Monetary policy matters

Monetary policy matters

2 February 2012

A change in the Reserve Bank Governor provides an ideal catalyst to change the Policy Targets Agreement between the Reserve Bank and the Government, say the New Zealand Manufacturers and Exporters Association (NZMEA). Bill English commented yesterday that monetary policy was not important as inflation pressures are low, but monetary policy is still vital to an improved performance from the traded sector.

English commented that:

“the issue now

isn’t monetary policy, it’s been quite accommodating.

The issue is building confidence and building

investment”;

And:

“There are a whole lot of

other issues that are much more important around

productivity, around getting our resources into the tradable

sector, around building investment, getting Christchurch

rebuilt”.

NZMEA Chief Executive John Walley says, “To suggest that monetary policy is not an issue when we are seeing 30 to 40 percent swings in the Trade Weighted Index is absurd. The best way to get more investment and growth into the tradable sector and lift productivity would be to sort out the exchange rate.”

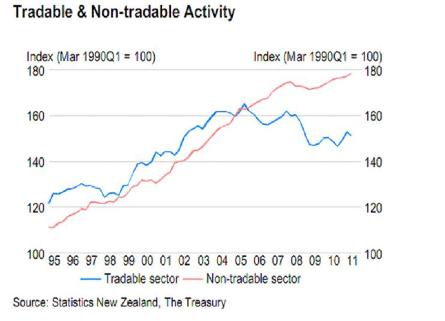

“English himself regularly presents this graph showing the tradable sector in decline since 2004.”

“Monetary policy is the biggest cause of this decline.”

“Over Dr Alan Bollard’s time as Governor we have seen severe damage to the traded economy, partly due to mismanagement of the current system, and partly due to a reluctance to use alternatives to the Official Cash Rate to support exporters.”

“Over time an elevated exchange rate strangles investment in the traded sector; that low investment inevitably leads to low productivity, contraction and failure, particularly for the high value added sector.”

There are three questions the Government need to consider before agreeing to a new Policy Targets Agreement:

• Does the Governor continue to make

decisions or do we use a committee?

• Should inflation

remain the only target of the RBNZ?

• Should

macro-prudential tools in addition to interest rates be used

by the RBNZ?

“There is a strong case for a change on all three points,” says Mr Walley. “The biggest barrier to export growth is an overvalued and volatile exchange rate; changes to the Policy Targets Agreement must be part of this solution.”

ENDS

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia NZ Police: New Zealand Police team up with Z Energy, NZTA and ACC to remind Kiwis to drive safe this Easter

NZ Police: New Zealand Police team up with Z Energy, NZTA and ACC to remind Kiwis to drive safe this Easter NZCAST: NZCAST Leads Ongoing Cross-Agency Collaboration To Break Down Barriers For Survivors Of State Abuse

NZCAST: NZCAST Leads Ongoing Cross-Agency Collaboration To Break Down Barriers For Survivors Of State Abuse Regional and Unitary Councils Aotearoa: Regional And Unitary Councils Back A Practical FWFP System

Regional and Unitary Councils Aotearoa: Regional And Unitary Councils Back A Practical FWFP System NZ Government: Stay Safe On Our Roads This Easter

NZ Government: Stay Safe On Our Roads This Easter YWCA: Global Push Back Against Gender Equality A Growing Crisis In Aotearoa

YWCA: Global Push Back Against Gender Equality A Growing Crisis In Aotearoa Te Pāti Māori: Ngarewa-Packer - Fast-Tracking Seabed Mining Ignores Māori Opposition And Environmental Precedent

Te Pāti Māori: Ngarewa-Packer - Fast-Tracking Seabed Mining Ignores Māori Opposition And Environmental Precedent