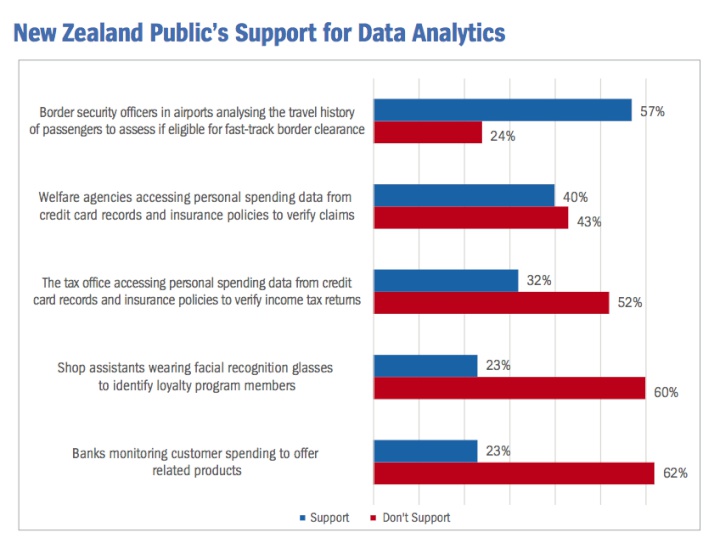

New Zealanders don't like welfare agencies using personal spending data from credit card or insurance to verify benefit claims.

The 2017 Unisys New Zealand Security Index found only 42 percent agree with welfare agencies accessing this kind of information.

It's not just welfare. Even fewer New Zealanders support the tax office collecting similar data to verify income tax returns. Just 21 percent think this is OK.

Researchers found the most positive government use of

analytics is with border security. Allowing border security

officers to analyse the travel history of passengers and

their fellow travellers to decide if they are eligible for

fast-track border clearance gets a tick from 57 percent of

New Zealanders.

Sharp insights or nosy parkers?

Business use modern analytics and big data. They see it as a way to pluck customer insights from masses of messy-looking scraps of information. It gives them a short cut to the consumers most likely to buy their products.

Governments use big data and analytics for social policy and security reasons. Marketers also love the technologies. Used well they can boost sales and reduce marketing waste.

It turns out New Zealand consumers are, at best, luke-warm, about that idea. We don't like marketing department computers sifting out personal data. Most of the time we are not at all happy with sharing information.

Unisys found a majority, almost two-thirds,

of New Zealanders do not like data analytics being used to

sell goods and services to them.

Lack of trust with banks

Researchers found 64 percent don't want their bank to monitor their spending habits to offer related products such as insurance for items they have purchased.Shop workers using face recognition glasses to identify loyalty programme members gets a thumbs down from 62 percent of New Zealanders.

Richard Parker, Unisys Asia-Pacific vice president financial services says: "While they may be trying to improve the customer experience, if businesses cross the line and appear to invade customers’ privacy by revealing that they know more about them than what the customer has knowingly shared, it just turns the customer off.

"Technology alone is not enough. It must be used in the context of understanding human nature and cultural norms.”

This is part of a series of sponsored posts about the 2017 Unisys Security Index New Zealand.

New Zealanders cool on data analytics catching benefit fraud first posted at billbennett.co.nz.

Binoy Kampmark: Fallibility, Dirty Wars And Pope Francis I

Binoy Kampmark: Fallibility, Dirty Wars And Pope Francis I Peter Dunne: Dunne's Weekly - An Issue No-one Can Afford To Lose

Peter Dunne: Dunne's Weekly - An Issue No-one Can Afford To Lose Martin LeFevre - Meditations: Choosing Mass Murder?

Martin LeFevre - Meditations: Choosing Mass Murder? Eugene Doyle: Quiet Mutiny - The U.S. Army Falls Apart

Eugene Doyle: Quiet Mutiny - The U.S. Army Falls Apart Gordon Campbell: Papal Picks, And India As A Defence Ally

Gordon Campbell: Papal Picks, And India As A Defence Ally Binoy Kampmark: The Selling Of America - Ending The US Dollar’s Exorbitant Privilege

Binoy Kampmark: The Selling Of America - Ending The US Dollar’s Exorbitant Privilege