The Digital Universe – Media Briefing Notes

Digital Touchpoints affecting The Connected Consumer

thedigitaluniverse.com.au/

Auckland, 18 October

2012

This paper provides a

360 degree glimpse of the new Digital Universe and how the

exponentially expanding range of touchpoints is affecting

New Zealanders' daily lives – their media consumption,

shopping habits, socialisation and expectations.

With the convergence of social networking, Smartphones, blistering Internet speeds, unlimited download bundles and new payment mechanisms, the Digital Revolution is one of the most impactful phenomena of our lifetimes.

With 84% of New Zealanders now using the Internet1 and consumers connecting with new and emerging technology with ever-increasing rapidity, marketers are realising that delivering a compelling, targeted message is no longer enough – you need to deliver your messages where and when your customers and prospects choose – and where and when they are most receptive.

To set the scene, I’d like to start by sharing 9 key trends:

1) Smartphone penetration and Mobile Internet - is growing rapidly.

Click for big version.

Today, 68% of Smartphone owners use their mobile phone to access the Internet and Internet access via mobile phone has increased by 99% in the last 12 months2.

2) Social media is

used by the majority of New Zealanders –.

Click for big version.

We have been monitoring Facebook for over five years. Now, over half (56%) of New Zealanders use Facebook in an average four week period1. This equates to approximately 2 million New Zealanders aged 14+. Even more people use social media, if you include other growing platforms such as Google+, LinkedIn and Twitter.

Twitter (which allows anyone to be a publisher and build an audience) is still an early adopter phenomenon. Only 6% of New Zealanders visit Twitter in an average four week period1, but its growth continues and has in fact increased by 31% in the last 12 months1.

3) 27% of Smartphone owners use their mobile for

social networking1.

Click for big version.

Given the growing prominence of Smartphones, it is not surprising that social media use on mobile phones is growing so fast. 11% of smartphone owners in New Zealand visit Twitter in an average 4 week period1.

4) Digital media is quickly growing

There are so many ways people can now access and read the news – via the printed edition, PCs, Tablets and Smartphones. Digital newspaper consumption, which has increased 112% in the past 5 years, is driving the total masthead readership of newspapers.1

Computer Tablets like the iPad, which are now accessible to over half a million (570,000) New Zealanders 14+1, allow readers to view a digital version of the newspaper in high resolution.

5) Like Print, Television has new competitive threats (and opportunities).

Over the past few years we have been monitoring the emergence of many rich media options which are alternative sources of video to television as we’ve know it for more than 40 years:

• YouTube is now used by 39% of New Zealanders 14+1

Of interest, the group most likely to stream video content is men aged 18-24 years, with 7% of these young men never watching commercial television1. This clearly demonstrates that some consumers cannot be reached with video content in traditional mediums but are embracing new forms of video or visual entertainment.

6) TV broadcasters have been quick to reach and embrace new digital platforms.

Traditional television networks, however, have been quick to react and embrace new digital platforms. We are seeing them create social TV experiments and deliver greater audience engagement by linking TV programs with the power of the Smartphone and social media.

Another example of how new digital technology is combining with traditional mainstream media like television is Roy Morgan’s Reactor, the world’s most advanced real-time audience involvement tool that records people’s second-by-second reactions to programs via the Reactor Mobile App, which can be segmented, averaged and graphed live on the show.

7) Online shopping is now mainstream.

Most of us are surprised to learn that Trademe is now one of New Zealand’s largest shopping outlets. Roy Morgan data shows that 2 million New Zealanders 14+ visit Trademe in an average 4 week period. Comparatively, 1.95 million New Zealanders shop (buy something) at the Warehouse in the same timeframe1.

With $5.6 billion spent in online shopping by New Zealanders in the last year1 it’s clear that the Internet, and the increased prevalence of Smartphones and Tablets, is impacting the way we shop and therefore the very fabric of retailing in New Zealand.

8) Online payment

systems, like PayPal, are increasingly being used by New

Zealanders when they shop online.

Click for big version.

Almost one in

five (19%) New Zealanders are using fast-growing online

payment systems like PayPal while 30% are using credit cards

online1. This also means that banks and credit card

companies are facing new competitive forces that didn’t

exist a few years ago.

9) The digital universe is not just impacting the way we shop, but also the way we pay our bills.

36% of New Zealanders 14+ have gone online to pay household bills in the last 12 months, while only 10% pay with cash and 17% with a cheque1.

With the advent of the digital wallet – e.g. Google wallet and the new iPhone iOS6 operating system – consumers will become more reliant on Internet payment mechanisms and less reliant on traditional modes of payment such as cash and cheques.

COMMUNITY

Word of mouth is not a new concept. It has been around forever in various forms, including mothers’ groups, church groups and rugby clubs. However, historically it was limited by physical interactions. Technology has now brought people together in virtual environments, through social networks. In these environments, word of mouth can be amplified, as information can be quickly and effortlessly disseminated to friends and strangers.

Social media offers consumers and businesses a platform of tools to easily create content (such as news updates, photo libraries, blogs and videos) and then effortlessly distribute it to a network of close friends, their friends, their friends’ friends and ultimately to strangers.

Each social network, however, is different and the amplification process works differently. How people behave on Twitter differs to LinkedIn or Facebook and then again differs when using these social networks via Smartphone.

To capitalise on this social phenomenon, businesses need to understand, at the very minimum, which social networks their customers use and what they are doing on them.

The vast majority of New Zealanders use some form of social networking. Facebook is clearly the largest, now used by 56% of New Zealanders aged 14+ in an average four week period1. However, social networking is not just Facebook. There are many other forms.

Facebook, having had its beginning as a messaging and photo sharing website, has evolved into a full, multi-media environment for gaming, communication and information seeking and sharing.

8% of New Zealanders visit Google +2, which is Google’s answer to Facebook, seeking to replicate many of its features and leverage Google’s huge customer base.

Twitter and YouTube are considered more to be community publishing platforms:

• YouTube (with 39% of New Zealanders1) allows the publishing of videos

• Twitter (with 6%1) allows for the publishing of text

These mainstream

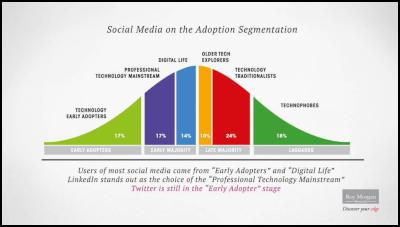

social media websites are still growing, particularly

Google+ (which has grown by 20% in the last 6 months

alone1). Interestingly, however, among Early Adopters of

technology (the ‘Technology Early Adopters’ segment in

Roy Morgan’s ‘Technology Adoption Segments’) Facebook

seems to have reached saturation, showing little growth over

the past 12 months1.

Although online social media or social networking is now mainstream, social networking on the mobile is actually still relatively new and largely the domain of Early Adopters.

Click for big version.

Currently, around 260,000 smartphone owners use their mobile phone for social networking in an average four weeks1. In fact, social networking is used only slightly less than general browsing and searching on the mobile. However, as Smartphone penetration increases, all the evidence suggests that social networking on the phone should follow suit.

Click for big version.

At Roy Morgan

Research, we are able to identify customers in terms of how

likely and quickly they are to adopt different technologies,

such as social media. Today, a large majority of social

media usage comes from the ‘Technology Early Adopters’

and ‘Digital Life’ segments1. Together, these segments

comprise almost half of all users of these social media

platforms.

Those in the ‘Digital Life’ segment have mostly grown up in the Internet era and thus are typically fast adopters of Internet services such as social networks. LinkedIn (a network designed for business networking) draws its greatest number of users from the ‘Professional Technology Mainstream’ segment1. They are highly career-motivated people, likely to be found in a corporate environment. They are also pragmatic technology adopters, in that they will adopt early any technologies that help them to achieve their goals.

Twitter, on the other hand, is still in the Early Adopter stage, with 39% of its visitors being ‘Technology Early Adopters’1.

For years Roy Morgan has researched the views of ‘Trusted Advisers’: those people whose opinions are sought about everything from cosmetics, to health, to the best car to buy and where to go on a holiday. Some people have always mattered more in the communication game and Trusted Advisers are seen by marketers as important influencers who are probably the most valuable target.

When you engage these Trusted Advisers on social media, the ripple effect (or multiplier effect) of new product launches, new offerings and new campaigns can be significant. It is therefore crucial to understand where these Trusted Advisers live in the social media world.

For example:

If you were launching a new credit card, Trusted Advisers for finance and investments are 73% more likely to be on a Business Networking site1.

If you were launching a new cosmetics range, Trusted Advisers for ‘buying fashion and looking good’ are 89% more likely to have created or managed a blog1.

If you were launching a new television, Trusted Advisers for home entertainment & electronics products are 97% more likely to be on internet forums1.

If you were launching a new mobile phone plan, Trusted Advisers for mobile phones are 120% more likely to be in a chat room1.

For those not engaged in social media it could be easy to see it as homogenous but, in fact, it is highly segmented. Just as ball games, rugby or cricket or tennis or snooker all have their own set of rules and attract their own community of followers and participants, so social networks are all different, attracting their own particular audiences.

As a really simple example, take the cosmetics market. MAC is a brand that has young, affluent, optimistic customers. Maybelline has very young ‘Look At Me’ customers. Thus, it is no surprise that MAC and Maybelline customers are online and heavily into social media, especially Facebook and Twitter.

By comparison, for Elizabeth Arden (a more mature brand) the majority of its customers are not as likely to be on Facebook or Twitter in an average four weeks, but, interestingly, Elizabth Arden has the same proportion of customers visiting Google+ in an average four weeks as does MAC1. Again, this emphasises the fact that, it is important not only to accept that social media is part of the media mix of New Zealanders, but to understand your customer base in terms of their social media usage. This knowledge will allow you to maximise your investment in social media.

BANKING & FINANCE

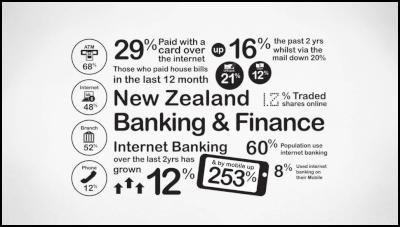

Click for big version.

Internet banking

is nearly as popular amongst New Zealanders as visiting the

branch. In Australia, internet banking has actually

overtaken branch visitation. Now, 48% of New Zealanders

conduct their banking via the Internet1.

Not only is the Internet influencing general banking activities, it is also influencing how we pay our bills:

• Today 29% of New Zealanders pay their household bills using a credit card over the internet – this is up 16% in the last 2 years, while cheque by mail is down 20%1

The banking and

finance industry exemplifies an industry that has embraced

the Internet and technology and been transformed by it.

This is further illustrated by the fact that Westpac’s website is the 12th largest in New Zealand with 626,000 visitors, not far behind the White Pages Online with 771,000 visitors1.

In fact, two of the major banking websites are in the top 30 and all of the major banks have over 380,000 visitors in an average 4 week period2.

The bank website is more than just a place where consumers conduct transactions. It is now a direct channel for one-to-one communication en masse with customers, providing an instant way for banks to talk to their customers.

Adoption of the Smartphone for banking is still in the early stages – only 8% of New Zealanders have done Internet banking on their mobile phone1 – but its growth has been massive in the last few years.

Smartphone Internet banking is up 157%1, whereas PC banking is near maturity with only 5% growth in the last 12 months1.

Mobile banking, near-field transactions via the mobile phone, bill payments and other financial transactions via the mobile are all being touted as ‘the next big thing’. The

Smartphone as a digital wallet will surely represent a threat to credit card companies and banks; and for all businesses, there are issues around infrastructure and risk and responsibility.

The banking industry exemplifies the story of mass technology adoption.

We have seen banks encourage consumers to move from branches to the ATM, to phone banking, to the Internet, and now to mobile.

With the introduction of each new innovation, the Technology Early Adopters have led the way. Today, they are 123% more likely to bank via their mobile1.

The challenge for banks is that many of their most valuable customers are not Early Adopters, rather they are Technology Traditionalists and even Technophobes. These people are less likely to adopt new technology just because it is new – rather it will need to add real value to them. This is illustrated by the fact that only 4% of people with total savings and investments over $200,000 have ever conducted banking via their mobile1, compared to the New Zealand average of 8%1.

The key question for banks, as it is for other businesses, is how to understand their most valuable customers and whether technology can help them engage better with these people – what technology, how and importantly, when. A lot of this digital decision making is about timing. Moving too late may mean the loss of customers. Moving too early can be a costly investment as the technology might still be in its early sub-optimal phase.

SHOPPING

For brands and retailers alike it is vitally important to understand online shopping and the impact the Internet is having on consumers’ purchasing behaviours and on retail in general.

With almost two-thirds (65%) of all New Zealanders 14+ now collectively spending online $5.6 billion in the last year1, and with Trademe attracting as many visitors as the Warehouse across all their shopping centres, the Internet as a sales channel is clearly important.

Not only is the Internet an important transaction channel, it also plays a critical role as consumers seek information and compare prices along the path to purchase for many categories.

One in five (20%) Internet shoppers say they shop in stores less often since using the Internet1. This is a sobering fact. It means that retailers must rethink their visual merchandising and point of sale strategies and overall technology investment.

So how large is the online shopping market?

Click for big version.

Many are

guessing this number, but Roy Morgan has been measuring

online shopping and spend for some years now and reports

that $5.6 billion was spent online in the last 12 months by

New Zealanders across all categories1.

In the last 12 months the major categories of expenditure were1:

• Travel Products (including tickets and accommodation) – $1.5 billion

• Entertainment & Leisure Products (including tickets, music and DVDs) – $1 billion

• Electronic Products (including home entertainment, computers and software) – $675 million

• Fashion Products (including clothing and footwear) –$405 million

• Food & Beverages (including supermarket and alcohol) – $393 million

The other categories are made up of a

host of other products that include1:

• Car Parts & Accessories – $259 million

• Fitness Products – $210 million

• Fashion Accessories – $195 million

• Reading Materials – $191 million

As the

largest industry, Travel is worth exploring in more detail,

given that $1.5 billion was spent online in this category in

the last 12 months1.

42% of people who went on a holiday in the last 12 months used the Internet to book, compared to 18% who booked via the phone and 13% who booked in person1.

19% of people who booked travel online used an online only agency (such as Webjet or Wotif) 1.

Interestingly, in an average 4 week period, with 758,000 visitors, Air New Zealand’s website has almost as many visitors as the NZ Herald site (with 870,000)1.

New Zealanders are not just buying online, they are also using a myriad of different online tools to educate themselves about products, services and retailers as they seek information on quality, support, availability and prices.

This has implications for online retailers, but more importantly for bricks & mortar stores, because:

• 49% of New Zealanders research online, but buy offline1

• 13% of New Zealanders read online catalogues1

• 11% use a price comparison website1

Of the 65% of New Zealanders who have shopped online,

they are 40% more likely to use price comparison websites

and 35% more likely to read online catalogues1.

Information is being provided online by the retailers themselves in the form of price comparison websites, corporate blogs, product catalogues, their social media pages and, of course, their own websites. They are paying for online editorial and selling products on Trademe.

Any business today that exists because its ‘customers do not know any better’, ‘don’t know their prices are too high’ or ‘the product or service are sub-standard’, will have a short life.

There is much hype about social media and its role in the path to purchase and, as social media is a less controllable environment for retailers, it is not surprising that we are seeing a flurry of retailer activity and a sense of panic.

Consumers are learning about new products and services from their friends on Facebook, they are reading ‘prosumer’ blogs, they are watching products being unwrapped on YouTube and reading ratings and reviews from other customers.

The data shows that it is still early days, however, with only:

• 12% of New Zealanders reading ratings and reviews1

• 4% posting reviews themselves1, and

• 1.4% saying they have purchased as a direct result of advice from a social network1

So there is time for retailers to take

stock, consider the customer – especially the difference

between a ‘price sensitive repertoire customer’ who will

always go for a bargain, and a high value loyal customer who

will be more appropriately engaged with a personalised, more

intimate program.

With the introduction of the Smartphone, information about prices, availability and ratings becomes instantly available to the consumer.

These mobile tools have a profound impact on bricks & mortar stores, as consumers can conduct research from within the store. Today, 8% of Smartphone owners have researched a product or service to buy via their Smartphone1. This may sound small, but it has grown 208% in the last 12 months alone and it is not hard to imagine this growing substantially as more people become familiar with the mobile Internet.

For retailers, it is thus vitally important to understand the adoption and influence of the Smartphone for their market and for their customer, so they can optimally influence the buying process.

If we look to the car industry as an example, we can really see the influence of the Internet on the path to purchase.

For New Zealanders looking to buy a new car in the next 12 months1:

• 39% use the Internet to check prices

• 43% check vehicle features

• 19% locate a dealer

Although buying a

new car online is still relatively new, $259m was spent

online by New Zealanders purchasing car parts and

accessories last year1.

Another key trend which has been around in concept for some time – and which many people believe will come into its own in the not too distant future – is real-time, location-based marketing, using electronic coupons. This involves the provision of coupons to a mobile that are relevant to a person’s personal needs and to their location (which can be found via their GPS).

Analysis of the attitudes and current behaviours of Smartphone users suggests that Smartphone users are ready. 49% often redeem coupons and 31% use GPS on their phone1.

QR codes are another mobile phone marketing initiative that is being implemented by digital marketers. The QR code reader is like a barcode scanning system that enables the consumer

to scan a QR code using their phone and retrieve information about the product or service to their phone.

Today only 7% of Smartphone users have used a QR code reader and only 6% of Early Adopters use them1 but this is not surprising, as few retailers are offering the opportunity. To realise their potential, retailers should work with channels ideally placed to promote QR code use, such as magazines, catalogues and even ambient media.

The industry is talking about the new battlefield for online retailers being fought on trust and service. This is not surprising given that:

• Only one-third of New Zealanders ‘feel comfortable giving credit card details over the Internet’1

• 2 out 3 three online shoppers ‘prefer to buy from online retailers they know’1 and

• 27% of online shoppers ‘only buy from New Zealand online stores’2

New Zealand retailers are still

well-placed to win this battle, with the trust they have

already established among consumers for their brand.

Click for big version.

Trademe

currently dominates online shopping, especially considering

Trademe has slightly more visitors (2 million) as the

Warehouse has shoppers (1.95 million) in an average 4 week

period1.

But Trademe’s advantage will not last forever, particularly as New Zealand retailers continue to develop their online offer and become about more than just price, creating user experiences that build on brand trust.

MEDIA CONSUMPTION

Over the last decade we have seen the fragmentation of media across traditional and digital platforms.

Publishing to 100s, 1000s and even millions is an opportunity now open to anyone with an Internet connection. While many newcomers remain niche, the new mass media success is YouTube.

Combined with the advent of Smartphones, Tablets and SmartTVs, we are on the midst of another consumer-led media consumption shift. That is, consumers have even more choice as to when and where they consume media.

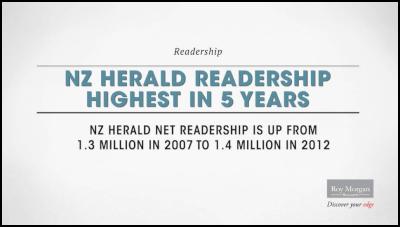

Click for big version.

For this reason

we hear that traditional media is under threat, however NZ

Herald readership1 is the highest in at least 5 years3.

Newspapers have actually been quite successful in migrating their audiences online, partly by design, and are clearly attracting new audiences.

For example, the NZ Herald – our largest national newspaper – has grown its net masthead audience1 (print and online) by 100,000 readers in the past 5 years3.

Today consumers can choose the most convenient platform in which they wish to consume their media of choice.

For instance, 32% of New Zealanders who read print newspapers also access news online. Conversely, 71% of those who read or access news online also read print newspapers.

Smartphone owners are 73% more likely than the average mobile user in New Zealand to listen to the radio on their phone1. So New Zealanders are clearly taking advantage of the technology they have at their disposal.

As we can see, technologies such as Tablets and the Smartphone are not at the expense of traditional media; rather, they simply offer people more choice in how they consume their preferred media and this data shows that consumers are definitely making their own choices.

Click for big version.

The impact of

technology and the Internet is just as apparent for

Television, which is facing threats and opportunities

similar to print:

• 1.4 million New Zealanders watch YouTube in an average four week period1

• 26% pause or rewind live TV programs1

With the majority of New

Zealanders already having a home network, all home

televisions will soon connect to the Internet and other

computers and media in the home.

Already 5% of New Zealanders access the Internet via their televisions and 28% say they would like to1. Technology Early Adopters are 73% more likely to have a television connected to the Internet1.

This demonstrates how the television is evolving and continues to be the entertainment centre or hub in most Australian homes.

Because of these opportunities and challenges, the television is no longer owned or monopolised by the broadcaster.

Television networks, however, have embraced these opportunities. They are extending their program assets across platforms to provide deeper experience and greater engagement, which in turn offers more opportunities to advertisers.

The rise of reality TV has provided the best opportunity to integrate television with the Digital Universe.

Television networks are linking their programs with Facebook, websites, Apps, chat rooms and real-time engagement via a second screen, using technologies like our own Reactor.

Click for big version.

The New Zealand production of The Block was a good example of this. It is not surprising The Block’s cross-media offering was successful, as their audience typically spends more time on the Internet and are 20% more likely to have access to a computer Tablet, such as an iPad.

If, however, Country Calendar were to run a cross-media offering, they would need to consider the fact that their audience is over 40% less likely to perform an online blogging or community activity and typically spend less time on the Internet compared to the average New Zealander1.

The Smartphone represents a person’s portable media and information hub. It replaces the MP3 player and it is the new Internet browser:

• 17% of Smartphone owners access, read or receive news content on their phone

• 14% stream & download radio or music on their phone

• 19% of Smartphone owners watch video content on their phone

These are numbers are growing.

There is no doubt that this portable multi-media device will help shape the media consumption habits of New Zealanders now and into the future.

What we have clearly shown is the fragmentation of media across platforms. The challenge is to understand how and when to best communicate with your audience. Knowing facts such as ‘your target market prefers news on their Tablet at breakfast time’ may become an important differentiator for your business and your marketing approach.

All the insights and data in this paper are provided by Roy Morgan Single Source.

Roy Morgan Single Source provides a unique view of trends and behaviour through the lens of the Digital Universe.

About Roy Morgan Single Source

Each year, Roy Morgan Research conducts approximately 12,000 interviews and collects comprehensive information about every aspect of New Zealand life. This information is used to build the massive Roy Morgan Single Source database that provides invaluable information to marketers and the media.

About Roy Morgan Research

Roy Morgan Research has over 70 years’ experience in collecting objective, independent information on consumers. Roy Morgan Research was founded in 1941 by Roy Morgan. While originally specialising in public opinion, corporate image and media measurement, the company has expanded to cover all aspects of market research information. Roy Morgan currently employs over 500 people worldwide and operates surveys in Australia, New Zealand, Indonesia, the UK and the US.

Sources:

1Roy Morgan Single Source, (New Zealand), September 2011-August 2012 (n = 11,771)

2Roy Morgan Single Source, (New Zealand), June – August 2012 (n = 3,133)

3Roy Morgan Single Source, (New Zealand), September 2007 – August 2008 (n = 11,192)

ENDS

Keith Rankin: Geopolitical Fractures, And Untidy Yet Workable Solutions

Keith Rankin: Geopolitical Fractures, And Untidy Yet Workable Solutions Gordon Campbell: On Winston Peters’ Battle Against The Phantom Legions Of The Woke

Gordon Campbell: On Winston Peters’ Battle Against The Phantom Legions Of The Woke Adrian Maidment: Road Cone Final Exam & Donald, I Warned You!

Adrian Maidment: Road Cone Final Exam & Donald, I Warned You! Binoy Kampmark: The Script Of Anxiety - Poland’s Nuclear Weapons Fascination

Binoy Kampmark: The Script Of Anxiety - Poland’s Nuclear Weapons Fascination Martin LeFevre - Meditations: Regarding Randomness And Significance

Martin LeFevre - Meditations: Regarding Randomness And Significance Ian Powell: When Apartheid Met Zionism

Ian Powell: When Apartheid Met Zionism