how vicious and unfair GST is as it cuts into low-income families.”

“Last week MANA Movement showed how unfair and

unbalanced our tax system is with a worker on the minimum

wage paying a 10 times higher tax rate than the Prime

Minister.”

Minimum wage worker 28% tax

Prime Minister 2.8% tax

“The minimum wage worker on 40 hours per week earns $29,640 and pays $4,207 in income tax and $4,149.60 in GST giving a total tax of $8,356.60 or 28% of income.”

“On the other hand the Prime Minister earns $428,000 from his PM’s salary along with this year’s $5,000,000 increase in his wealth (according to NBR’s rich list) which gives him a total income of $5,428,000. On this total income he pays just $132,160 in income tax and approximately $21,400 in GST giving a total tax of $153,560 or 2.8% of income.”

“Low and middle income families are doing all the heavy lifting for the economy and need a break.”

“Cleaners, fast-food workers, hospitality workers and security guards are all heavily subsidising the lifestyles of the Prime Minister and his superrich mates.”

The MANA Movement would overhaul the tax system and as well as abolishing GST altogether we would introduce –

• A robust capital gains tax paid at the same rate as

the person’s income tax

• A financial transactions

tax on currency speculation to replace

• Higher tax on

higher incomes

• An inheritance tax on estates over

$500,000. (National abolished inheritance tax in the early

1990s allowing wealthy family dynasties to flourish at the

expense of everyone else.

ends

Gordon Campbell: On Why Leakers Are Essential To The Public Good

Gordon Campbell: On Why Leakers Are Essential To The Public Good The Tree Council: Auckland Council Notifies Plan Change 113 Notable Trees

The Tree Council: Auckland Council Notifies Plan Change 113 Notable Trees ACT New Zealand: ACT New Zealand Celebration Brunch - David Seymour's First Speech as Deputy PM

ACT New Zealand: ACT New Zealand Celebration Brunch - David Seymour's First Speech as Deputy PM NZ Police: Operation Purple | Anti-Social Road User Gathering In Levin

NZ Police: Operation Purple | Anti-Social Road User Gathering In Levin New Zealand Defence Force: The Latest Update On The HMNZS Manawanui Response

New Zealand Defence Force: The Latest Update On The HMNZS Manawanui Response NZCTU: NZCTU Release Detailed Budget 2025 Analysis

NZCTU: NZCTU Release Detailed Budget 2025 Analysis Department of Conservation: DOC Reveals Surprising Toilet Paper Stats

Department of Conservation: DOC Reveals Surprising Toilet Paper Stats