Rubenstein's Lacera Talk Predicts Lehman Collapse?

Rubenstein's Lacera Talk Predicts Lehman Collapse?

By SUZAN MAZUR

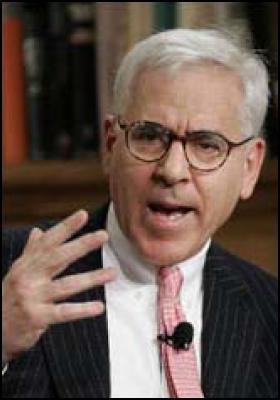

In the now-famous "How Bush Got Bounced from Carlyle Board " speech that Carlyle Group's co-founder David Rubenstein gave to the Los Angeles County Employees Retirement Association on April 23, 2003, he also touched on the matter of investment bubbles. Lacera had $95 million in Carlyle, then the "world's largest private equity firm," and Rubenstein warned those attending the meeting of Lacera's Board of Investments about the next bubble bursting, saying, "something is going to break in five years." He offered further explanation "off-record."

Did Rubenstein forsee the mortgage catastrophe and 2008 collapse of Lehman Brothers? And was anyone from Lacera's BOI curious enough to take Rubenstein up on his offer for a private chat? Apparently not, since Lacera lost almost half its treasure (CalPERS -- California Public Employees' Retirement System -- lost even more) when the housing bubble burst. Here are Rubenstein's further remarks to Lacera, followed by a recap of his "Bush Bounced" comments -- which I transcribed after receiving the tape from an anonymous source, posting July 1, 2003 on Sam Smith's Progressive Review.

DAVID RUBENSTEIN:

"I

think you should recognize, though, that the history of

investing over thousands of years is that there always will

be bubbles. And bubbles will always burst.

No

matter what you think is the greatest investment vehicle,

the greatest idea over a period of time -- if too much money

goes into it, it will burst.

And I don't know

when the next bubble is going to burst or what it's going to

be but something is going to break in 5 years. I can give

you my view of what it'll probably be, but I'll do it

off-record."

HOW BUSH GOT BOUNCED

FROM CARLYLE BOARD[David Rubenstein, co-founder and Managing Director of The Carlyle Group, the "world's largest private equity firm," recently recounted his first meeting the current president and Bush's days on the Carlyle board in a speech to the Los Angeles County Employees Retirement Association. LACERA has invested $95 million in Carlyle, now the 11th largest defense contractor in America as majority shareholder in United Defense. For ethical reasons, many in the association would like to see LACERA funds pulled and invested elsewhere.

In the speech Rubenstein also touched on company ethics - under intense scrutiny since 9/11 - including widely reported stories about Carlyle operating as a shadow government. He assured investors that "making money is nice" but Carlyle is "first and foremost" concerned with ethics.]

DAVID RUBENSTEIN - We have an enormous amount of our own personal capital - about 90% of our net worth is tied up in these funds. My partners and I and all the other professionals have committed $700 million to our various funds throughout the world so we've got a lot of money committed to this and it's important to get it back. But it's more important that we not do anything that impairs the reputation of ourselves or our investors. So making money is nice but we're more worried about our reputation and concerned with ethics and that's first and foremost.

[He had this to say about George W. Bush]

Let me talk about a bad deal. At the beginning of Carlyle - early - we didn't have any funds. We didn't have any dedicated funds. And we had a deal that seemed like it would be the greatest deal since sliced bread. It was handed to us. Marriott said to us, look, we're going to sell our airline catering business [Caterair].It's number one in the world. Management team has been there for 10 years. We dominate all the markets and we're not going to do an auction. We're going to sell it to you guys 'cause some of our people [Carlyle co-founders Steve Norris and Dan D'Aniello and Bush crony Fred Malek] used to work at Marriott. You know, what could be better?

So the financing was there. And we thought, this is an easy business. So they're going to give us a company. Number one in the world. Gold plated. Got all the equipment you need. Good management team.

Well, then the Gulf War came. And all of a sudden people stopped flying. And then those who were flying realized that they weren't going to be getting the food that they thought they were going to get. . . . So no matter how good you think a company can be something can go wrong. We couldn't anticipate the Gulf War. So the airline catering business has gone this way.

I mention this because it reminds us all the time we shouldn't have hubris. You know no matter how smart we think we are or how good we are, something can go wrong. And if something seems too good in life to be true, it usually is. In this case, the only interesting thing about the deal--and we lost all our money in it. Our money and our investors' money in it. In that deal.

But when we were putting the board together, somebody [Fred Malek] came to me and said, look there is a guy who would like to be on the board. He's kind of down on his luck a bit. Needs a job. Needs a board position. Needs some board positions. Could you put him on the board? Pay him a salary and he'll be a good board member and be a loyal vote for the management and so forth.

I said well we're not usually in that business. But okay, let me meet the guy. I met the guy. I said I don't think he adds that much value. We'll put him on the board because - you know - we'll do a favor for this guy; he's done a favor for us.

We put him on the board and [he] spent three years. Came to all the meetings. Told a lot of jokes. Not that many clean ones. And after a while I kind of said to him, after about three years - you know, I'm not sure this is really for you. Maybe you should do something else. Because I don't think you're adding that much value to the board. You don't know that much about the company.

He said, well I think I'm getting out of this business anyway. And I don't really like it that much. So I'm probably going to resign from the board.

And I said, thanks - didn't think I'd ever see him again. His name is George W. Bush. He became President of the United States. So you know if you said to me, name 25 million people who would maybe be President of the United States, he wouldn't have been in that category. So you never know. Anyway, I haven't been invited to the White House for any things.

Ends

Suzan Mazur

is the author of The

Altenberg 16: An Exposé of the Evolution

Industry. Her reports have appeared in the

Financial Times, The Economist, Forbes,

Newsday, Philadelphia Inquirer,

Archaeology, Connoisseur, Omni and

others, as well as on PBS, CBC and MBC. She has been a

guest on McLaughlin, Charlie Rose, and various

Fox Television News programs. For some years along the way,

she was a runway fashion model for Giorgio Sant' Angelo,

Geoffrey Beene, Bill Blass and other legendary designers.

Email: sznmzr@aol.com

Suzan Mazur

is the author of The

Altenberg 16: An Exposé of the Evolution

Industry. Her reports have appeared in the

Financial Times, The Economist, Forbes,

Newsday, Philadelphia Inquirer,

Archaeology, Connoisseur, Omni and

others, as well as on PBS, CBC and MBC. She has been a

guest on McLaughlin, Charlie Rose, and various

Fox Television News programs. For some years along the way,

she was a runway fashion model for Giorgio Sant' Angelo,

Geoffrey Beene, Bill Blass and other legendary designers.

Email: sznmzr@aol.com

Martin LeFevre - Meditations: Animal Encounters During Meditative States

Martin LeFevre - Meditations: Animal Encounters During Meditative States Ian Powell: Gisborne Hospital Senior Doctors Strike Highlights Important Health System Issues

Ian Powell: Gisborne Hospital Senior Doctors Strike Highlights Important Health System Issues Keith Rankin: Who, Neither Politician Nor Monarch, Executed 100,000 Civilians In A Single Night?

Keith Rankin: Who, Neither Politician Nor Monarch, Executed 100,000 Civilians In A Single Night? Eugene Doyle: Writing In The Time Of Genocide

Eugene Doyle: Writing In The Time Of Genocide Gordon Campbell: On Wealth Taxes And Capital Flight

Gordon Campbell: On Wealth Taxes And Capital Flight Ian Powell: Why New Zealand Should Recognise Palestine

Ian Powell: Why New Zealand Should Recognise Palestine