Why NZ Should Oppose Air NZ / Qantas Alliance

http://www.saveairnz.org.nz

PO Box 2947

8th Floor, Central House

26 Brandon Street

Wellington

WHY NEW ZEALAND SHOULD OPPOSE

THE ALLIANCE BETWEEN AIR NEW ZEALAND AND QANTAS

A

BRIEFING PAPER

Air New Zealand wishes to form an alliance with Qantas to enable it to maintain its international operations. Is a monopolistic or duopolistic airtravel market within and into New Zealand a price worth paying? Will the deal even be good for Air New Zealand?

- Air New Zealand’s domestic operations are profitable and provide a more than satisfactory return on capital.

- Air New Zealand’s Freedom services on the Tasman are profitable and provide a satisfactory return on capital.

- Air New Zealand and Qantas are already the only carriers linking New Zealand with Los Angeles and Japan.

- The transaction would entail Air New Zealand leaving the Star Alliance, which carries 22% of world air traffic. New Zealand would cease to have Star links with most of the world. All Star generated traffic from North America would cease.

- Air New Zealand would be locking itself into the “big” airline model at a time when flexibility may be the hallmark of success.

The deal doesn’t make sense for Air New Zealand it doesn’t make sense for New Zealand.

REGULATORY POSITION

Air New Zealand’s Australian economic advisers argued that the transaction would benefit New Zealand by $1,300million over the next five years. The Commerce Commission found annual net detriments of $156million to $402million.

Over the next few months regulatory agencies on both sides of the Tasman will review their preliminary decisions. The outcome should not be taken as forgone, certainly Air New Zealand seems not to have recognised that it is time to move on to “plan B”.

Air New Zealand recently unveiled “undertakings” to assuage the concerns of regulatory agencies. In fact the Undertakings are just more of the same and aim at allowing a niche for a competitor on some routes. For consumers it will make little difference if there is a monopoly or a duopoly with two airlines operating set market shares. Any step away from a market place with two substantial airlines supported by huge international alliance-networks is a step towards lower quality higher cost services within and into New Zealand. This can never be in New Zealand’s best interest.

AIRLINES KNOW BEST?

2003: “The [Air New Zealand / Qantas] Alliance … will ensure that both Australia and New Zealand have sustainable and independent airlines focused on the needs and requirements of the travelling public and exporters in both countries.” [Air New Zealand Managing Director and CEO, Ralph Norris].

1996: “The alliance will add commercial strength to both Ansett Australia and Air New Zealand… $70m pa. moving to $170m pa after 3 years… It is our clear judgement that the investment in Ansett Australia is the only practical, timely and available means of doing what we consider needs to be done.” [March 1996, Air New Zealand Managing Director and CEO, Jim McCrea to the Commerce Commission].

1996: “Qantas has no current intentions to enter [the New Zealand domestic] market as a start-up operator.” [January 1996 Qantas Managing Director and CEO, James Strong to the Commerce Commission].

1995: "If there had been a capitalist down there [at Kitty Hawk the day the Wright brothers made their first flight] the guy should have shot down Wilbur! One small step for mankind, and one huge step backwards for capitalism!" [The world’s second richest man, Warren Buffett on Investing in the Airline Industry].

1953: “Prediction is very difficult, especially if it's about the future.”[ Danish physicist Niels Bohr].

Be very sceptical about the predictions of Airline Chief Executives. Their views do not always coincide with the facts. Their “clear judgement” may not be the best judgement. Their predictions have been shown to be the worst of almost any commercial group in history.

THE BASIS OF THE AIRLINE CASE FOR THE ALLIANCE

1. Air New Zealand’s CEO predicts that Air New Zealand will not be able to maintain its international links if it remains independent of Qantas. Air New Zealand is predicted to become a domestic airline, New Zealand to lose control of its links with the world.

The rest of the Air New Zealand case is more obscure, but is essentially that the burden on New Zealand travellers will be minor relative to the loss Air New Zealand will suffer if its Alliance is thwarted.

2. The Qantas case is different. It argues that the benefits Qantas will extract from New Zealand will outweigh the cost to Australian travellers from their loss of Air New Zealand as a competitive option/possibility. It is no mystery why Australian government support for the Alliance is so strong given which side of the Tasman the costs and benefits respectively fall. The ACCC’s rejection of the Alliance is notable as they see even the relatively smaller loss suffered by Australian consumers outweighing Qantas’ gains, which include those from New Zealand.

THE BASIS OF THE NEW ZEALAND GOVERNMENT’S SUPPORT FOR THE ALLIANCE

3. Michael Cullen is clearly a supporter of the Warren Buffet view of airlines and sees Air New Zealand as an ongoing liability for the Crown. The Alliance is an opportunity to fund Air New Zealand with someone else’s money and to create a monopoly where Air New Zealand may prosper via a “tax” on consumers.

But, is Qantas really the only alternative investor to the Crown? Is aspiring to be a monopoly Air New Zealand’s best business proposition?

DO MONOPOLISTS PROFIT? & IS AIR NEW ZEALAND OTHERWISE DOOMED?

4. The Airline industry clearly has problems, but is attempting to create a monopoly over New Zealand’s skies the solution?

American Airlines is the world’s largest airline and is teetering on bankruptcy. Its strategy was “to create an airline that was so big it would always be able to charge a revenue premium”. Explaining the failure of the strategy, and the ensuing resignation of the American Airlines’ CEO Don Carty, Yale Professor Michael Levine noted; “his dream was to wake up one morning and see the world divided between American and United, with the remaining 20% going to Southwest to keep the plebeians happy. That vision was ultimately unrealisable and he didn’t understand that till very late.” [Financial Times 26 April 2003].

5. Creating monopolies, or all-encompassing networks, is not a solution to the airline industry problems. The history of airline failure is more a history of the failure of the “get big” strategy than some intrinsic commercial problem with moving goods and people by air. Southwest is the world’s most commercially successful airline, Ryanair and Easyjet are in the top echelon. Their objectives are not to “charge a revenue premium”, but to attract passengers by delivering the lowest fare commensurate with making a satisfactory return on capital. The Ryanair CEO, Michael O’Leary, notes “Our price is our brand”. Southwest and Ryanair are financially successful by any measure, not just relative to other airlines.

Whether “moving people cheaply” is the touchstone for industry success is as yet unknown (that would entail a prediction). But it certainly looks a lot better than “get big”.

6. Notwithstanding the relative success of the “big” airlines versus the “cheap” airlines, Air New Zealand has decided that it wants “big”. Explaining this choice isn’t easy, certainly Air New Zealand hasn’t. Air New Zealand has a low-fare subsidiary, Freedom, that is successful, but it is kept on a short leash to be used as a mean of deterring competitors rather than as a business that Air New Zealand is willing to let grow on its own merits.

Air New Zealand has the prospect of being a successful airline if it focuses on “cheap”. It has the prospect of ending up on the scrap-heap with many before it if it goes for “big”.

IF IT AIN’T BROKE…? DOES AIR NEW ZEALAND HAVE A PROBLEM?

7. In the six months to 31 December 2003 Air New Zealand carried 4.7million passengers made a net profit of $138million and had free cashflow of $325million. Its planes flew at 75.8% capacity (average for the last five years 69.4%), with international services 76.6% full (5 year average 70.3%).

Is Air New Zealand failing?

Not only is Air New Zealand performing satisfactorily, the immediate prospects look good. Domestic growth is strong, it now has a duopoly on the NZ-USA route, US air travel is picking up after the Iraq war, and analysts are seeing the SARS’ panic replaced by rational response as Chinese controls deliver falling infection rates.

8. Why is the Air New Zealand’s CEO predicting doom? Some clues to his pessimism come from an Air New Zealand investor presentation which can be viewed on their website.

Simply, Air New Zealand seems to be putting the bar too high.

They have set themselves a target return on capital of 15%pa. This translates to something like 35%pa. return to shareholders after tax. The Air New Zealand CEO seems to have decided that some parts of Air New Zealand’s operation can’t achieve this type of return, so he wants out.

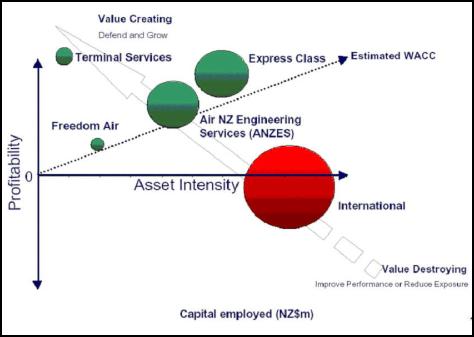

The following chart [Figure 1] is from an Air New Zealand’s investor presentation of April 2003. Elsewhere in the presentation the 15%pa. cost of capital is noted.

9. The chart

shows that Air New Zealand sees all parts of its operation

creating value (ie returning better than their cost of

capital), except international, which seems to be merely

breaking even. Air New Zealand’s domestic and Freedom’s

Tasman services are subsidising the rest of international.

If this were true, and Air New Zealand was manufacturing

goods rather than providing services, it would be illegally

dumping on the international routes.

IS INTERNATIONAL A PROBLEM? IS THE ALLIANCE A SOLUTION?

10. Air New Zealand’s international services are 76.6% full. It shares a duopoly with Qantas on the New Zealand - North America route. The NZ - Japan route is profitable. Freedom makes a profit on the Tasman and much of the rest of the Tasman market is shared between Air New Zealand and Qantas. Where is Air New Zealand losing money?

There is nothing intrinsically unprofitable about international services. Singapore Airlines only has international services and is the world’s most profitable airline.

11. Putting aside doubts about whether international is really that tough, is the Alliance an appropriate solution to the problem? Air New Zealand is expressly advocating that it should be able to milk its domestic services to subsidise its international links. What are the other alternatives?

12. Air New Zealand’s case rests on an unproven assertion that it can only continue to operate internationally by making “excess” profits in New Zealand and that it needs even more local profits in future than it is reaping now. This argument is flawed and Government should not be endorsing it.

- If the international aviation market is too tough for Air New Zealand because Air New Zealand isn’t good at it, then the solution is better management at Air New Zealand, or Air New Zealand’s withdrawl in favour of better operators.

- If the international market isn’t fair, for instance because other operators receive subsidies that discriminate against Air New Zealand, then it is up to the New Zealand Government to directly address this issues. Perhaps to provide balancing supports for Air New Zealand where it can show that the playing field isn’t level.

- If Government believes New Zealand must have international links that are under the control of a New Zealand company then an arrangement of explicit subsidies would be an appropriate means of delivering this.

If a “too tough” international market is the problem, a clear focus on sorting out that issue is the solution. Damaging the New Zealand aviation market and attempting to “muscle up” internationally is attempting to get a right from two wrongs.

SUMMARY

- Don’t give too much credence to airline executives pushing the “we must get big” line with no supporting evidence.

- If Air New Zealand’s focus is extracting “revenue premium” rather than offering the cheapest possible flexible services, expect it to ultimately fail as cheaper more flexible operators under-cut it. In the short term consumers will suffer from a lack of competition and higher than necessary airfares. In the medium term the owners of Air New Zealand will suffer as the airline finds it cannot compete.

- Freedom makes a satisfactory profit flying the Tasman, which Air New Zealand claims it cannot do with its full-service operations. Air New Zealand has a solution to its problems already.

- There are better ways for Government to avoid having to provide further funding to Air New Zealand. There are better ways for Air New Zealand to fix any problems it may be having on some international links than a holus bolus alliance with Qantas.

- Air New Zealand is not failing. It is in robust financial health. It’s CEO may just have unrealistic targets.

OTHER POINTS

The proposed Air New Zealand – Qantas alliance has significant consequences for New Zealand. It matters a lot that New Zealand has an efficient aviation market and the best possible links with the rest of the world. The tourism industry, which relieves heavily on air transport, is worth $14,000 million per annum to the NZ economy ($6,200 million from international visitors). The industry’s value-added contribution to GDP is $10,200 million pa. and it employs 90,000 people with a further 60,000 jobs indirectly supported. Tourism makes up 14.3% of exports, second only to dairy.

The kafuffle over New Zealand’s energy problems underline how Government runs into problems when faced with the conflict of interest of being an investor and a regulator, and doesn’t manage the conflicts well.

Dr Cullen has not managed this conflict well and has injected personal objectives into this process. It is up to the rest of our parliamentary representatives to adopt a more discerning position and keep the conflict of interest in clear perspective.

There is no reason why this matter could not be put in front of a select committee and thoroughly addressed in that venue at the same time as the Commerce Commission reaches its conclusions.

POINTS TO PONDER

13. On 12 December 2002 the chief executive of the Ministry of Tourism provided a memo to his Minister setting out issues with the Airline Alliance. The memo noted many problems with the Alliance, yet the Ministry seems to have had no subsequent input into the process. It certainly did not submit to the Commerce Commission on its concerns.

Key points in the memo were:

(i) Potential shortage of capacity on some international routes.

(ii) The loss of links with one of the two global airline alliances.

(iii) The possible conflict with Tourism New Zealand’s focus on marketing New Zealand as a sole destination.

14. The most insoluble of these points is the loss of links to one of Star or OneWorld alliances. Pertinent points about the alliances are:

- Star Alliance has 22% global market share and Oneworld 18%.

- Air New Zealand’s membership of Star gives feed to New Zealand from 11 other airlines, it gives travellers a wide range of fares, it means passengers that accumulate air points on Lufthansa, United and the other Star airlines can use them to get to New Zealand (which generates “a significant number of high yielding visitors”), it provides seamless distribution and interline access to 23 domestic destinations and 11 transtasman routes for the inbound passengers of Thai, Singapore and United.

- If Air New Zealand were to join Oneworld, the Star Alliance contribution to bringing passengers to New Zealand would be significantly reduced in our top five tourism markets (Australia, the United Kingdom, the USA, Japan and Korea).

- If both airlines were to join Star, Oneworld would be all but eliminated in terms of New Zealand’s top five tourism markets (the remaining Oneworld airline Cathay Pacific plays only a small role in carrying residents from the USA, UK, Japan and Korea).

- The demise of Ansett and the Star Alliance connection into Australia has been seen as one of the reasons for the poor performance of Australian tourism over the last 2 years.

- Air New Zealand and Qantas becoming members of the same alliance will also have implications in the domestic market, where Air New Zealand and Qantas provide interconnect services for other carriers in their respective alliances beyond the gateway cities. It may become more difficult for carriers from the rival alliance to offer services to visitors who wish to travel beyond Auckland.

- In June US Airways, the 7th largest US airline, became the 18th member of Star Alliance. Star now links 771 cities in 133 countries. Contacts New Zealand’s tourism and export industries can ill-afford to lose. US Airways estimated that joining Star Alliance would increase its revenue by US$75 million per annum.

15. Another point noted in the Ministry of Tourism memo was the existing dominance of the two airlines on key routes to New Zealand and concerns that they may not meet future demand by increasing capacity.

Given that Air New Zealand has 77% capacity on its international services and is looking to increase its international profitability, increased prices will, presumably, be the Allied airlines response to increased demand.

Australia ---> 87% ---> 10.7%

Los Angeles ---> 73% (now 100%) ---> 19.6%

Japan ---> 100% ---> 1.3%

Singapore ---> 26% ---> 32.8%

Hong Kong ---> 37% ---> 20.9%

Taipei ---> 50% ---> 17.6%

16. The dominance of Air New Zealand and Qantas on several key routes also raises the question of why the two airlines don’t code share if there is a particular route that is too tough for them individually.

Air New Zealand and Qantas have code-shared routes in the past, and as James Strong (then Qantas Managing Director and CEO) told the Commerce Commission in January 1996 “Equity stakes, either cross-holdings or one-way, are often incorrectly misconstrued as being a necessary pre-condition to a successful alliance. However, the place of equity in an alliance is debatable at best… an assertion that a strategic stake is the only, or even the best, way to achieve a successful alliance is open to challenge. Mutual motivation seems to be a much better driver of success and this is clearly capable of existing regardless of equity structure.”

Of course at that time Qantas was submitting in opposition to Air New Zealand’s further investment into Ansett Australia.

17. And on Air New Zealand’s continued claims of imminent demise due to industry melt down; 16 May 2003 Reuters reported:

Bankrupt United Airlines plans to reinstate next month most of the domestic and trans-Atlantic flights it had cut in April and May because of weak demand during the war in Iraq. But the world's No. 2 airline said it would extend cuts on several trans-Pacific routes into the summer due to weakness in those markets related to the outbreak of SARS. United also said it would reinstate nonstop service between San Francisco and Seoul in June after suspending it as part of its post-Sept. 11 cutbacks. The airline will also restore flights to Australia and Tokyo and said it hopes to return to its full Asia schedule by autumn.

On June 12, the unit of UAL Corp, which filed for bankruptcy court protection in December, will add 162 mainline flights to its schedule. United said it plans to operate 1,722 daily mainline domestic and international flights in June, up from 1,560 in May. Even with the additions, United will be running about 13 percent fewer daily mainline flights in June than it was a year earlier.

American Airlines, a unit of AMR Corp, and the world's largest carrier, said half of the international flights that were eliminated in April and May will be restored in June. Delta Air Lines also said it would begin to restore most of the international and domestic flights it suspended in April and May, but said it would maintain some capacity reductions since bookings have not returned to pre-war levels.

18. The resilience of the Airline industry and the underlying growth in demand is not to be underestimated. The industry has just gone through one of its toughest ever periods. In its last reported six months, Air New Zealand only made a net profit of $138m on its free cashflow of $325m. Air New Zealand is well placed to weather the industry problems. It is much less well placed to weather closer links to Qantas.

BEEN THERE DONE THAT. LEARN BY DOING?

In 1988 the Lange Labour Government made a poor choice of partner for Air New Zealand when it selected Qantas. Another transactions with Qantas would be another error.

Figure 2. Cartoon: Lange and Douglas fight over whether British Airways or Qantas should buy Air New Zealand

Figure 3. Cartoon: Suddenly NZ is planning to buy Aussie Frigates

Cynicism and relentless pursuit of self-interest is a hallmark of Australian Government actions. Last week the Australian federal transport minister John Anderson responded to pressure from Qantas to reject Emirates Airlines' application to fly between Sydney and Dubai. Qantas wants to protect its position on the Sydney- London route. But Mr Anderson granted Emirates the right to fly transtasman to provide competition as regulators assess Qantas's proposed anti-competitive alliance with Air NZ.

ENDS

Gordon Campbell: On The West’s War Against Iran

Gordon Campbell: On The West’s War Against Iran NZ Government: Targeted Action On Suicide Prevention

NZ Government: Targeted Action On Suicide Prevention NZ Labour Party: Luxon Open To Halving Workers’ Sick Leave

NZ Labour Party: Luxon Open To Halving Workers’ Sick Leave NZCTU: Government Turns Its Back On Workers’ Safety

NZCTU: Government Turns Its Back On Workers’ Safety Auckland Council: Experienced Property Owners Convicted For Persistent RMA Breaches Across Auckland Homes

Auckland Council: Experienced Property Owners Convicted For Persistent RMA Breaches Across Auckland Homes EDS: Government Undermines Regional Powers To Protect Coastal Biodiversity

EDS: Government Undermines Regional Powers To Protect Coastal Biodiversity Greenpeace: Shane Jones Indicates NZ's Entire EEZ Now Open For Oil And Gas Free-for-All

Greenpeace: Shane Jones Indicates NZ's Entire EEZ Now Open For Oil And Gas Free-for-All