Bad Banks exposure of ASB's "Kiwi bank" claim

Click to enlarge

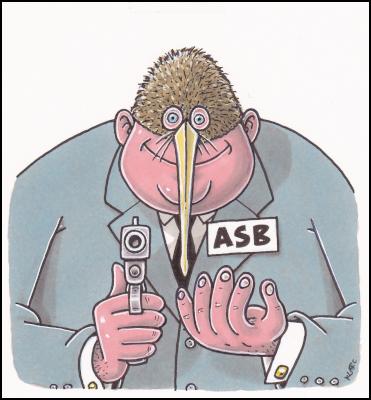

Cartoon by KLARC especially produced for the Bad Banks campaign.

Can be reproduced in web and print publications.

Band

Banks media release

7

December 2009

www.badbanks.co.nz

Bad

Banks exposure of ASB's "Kiwi bank" claim

- 12noon, Friday 11

December

Bad Banks campaigners will be

outside ASB Bank on Queen Street (cnr Wellesley St),

Auckland, this Friday to expose ASB's claim that it's a

"Kiwi bank".

"ASB ain't no Kiwi bank," says Vaughan Gunson, Bad Banks media spokesperson. "They're 100% owned by the Commonwealth Bank of Australia, one of the bigger banks in the world. They're misleading the New Zealand public, to say the least."

"We find their recent advertising campaign hard to stomach, and I'm sure many people feel the same," says Gunson, "because ASB and the other Aussie-owned banks (ANZ National, BNZ, and Westpac) aren't serving our interests at all. Their only goal is to make as much money as possible for bank bosses and corporate shareholders."

"The Aussie-owned banks have been making exorbitant profits for years from high interest rates on mortgages and credit cards, as well as imposing high fees and late penalties. They've been hurting grassroots New Zealanders," says Gunson.

"And now with the recession and people struggling to pay the bills, the banks are out to protect their own equity position by forcing mortgagee sales in record numbers," says Gunson.

On top of these injustices, ASB is refusing to pay an unpaid tax bill of $285 million. "Rather than big-budget advertising campaigns designed to mislead us, ASB bosses should just pay up the tax they owe," says Gunson.

"It's obvious that ASB and the other big banks are trying to suck up to us. Why? Because they're worried that the bad public mood against them will result in the government being forced to curb banking power and rein in their profits. Which is exactly what the Bad Banks campaign wants to see, " says Gunson.

"We've started a long term campaign to build pressure on the banks, which we hope will result in tougher regulations being placed on the banking and finance industries. Most people would say it can't happen too soon," says Gunson.

Bad Banks campaigners recently nominated ASB Bank for the 2009 Roger Award, given annually to the "Worst Transnational Corporation Operating in Aotearoa/New Zealand" (see Backgrounder #2 below).

"It was difficult to choose which bank to nominate for The Roger Award, because in the eyes of most New Zealanders all banks are bad," says Gunson. "But what tipped the balance in favour of ASB, was the fact that ASB bosses have been very hostile to the bank workers union, Finsec."

"Today, ASB is the only big bank which is not unionised. Which begs the question: is it "Kiwi" to be anti-union?" asks Gunson.

Bad Banks campaigners will be carrying placards, making some noise, and handing out leaflets to the public outside the Queen Street branch of ASB Bank at 12noon, this Friday, 11 December. Media are invited to attend to get more comment, plus photos/footage.

The cartoon image attached to this media release is by ex-NZ Herald cartoonist, KLARC. It is freely available for reproduction on websites or in print publications.

--

Backgrounder #1

The Bad Banks campaign has been initiated by Socialist Worker-New Zealand. We believe the banks in New Zealand and globally have grown to exercise enormous and dangerous power over the economy.. The big banks and their government backers are driving forward economic policies that threaten people and planet.

There are a range of measures needed to stop the banks, from tough government regulations to establishing proper public banks which provide credit as a service rather than to make a profit.

The Bad Banks campaign also advocates measures like a Financial Transaction Tax (FTT) to net the banks and other financial speculators whose profits from wheeling and dealing goes largely untaxed. Such a tax would allow New Zealand to move towards a fairer tax system which shifts the tax burden off low and middle income people and onto the big wealthy corporates.

For more information on the Bad Banks campaign go to www.badbanks.co.nz

Backgrounder #2

These were the 10 reasons given by Bad Banks campaigners

for why ASB deserved to receive the 2009 Roger Award:

1.

Interest gouging grassroots Kiwi homeowners.

Mortgage

holders know it. Even the Reserve Bank in 2009 came out and

said that the banks, including ASB, were keeping their

interest rates too high. High interest rates on large

mortgages put modest income earners under considerable

financial stress in 2009, as many were affected by job

losses, income cuts, and general financial insecurity. (See

http://www.nzherald.co.nz/interest-rates/news/article.cfm?c_id=235&objectid=10582846)

2.

Foreclosing on people's homes.

2009 saw record numbers

of mortgagee sales, as banks moved to protect their own

equity position by turfing increasing numbers of "mum and

dad" mortgage holders out of their homes. Hundreds of

homeowners were foreclosed in Auckland , ASB's home turf.

(See http://business.scoop.co.nz/2009/09/28/record-high-for-mortgagee-sales-despite-recovery)

3.

Continuing to make massive profits at the expense of

grassroots people.

The recession of 2008/09 did not

prevent ASB making a big profit, $238 million for the first

six months of the financial year. Such a high profit in a

recession points to the power the bank has to shift the

burden of economic hard times on to ordinary New Zealanders.

(See http://tvnz.co.nz/business-news/asb-tax-operating-profit-down-2477075)

4.

Mega-scale tax dodging.

It came to public attention in

2009 the full extent of tax dodging by the Big Four

Aussie-owned banks, over $2 billion. The IRD is after $285

million from ASB for unpaid tax between 2001 and 2004.

Having been caught, ASB bosses are still refusing to pay up,

and will likely use teams of expensive lawyers to drag the

process through the courts, costing the IRD and the Crown

millions. (See http://www.nbr.co.nz/article/asb-estimates-285-million-exposure-nz-tax-case-113373)

5.

Failing to face up to public scrutiny.

Nobody from ASB

Bank fronted up to the parliamentary inquiry into the

operations of the banks organised by the Green, Labour and

Progressive parties in 2009. While this inquiry had no

teeth, because it was not supported by the National

government, this disregard for the New Zealand public showed

how arrogant and conceited is the position of the

Aussie-owned banks. (See http://www.scoop.co.nz/stories/PA0909/S00049.htm)

6.

Union busting.

The ASB Bank has determinedly used

anti-union practices to stop Finsec Union from organising

bank workers. To inquire more about ASB's union busting you

could contact Finsec Union directly, phone 04 385 7723,

email union@finsec.org.nz.

7. Imposing a

wage freeze on workers.

All ASB Bank employees earning

over $50,000 have been informed this year that they will be

subject to a wage freeze. This will affect 3,500 of the

bank's 4,700 staff nationwide. The low bar compares

unfavourably with that being used by ASB's parent company in

Australia, Commonwealth Bank, where the wage freeze is for

staff earning over $100,000. (See http://finsec.wordpress.com/2009/04/24/asb-bank-freeze-staff-wages-%E2%80%93-no-union-members-to-stop-it/)

8.

Deceiving New Zealanders by claiming to be a "Kiwi

Bank".

ASB advertisements in October 2009 used the phrase

"we've been a KIWI BANK since 1847", when in fact ASB is

almost entirely Aussie owned. The phrase cynically seeks to

convey the impression that the ASB Bank operates in the

interests of New Zealanders, when its corporate practices

plainly tell another story. (See http://www.nzherald.co.nz/sideswipe/news/article.cfm?c_id=702&objectid=10604600)

9.

Cutting funding to community groups.

Just when many

community organisations needed it most, to deal with the

human fallout of the recession, ASB Bank, through its ASB

Charitable Trust, froze grants for six months in 2009. This

is despite continuing to make big profits. (See http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10603631)

10..

Using the media to frame public debate in a way that's

advantageous to banks.

Any search of news websites like

NZ Herald or Stuff for "ASB" reveals just how often

spokespeople for the bank are in the media. The bank

produced a constant stream of statements and commentary on

economic indicators, which are clearly designed to frame

media debate on economic issues in a way that's favorable to

banking operations.

For more information on CAFCA (Campaign Against Foreign Control of Aotearoa) and The Roger Award go to http://canterbury.cyberplace.co.nz/community/CAFCA/

ENDS

Gordon Campbell: Papal Picks, And India As A Defence Ally

Gordon Campbell: Papal Picks, And India As A Defence Ally Ministry For Culture And Heritage: New Zealand Flag Half-Masting To Mark The Passing And Funeral Of His Holiness Pope Francis

Ministry For Culture And Heritage: New Zealand Flag Half-Masting To Mark The Passing And Funeral Of His Holiness Pope Francis NZ Government: PM Sends Condolences On Passing Of Pope Francis

NZ Government: PM Sends Condolences On Passing Of Pope Francis NZDF: Battlefield Remains Unearthed By Wildfires In Gallipoli Covered Over By Kiwi Team

NZDF: Battlefield Remains Unearthed By Wildfires In Gallipoli Covered Over By Kiwi Team NZ Police: New Zealand Police team up with Z Energy, NZTA and ACC to remind Kiwis to drive safe this Easter

NZ Police: New Zealand Police team up with Z Energy, NZTA and ACC to remind Kiwis to drive safe this Easter NZCAST: NZCAST Leads Ongoing Cross-Agency Collaboration To Break Down Barriers For Survivors Of State Abuse

NZCAST: NZCAST Leads Ongoing Cross-Agency Collaboration To Break Down Barriers For Survivors Of State Abuse Regional and Unitary Councils Aotearoa: Regional And Unitary Councils Back A Practical FWFP System

Regional and Unitary Councils Aotearoa: Regional And Unitary Councils Back A Practical FWFP System