Experts Call for Strategic Tobacco Tax Hikes

Experts Call for Strategic Tobacco Tax Hikes

Smokefree

Coalition, Media release

Embargoed until 12:01 am, 3

September 2007

A long-term tax strategy is needed to

double the price of tobacco products within 10 years. That

is the recommendation of tobacco control experts presenting

papers at the “Death and Taxes: Future directions for

tobacco taxation” seminar in Auckland today. Their work

was commissioned by the Smokefree Coalition and ASH

NZ.

The team of public health experts from the Wellington School of Medicine & Health Sciences, University of Otago, say high tobacco tax rates significantly deter smoking and would result in considerable improvements in public health.

They say an essential part of the tax increase strategy is the revenue being used to fund quitting programmes and reduce smoking initiation; particularly those aimed at low income, Māori and Pacific populations, where smoking rates are highest.

“If the tobacco tax money was used to address the problem of smoking, smokers would be more likely to accept higher prices,” says Dr George Thomson.

Health Economics Lecturer Des O’Dea says, “Smokers would also be much more likely to quit, and young people would be much less able to afford to start, if the cost of cigarettes and tobacco were higher.”

They say while smokers in some low-income families will continue to smoke and may have difficulty finding extra money for cigarettes, a substantial number will quit, leading to financial savings as well as the obvious health gains.

The seminar is being hosted by the New Zealand Medical Association (NZMA). NZMA Chairman Peter Foley says the Government needs to get serious about reducing the 14 deaths each day caused by tobacco use, and agrees tobacco tax revenue should be put back into tobacco control.

“Tobacco products have become relatively cheaper over the past seven years. We haven’t had a one-off increase in tobacco taxation since 2000. Meanwhile, real wages have gone up, making cigarettes more affordable.

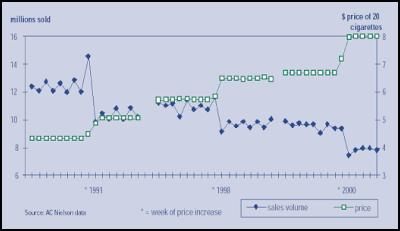

“There were quick and dramatic drops in cigarette sales after the price increases of 1991, 1998 and 2000, and a price increase in 2008 would cause a similar drop in smokers’ numbers.”

ENDS

Further

information follows below.

The four health experts making up the team are:

George Thomson, Senior Research Fellow, Department of Public Health, University of Otago, Wellington.

Des O’Dea, Lecturer in Health Economics,

Department of Public Health, University of Otago,

Wellington.

Principal author of Report on Tobacco

Taxation in New Zealand. Volumes I and II.

Heather Gifford, Post Doctoral Fellow, Massey University

Richard Edwards, Senior Lecturer in

Epidemiology, Department of Public Health, University of

Otago, Wellington.

Note: Most of the members of the

team work at the Wellington School of Medicine, University

of Otago. However the work was carried out independently of

that institution, and the School bears no responsibility for

the contents of the reports.

A PDF summary of the

team’s findings is available online

at:

www.sfc.org.nz/pdfs/taxareportsummary07.pdf.

Two reports commissioned by the Smokefree Coalition and ASHNZ will be presented:

- Tobacco Taxation in New Zealand: Principal author Des O’Dea

- Dedicated Tobacco Taxes – Experiences and Arguments: Principal author George Thomson.

A cross-party panel of MPs has also been invited to participate in a forum on this issue. They will be presenting their parties’ views on tobacco taxation and answering questions.

1991, 1998 and 2000 sales

drops resulting from tax increases

Manufactured cigarette sales before and after the Budgets of 1991, 1998 and 2000 (using data from supermarket checkouts). From Tobacco Tax – The New Zealand Experience.

Click to enlarge

The above graph clearly shows the large drop in the sales of cigarettes after tobacco tax increases in New Zealand in 1991, 1998 and 2000.

ENDS

Gordon Campbell: On The Hikoi Aftermath

Gordon Campbell: On The Hikoi Aftermath Stats NZ: National Population Estimates: At 30 September 2024 (2018-base)

Stats NZ: National Population Estimates: At 30 September 2024 (2018-base) NZ Government: New Zealand’s COP29 National Statement

NZ Government: New Zealand’s COP29 National Statement Surf Life Saving NZ: Volunteer Lifeguards Make Big Effort To Keep Us Safe, As Paid Lifeguard Service Commences In Northern Region

Surf Life Saving NZ: Volunteer Lifeguards Make Big Effort To Keep Us Safe, As Paid Lifeguard Service Commences In Northern Region Action Station: Biggest Ever Community Petition, With Over 200,000 Signatures, Opposes Treaty Principles Bill

Action Station: Biggest Ever Community Petition, With Over 200,000 Signatures, Opposes Treaty Principles Bill Palestinians for Hīkoi mō te Tiriti: Statement From Palestinian Leaders - Hīkoi Mō Te Tiriti Is A Historic Moment For All In Aotearoa

Palestinians for Hīkoi mō te Tiriti: Statement From Palestinian Leaders - Hīkoi Mō Te Tiriti Is A Historic Moment For All In Aotearoa Anglican Church in Aotearoa: Anglican Archbishops To Join Hīkoi Mō Te Tiriti In Wellington

Anglican Church in Aotearoa: Anglican Archbishops To Join Hīkoi Mō Te Tiriti In Wellington