Labour’s modern approach to monetary policy

Grant Robertson

MP for

Wellington Central

MEDIA STATEMENT

10 April

2017

Labour’s modern approach to monetary policy

A commitment to full employment and a more transparent process to provide market certainty are the hallmarks of Labour’s proposals for a new approach to monetary policy, says Labour’s Finance spokesperson Grant Robertson.

“Since the Reserve Bank Act came into effect 28 years ago, there’s been massive change in the way the global economy operates. It is time to review our approach to monetary policy and ensure it is meeting New Zealand’s needs the 21st century.

“Labour is proposing more transparency to the decision-making process and governance of the Reserve Bank, and to broaden the scope of its focus to include both controlling inflation and achieving full employment

“We’re doing this because in the wake of the global financial crisis there has been a significant challenge to the effective operation of monetary policy, in particular in dealing with a low or no inflation environment.

“Labour is fully committed to low inflation and will seek to continue the Reserve Bank’s current inflation target of 1-3 per cent. We will add the goal of full employment to the Reserve Bank’s mandate. This would bring us into line with other countries such as Australia and the United States.

“The next Labour Government is determined to focus on creating more jobs and higher wages. It’s in Labour’s DNA to ensure New Zealanders have the best possible quality of life through the best employment opportunities.

“The other significant change will provide a more robust decision making process and more certainty for financial markets. Currently, the Reserve Bank Governor is the sole arbiter of the Official Cash Rate.

“Our policy introduces a more open and inclusive process, establishing a committee with some external members, and the committee’s minutes will be published so that the financial market can have a more sound understanding of the trends in the decision-making process. Australia and the United Kingdom are among the countries that have similar models to this.

“Upmost in our policy will be the enduring independence of the Reserve Bank. There will be no change in the current level of operational independence it has from the Government.

“After 28 years it is the right time to undertake a review to ensure the Reserve Bank and New Zealand’s monetary policy still provide the most efficient and effective model for New Zealand. Labour understands this and will introduce the reform that is needed,” says Grant Robertson.

--

Attached: Monetary policy background information

Modernising Monetary Policy – The Need for Reform

28 years on from the passing of the Reserve Bank Act much has changed in the way the global economy and the New Zealand economy operates. The failure to meet our agreed inflation goals for the past four years has raised questions about whether monetary policy is making a decisive difference to the successful operation of the economy.

In the face of this evidence we believe the time is right to review the Reserve Bank Act. Our approach would fully protect the independence of the Bank - whilst allowing monetary policy to play its part in meeting the economic goals of the country.

At the outset of this process we want to signal two proposed changes to the Reserve Bank Act 1989. We also want the review to consider the adequacy and relevance of the measures and tools used by the Reserve Bank, and will work with the Bank on this once in government as part of the review.

1) Broadening of the objective of the Bank (Section 8 of the Act) from just price stability to also include a commitment to full employment.

We have seen the damage that out of control inflation can do to our economy and to our citizens. It is our most vulnerable who are the most affected by rising prices. It is right that we should continue to have price stability as a focus of monetary policy. It would be our intention to continue the inflation goals currently in the Policy Targets Agreement.

The next Labour government is also determined to focus on the creation of decent work with high wages. We want all parts of our economic system working towards that goal. Countries like the US and Australia have commitments for full employment within their Central Bank legislation. The evidence is that those countries who have a dual mandate perform better than or as well as those with a single mandate at managing inflation.

2) Change to the decision making process of the Bank so that a Committee, including external appointees, will have responsibility for setting the Official Cash Rate. The Committee will publish the minutes of its decision within three weeks, noting any dissenting views

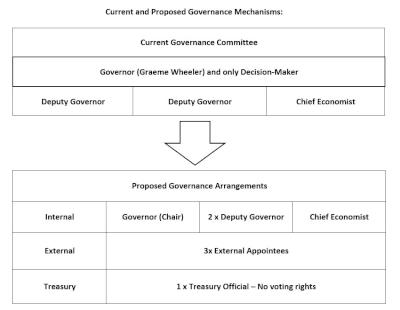

Having a single decision maker for OCR decisions is out of step with international practice. We propose that the existing governing committee of the Reserve Bank be joined by three independent experts. We would expect them to make a substantial time commitment to this work. The appointment of the experts would remain in the hands of the Governor, after consultation with the Minister of Finance, and would be subject to scrutiny as part of the Finance and Expenditure’s review of the Bank.

To help sustain public confidence in the system, we are proposing putting the minutes of each meeting of the Committee on-line within three weeks, including the result of any vote. This is done in a number of other jurisdictions. It is important that a public institution making as important decisions like the Reserve Bank, has this level of public transparency.

RBNZ Staff would continue to prepare projections and financial information for the Committee. The RBNZ Board would still have retrospective oversight of the committee’s decisions, and would hold it to account for any systematic errors or omissions.

The diagram below sets out the personnel changes that would be made:

Gordon Campbell: On Abortion’s Role In The US Election

Gordon Campbell: On Abortion’s Role In The US Election Te Kāhui Tika Tangata Human Rights Commission: Commission Calls For The Promise Of Te Tiriti O Waitangi To Be Honoured

Te Kāhui Tika Tangata Human Rights Commission: Commission Calls For The Promise Of Te Tiriti O Waitangi To Be Honoured West Coast Emergency Management: Local State Of Emergency Declared for the Southern ward of Westland District

West Coast Emergency Management: Local State Of Emergency Declared for the Southern ward of Westland District NZ Defence Force: NZDF Honours Last Māori Battalion Warrior, Sir Robert Nairn Gillies KNZM

NZ Defence Force: NZDF Honours Last Māori Battalion Warrior, Sir Robert Nairn Gillies KNZM The Treasury: Interim Financial Statements Of The NZ Govt For The Three Months Ended 30 September 2024

The Treasury: Interim Financial Statements Of The NZ Govt For The Three Months Ended 30 September 2024 NZ Labour Party: Labour, Greens And Te Pāti Māori Call On The Prime Minister To Block The Treaty Principles Bill

NZ Labour Party: Labour, Greens And Te Pāti Māori Call On The Prime Minister To Block The Treaty Principles Bill NZ Taxpayers' Union: Has Simon Watts Forgotten Who The Minister Is?

NZ Taxpayers' Union: Has Simon Watts Forgotten Who The Minister Is?