Debate AirNZ Report On Propose Qantas/Air NZ Deal

DEBATE AIR NEW ZEALAND

www.debateairnz.org.nz

calls on the Government to SLOW DOWN the Kiwi Share approval of Qantas investment into Air New Zealand

The case for more deliberation, consultation and public say in the decision on whether Qantas should be allowed to acquire a shareholding in Air New Zealand

Prepared by Debate Air New Zealand, PO Box 1702, Wellington • http://www.debateairnz.org.nz

11 DECEMBER 2002

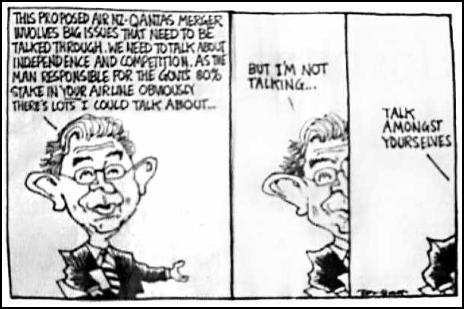

Dominion

Post

CONTENTS

- Introduction: "PULL

UP!"

- Ten good reasons for not rushing

into the Qantas proposal

- What others

are saying

- The December 18 Kiwi Share

decision

- Government’s exercise of its

Kiwi Share rights

- Is there an

alternative?

- The Commerce Commission

and Commerce Act

- Question and

Answer: Air New Zealand’s views and our reply

-

Will the airlines lower fares to encourage

demand?

In May 2001 Qantas

proposed that it acquire a shareholding in Air New Zealand.

PM Helen Clark indicated that there were "serious obstacles"

due to international landing rights, competition law and New

Zealand’s position as a high-class international tourist

destination.

At that time the Government was slowly

deliberating the merits of Singapore Airlines increasing its

stake in Air New Zealand. Previously the Government had

just as deliberately undertaken the review of Virgin Blue’s

application to fly the Tasman. Qantas is now asking for

Government approval, under the Kiwi Share powers, to be

allowed to acquire a shareholding in Air New Zealand and

Government has accepted a deadline of 17 business

days. Why are the "serious obstacles" no longer so

serious? There is a sorry tradition in New Zealand of

governments rushing major decisions that benefit some and

cause long-term harm to the country. We can all think of

examples. Right now Government seems headed towards

another hasty, arrogant decision by allowing Qantas to buy

into Air New Zealand. This paper questions the wisdom of

hurrying the decision and whether Qantas will really be that

good for Air New Zealand. In particular, we call on

the Government to . . . SLOW DOWN Why does

the Government (including the Kiwi Shareholding Minister)

need to make any decisions at this time? Urgency is being

driven by those who want to make the deal a fait accompli.

Making a decision now excludes the public.

LOOK Ministers should decide whether the Qantas option

is in the national interest AFTER the analysis has been

done, not before. They should delay making any commitment

on the Kiwi Share until after the Commerce Commission has

investigated the transactions costs and benefits. … AND

LISTEN Why has the issue been managed to minimize

public involvement? Details of the proposed deal were kept

quiet until very recently and now there is a barrage of

public relations pushing the Qantas option. The transaction

affects all New Zealanders and has significant commercial

and community consequences. Ministers need to listen to

these people before making a decision. 1.

NO URGENCY The claims that Air New Zealand is not

viable without the deal are not true. They are

scaremongering public relations. Air New Zealand has

recovered from the Ansett purchase. It is profitable. It has

the capacity to raise any capital it needs from the New

Zealand capital markets. The New Zealand Government is its

82% shareholder. It is part of the world’s largest airline

alliance. 2. ALTERNATIVES NEED TO BE

CONSIDERED There are better ways for Air New Zealand

to raise capital than tying the company to Qantas. The

Qantas deal is being promoted as the only viable option, but

there are other options. The best option may be Air New

Zealand raising needed capital from New Zealand investors

(without any loss of sovereignty). Air New Zealand does not

need an airline shareholder. 3. FARES WILL RISE UNDER A

MONOPOLY Air New Zealand claims that the transaction

would result in higher profits, lower fares, increased

services, and more engineering work. This is good PR but not

credible in the real world. The likely losers would be New

Zealanders and New Zealand companies, facing rising charges

and rationalized services. 4. AUSTRALIAN DOMINATION IS

NOT IN NEW ZEALAND’S INTEREST This deal is much more

to Australia’s advantage than New Zealand’s. The promises of

a ‘partnership of equals’ would count for nothing as Qantas

inevitably made business decisions in its own best interests

(e.g. why should it direct tourists to New Zealand?). Qantas

is in various ways the worst conceivable airline partner

because its commercial interests clash directly with Air New

Zealand’s. The strong diplomatic pressure from Australia for

New Zealand to accept the deal is a warning that it is

primarily to Australia’s advantage. Over time Air New

Zealand would wither as Qantas built itself up at Air New

Zealand’s expense. 5. AIR NEW ZEALAND DOESN’T NEED

QANTAS Air New Zealand does not need Qantas to survive

in the international airline market. Domestically, the

future is in being ‘low cost’ and Qantas is not low cost.

Internationally, the future is being efficient and

interlinked with an alliance of airlines. Nothing Qantas can

offer will enhance Air New Zealand's current position in the

Star Alliance. 6. PUBLIC OPPOSITION All the

evidence suggests that a clear majority of New Zealanders

are opposed to the Qantas proposal. There is widespread

disquiet. Spokespeople representing tourism, export and

consumer interests oppose the plans. The Government and Kiwi

Share Minister do not have a mandate from the public to

commit New Zealand to the deal. 7. NEW ZEALAND’S

NATIONAL INTEREST IS NOT RECEIVING DUE CARE It

appears, on the current hasty schedule, that the Kiwi Share

Minister’s judgment of the public interest will be cursory

and incomplete. Many important issues, such as airfare and

freight price rises and reduction of services, will barely

be considered. 8. MORE DELIBERATION AND CONSULTATION

MAKES SENSE AND IS VIABLE There is no legal,

commercial or governmental reason why any decision needs to

be made at this time. Haste forestalls democratic input from

New Zealanders. The Government should take time to listen to

the wide range of New Zealanders with concerns before

considering any action. 9. NEW FACTS NEED TIME TO BE

CONSIDERED AND ASSESSED Government apparently received

the application on 25 November 2002. No substantive

statement of costs and benefits was put forward at that

time. On 9 December Air New Zealand made available a cost

benefit analysis on the transaction. A number of differences

are apparent between the benefits as originally announced

and those set out in the cost/benefit report. Airlines

have a track record of presenting ‘facts’ that suit their

immediate objectives. The Government needs to be very

sceptical and careful in considering the airlines’ proposal.

The original timetable allowed 17 working days from Air New

Zealand’s announcement to the time the Kiwi Share decision

is to be made. Now Government has 7 business days to digest

a 213 page report which includes new facts such as $183

million per annum of cost savings in New Zealand. 10.

PROPER PROCESS FOR A TRANSACTION WITH "SERIOUS

OBSTACLES"? There is no need for the Government or

Kiwi Share Minister to make a decision before the New

Zealand Commerce Commission has considered the competition

issues. A Ministerial declaration now on ‘National

Interest’, based on scant information and no proper scrutiny

of the airlines’ case, can only undermine the Commerce

Commission’s independence. A Kiwi Share decision now is in

direct contradiction of Hon Michael Cullen’s promise that

this transaction would be managed to avoid Government’s

inherent conflicts of interest as Air New Zealand’s main

shareholder, as the protector of National Interest and as

overseer of competition law. It is blatantly apparent that

the Minister of Finance’s interests are being given priority

and "serious obstacles" are not impeding his agenda. NZ Herald, 1 August 2002 In

one of the more extraordinary comments of the election

campaign Finance Minister Michael Cullen observed: "I cannot

understand this assumption that somehow or other Qantas

being involved is somehow worse than any other airline." Can

it really be true that the future of the airline is in the

hands of someone who: 1. Hasn’t noticed that any link

between Air New Zealand and Qantas would create an effective

monopoly in the domestic aviation market. 2. Isn’t aware

that the same two airlines also dominate the trans-Tasman

market and many international routes. 3. Doesn’t care that

the two airlines belong to different international

alliances. 4. Doesn’t recall that Qantas has had a stake

in Air New Zealand before with disastrous results. 5. Is

oblivious to the fact that it was largely due to the

machinations of Qantas that Air New Zealand got into the

mess in the first place. - Jim Eagles Underarm Bowling In The Boardroom, New

Zealand Herald, 8 August 2002. Jim Scott was boss when

[Air New Zealand was privatised in 1988]. Scott’s joy at

being ‘liberated’ from the shackles of government control

quickly turned sour. Qantas’ 19.9 per cent stake gave it

two board seats. The two directors had to leave the room

during discussions on sensitive competitive matters, but

Scott believes they picked up enough between meetings to

piece together Air New Zealand’s long-range

strategy. ‘Qantas sat at the table and dorked us – of

course they were asked to leave, but they knew what was

going on, they understood the strategy of Air New Zealand to

strengthen its position.

Dominion Post, 2 September 2002 Increasing numbers of

businesses in the Wellington region want Qantas Airlines to

keep its hands off Air New Zealand. The August BRC-Sherwin

Chan Walshe poll of more than 300 businesses, prepared for

the Dominion Post, shows 67 per cent of those questioned

were opposed to Qantas snapping up a stake in New Zealand’s

national carrier – up from 56% opposition in June. The

survey result comes as several leading investment houses and

business people put pressure on the Government, as Air New

Zealand’s controlling shareholder, to draw on New Zealand

investors to recapitalise the airline – rather than

undermining market competition by allowing Qantas on to the

share register. - Ho-Sang Mathew Loh New Zealand Herald 3 December

2002 Ralph Norris is the figurehead of a huge public

relations exercise to convince the public that a

near-monopoly and reduced competition in the airline

industry is good for the country. The business community

sees this as an extremely dangerous campaign, because Norris

must get Commerce Commission and the public to buy into this

story. They will only do this on the basis that the airline

industry, which will be dominated by a near monopoly, should

be more heavily regulated. - Brian

Gaynor New Zealand

Herald 26 November 2002 If the Air New Zealand-Qantas

deal seems to good to be true, that’s because it

is…. First there is the claim that it will be worth $450

million a year to the two airlines with no staff cuts, no

fare rises and no reduction in services…. Certainly,

co-ordinated marketing and a wider spread of flight times

(instead of two airlines operating almost identical

timetables) could well generate extra traffic. But the

suggestion that the two airlines can pick up an extra $450

million without reducing services or putting up fares is a

bit hard to swallow. Second, there is the constant

reference to this as a partnership of equals and not a

Qantas takeover. The sad truth is that the collapse of

Ansett Australia gave Qantas a big revenue boost and left a

wounded Air NZ convinced it needed a big brother in order to

survive. A 22.5% shareholding and two board seats would

usually be considered enough to call the shots (especially

as most of the other shares are held by a passive

investor). But in this case Qantas is further strengthened

by the fact that the advisory board running the joint

operation will have equal numbers from the two airlines and

any disagreements will go to the two chief executives. If

it comes to the crunch, who will have the most weight? Which

airline thinks it needs the other most? Whose interests will

come first? - Jim Eagles 1. Government is set to make

a Kiwi Share decision about the deal on 18 December. This

decision will be handed down after less than a month’s

consideration of the merits of the transaction. All the

signs are that key Ministers had made up their minds without

even going through the National Interest process. 2. There

is no reason for the Crown to not take a more consultative

and deliberative approach. Releasing a report on its

assessment of National Interest in December and allowing

interested parties to make submissions in, say, April would

not delay the final outcome by even one day (assuming that

the Government’s decision is the same under both

approaches). 3. The Kiwi Share criteria that Government

has set itself are absurd. They do not even include the

fundamental issue of whether the transaction will be likely

to result in higher or lower fares and better or worse air

services within NZ and between NZ and the world. 4. The

transaction put forward by AirNZ rests on a single precept.

AirNZ will lower fares to encourage demand. AirNZ will gain

great additional profitability (and NZ many more

international tourists) because more people will fly due to

low fares. Every single piece of evidence to hand points

to airlines setting price based on competition. Airlines do

not lower fares to encourage demand. If they do not have

enough passengers to fill their aircraft, they reduce

flights. 5. Over 2 million tourists visit NZ each year.

About half of these people fly on the Star Alliance. If

AirNZ leaves the Alliance it is very unlikely that those

people will follow AirNZ. Whatever passengers Qantas can

offer AirNZ it pales against the lost of feed from

Star. 6. AirNZ and Qantas do not have a ‘common vision’

despite the views of AirNZ’s current CEO and Chairman. AirNZ

was bailed out by the NZ Government because it recognized

that New Zealand would suffer great economic harm through

the loss of its national carrier. Qantas is the

quintessential Australian company. It is run for Australia.

Its CEO is an ex-Australian diplomat and the interlinkages

between Qantas and its Government are deep. NZ and Australia

are competitors in many areas, not least for the world’s

tourist dollar. The subjugation of AirNZ will see NZ take a

back seat to Australian interests. 7. The two aspects of

the deal (coordination of services and Qantas’ investment

into AirNZ) need not be linked. The Crown does not need to

allow Qantas to buy one share in AirNZ. THE

DEAL Financial 8. If the Government goes

ahead, AirNZ will issue a convertible note to Qantas for

$110m as soon as the Minister of Transport gives approval

(under his Kiwi Share rights). This is effectively 44.5

cents per AirNZ share. The Convertible Notes would give

Qantas 4.99% of AirNZ. Presumably if the deal ultimately

does not progress the Notes would be repaid by AirNZ. If the

deal progresses they convert into shares. 9. Once

regulatory and shareholder approval are given, Qantas will

acquire a further 10% for $245m (also 44.5 cents per AirNZ

share). Within 3 years of the second investment occurring

Qantas may acquire a further 7.5% for $183m (it is vague as

to whether Qantas could avoid ever making this

investment). 10. Also announced is an intention to

undertake a rights issue to raise $200m, but quite how fits

with the Qantas arrangement is uncertain. 11. AirNZ seems

likely to raise between $355m and $750m, with final

shareholdings of somewhere between Crown 64%, Qantas 22.5%,

Others 13.5%; and Crown 70.5%, Qantas 15%, Others

14.5%. Outcomes depend on whether Qantas buys 15% or 22.5%

and whether the rights issue progresses.

Operational 12. All New Zealand routes (and to and

from New Zealand) will be controlled by AirNZ. However,

overseeing this control will be an Advisory Group which will

include Qantas staff. 13. AirNZ will appoint one director

to Qantas. Qantas will appoint two directors to AirNZ. At

least one Qantas directors will be required to sign all

AirNZ board resolutions. AIRLINE IDENTIFIED

BENEFITS 14. Initially the claimed benefits of the

transaction were from an extra 50,000 international tourists

(an increase of 2.5% on the 2 million who visit now) and 200

jobs that would be created in NZ. 15. With the release of

the larger cost benefit report the shape and scale of

benefits has changed. Now the main feature of the benefits

is that the combined cost of the New Zealand operations of

Qantas and AirNZ will decline by $183 million per

annum. ‘PLAN B’ 16. AirNZ’s announcement said

that they had "considered two strategies, that of joining

with another airline and then competing against Qantas, or

working with Qantas and competing as a strong alliance. The

Qantas alliance offered the best outcomes, both from the

company's, and the national interest, perspective." No other

details are available. AirNZ seems not to have even

considered going it alone. GOVERNMENT’S DECISION

MAKING PROCESS 17. As set out at present the approval

process for the transaction starts on 18 December when

Government decides in principle whether it should exercise

its Kiwi Share rights. This will be followed by 6 months

of regulatory process, which will then be followed by the

shareholder process. Government’s two political moments of

choice are when the Kiwi Share rights are exercised and then

when it votes its shares. 18. In reality only the Kiwi

Share decision is important, because Michael Cullen has made

it very clear that he will vote the shares to support the

transaction once it has regulatory approval. WHAT IS

THE PUBLIC’S INTEREST 19. Before addressing the

criteria/process Government has set itself under the Kiwi

Share, it is worth noting what the public’s interest in the

outcome is, so the Kiwi Share criteria may be

benchmarked: (i) Consumer interests: — Lower airfares

and airfreight rates — More destinations — More frequent

flights — More convenient booking options (ii) Airline

interests: — Lower costs — Higher revenue per service

(via either higher loadings or prices) — New services

which are profitable (iii) Related industry interest: —

Purchase of NZ sourced goods and services by AirNZ — More

tourists (via lower fares, better services, more

advertising) (iv) Investor interests: — Greater

profitability. — Less risk. Not one of these points is

included in any obvious way in the Kiwi Share

criteria. THE KIWI SHARE RIGHTS 20. In AirNZ’s

constitution it states (clause 3.3): No person that owns or

operates an airline business, nor any other person where the

first-mentioned person and that other person are Associated

Persons, may hold or have an Interest in an Equity Security

unless the prior written consent of the Kiwi Shareholder has

been given to such holding or Interest, and any such consent

may be given on such terms and conditions as the Kiwi

Shareholder thinks fit. 21. The considerable leeway given

to the Minister should be noted. His decision depends on

what he ‘thinks fit’. The scope of the Minister of Transport

to act arbitrarily can be inferred from the last Minister’s

(Hon Mark Gosche) refusal to allow Virgin Blue to fly the

Tasman (24 November 2000). He provided no explanation of his

actions other than to note that Virgin was not an Australian

airline. 22. Cabinet minutes and the

Treasurer’s description of the criteria that Government will

address in reaching a decision on the 4.99% are set out

below. Salient points to note are: . It does not include

any consideration of competition or the efficiency of New

Zealand’s domestic or international air services. . It

does not include any consideration of the commercial logic

of the transaction. . Michael Cullen, as the shareholding

Minister, has said that he will make his decision on whether

the deal makes sense to the Crown as a major AirNZ

shareholder only once the deal has regulatory approval. .

There is no facility for public input or consultation. .

In theory Government has indicated that it will reach its

Kiwi Share decision within a month. . There is no reason

for the Kiwi Share decision to be made now or with any

particular urgency. As the final transaction is not expected

until the second half of 2003 there is plenty of time. .

There is no express linkage of the Kiwi Share criteria to

the reasons put forward when Government bailed out

AirNZ. 23. Minutes of the Cabinet Policy Committee 20

November 2002 1. noted that Qantas and Air New Zealand

have revealed to the market that the two airlines are in

discussions about a strategic partnership that includes

Qantas taking an equity stake in Air New Zealand; 2. noted

that should a proposal by the airlines be received within

the next week the Government will make an in-principle

decision on the ownership case, and a conditional Kiwi

Shareholder decision, in December 2002 [CAB Min (02)

31/23]; 3. noted that the Kiwi share is a device for

maintaining government control of aspects of the operation

of a publicly listed company, sufficient to ensure that

wider public interests are able to be protected; 4. noted

that a favourable Government decision in December 2002 will

mean Qantas will be advised that Kiwi Shareholder approval

has been given for the entire shareholding sought by Qantas,

subject to: 4.1 there being no material changes to the

commercial proposal, or significant new information being

revealed, during the subsequent competition and other

regulatory processes; 4.2 approval of the transaction by

Air New Zealand Shareholders, with respect to any portion of

shares requiring Shareholder approval; 5. noted that all

competition issues will be addressed by the Commerce

Commission and Australian Competition and Consumer

Commission; 6. agreed that the following considerations

should be used to assist the Government’s national interest

evaluation: 6.1 maintenance of effective control of Air

New Zealand by New Zealand nationals; 6.2 continuation of

Air New Zealand’s ability to exercise New Zealand’s existing

and future air rights; 6.3 preservation of the unique New

Zealand identity of Air New Zealand; 6.4 provision of

effective channels for international tourism and

travel; 6.5 provision of a durable domestic air services

network; and 6.6 preservation of New Zealand based

employment; 7. noted that the commercial proposal may

raise other issues of relevance to the national interest

evaluation which are not covered in paragraph 6 above; 8.

noted that in light of the considerations in paragraph 6

above, the information to be sought from the airlines,

without prejudice to further information that may be needed,

is: 8.1 any proposed amendments to the Air New Zealand

Constitution; 8.2 information on any proposed governance

and ownership changes; 8.3 expectations of branding,

marketing and promotion of Air New Zealand; 8.4

expectations of destination marketing of New Zealand; 8.5

any changes to the nature, distribution and quantum of Air

New Zealand’s activities globally; 8.6 international

routes, frequencies, and schedules; 8.7 alliance

implications, and expected costs and benefits, including

changes to expected passenger volumes, and seat

capacities; 8.8 Air New Zealand’s role and influence in

alliance and code sharing arrangements; 8.9 international

competition processes including US antitrust

timelines; 8.10 frequent flyer programmes’ status and

data; 8.11 structuring of holiday packages; 8.12

domestic routes, frequencies, and scheduling; 8.13

domestic partnership and international inter-line

arrangements; 8.14 any changes to the location and skill

mix of direct and indirect employment in New Zealand; 9.

noted that to ensure clarity and consistency of

communications and information flows to and from the

airlines, a single contact point (Treasury) within the

public sector on the national interest evaluation will be

established; 10. directed the Treasury to inform Qantas

and Air New Zealand of these considerations and request

information from the two airlines, as appropriate, to assist

the Government to make an informed decision; and 11. noted

that both the quality and timeliness of the information

provided by the airlines will have a significant influence

on whether the Government will be in a position make an

informed decision in December 2002 24. On 25 November 2002

Hon Dr Michael Cullen described how Government was the

manage its consideration of the AirNZ

proposal: The Ministers leading the Government’s

response are: Finance Minister Michael Cullen as holder of

the Crown’s 82 percent shareholding in Air New Zealand;

Transport Minister Paul Swain as holder of the Kiwi Share;

and Associate Finance Minister Trevor Mallard, who has been

delegated authority for regulatory issues by Dr

Cullen. "The Government intends to maintain majority

ownership and control of Air New Zealand for the foreseeable

future. The proposal is consistent with that

intention. However there are a number of other factors

which need to be considered," the Ministers said. The

Government will assess the proposal both from a principal

shareholder and from a Kiwi Shareholder perspective. As

principal shareholder it will have to be satisfied that the

proposal is in the best commercial interests of the company

going forward. As Kiwi Shareholder, it will have to assess

whether the proposal meets the national interest

considerations agreed by the Cabinet. These include: .

maintenance of effective control of Air NZ by New Zealand

nationals . continuation of Air New Zealand’s ability to

exercise New Zealand’s existing and future air rights .

preservation of the unique New Zealand identity of Air New

Zealand . provision of effective channels for

international tourism and travel . provision of a durable

domestic air services network, and . preservation of New

Zealand based employment. The two companies will be

expected to provide any information required to assist this

evaluation. The Government has undertaken to come back to

Air New Zealand on 18 December with conditional

decisions. The airlines will apply to the Commerce

Commission in New Zealand and to the Australian Competition

and Consumer Commission across the Tasman. Consideration

by these bodies is expected to take some months. "We have

made it clear that the proposal will have to satisfy all the

normal regulatory and competition criteria. There is no way

that we will intervene legislatively to remove or even to

lower any of those hurdles. Only after this process has been

completed will the Government be in a position to make a

final decision. We ask the media meanwhile to be aware

that until then, our legal advice is that we should avoid

publicly commenting on the detail of the proposal or what we

think of it. Because the Crown has an ownership interest in

Air New Zealand, we are covered by the insider trading laws

and must avoid any public statements which might be

construed as advising or encouraging the purchase or sale of

Air New Zealand shares," the Ministers said. from

Dr Michael Cullen’s website 25. The previous

National-lead Government policy was: "The Government

believes that while it is in the country’s best interests to

have a well-performed international airline headquartered in

New Zealand, the interests of New Zealand airlines should

not be permitted to override the country’s broader

interests." International Air Transport Policy of New

Zealand, issued by the Hon. Maurice Williamson, Minister

of Transport, February 1998. This may not be the best

policy, but it is at least recognising that what matters is

"country’s broader interests" rather than merely those of

AirNZ as perceived by a few Treasury officials. 26. To quote the Commission: The overriding

purpose of the Commerce Commission (‘the Commission’) is to

promote market efficiency by fostering: . healthy

competition amongst businesses; . informed choice by

consumers; and . sound economic regulation. This purpose

definition represents the Commission’s view of its various

statutory responsibilities. The purpose of the principal

Act, the Commerce Act, is to promote competition in markets

for the long term benefit of consumers within New

Zealand. 27. The Commerce Act is a set of generic

competition laws that prohibit anti-competitive market

behaviour and structure. The Act prohibits: . contracts or

arrangements by businesses that could lead to a substantial

lessening of competition; . the taking advantage of

substantial market power to deter or eliminate competition;

and . mergers or acquisitions that would substantially

lessen competition 28. Seemingly an arrangement between

AirNZ and Qantas that is mainly intended to work by reducing

competition would run foul of the Commission and the Act. In

practice the Commission’s criteria are not black and white.

Against the cost to consumers will be the various benefits

of the arrangement (e.g. lower costs). This form of

cost/benefit analysis is somewhat arcane and it is not

difficult to imagine small algebraic adjustments giving

unexpected outcomes. 29. AirNZ has indicated that one of

the merits of the transaction is that it will enable the

airline to attract more passengers, as well as some

additional engineering work. They have indicated: .

AirNZ has estimated its synergy benefits from the deal will

amount to $200m p.a. after three years. . Qantas have

estimated total synergies of between NZ$330m and NZ$450m

p.a. after three years. The benefits will be adjusted

between the two airlines in accordance with an agreed

mechanism with reference to capacity and route

profitability. . Almost all synergy benefits are revenue

driven (i.e. not from cost reductions) To be sceptical,

AirNZ did not achieve anything like this benefit from its

takeover of Ansett. Previously when AirNZ and Qantas stopped

code sharing, when Qantas sold its shareholding to

Singapore, there was negligible revenue impact. 30.

AirNZ has set out the following Q&A. We have added

alternative comments below each Air New Zealand

answer. How will you ensure consumers continue to be

offered competitively priced airfares? AIR NEW

ZEALAND’S ANSWER: Our fare structures are based on the

need to stimulate the market through affordable fares,

higher loads and better aircraft utilisation. Our commitment

to this approach is shown through initiatives such as

Express Class and the enhanced trans-Tasman services for

Freedom Air. Express Class and Freedom Air will continue and

the current airfare structure is here to stay. DEBATE

AIR NEW ZEALAND’S RESPONSE: Airline pricing is

determined by the ability to set fares rather than

altruism. Between March 1990 and June 2002 the cost of

domestic air travel rose 95%. The cost of international air

travel rose 2% (Dept of Statistics). The international

market has been competitive. The domestic market was not.

Ansett NZ was a lame duck and prices were set by AirNZ.

Competition is the only factor which stimulates lower

fares. Can you assure consumers that fares will not go

up? AIR NEW ZEALAND’S ANSWER: Air New Zealand

can confirm that its Express Class and Freedom Air fare

structure will remain competitive. Fares will continue to

be market competitive. Express Class and Freedom Air’s

expansion are prime examples. DEBATE AIR NEW

ZEALAND’S RESPONSE: “The New Zealand domestic passenger

market is fully deregulated, and barriers to entry are

low. Successful competitive entry is available at current

fare levels, and thus imposes a real constraint on pricing

by incumbent airlines.” [para 6 Air New Zealand submission

to the Commerce Commission on its application to buy Ansett

Australia 27 February 1996] Between December 1995 and June

2002 the cost of domestic air travel in New Zealand rose

44.8%. The cost of international air travel fell

3.6%. Fares will rise unless there is competition.

Why has Air New Zealand chosen to go with Qantas,

particularly given the fact that many New Zealanders have

expressed their lack of support for the move? AIR

NEW ZEALAND’S ANSWER: This alliance is a bold move that

is good for the country as well as Air New Zealand. It will

create wealth and employment. Now that we have at last been

able to tell New Zealanders the terms of the agreement they

will be able to appreciate that this was too good an

opportunity to miss. It will: – Allow continuation of

affordable, convenient travel for New Zealanders using their

own national airline carrier – Provide economic benefits

for New Zealand of close to NZ $1 billion over five

years – Ensure Air New Zealand has a successful future as

a global, New Zealand owned and managed company Leave us

in charge of our own destiny DEBATE AIR NEW ZEALAND’S

RESPONSE: “Qantas… has done everything in its power to

prevent a transaction that is in Air NZ’s best interest and

clearly in New Zealand national interest” “This sort of

hostile action by Qantas against Air NZ’s interests and the

national interests of New Zealand is nothing new” [Air

New Zealand counsel describing Qantas’ position on Air New

Zealand’s expansion into Australia to the Commerce

Commission in Air New Zealand’s application to buy Ansett

Australia 27 February 1996] How much control will

Qantas have over Air New Zealand? AIR NEW

ZEALAND’S ANSWER: The basis of the strategic alliance

is the absolute commitment of both parties to Air New

Zealand being New Zealand controlled, and managed

autonomously under the oversight and direction of its own

Board. Air New Zealand will control its own destiny and

retain its identity as New Zealand’s airline. Some 70% of

shareholding will remain in New Zealand hands and the Kiwi

Share structure will remain. The commercial management of

the combined operations of Air New Zealand and Qantas in New

Zealand and across the Tasman will be Air New Zealand’s

responsibility. DEBATE AIR NEW ZEALAND’S RESPONSE:

AirNZ may control both airlines’ NZ domestic and

international operations, but this control is to be overseen

by an “Advisory Group” which will include Qantas

staff. Qantas’ shareholding will be only 2.5% below the

level necessary to vote down any special resolution. It will

have an effective veto over any major transaction AirNZ may

subsequently wish to undertake. Will Qantas have

boardroom control? AIR NEW ZEALAND’S ANSWER:

Qantas will have only two out of nine board positions, 22%

is well short of control. At one time British Airways had

as much as a 25% shareholding in Qantas. That did not

constitute control of Qantas. DEBATE AIR NEW ZEALAND’S

RESPONSE: Qantas will appoint two directors to AirNZ

and at least one director will be required to sign all AirNZ

board resolutions. What does the alliance mean for the

travelling public? AIR NEW ZEALAND’S ANSWER:

An even stronger, growing Air New Zealand. This translates

into: – The retention of affordable fares for Express

Class and Freedom Air – The extension of Airpoints, in

time, to Qantas services. – Greater options and

flexibility in the number of flights through code sharing

with one of the world’s leading airlines. Choice will be

increased threefold. – Code share access to routes from

New Zealand, Sydney to Singapore, London and Europe

DEBATE AIR NEW ZEALAND’S RESPONSE: The economic

rationale for the transaction is to increase aircraft

utilisation. There are two ways for this to

happen. Fares can be lowered to encourage patronage or

capacity can be reduced. There is no protection against

the latter option. It is the much more likely consequence of

the deal. What exactly has happened between Air New

Zealand and Qantas? AIR NEW ZEALAND’S ANSWER:

We have formed a new regional airline grouping in this part

of the world. Our focus will be on co-operating so that we

do what is best for New Zealand and Australia, our

respective customers and for Air New Zealand and

Qantas. We are co-operating so we have the size and

strength to take on the rest of the world’s airlines.

DEBATE AIR NEW ZEALAND’S RESPONSE: Size does not

equate with strength in the airline industry. Large badly

run airlines are going bust. Small well-run airlines are

prospering. “Pure economies of firm size are not important

in the airline industry, since airlines with a few aircraft

can operate efficiently.” [Air New Zealand expert

witness Dr P Forsyth submission to the Commerce Commission

on Air New Zealand’s application to buy Ansett Australia 27

February 1996] How will the alliance

operate? AIR NEW ZEALAND’S ANSWER: Two of the

more important operational aspects are Air New Zealand and

Qantas continuing to operate their own services in New

Zealand and trans-Tasman, but commercial management of

scheduling, pricing, routes and marketing will be the

responsibility of Air New Zealand We will co-operate to

develop new routes internationally and improve scheduling

and frequency DEBATE AIR NEW ZEALAND’S RESPONSE:

(As above) AirNZ may control both airlines’ NZ domestic and

international operations, but this control is to be overseen

by an “Advisory Group” which will include Qantas

staff. Qantas will appoint two directors to AirNZ and at

least one director will be required to sign all AirNZ board

resolutions. Why didn’t Air New Zealand get New

Zealanders to invest in the company rather than selling out

to Qantas? AIR NEW ZEALAND’S ANSWER:

Continuing as a stand alone airline was an attractive

notion. The stark reality of the international aviation

market is however that it would be a high risk path for Air

New Zealand. This alliance is not about the short or

medium term. Our vision is on the long term and we are

determined to be a New Zealand owned, globally operating and

sustainable airline of which every New Zealander will be

proud. This is a strategic vision which capital alone could

not fulfil DEBATE AIR NEW ZEALAND’S RESPONSE:

There is no reason why the two aspects of the transaction

(the operational agreement and the shareholding) need be

linked. AirNZ and Qantas could have seen if a regulator

would approve the operational links, while AirNZ could have

raised its capital requirements from the NZ capital

market. This alliance is dependent on Commerce

Commission and Government approval. What happens to Air New

Zealand if they do not give that approval? AIR

NEW ZEALAND’S ANSWER: We believe that when the

regulatory authorities examine the alliance in detail and

the benefits that will accrue to the respective countries

and airlines, we will get agreement to proceed. We have no

doubt shareholders and the majority of New Zealanders will

see the very real wealth creation benefits that will come

from the alliance DEBATE AIR NEW ZEALAND’S RESPONSE:

The transaction is blatantly against the intention of

the Commerce Act. It may of course get through, but it would

be nice to know why AirNZ adopted an approach which means

its whole resource is focused only such a problematic deal.

If it fails what will Michael Cullen think of John Palmer?

What should the electorate think of Michael Cullen?

What is Air New Zealand giving Qantas in return?

AIR NEW ZEALAND’S ANSWER: We share a common vision of

what is best for this region and the common realisation that

we need to work together to compete against existing and

future competition that comes from other carriers. Qantas

also clearly value our outstanding reputation for service,

safety and technical excellence. DEBATE AIR NEW

ZEALAND’S RESPONSE: As noted “This sort of hostile

action by Qantas against Air NZ’s interests and the national

interests of New Zealand is nothing new”. Qantas and AirNZ

have never had a common vision until now. Why has it taken

John Palmer (kiwifruit grower) and Ralph Norris (ex

Australian bank employee) to find “common vision”?

What happens to Airpoints and existing alliances?

AIR NEW ZEALAND’S ANSWER: The benefits of Air New

Zealand Airpoints members are fully protected. In time it

is planned to extend Airpoints to Qantas services. Air New

Zealand is a member of the Star Alliance. No decision will

be made in the near future and it should not be assumed that

Air New Zealand will leave the Star Alliance. DEBATE

AIR NEW ZEALAND’S RESPONSE: AirNZ cannot remain a

member of Star Alliance if this transaction occurs, unless

Qantas leaves the One World Alliance. Will Qantas

still operate domestically in New Zealand?? AIR

NEW ZEALAND’S ANSWER: Qantas will operate on domestic

New Zealand routes and Qantas will be responsible for flight

operations matters such as air crew, provision and

maintenance of aircraft, and passenger services.

DEBATE AIR NEW ZEALAND’S RESPONSE: At present Qantas

operates NZ domestic services using Polynesian Airways

aircraft. If the transaction occurs Qantas will use AirNZ

aircraft.

Introduction: PULL UP!

TEN GOOD REASONS FOR

NOT RUSHING INTO THE QANTAS PROPOSAL

WHAT OTHERS ARE

SAYING

THE DECEMBER 18 KIWI

SHARE DECISION

GOVERNMENT’S EXERCISE OF ITS KIWI SHARE

RIGHTS

The Government today received a

proposal for Air New Zealand to enter a strategic alliance

with Qantas under which Qantas would take a minority stake

in Air New Zealand.

IS THERE AN

ALTERNATIVE POLICY?

WHAT IS THE ROLE OF

THE COMMERCE COMMISSION AND COMMERCE ACT?

Question and

Answer: AIR NEW ZEALAND’S VIEWS

Gordon Campbell: On Surviving Trump’s Trip To La La Land

Gordon Campbell: On Surviving Trump’s Trip To La La Land Greenpeace: Greenpeace Slams PM’s Science Pick - 'Polluters Are Running The Show'

Greenpeace: Greenpeace Slams PM’s Science Pick - 'Polluters Are Running The Show' NZ Government: PM’s Science Prizes Celebrate Excellence

NZ Government: PM’s Science Prizes Celebrate Excellence Department of Conservation: Pinnacles Hut, Summit Track Set For Improvement

Department of Conservation: Pinnacles Hut, Summit Track Set For Improvement  Tax Justice Aotearoa: New Report Illustrates Tax System Failures

Tax Justice Aotearoa: New Report Illustrates Tax System Failures PSA: PSA Welcomes Increased Defence Spend On Civilian Salaries

PSA: PSA Welcomes Increased Defence Spend On Civilian Salaries New Zealand Government: New Helicopters A Commitment To Global Security

New Zealand Government: New Helicopters A Commitment To Global Security