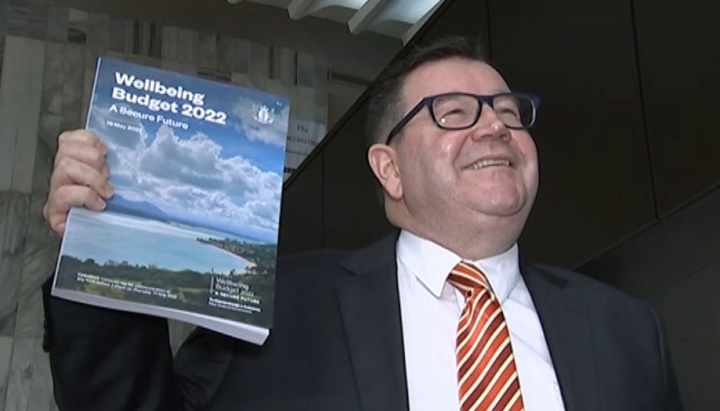

On Budget 2022

At base, the political biffo back and forth on the merits of Budget 2022 comes down to only one thing. Who is the better manager of the economy and better steward of social wellbeing – National or Labour? In its own quiet way, the Treasury has buried a fascinating answer to the “who’s best at running an economy during a crisis?” question, at page 57 of the Fiscal Strategy section.

What Treasury did was to compare the handling of the economic harms done by the GFC (ie. under a National government) with the handling of the economic harms caused by the Covid pandemic (under a Labour led government.) Here’s what it found initially:

Real GDP fell 10 percent in the second quarter of 2020 as a result of the economic impacts of COVID-19, compared to a peak-to-trough fall of nearly 3 percent of GDP through to the second quarter of 2009 following the GFC.

So… The impact on GDP of the pandemic was three times worse than the damage done by the GFC. But guess what? The Labour-led government was over three times faster at getting the economy back on the rails, even though the problem it faced was three times bigger than the one that faced the Key government:

Government support of businesses

and

workers contributed to a much

stronger

economic bounce-back from

COVID-19.

New Zealand’s real GDP was back to

pre-

pandemic levels within three quarters

from

the start of the crisis. In

comparison,

following the GFC, New Zealand’s

real GDP

took 10 quarters to return to

pre-recession

levels (Q2 2010).

As Treasury goes on to relate, the comparison is even more marked with regard to the handling of the unemployment situation during the two crises:

The employment

rate declined almost three percentage points from its

pre-crisis level following the GFC and stayed below pre-GFC

levels for most of the next decade. The economic and social

costs of long-term unemployment can be great, and

international

research has focused on the lasting

effects of job displacement through the atrophy of skills

and

workers becoming discouraged about their

ability to find work.

So once again, the Labour-led government faced a bigger unemployment problem, yet managed to return the jobs situation to normality far more quickly:

Following the initial impact of

COVID-19, the employment rate fell more swiftly than during

the GFC. However, the success of investments like the Wage

Subsidy, Resurgence Support Payment and Jobs for Nature

programme meant that more New Zealanders

remained

connected to their jobs during the crisis. The unemployment

rate peaked at 5.3 percent

in the third quarter of

2020 and has since fallen considerably below its

pre-pandemic level.

Unemployment fell to a

record-low 3.2 percent in the December 2021 quarter and held

at that level

during the March 2022 quarter, as

more New Zealanders benefitted from more jobs due to

the

strong economy.

So much, then, for Opposition claims that Labour has made a mess out of managing the economy, that it hasn’t got a plan etc etc. That’s a mega dose of fake news. As Treasury concludes: “Unemployment levels have consistently remained lower than Treasury forecasts, which anticipated a peak of close to 10 percent at Budget 2020, followed by forecasts of nearly 8 percent unemployment at the Pre-election Update 2020.”

This isn’t spin. This is the Treasury's dispassionate analysis. The same positive verdict has been echoed by the IMF and the international credit rating agencies. Keep this example in mind when next you hear Christopher Luxon trying to assert that National is an inherently better economic manager. There is absolutely no evidence to support that claim, and some compelling evidence to the contrary.

The Details

The outlines of Budget 2022 are already pretty familiar. Apart from the previously announced $2.9 billion plan to combat climate change, it has been public health and cost of living relief measures that have got the lion’s share of the remainder.

The four year, $11.1 billion package of public health reforms, DHB debt write-offs and other increases (eg to Pharmac funding) will eventually deliver major gains – if only by reducing the ruinously expensive and inefficient farrago of 19 competing DHBs imposed on us by the free market zealots within the National government of the early 1990s. (Back then it was all about how health should be provided, and not about whether the market model would deliver better health outcomes. Reader, it didn’t.)

No doubt, the new Maori Health Authority should be better able to identify and deliver health outcomes to Maori. Unfortunately… When set alongside the initial set-up costs for the health reforms, the allocation for the delivery of actual services to Maori looks disappointingly small. It comes down to $168 million in funding for the Māori Health Authority to pay for the direct commissioning of services.

The other Budget big ticket item is the $1 billion bag of cost-of-living relief measures. The dominant $814 million feature of this package consists of a targeted payment of $350 in relief payments to help address the cost of living crisis. This temporary relief ( its worth about $27 a week for three months) will still be welcomed by the estimated 2.1 million adults who can meet the qualifying conditions. That will especially be the case within low and middle income households that may contain two or more recipients.

The disappointing aspect is that this isn’t a universal payment (people earning over $70,000, beneficiaries and those receiving the Winter Energy Payments won’t qualify) and the relief will be well gone by Christmas. BTW, how do you actually prove that your income was below $70,000 as at March 31, 2022? Apparently, by filing a tax return quick smart in time to qualify. Good luck with getting 2.1 million low and middle income people to do that on schedule.

To use the old cliché, this is a handout, not a hand-up. It will provide some relief, and will be a sugar hit for retailers facing the reality of a slowing economy. Yet – obviously – it involves no ongoing commitment to a society that’s actually facing chronic cost-of -living problems e.g. with rent. Though you wouldn’t know it from the media coverage, access to housing is not merely an ownership issue. Some 1.4 million New Zealanders are renters, and $350 will not meet even one week’s rent.

The Options

OK… What could have been done in Budget 2022, but wasn’t? For no good reason, the one off payments, and the temporary wage fixes keep on making a pernicious distinction between those in paid employment and those reliant on benefits. While the rise in benefit levels that kicked in on April 1st was welcome, it was also quite modest given that, as the Child Poverty Action Group (CPAG) points out, it has still left one in eight New Zealand children living in poverty.

Robertson could have easily used Budget 2022 to extend some of the existing Working For Families/tax credit entitlements ( of circa $70 a week) to all of those on low incomes. Details of the feasible tax and WFF changes proposed by CPAG are available here. Other countries – even conservative Australia - do not make the same income support distinctions that we do between those on low wages within the paid work force, and those reliant on benefits. Needless to say, core benefit levels could also be sharply increased, as was recommended years ago by the government’s own welfare advisory expert panel.

However, there’s a line that the Ardern government continues to walk. It seeks applause for adhering to the strictures of orthodox market economics while also wanting to be seen as big-hearted and compassionate. Tokenism tends to be the unsurprising result. There is a desire to address poverty, but a reluctance to change the structures that keep on generating it.

Looking Ahead

Budget 2022 was to be a reckoning. Hey, if the books are that good and our very low Crown debt to GDP ratios are the envy of the rest of the world – which they are – there is no valid reason not to borrow more, and spend more. After all, the inflation bogey is not being driven so much by the domestic demand, and by the supply side pressures emanating from offshore (fuel prices, sup0lly chain blockages) are these are being forecast to start subsiding in 2023. In the medium term, there’s room to breathe on inflation.

Moreover, the current tax take does look pretty robust. As interest.co.nz pointed out yesterday, the tax revenue for the year ending 30th June 2022 will probably cross the $100 billion mark this year for the first time:

The main growth is from PAYE, forecast to rise by $3.7 billion to just under $42 billion and corporate income tax projected at $16.7 billion up nearly $2 billion…. GST receipts are also up over $1.2 billion from June 2021 to an expected $25.7 billion.

Hmm. Room for movement then, on GST? Room for corporations to be asked to make a bigger tax contribution? They’re contributing well short of half the tax take being extracted from the wages of their workers. (If taxation is theft, PAYE amounts to a ram raid on worker wallets.)

Moving right along… There is no political gain for Labour and the Greens from being dutifully orthodox and circumspect. National and ACT are already (and falsely) accusing Labour of being a bunch of ‘borrow and spend’ liberals, anyway. Bernard Hickey has just written an excellent Twitter thread – starting here - that debunks that line of criticism.

Come election 2023, Labour will struggle to retain the blue green neo-Nats who gravitated to it the last time around (a) out of gratitude to Jacinda Ardern and (b) because Judith Collins was so awful. Many male voters do love a confident sounding business guy giving them a TED talk on the power of positive thinking. But will centre-right women support Christopher Luxon in droves? You have to wonder. The answer to that question may well decide the election outcome next year.

In the meantime, Labour is evidently willing to shoulder both the cost and the political risk of carrying out significant reforms in public health. Surely, it should be showing the same resolve to tackle structural changes to incomes, and regardless of the employment status of the people in question. It could also subsidise job creation schemes to give more hope to people in need( and their communities) that there is a working alternative to dependency and drugs.

The government should also be bringing dental care into the array of normal public health services, rather than using Budget 2022 to just increase the dental care subsidy paid to low income families. It could also be choosing to expand the anti-trust legal toolkit under the Commerce Act and thereby take the supermarkets head on over their proven anti-competitive practices. Instead, Budget 2022 will merely make it easier for some theoretical new entrant to acquire land on which to build premises… So that they can then try to compete against the entrenched duopoly currently calling the shot on supermarket prices and profits. Dream on.

Other roads not taken

GST is a highly regressive tax. This is a broken record, but you really would expect a centre left government to be more willing to take GST off fruit and vegetables, for starters. For a Labour government, the safe-guarding of the virginal purity and simplicity of our sales tax regime should not be being treated as a higher priority than helping people to put healthy food on the table. What would Michael Joseph Savage be doing?

Currently, it should be a source of shame for Labour that even the Tory caucus in the UK Parliament is reportedly debating whether to reduce the VAT sales tax on everything, as a temporary response to the UK’s own cost of living crisis. In New Zealand though, the spectrum of what is deemed politically possible always seems to be extremely narrow. Right now, we’re being invited to treat the throwing of $350 out of the helicopter – money that was left unspent from the Covid Fund – as being an act of radical compassion. It really isn’t.

Making life affordable

Finally, the term “cost of living crisis” is a bit of a misnomer. This is really a “low wages” crisis. Meaning: It's not the cost, it’s the affordability. For those in the upper middle class and above, the supermarket checkout isn’t an anxiety zone. It never has been, and never will be. Renting, public transport…this is alien territory to them as well. Just don’t mention a wealth tax.

Obviously, the current cost of living pressures fall heaviest on people on benefits and the people in poorly paid jobs, of which a developed country like New Zealand has far more than its share. (Over the past decade, we’ve got productivity gains only by boosting immigration, and by working longer and longer hours.) The low wages directly affect people on benefits, since their benefit increases are no longer tied to inflation but to annual rises in an average wage that’s currently running at less than half the 6.9% annual rate of inflation. Again, the government has failed to take the option of re-indexing benefits to inflation whenever inflation exceeds wage growth.

To repeat: it is our low wage economy that has made food and rent unaffordable, and that’s the result of a shareholder-driven orthodoxy that has been actively imposing a low wage economy for the past three decades. It still is. Just this week, BNZ economist Stephen Toplis was calling for a wage softening to make it absolutely dead certain that inflation will eventually decline :

The RBNZ needs to see a marked softening in the labour market not only to meet its maximum sustainable employment objective but also to help ensure expected declines in inflation become more permanent.

Yep, that’s the orthodoxy’s message to workers facing the cost of living crisis: lump it, for the greater good lest ye awaken the dragon of inflation. Volunteer instead to be an under-paid foot soldier in the battle against inflation. Expect casualties.

The Budget day Blues

For some people, the only thing worse than taxation is the sight of governments spending the money on services that are actually used by the people who paid the tax. ( I concede there are some taxpayers who have never ridden on a bus.) Alas, Budget day flaunts both of those activities - the government’s tax take and how it plans to spend it – in the one sinful package.

BTW, calling it a “wages crisis” is not merely a matter of accurate labelling. It is also a useful yardstick for the solutions on offer. National for example, is keen to label it a ‘cost of living’ crisis because that distracts attention from its track record of opposing every single measure likely to boost wages and thereby make essential items like food and rent more affordable. Like UFOs, the cost of living crises seem to arrive out of nowhere. Panic and outrage is allowed, but organised resistance is deemed to be useless. And inflationary.

Lest we forget, National opposed raising the minimum wage and raising benefit levels. It opposed the Fair Pay Agreements that will increase union bargaining power and make wage increases more likely. For all of National’s crocodile tears about the “squeezed middle” doing it tough, its own tax package offers relatively little to those on middle and low incomes, while delivering huge dollops of cash to the very wealthiest New Zealanders, who are definitely not part of the “squeezed middle.” No surprise there.

Footnote One: Meanwhile… Over on the government side of the equation, the commentariat spent all last week wringing its hands about how government spending would only make the inflation picture even worse. So very difficult, it would seem, to think of anything at all that might improve the lot of people in need, without increasing the pain of the poor devils. Let them eat cake. Whatever you do, don’t feed them relief after midnight.

Footnote Two: While the lot of the precariat becomes ever more precarious, you may be wondering what Budget 2022 is doing about our digital security. Is it subsidising the private sector and thereby helping it to repel the hackers? Yes it is. Corporate welfare alert: the government’s digital watch-dog CERT will be getting a $25 million boost to its operations, plus $5 million for new gear to help it assist the private sector. Oddly, being on corporate welfare is never a disqualifier from receiving further forms of assistance.

Extra funding for the Government Communications Security Bureau( see page 97 of the estimates ) is also in train. This will double from $2. 18 million this year to $4.42 million in 25/26. In a separate line item, the GCSB allocation for cybersecurity services will increase from $2.089 million this year to $5.29 million in 25/26.

And in yet another line item, the GCSB’s need to respond to the recommendations made by the Royal Commission into the mosque shootings will see an increase in funding for that purpose from $2. 619 million this year to $3.64 million in future. Nice to see that the spooks at least will be keeping well abreast of the cost of living crisis.

Footnote Three: Given the option, most people could live with adding a few points to the inflation rate if that enabled them and/or others to put food on the table and pay the rent. Chances are the upward pressure on prices from wage increases driven by (a) labour shortages largely due to short-sighted immigration policy and (b) enhanced worker bargaining power would still end up having far less impact on the cost of living than the war in Ukraine and its flow-on effects on the prices of wheat, oil, diesel, and related transport costs.

Not to mention the inflationary effect of supply chain blockages being compounded by the Covid lockdowns in Shanghai. Not to mention the declining value of the Kiwi dollar against the US and Aussie dollars, which is also pushing up the cost of every single thing we import. Compared to all of that, wage increases tied to labour shortages and union power would seem to be the very least of our inflationary problems. Unfortunately, maybe these are the only areas that governments (and opposition parties) think they can control.

Footnote Four: Finally, there’s no real conflict here. Most voters would be happy enough to hear the economy is in reasonable shape, even if day by day, it delivers them little or nothing in the way of tangible benefits. Next year, the economy will be flirting with recession as it slows to a measly 1% rate of economic growth, although growth rates are being forecast to rebound soon afterwards.

Along the way, the deficit is also forecast to steeply decline from a high point of $19 billion this year, to $6 billion soon thereafter, before delivering a small surplus in 2025. It is hard to escape the conclusion that this trajectory of delivering the economy back into surplus is really the guiding principle behind Budget 2022. On that score therefore, there’s little real difference between Labour and National. At the end of the day, they both appear to worship at the altar of a budget surplus as an end in itself.

Regardless, all that workers and beneficiaries want is a more generous share of the strong numbers that Grant Robertson – and the IMF and the rating agencies – keep on saying are on the books. Much more could be being done, despite what the bank economists might think about that prospect.

Frances Palmer: Remembering Vietnam And Cambodia 50 Years On During ANZAC Week

Frances Palmer: Remembering Vietnam And Cambodia 50 Years On During ANZAC Week Binoy Kampmark: Euphemistic Practices - The IDF, Killing Aid Workers And Self-Investigation

Binoy Kampmark: Euphemistic Practices - The IDF, Killing Aid Workers And Self-Investigation Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia Ramzy Baroud: French Contradictions | Macron's Palestine Play - Too Little, Too Late?

Ramzy Baroud: French Contradictions | Macron's Palestine Play - Too Little, Too Late? Martin LeFevre - Meditations: Easter Reflections

Martin LeFevre - Meditations: Easter Reflections Binoy Kampmark: Dotty And Cretinous - Reviewing AUKUS

Binoy Kampmark: Dotty And Cretinous - Reviewing AUKUS