NZCPR-Weekly - Good Policy Relies On Good Data

New Zealand Centre For Political Research

Dear Reader,

This week we look at how

unreliable statistics can have extremely serious public

policy implications, our NZCPR Guest Commentator Michael

Littlewood questions Census data on housing and suggests

that home ownership rates in New Zealand may not be falling,

and our poll asks whether taxpayers should fund housing

exclusively for Maori.

Through your support, the

NZCPR is campaigning to raise public awareness of the Maori

Party's constitutional review. In such a review, numbers

matter. If advocates of a Treaty-based constitution have

proactively sent in large numbers of submissions, but

opponents have not, then the Advisory Panel may well

conclude that the public are not overly concerned. That's

why, if you know anyone who feels strongly about this issue,

please urge them to send in a submission by the end of the

month - even if it is just a short one.

To assist, we

have provided our summary Briefing

Notes on all of the

items listed in the government's constitutional review Terms

of Reference HERE.

Submissions to the Constitutional Advisory Panel can be

sent to: constitutionalreview@justice.govt.nz.

Thanks very much for your interest and support.

Kindest regards,

Dr Muriel Newman

NZCPR

Founder and Director

What’s new on our Breaking

Views blog…

•

Lindsay Mitchell: Radical feminists push for Labour Party

quotas

•

Ron Smith: Experiments in Democracy

•

Benjamin Herscovitch: Authoritarian China's successes

vindicate liberalism

•

Matt Ridley: The Tabarrok curve - balancing intellectual

property and freedom to innovate

NZCPR Weekly:

GOOD POLICY RELIES ON GOOD DATA

By

Dr Muriel Newman

New Zealand’s so-called

home ownership crisis has become a political

bandwagon that everyone seems to be jumping on. It is based

on Statistics New Zealand Census data that shows home

ownership rates have been falling over recent years from

73.8 percent of total households in 1991, to 70.7 percent in

1996, to 67.8 percent in 2001, and to 66.9 percent in 2006.

Socialist groups in particular are using

the figures as a clarion call for redistribution on a grand

scale - a multi-billion dollar taxpayer funded spend-up in

the form of government home-building programmes to fast

track low income families into their own

homes.The Labour Party wants the

government to build 100,000 new “affordable” homes at a

rate of 10,000 a year over a 10 year period. They claim that

their homes could be built for $300,000 and would be offered

to low income families to buy – using a ballot system if

the demand exceeds supply.The Greens

want the Government to do more – not only build 100,000

new “affordable”, “healthy”, “warm”, and

“environmentally-friendly” homes, but fund them as well.

These homes would be offered to families under an

equity-sharing scheme, meaning that taxpayers would carry

the full $300 billion cost burden of private home ownership

debt. This debt would be paid off over a 25 year period,

according to the Greens’ best-case scenario, but the

timeframe would be decades longer, if families opted to pay

the minimum of $100 a week off their low-rate $300,000

government loan.In spite of being a

so-called “movement of the people”, the Mana Party’s

core principle is that “what is good for Maori is good for

Aotearoa”. Their plan for affordable housing is

predictably race based: 10,000 houses a year built only by

Maori, only for Maori, and which can be on-sold only to

Maori. The estimated $200,000 cost of these homes would be

funded by all taxpayers, with successful Maori recipients

paying no deposit and being charged low government interest

rates.These policies to provide low cost

housing to first home buyers are based on the apparent

declining rate of home ownership in New Zealand. But party

policy analysts clearly haven’t delved into the robustness

of the figures upon which they are making their

multi-billion dollar promises. Those who have investigated

Statistics New Zealand’s housing tenure Census data are

concluding that the claims that home ownership rates in New

Zealand are in decline, could be

wrong.When it comes to “official”

data collection and interpretation, Statistics New Zealand

is no stranger to controversy. Even when their figures

convey false impressions that lead to misguided public

policy prescriptions, it is not easy to bring about

change.One long-running controversial

example of Statistics New Zealand data conveying false

impressions is the Household Labour Force Survey. The HLFS

is a quarterly survey that samples 15,000 households during

a reference week, asking residents about their employment

status. The results are touted as the country’s

“official” record of employment and unemployment. The

problem is their methodology: people who are officially

unemployed but not looking for work – or not available for

work - are not counted as being unemployed. Instead

they are labelled as ‘jobless’ and excluded from

the unemployment figures. Similarly, anyone who is

officially unemployed but who worked for just one

hour, in either a voluntary or a paid capacity, during the

survey week is counted as being employed - even if

their one hour of voluntary work was the only time

they ‘worked’ during that three month

period.As a result of these anomalies,

governments are tending more and more to use the

unemployment benefit figures as a clearer indication of what

is going on than the distorted HLFS, even though not

everyone who is unemployed is on a

benefit.Another example where the

statistics are misleading - with extremely serious public

policy implications - relates to ethnicity. Statistics New

Zealand counts everyone who indicates on their Census form

that they have a smidgeon of Maori blood, as Maori – even

when their predominant ancestry is some other ethnicity. As

a result the ‘official’ size of the Maori ethnic group

is significantly overstated.This issue

has long been the subject of challenge. When Simon Chapple

was a Senior Research Analyst with the Department of Labour

in 2000, he outlined the problem in his groundbreaking

report on Maori socio-economic disparity: “Currently

Statistics New Zealand’s official policy is to arbitrarily

classify mixed ethnicity individuals who have Maori as one

of their ethnic groups as Maori and not as the other group

or groups to which they also

belong.”[1]He warned, “Social

scientists and policy makers need to be more aware that

Statistics New Zealand’s arbitrary classification may

confuse analysis if it is taken

literally”.He suggested a solution:

“A random statistical allocation of half of mixed

Maori/non-Maori to the Maori ethnic group and half to the

non-Maori ethnic group is a more intellectually appealing

solution to the taxonomic problem of mixed ethnicity people

than calling them all Maori. This solution still does

some – but surely much less - violence to people’s

subjective choice to indicate they belong to several ethnic

groups. The solution also guards against some of the more

egregious perceptual and analytical errors arising from the

current taxonomy.”In other words,

rather than classifying everyone who mentions they have

mixed Maori ancestry on their Census forms as being a member

of the Maori ethnic group, he suggests a more accurate

methodology would be to classify only a half of them as

Maori, with the other half allocated to their main non-Maori

ethnic group. The fact that such changes have not already

been made after all these years is an indictment of those

politicians and officials charged with providing accurate

statistics on which to base public policy, since overstating

ethnicity data has profound consquences, not only in terms

of public funding for Maori-based initiatives, but also in

the crucial population calculations for Maori seats.

But back to the issue of home ownership.

The problem in this case is that Statistics New Zealand has

failed to adequately account for the growing trend over

recent years for families to place their family homes into

family trusts. Although questions were finally asked about

family trusts in the 2006 Census, they were inadequately

framed and produced inconclusive data. That means the

Statistics New Zealand claim that home ownership rates in

New Zealand are in decline, is

unreliable.This week’s NZCPR Guest

Commentator is Michael Littlewood, the Co-director of the

Retirement Policy and Research Centre at Auckland

University. In May, the Centre published a paper,

PensionBriefing: Census 2013 - shortcomings in

questions about housing, which challenges Statistics New

Zealand’s findings about declining home-ownership trends.

They found that of the 1,613,451 dwellings in New Zealand in

2006, the ownership status of 19.4 percent of them –

almost 1 dwelling in 5 - cannot be accounted for. Further,

with family trusts becoming increasingly popular, and the

Census questions failing to adequately provide reliable

data, the accuracy of the Statistics New Zealand claim that

home ownership is in decline, is being

challenged.In his NZCPR commentary -

which provides a synopsis of the briefing paper - Michael

Littlewood explains that given the serious gaps in the data

on the ownership of dwellings, a more reliable estimate of

home ownership trends might be found by examining the number

of people who are renting. Clearly, if Statistics New

Zealand is right and home ownership rates are in decline,

then the number of people who are renting should be

increasing. However, the data has remained relatively stable

over the last 30 years: “If

rent-payers have no connection to the owners, home ownership

rates may possibly be deduced from the numbers of households

who say they are paying rent and who specify the amount

paid. Rent payers were 49.3% of occupants in the 1936

Census - the proportion has about halved over the following

70 years. However, of particular note is that the proportion

of rent-payers has been relatively flat over the 30

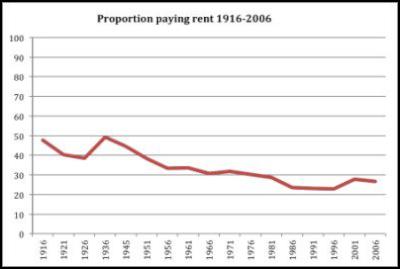

years 1976-2006, as the chart shows:

Click for big version.

“It seems difficult to construct a story about falling home-ownership rates from this chart. If home-ownership rates were really falling, we should expect rising, rather than relatively flat rent-paying occupancy rates over the 30 years between 1976 and 2006. Rent-payers were 30.3% of occupied dwellings in 1976. Since then, rent-paying rates ranged from 22.9% to 28.6%. The 2006 rate was at the mid-point of the 30-year range of +3.6 percentage points.”

In questioning the reliability of the data that underpins claims of declining home ownership in New Zealand, Michael Littlewood and his team are doing the country a great service. Billions of dollars of public money has been promised by opposition parties to build affordable homes to arrest the reported downward trend in home ownership. If, as seems likely, the trend is not downwards at all, but may even be upwards, these policies will be seen to be redundant.

The National Party’s approach has been to focus on the more urgent problem of housing shortages and rising prices in some of our key cities, namely Auckland - and of course Christchurch. They are attempting to address the causal factors: a scarcity of land on which to build new homes, excessive delays and charges due to the Resource Management Act and local government administration, and the rising cost of construction.

Their solution has been to propose new Housing Accords in areas where there is a significant problem so that housing construction can be fast-tracked and costs cut. As a result of such an Accord in Auckland, they hope to streamline administration so that 39,000 new house consents can be issued over the next three years. In addition they are tackling the high cost of construction, not only through cutting red tape and regulation, but through productivity improvements in the building sector and reduced delays.

In conclusion, the political panic over falling rates of home ownership is based on figures that cannot be relied upon, with home ownership rates probably not in decline at all. The concerns over housing affordability are concentrated in just a few centres around the country, where population increases have outpaced the building of new houses. In many other parts of the country, low income families looking to buy their first home have plenty of affordable houses to choose from – especially if they make use of KiwiSaver.

In the year to March, some 10,733 KiwiSaver members drew on their savings to put a deposit on their first home - up from 5,727 last year. Members who have been in KiwiSaver for three or more years are able to use their savings contributions as a deposit on a first home – topped up with a government subsidy of $1,000 for each year they have been enrolled in the scheme, up to a maximum of 5 years. That means that on top of their KiwiSaver savings, a couple can receive a generous government contribution of $10,000 towards their deposit.

While most New Zealanders will applaud the government’s focus on making it easier and cheaper to build a new home, many others will be wary of political plans for massive government home-building schemes – especially when claims of falling rates of home ownership look to have been seriously overstated.

THIS

WEEK’S POLL

ASKS:

Should

taxpayers fund housing exclusively for Maori?

Click HERE

to

vote

*Read this week's poll comments daily

HERE

*Last week 99% of readers wanted the

Maori seats abolished ... you can read the

comments HERE

FOOTNOTES:

1.

Simon Chapple, Maori

socio-economic disparity

NZCPR

Guest

Commentary: ARE

HOME OWNERSHIP RATES REALLY

FALLING?

By

Michael Littlewood

“The first shortcoming with the 2006 Census (and with all Censuses carried out since 1991) is that there is no attempt to gather information about dwellings that were unoccupied on Census night. We know how many there were in 2006 but not why they were unoccupied. The 1986 and 1991 Censuses were the last to wonder why: twenty or so years ago, 37.5% of unoccupied dwellings were holiday homes and the usual occupier was away in respect of a further 30.5%. So on Census night in 2006, about two-thirds of unoccupied homes may have been owned by households and about half of those may have been usually occupied by the owners who happened to be away from home on the night…

“When the 2013 Census results are published later this year, they will have the same difficulties that were apparent with the 2006 data analysed above. That’s because the questions in 2013 were the same as in 2006.” ... read the full article HERE

ENDS

Gordon Campbell: Gordon Campbell On The Folly Of Making Apologies In A Social Vacuum.

Gordon Campbell: Gordon Campbell On The Folly Of Making Apologies In A Social Vacuum. Forest And Bird: Modernisation Of Conservation System Must Focus On Improving Conservation

Forest And Bird: Modernisation Of Conservation System Must Focus On Improving Conservation NZCTU: Uniformed Defence Force Should Not Be Used As Strike Breakers

NZCTU: Uniformed Defence Force Should Not Be Used As Strike Breakers MetService: Damp Start To Canterbury Anniversary Weekend; Wet Start For Coldplay Fans In Auckland

MetService: Damp Start To Canterbury Anniversary Weekend; Wet Start For Coldplay Fans In Auckland RNZ: Senior Lawyers Call For Treaty Principles Bill To Be Abandoned

RNZ: Senior Lawyers Call For Treaty Principles Bill To Be Abandoned Lobby for Good: Small Business Owners, MPs Rally Together To Demand Transparency In Tauranga Marine Precinct Sale

Lobby for Good: Small Business Owners, MPs Rally Together To Demand Transparency In Tauranga Marine Precinct Sale VisAble: National Apology Marks Important Step For Disabled Community, But True Change Requires Lasting Action

VisAble: National Apology Marks Important Step For Disabled Community, But True Change Requires Lasting Action