Simplifying Our Tax & Benefit Systems

Simplifying Our Tax & Benefit

Systems

by

Perce Harpham July 2018

Table

of contents. Page

Summary and

Conclusions

Some

History

The Case for Enforcing a

“trickle down”

The New Zealand

Scene

Benefits to be expected from

an Adult Basic Income

Why are the Poor

poor?

Personal Income

Tax

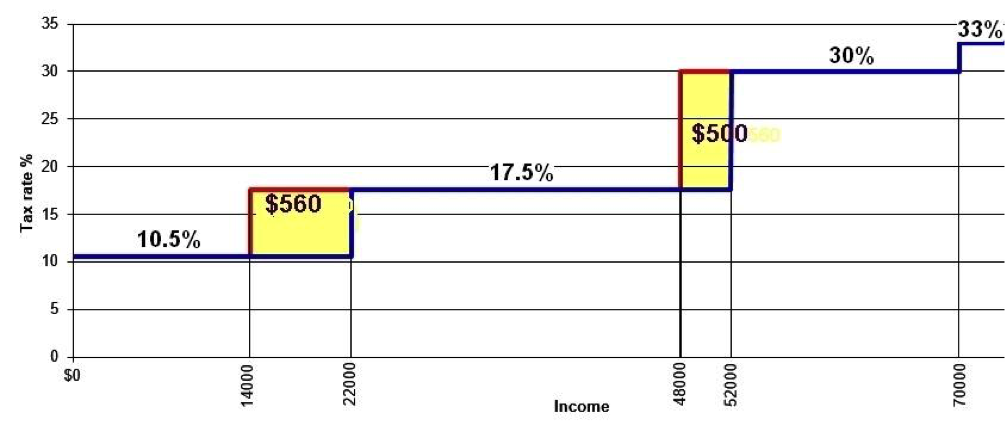

Figure 1.Tax Rate versus

Income

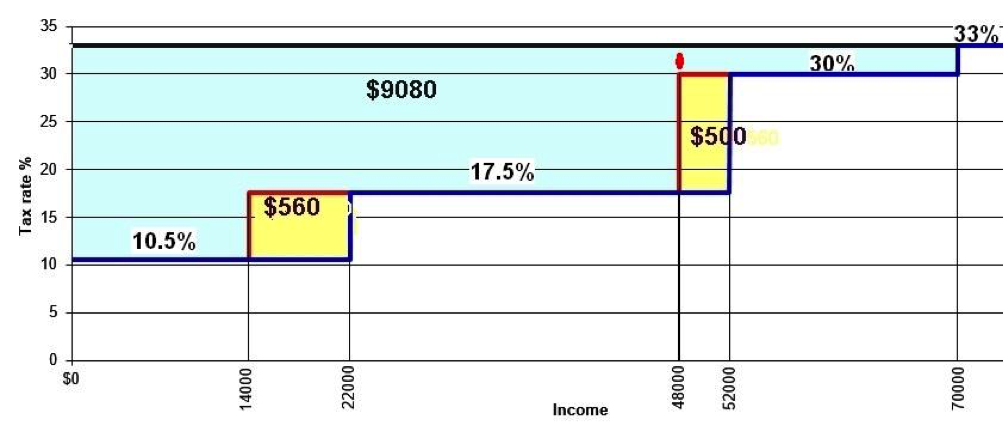

Figure 2. Removing the

“Bracket Creep”

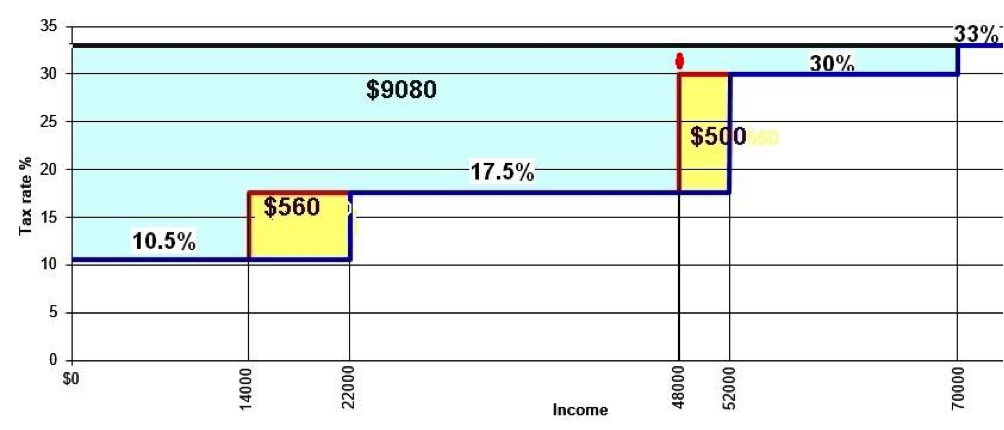

Figure 3. Making

the Income Tax rate the same for everyone, or nearly

everyone.

The Choice of Tax

The Net Effect on people

Table 1. The Net Effect for different

people

Conclusion

of the Adult Basic Income section

Superannuation as a Basic Income

Principles for Basic

Incomes

Philosophy

Table 2. Actual

Income & Tax 2015/16

Some

Implications from Table 2:

Table 3.

April 2015 Superannuation

Rates

Measuring Government

Performance

Some Political

Implications

Note that this paper is available at https://perce.harpham.nz

Simplifying our Tax & Benefit Systems

Summary and Conclusions

Because of the interlinked nature of our benefit and taxation systems I will start this article with conclusions in the hope that discussion of the reasons for these conclusions will then be easier to understand. I also hope that this work can be taken as a starting point for decisions about the entire benefit and taxation systems. They impact one another as well as health, economy and much else. But the current Government reviews follow the traditional “silo” pattern of Government departments. The ideas laid out here will have to be refined, updated and to have careful transition arrangements plans made.

An overriding objective is to reduce poverty as well as the inequality of income and wealth. This overall objective leads naturally to the idea of Basic Incomes simplifying both the Personal Income Tax and Benefit systems.

Our Superannuation system has essentially removed poverty from the elderly for nearly 80 years. Superannuation, along with other parts of the Social Security Act (1938) was funded at the time by a new tax of one shilling in the pound”. That was 5% of ALL income. The Superannuation “trial” is taken as a model for a new system. The only requirement to get this payment is that one must be 65 years old or older. Bureaucracy, surveillance, stand -down periods, poverty traps, requirements to seek work or do anything specified are almost non-existent. So too is stigma for the recipients.

There is one aspect of Superannuation which needs to be modernised to comply with Basic Income concepts. This is the difference in payments for different living arrangements. It is proposed that all superannuitants receive the same tax-free payments and that this be set at the after-tax level currently applying to those who are single and living alone.

The superannuation model could be extended to all ages. A Basic Income to replace Working For Families is not explored here because what is needed for children and teen-agers will partly depend on the size of the payments decided for 18 to 64 year-old adults.

All citizens and permanent residents could have payments depending solely on their age. There could be different payments which I will refer to as Child, Adult and Elderly Basic Incomes. The term “Universal Basic Income” is commonly used for these payments but “Universal” implies that everyone gets the same payment. This wrongly conveys the idea that Superannuation payments will be reduced.

Basic Incomes, including those for the elderly, would be tax free. All other income could be taxed at the same uniform rate for income up to, maybe, $150,000/yr. Then the rate could be lifted 1%. With another 1% each $50,000 thereafter up to some limit. With the new rate applied to ALL the income of those affected. This and other ways of taxing high incomes are not explored here.

The current highest level tax rate of 33% is used an example of the uniform tax rate. More tax is needed than this example will provide. There are many new and existing taxes which could be used to complete the financing of Basic Incomes. An Asset Tax levied as a percentage on the improved value of ALL property and collected with the rates is suggested as an example. It is important that there be no exemptions. Exemptions for Family Homes are unfair because of the range of the value of homes and those who do not own a home would face increased rents since the landlords would have to pay the tax,

With an Elderly Basic Income as above and an Adult Basic Income of $11,000/yr the necessary Asset Tax would be about 0.5%. If the Adult Basic Income was raised to $13,000 the Asset Tax needed would be about 1%. In both cases with the Income Tax rate at 33%. Both tax and benefit systems would be enormously simplified.

The effect of the combination of tax with Basic Income for individuals with different properties and different incomes is illustrated and discussed. Read on to see how these conclusions have been arrived at. And see some political comments at the end - such as the importance of reporting separately the proportion of GDP which is redistribution rather than the cost of Government services.

Some History

In the early nineteen eighties the whole of the Western world was swept by the neoliberal slogans - user pays, market forces, less government, and trickle down.

“User Pays” has led to increasing inequality. Pope Francis has called inequality one of the greatest threats to our civilization. The OECD has declared inequality to be a threat to economic growth. So both those who worship God and those who worship money want to see a greater distribution of wealth.This objective is given further impetus by other studies which report that policies which put spending power into the hands of those with the least spending power increase GDP the most. So it may well be the case that by increasing equality the increased demand makes everyone better off financially and/or socially.

“Market forces” have clearly become damaging to the environment and to working populations in some countries. A lot of work has been moved to countries where Corporations can harness cheaper labour, avoid regulation, use local resources and externalise their costs by discharging waste into rivers and the atmosphere.

“Less Government” has often meant that services provided to the whole population have been cut, allowed to decay, performed by consultants or subcontracted locally or overseas.

“Trickle down” has simply not worked. With a few exceptions those who have the money have used the power it has given them to maximize their own benefit. The result would be more correctly called “pump up”. Even the “middle class” have become increasingly precarious.

Many of the undesirable consequences of the neo-liberal doctrine would have been avoided if there had been adequate “trickle down”. And this will be essential as the technological and climate change revolutions gather pace. Otherwise, as in the industrial revolution, those who own the new technology/robots will reap the rewards and those who do not will be bereft.

The Labour Party's Commission on the Future of Work reported in early 2016 after two years of intensive consideration of the consequences of advancing of technology and corporatization. They said ( page 38) " In a world where people are more likely to move in and out of work more often and there may be a shortage of full time jobs, we need to reassess the interface between working and welfare".

Variations of these problems are now very visible with "Internships" where (as in Captain Cook's day) people work for long periods without pay in the hope of then having paid work. More and more frequently people have to be on standby - unpaid – in the hope of short periods of paid work. Current examples are zero hour contracts and the plight of some contracted courier drivers. Those affected ( the "precariat") range from the unskilled to the most highly skilled. Consider the hundreds of people displaced by the IRD's new computer system.

The Commission heard from Robert Reich (US Minister of Labour from 1993 to 1997) and others about Universal Basic Income. The Commission then recommended ( see page 37 of the report) that "…the Government continue to investigate alternative income-support models …"

Winston Peters has said "Capitalism must get a heart".

In other words we need to think about making something like "trickle down" work.

The Case for Enforcing a “trickle down”.

The idea that there are “deserving poor” who should be given benefit payments was a development of the first industrial revolution. This idea has persisted but means that bureaucracy is needed to decide whether a person meets the defined target requirements. These have become increasingly complex. The corollary is that there are “undeserving poor”. And today we also have “the working poor”

See the film “I, Daniel Blake” to understand the difficulties with targeting which can drive people and those trying to get help for them to despair. Target requirements become stricter and more onerous as Governments strive to achieve chosen economic indicators rather than to improve wellbeing. And surveillance, sometimes becoming harassment, is needed to ensure that beneficiaries continue to meet the target for being a beneficiary.

There is a huge literature, dating back centuries, suggesting that targets should be abandoned. A recurring idea is that payments could be made to everyone regardless of income or accumulated wealth. Unfortunately, few authors deal in any detail with the problems of how to finance these payments. Let alone the problems of transition. I will not here review the literature or give many references but would be glad to provide particular supporting references if requested.

Keith Rankine argues forcefully that such payments are a human right. ( see http://briefingpapers.co.nz/from-universal-basic-income-to-public-equity-dividends/)

Guy Standing has put this case succintly :

“First, a BI is a matter of social

justice. The wealth and income of all of us has far more to

do with the efforts and achievements of our collective

forebears than with anything we do for ourselves. If we

accept private inheritance, we should accept social

inheritance, regarding a BI as a “social dividend” on

our collective wealth. In an era of rentier capitalism, in

which more and more income is being channelled to the owners

of assets—physical, financial and intellectual—and in

which wages will continue to stagnate, a BI would provide an

anchor for a fairer income-distribution system. And it would

compensate the growing “precariat”, hit by labour

flexibility, technological disruption and economic

uncertainty.

In an era of rentier capitalism… [a basic income] would provide an anchor for a fairer income-distribution system

Second, a BI would enhance freedom. The political right preaches freedom but fails to recognise that financial insecurity constrains the ability to make rational choices. People must be able to say “no” to oppressive or exploitative relationships, as women know only too well. Some on the right understand that and support a BI. Meanwhile, the left has ignored freedom in its paternalistic social policies. Welfare recipients are treated as subjects of charity or pity, subject to arbitrary and intrusive controls to prove themselves “deserving”.

BI would enhance “republican freedom” from potential as well as actual domination by figures of unaccountable power. As argued elsewhere, a BI is the only welfare policy for which the “emancipatory value” is greater than the monetary value.

Third, a BI would give people basic (not total) security in an era of chronic economic insecurity. Basic security is a natural public good. Your having it does not deprive me from having it; indeed we gain from others having basic security. Psychologists have shown that insecurity lowers IQ and “mental bandwidth”, diminishing the ability to make rational decisions, causing stress and mental illness. Moreover, people with basic security tend to be more altruistic and empathetic, solidaristic and engaged in the community.

People with basic security tend to be more altruistic and empathetic, solidaristic and engaged in the community.”

An enforced “trickle down” may be essential if we are to preserve capitalism in democracies as we know them. There is increasing concern at the agglomeration of companies and their increasing power. A book has just been published entitled “Can Democracy survive Increasing Globalisation?”. A large corporation can already have financial, political and, if we are not careful, the legal power to successfully threaten countries into changing their laws. We have already seen examples of this.

The New Zealand

Scene

We are fortunate that our Social Security system dates back to 1938 and our “trial” of Superannuation has largely solved the problem of poverty amongst our elderly. It is an excellent model being almost entirely dependent only on age. From 65 onwards it is paid automatically without regard for wealth or other income. It has one blemish in that the amount paid depends on the marital or living arrangements of the recipient. At the end of this paper I will suggest how that could be remedied.

We used to have a Universal Child Allowance paid to the Carer until the 1990s. It has been replaced by the heavily targeted Working For Families. Instead there could be a Basic Income for “Children and Teen-agers” aged 0 to 18 paid to the Carer. This will depend in part on the levels chosen for Adults and I will not deal with it here.

Ideally Tax and Welfare should be considered together as they are inexorably intertwined as will become apparent as I now develop an approach to providing a viable Basic Income for Adults.

Benefits to be expected from an Adult

Basic Income.

There are many potential benefits which, if the Basic Income is set at the right levels, could include:

A stop to “beneficiary bashing” and official intrusion into people’s lives·

Easy collection of fines and child maintenance

Reduction of child poverty

The empowerment of women and recognition of mothers and carers

Possible repopulation of rural centres with retired and seasonal workers.

A large saving in the administration costs of benefits

A reduction in problems associated with ACC.

A reduction in student “Living Allowance” problems.

Easier rehabilitation of prisoners

Improved feelings of security and reduced stress for many

An improved worker/employer power balance

Improved social cohesion and a more resilient economy

An improvement in health and school attendance

If the Adult Basic Income is set at a level that allows most existing benefits to be abandoned then the accompanying bureaucracy can be shrunk to dealing with hardship only. And if Income Tax is set at a level or levels which are felt to be really equitable then there would be no need for all the things which depend on the income earned. For example student living allowances are not granted if the parents have incomes at a given level and benefits are “clawed back” or stopped at different levels of income giving rise to “poverty traps”. There can be great simplification if the income tax rates are appropriate. Other grants etc need not then be income dependent. It is particularly important that income is properly taxed rather than setting targets trying to vary the Basic Income or anything else with Income. There could be one Basic Income level of payment for all in a particular age group.

With the certainty that the Basic Income will continue regardless of whether one has a job or not there will be no disincentive for getting a job with all the costs of travel and clothing etc which that brings with it. Stand down provisions also disappear. There is a reasonable expectation that innovation and small start-up enterprises will be promoted as they can then survive with little income from the enterprise.

The 2010 Penguin book by Wilkinson & Pickett (The Spirit Level - Why More Equal Societies Almost Always Do Better) bears testimony to these expectations, some of which have the result of trials to support them.

In terms of Health & Welfare there is evidence that a Basic Income approach can be expected to be a great improvement over our present stressful targeted system. And Basic Incomes may well be good for the economy when measured in purely financial terms. The factors chosen for these measures should be considered - both wealth and income have to be taken into account.

Equality is, of course, a matter of more than money. Other non-monetary factors (such as gender, ethnic identity, disability and so on) can lead to very significant inequalities. Also, if the same facilities and services were provided free of charge to everyone (using public funding) then there would be equality with respect to such offerings. I think of the availability of free swimming pools, healthcare, education, transport, school meals, parks, childcare and so on. There are many such things which are not currently fully publicly funded. Thus income and personal wealth play a very significant role in people's ability to lead the lives that they could live, and in the shaping of society as a whole.

To reduce inequality there will have to be redistribution of both wealth and income. Clearly great care is needed to decide on how great this distribution should be and how we could change to a new paradigm.

There is a huge amount of work needed to get up to date and accurate data as well as to make all the detailed decisions required. But enough is available to determine that such a system of Basic Incomes for different age groups is practical. First let us do a little analysis.

Why are the Poor poor?

There are many reasons. Physical and mental sickness or disability aside there are strong inter-generational effects and, basically, the Poor are poor because they have no money and no assets. The world is then biased against them and their children. It is a vicious circle. It becomes impossible to borrow money, or only at penal rates of interest. When they are unable to meet their obligations they have their belongings repossessed and all credit denied to them. The better off may well have huge debts and be bankrupted but can be left with viable living arrangements and can start again. Or they may be sheltered by the use of trusts or company structures so that they go unscathed by leaving their debts behind. And they will probably know how to benefit from tax advantages enjoyed by companies and others.

Many of the poor are dependent on having jobs with wages. The lower their skill level the fewer choices they have and the more likely that they will only be able to get part-time jobs with significant unemploymnet.There are increasing prospects of their skills becoming redundant and they may not be able to afford to retrain or have the pre-reqisites for training.. Their Unemployment (now “Job Seeker”) Benefit requires them to seek work - this can be an expensive process. And so on.

The present taxation system exacerbates this. Companies pay 28% tax on profits. People pay up to 33% tax on income. The maintenance cost of a machine to replace a worker is tax deductible. The cost for a worker to stay alive is not deductible for their Income Tax purposes. It is tempting to think that the Living Wage should be made tax-free but this would require an enormous increase in other taxes and would not assist those with no income. And, again, with higher incomes one would get all the advantages intended to help those lower down while those with no income would get nothing.

If you are homeless you have great difficulty in registering for most things – benefits, bank accounts, credit cards and much else.

There are many ways in which those who are better off are advantaged by our current tax systems. GST at 15% hurts those who have to spend all their income on living much more than those who have disposable income and can afford to save. A recent example of built in bias to the better off is the choice of a levy on petrol instead of on rates. This is particularly unfair because in many cases new roads improve property values.

Huge complexities have been introduced over the decades to partially compensate for such issues. A well established axiom in developing computer systems is KISS - Keep It Simple Stupid. Our current tax and benefit systems are undeniably complex rather than simple.

As an example of this complexity and its undesirable side effects let us now consider our system for Personal Income Tax.

Personal Income Tax

Some graphs may help to understand what is a fairly complicated situation.

Figure 1.Tax Rate versus

Income

On the left of the graph we have the percentage tax rate which applies for incomes as shown at the bottom. Thus one can see that below 14,000 per year of income the tax rate is 10.5%. Between 14,000 and 48,000 it is 17.5 %. Then another bracket with a rate of 30% and finally 33% applies regardless of how high the income may be.

At first sight it is good to have lower rates for lower incomes. They are effectively discounts from the top rate of 33%. But to get all the discounts available one has to have an income of $70,000/yr or above. The more income you have the more discounts you get. Up to $14,000/yr it is 22.5% (33%-10.5%) so on the full $14,000 this is 14000x22.5/100 = $3150/yr. In the next bracket it is 15.5% (33-17.5)%. On a full $48,000/yr this is(48000-14,000)x15.5/100 = $5,270/yr. But someone on 48,000/yr also gets the discount of $3150/yr on the first 14,000 of their earnings – a total of $8420. And someone on $70,000/yr or above scores a total discount of $9080/yr.

What is demonstrated here is that with this sort of structure the more you have the more you get. The Poor get relatively poorer. All the low tax benefits that are given to the less well off accrue to the better off also.

Nonetheless when people moved up the income scale they complained for years about “bracket creep”. For example if they moved from 48,000 to 49,000 instead of rejoicing that they had more money they would complain that on the 12.5% higher tax rate they were paying $125 more tax than if they stayed on the on the old rate.

Figure 2. Removing the “Bracket Creep”

Here we can see, in the block labelled $560, that the National Government moved the line for application of the 10.5% rate from 14,000 to 22,000. So in this $8000 range the rate decreased from 17.5% to 10.5%. A 7% discount. So those earning more than $22,000 would pay $560 less per year. Between !4,000 and 22,000 they would save a proportion of this.

Similarly the move from 48,000 to 52,000 shown in the block labelled $500 meant that those over 52,000 would save another 12.5% on $4,000.That is $500 per year added to the $560. And all those over $52,000 would get $1060 per year of tax cuts. But those with no income or below 14,000 per year would get none. Yet if the National Government had chosen to distribute about the same amount of money by making the first $5,000 of income tax free then everyone earning above $5,000/yr would have saved 10.5% of it - $525 per year. Or, possibly even better, reducing GST would have been of more benefit to those at the bottom.

Not surprisingly, the new Government moved the brackets back to where they had been and used the money to help with urgent problems.

Here we have another example of the general problem causing the Poor to be poor! Tax cuts do not benefit those with little or no income. The same is true for tax exemptions.

An example of the tax exemption effect is the exemption of “family homes” from the “bright line test”. This is of no benefit if you do not have a family home. And, worse, if the owner does not expect to meet the conditions for exemption the rent will no doubt increase as a result. And/or the availability of properties for rent may diminish.

Tax exemptions increase inequality!

Let us now speculate on what can be achieved by carrying the current Governments reversal of the tax cuts to a logical extreme.

Figure 3. Making the Income Tax rate the same for everyone, or nearly everyone.

We have seen that the new Government moved the barriers back to their original positions so that those who earned more than $52,000 per year would not have a tax cut of $1060 per year and Government could fund other needs.

There is a need for Government to further increase its revenue. One possibility is to raise the top rate for incomes above, say, $150,000 in 1% increments every $50,000. It is now just 33% regardless of whether that income is in the multi millions or not. To avoid creating another “bracket” problem each increase should be levied on the WHOLE income so that those on higher rates do not get any advantage from lower rates on lower parts of the income. The highest tax rate might be capped at, say, 60%.

Whether the top rate is regarded as immutable or not then keeping the 33% rate above 70,000 but charging 33% from 48,000 instead of just 30% (see the short line extending the 48,000 line upwards) would collect $660 (3% on $22,000) from each taxpayer on 52,000 and above. Other similar moves are possible but let us think about the whole of the area above the current rate lines and make 33% the rate for all incomes. That would really deal with the bracket creep problem because there would be no brackets! All those on $70,000 upwards would then be paying an additional $9080 per year. And those below would also be paying more than at present. Horrors!

But we could pay all Adults $9080 per year and charge 33% on every dollar earned. Then those above 70,000 would be in exactly the same position as at present and those below would be better off . In fact those with no income would be $9080 per year better off. AHA! Those over 65 already have Superannuation and those below 18 have Working for Families. These are already in use and are currently funded. So, for the moment, we will only consider paying the $9080 as an Adult Basic Income to ages 18 to 64.

At $9080/yr this Basic Income would have some of the benefits noted above. But how would the country pay for those who are below the $70,000 limit and are better off with any such payment? The question looms even larger if we wish to replace all the bureaucracy and surveillance, leaving just that necessary to continue to provide hardship allowances. This replacement is needed if we are to become almost entirely free of stand-down periods, targeting, surveillance and poverty traps. The tax-free Basic Income would then simply depend on age. For this replacement we need to move the Adult Basic Income payment to a minimum of something like $11,000 per year. Then, using 2015/16 figures to get consistency across various data sets, we will need some 31 billion dollars. OUCH!

And while about $11,000/yr will let us remove most benefits without making the recipients worse off it will not improve things for them. The cost of hardship allowances could remain at about the current level unless it is decided to make them more generous Nonetheless let us work through the idea of having an Adult Basic Income of $11,000 per year and a 33% tax rate. The same process can then be followed to find the consequences of choosing some other figure.

Those above $70,000 per year on a tax rate of 33% levied on all of their income will then be paying an extra $9080/yr each while those below $70,000/yr will be paying proportionately less. But all this payment of the increased rate for those below $70,000/yr adds up to about $18bn. We might also save about 6bn from removing existing benefits and bureaucracy. (This needs careful detailed consideration with decisions to be made benefit by benefit).However we will need about 7bn more in tax if we have a tax-free Adult Basic Income of $11,000/yr and a universal tax rate of 33%.

The Choice of Tax.

Increasing the uniform Income Tax rate from 33% for all income to 38% would provide the necessary 7bn. But everyone earning more than $50,250/yr would then be worse off than when they were paying the current taxes. Their $11,000 would have been eaten up at the increased tax rate. ( They currently pay $7420 on 48000/yr and 30% thereafter up to $70,000/yr. At 38% on all their income they will pay $18,240/yr on 48,000 and 38% thereafter.)

The size of the Adult Basic Income and the Uniform Tax rate chosen determine how much extra tax is needed. This and the tax chosen will determine who are the winners and who are the losers with a new system. The necessary choice for political acceptance may be to have at least 70% of the population as winners.

There are many possibilities to consider such as financial transaction tax, stamp duty, putting company and personal taxes at the same level, higher taxes on higher incomes, capital gains tax, modern monetary theory etc etc. I will here make only a few comments.

At this time there is a Tax Working Group considering the structure and make up of our taxation system. It is to be hoped that they will consider what tax(es) could fund Basic Incomes.

The increase in inequality creating social disturbance, a concentration of wealth and power in fewer hands, and depression of economic growth have become a major concern around the world. One of the objectives of any method of financing Basic Incomes should be the redistribution of wealth, not just the redistribution of income.

Local Bodies and Regional Councils have always been funded from taxes on properties with Governments fixated on income.

An Asset Tax is worth serious consideration. Property is a good proxy for total wealth and it is hard to hide. An Asset Tax might ultimately include the value of motor-homes, helicopters, cars, boats and such like but starting with real estate would make use of the existing valuation and rating base which we have in place. The Improved Value tax base was some 1,330 billion in March 2017. 1% is 13.3 billion. Whoever pays the rates pays the levy. And it can start to reduce inequality as those who have more assets pay more.

There should be no family home exemptions for either an asset tax or a capital gains tax. These exemptions are grossly unfair. A 0.5 % levy on a “family home” of $20,000,000 is $100,000. On a $1m home it is $5,000. Again those with more wealth get more benefit from the exemption . If your family home is an old car the exemption is not worth much. And renters dont get the exemption benefit.

So the Adult Basic Income could be funded with an Asset Tax of about 0.5% on ALL properties. One might add a Stamp Duty on house sales to cover contingencies.

The net effect on people

Note that we are here considering Adults and the Adult Basic Income. Superannuitants are discussed below

With an $11,000/yr tax free Basic Income, a 33% tax on all their other income and a 0.5% Asset Tax on the Improved Value of their property we can easily tabulate roughly what the net effect will be for different people. Some might have a current benefit which would be removed and replaced by the Basic Income. The net effect on their income would be zero but they would be no worse off with the new system.

Table 1. The Net Effect for Different People

-5,000

=-$3080Income/yr Property

Value Current Benefit Net

Result/yr None None None $11,000 None None Yes Little

change None $1,000,000 None +$6000 None $1,000,000 Yes-

approx. 11000 -$5000 $70,000 (pays

$9080 more income

tax) $1,000,000 None 11,000-9080-5,000

=

-$3080 $70,000 $386,000 None Little

change Two

@$70,000 $772,000 None Little

Change $200,000 $1,000,000 None 11,000-9080

With the level of Basic Income I have suggested those who have no income and no home would each be better off by the tax-free $11,000 per year. If this figure is properly chosen then those on a benefit with no home would be no worse off than at present. The Basic Income would replace their benefit.

The worst case scenario could be someone who lost their benefit but had a $1,000,000 house. At 0.5% Asset Tax they would be $5,000/yr worse off. At least they would not be paying rent and if they shared the house with a similar beneficiary would be much better off than most of those renting. Alternatively they could down-size and hopefully ease the housing problem for a family. Or take a reverse mortgage (these should be available from a Government organisation - as of right for this purpose). Even if their equity was only $200,000 in the $1,000,000 property it would take many years to extinguish their equity.

With the $11,000 per year I have chosen then those on an income of $70,000per year and no property would be better off if they had a home worth less then $386,000 otherwise they would be worse off. Of course if there were two occupants each on $70,000 they would not be worse off until they had a property worth more than$772,000.

The ones who would start to lose would be those with higher incomes AND higher value homes. The last example in the table highlights the need to raise the income tax for those on higher salaries.

There are currently various vexatious penalties depending on incomes - such as depriving children of student loans if their parents earn too much and reducing Working for Families benefits. If incomes are properly taxed then these various penalties can be dispensed with.

Conclusion of the Adult Basic Income section

The time for having an Adult Basic Income for everybody depending only on their age has arrived.

A great deal of thought, effort and public discussion is needed. Each decision is likely to impact on other decisions and the side effects need to be thought through. The transition to establish working systems for collection and payment needs care.

There are many knotty questions to be decided. For example when the new payments are being made to everybody should tax exemptions for various groups be abolished - maraes, church property, various NGOs. An exemption for one group requires more tax to be collected from another.

Choosing the level of the Basic Incomes and therefore the accompanying tax and tax rates is yet another matter. For example at $13,000/year the Asset Tax needed is about 1%.

Some people have assumed that there will be one level of Basic Income for all adults regardless of age and that either it will be comparable to Superannuation or that Superannuation will be diminished. Both of these thoughts are untenable. There are roughly four times as many in the 18 to 65 age group as those 65 and over. The tax to pay the Adults at the same rate as superannuitants is untenable. And the lowest level of Superannuation is already too low.

Let us now consider bringing Superannuation into the same Basic Income framework as has been developed above.

Superannuation as a Basic

Income

Principles for Basic Incomes:

• KISS - Keep It Simple Stupid

• Basic Incomes are tax-free

• Income Tax is a constant rate for all other incomes up to a higher level than, maybe, $150,000 per year

• Same payment to everyone dependent solely on age..

• Hardship allowances are available but strictly targeted and monitored.

• Most other benefits and restrictions are abandoned.

• No restrictions or “claw back”on earning other income.

Philosophy:

Other benefits have been endlessly “tweaked” and complicated by increased targeting which makes those administering the system sometimes appear heartless and unresponsive while many of the “clients” do not understand the process. I have already shown how to apply the principles above to deliver a Basic Income for all Adults aged 18 to 65 and to paying for it with a 33% rate of tax on all income plus either an increase in this rate or some other tax .

The present superannuation system is a wonderful example of a Basic Income which for nearly 80 years has largely solved the poverty problems of the elderly. It needs some changes to remove the distinctions between different marital and other states which are no longer easily defined and to have superannuation comply with the principles above.

It is common for people to become weaker, slower, forgetful and less adaptable as they age. Their earning capacity diminishes. Their health and energy decline. Associated costs rise. It is appropriate at some age for them to be rewarded in return for their years of contributing to the community. The pressure on them to “perform” is then reduced and they can work shorter hours or contribute their wisdom and experience to children, grandchildren, NGOs and others to the extent that they are able.

Further, one of the major objectives of any change has to be to ensure that the less well off are not more disadvantaged. Thus Superannuitants need to continue to have a different and higher rate than the Adult Basic Income.

Also it is probably inevitable that whatever tax is chosen will impact on Superannuitants, just as on Adults. Thus an Asset Tax, for example, will affect Superannuitants.

This, in part, is the justification for ceasing to charge Income Tax on the Superannuation payment and for increasing it somewhat.

Table 2. Actual Income & Tax

2015/16 Information derived from IRD and SWD figures - ( MILLIONS).

| Declared Income | Tax Take on Present Income | Income Tax at 33% | Extra Tax Take | |

| Whole Population | $149,692 | $29,246 | $49,438 | $20,192 |

| Superannuitants Super only | $12,581 | $1,888 | N.A. See below | - $1,888 See below |

| Superannuitants Other Income | $11,236 | $2,244* | $3,708 | $1,464** |

| Net extra tax. See below. | $18,304 |

*This is a derived figure {11,236/(149,692 - 12,581)} x 29,246 = 2,244

**This is included in the 20,192

Some Implications from Table 2.

1. Continuing the current custom of taxing superannuation as if it was earned income and increase the tax on it to 33% on every dollar would be disastrous for many.

2. Superannuitants income other than the Super will return some $1,464m more if it is all charged at 33%. This will increase if the rates are increased on higher incomes.

3. Superannuation had $1,888m subtracted from it as tax in 2015/16.

I have assumed in calculating the Adult Basic Income that Elderly Basic Incomes will be made tax free - hence the deduction in the right hand column above.

Table 3. April 2015 Superannuation Rates per person taken as applying for the year.

| Classification | Tax free payment per year | Number of people |

| Single living alone | $18,495 | 162,000 |

| Single, sharing accommodation | $16,997 | 74,000 |

| Married couple. Both qualify. | $14,981 | 343,000 |

| Married couple. One qualifies. | $14,249 | 27,000 |

| Other | $8,862* | 87,000 |

| Total | N. A. | 693,000 |

*This is derived by taking the total payment to “others” and dividing by the number of them. It is probably irrelevant for present purposes.

We should provide the same framework as other Basic Incomes - dependent only on age, everyone in the age group getting the same payment. Everybody, regardless of age, paying the same rates of income tax on income other than their Basic Income and being free from bureaucratic processes and surveillance unless they need a hardship allowance.

In 2015/16 $12,581million was the total payment (including tax) to 693,000 superannuitants giving an average of $18,154 each. If this was made tax free and paid to all superannuitants the table above shows that only those who were living alone would be worse off. They are about 15% of the total number of Superannuitants.

The hardship framework will have to be adjusted in any case and could well cover the $341 difference for some single persons living alone. But if the chosen tax was an Asset Tax as described for the Adult Basic Income then an additional 0.018% on the Asset Tax would allow Superannuation to be $18,495 for all. Then none of the Superannuitants would be worse off and many would be substantially better off if they did not own or rent a home which would attract substantial Asset Tax.

More data and study is required but Table 3 shows that the increases proposed mean that singles sharing will be some $3,000/yr better off between them. This increase will serve a 0.5% Asset Tax on a $600,000 home without making them worse off. Married couples would be some $7000/yr better off between them and could well pay the asset Tax on a substantial home and still be better off than at present. Earlier remarks about reverse mortgages etc are possibly even more relevant for Superannuitants. As with " living alone" Adults on their Basic Income the single-sharing and the single superannuitants may need assistance either to make other arrangements or to have hardship allowances.

One of the "benefits" of this difficulty could be that the financial incentive to live alone - or claim to be living alone - which is embodied in the present structure would disappear. People may need help to make the effort to share with others but it is especially important as people age for them to share premises with others. They then may be able to share tasks, to reduce loneliness and depression and to support one another for a long time instead of needing to have external official ( and costly) assistance from the District Health Boards in order to survive in their existing premises.

Basic Incomes are eminently feasible both for Adults, Superannuitants and Children.

Note that various data required for accurate calculation are not concurrent and/or not available. All of the figures that I have used need to be updated and developed in detail but I believe that it should be clear that Basic Incomes offer huge benefits including security for the future of our people and democracy.

Measuring Government Performance.

There is a move now being made to get better measures of Government Performance. These should help Governments to do what is required for the welfare of the country rather than continue being bound by the neo-liberal concept of achieving “less Government” as measured by GDP with all its failings. In this respect Government does not “spend” all the tax it gathers on providing its services. Some is simply redistributed as benefits and spent by the recipients. There is a fundamental difference. By including benefit money in the GDP cap adopted with the Budget Responsibility Rules then, as has happened, the temptation is to cut benefits in order to achieve surpluses while staying within the cap.

The amount of the benefits or other redistributions should be reported as a separate GDP amount. Then we would be able to judge the level of “trickle down” being enforced.

Some Political Implications.

Not only is the need for Basic Incomes great but so is development of the public awareness of the benefits that they will bring. A huge amount of detailed work is required before any supportable alternatives can sensibly be put to the test of the ballot box. The choices of the levels of Basic Incomes, the tax or taxes to pay for them, the transition processes and the timing of them need to be well thought through.

It is my hope that the Welfare Expert Advisory Group will not only carry through development of the sort of ideas that I have outlined here but will bring Basic Incomes before the public at an early stage so as to facilitate discussion and allow different Parties to adopt informed positions - probably with different tax choices etc but nonetheless achieving a great simplification of our systems as well as a reduction of inequality and poverty.

I note that the Labour Party’s Commission on the Future of Work recommended continuing to investigate Universal Basic Incomes. The Green Party’s Income Support Policy specifically aims at developing a UBI proposal. And Winston Peters has said that

“ Capitalism must get a heart!”

Let’s do this.

About the author

Perce Harpham B.E., M.Sc.,FIITP, Dip Bus Stud. Is best known for establishing the first computer software company in New Zealand. Progeni built most of the software for the Wanganui Computer Centre, largely developed the NZ Poly computer system, worked with Boeing on the software for the RNZAF Orion aircraft and much else. In 21 years it grew to have branches throughout NZ and Australia as well as in Chicago, Los Angeles and Beijing. In 1989 Progeni was "collateral damage" in the failure of the Bank of New Zealand.

Eugene Doyle: Quiet Mutiny - The U.S. Army Falls Apart

Eugene Doyle: Quiet Mutiny - The U.S. Army Falls Apart Gordon Campbell: Papal Picks, And India As A Defence Ally

Gordon Campbell: Papal Picks, And India As A Defence Ally Binoy Kampmark: The Selling Of America - Ending The US Dollar’s Exorbitant Privilege

Binoy Kampmark: The Selling Of America - Ending The US Dollar’s Exorbitant Privilege Frances Palmer: Remembering Vietnam And Cambodia 50 Years On During ANZAC Week

Frances Palmer: Remembering Vietnam And Cambodia 50 Years On During ANZAC Week Binoy Kampmark: Euphemistic Practices - The IDF, Killing Aid Workers And Self-Investigation

Binoy Kampmark: Euphemistic Practices - The IDF, Killing Aid Workers And Self-Investigation Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia

Gordon Campbell: On The Left’s Electability Crisis, And The Abundance Ecotopia