Geoff Bertram - Fresh Ideas for a Productive Economy

Notes for Fabians Seminar "Fresh Ideas for a

Productive Economy"

July 2011 - Legislative Chamber, NZ

Parliament

By Geoff Bertram

Geoff Bertram – Institute of Policy Studies

In terms of short-run sustainability, on the whole the New Zealand economy rolls along surprisingly well in terms of its resilience to real and financial shocks. It’s important not to be panglossian, but equally important not to be panicked by alarmist rhetoric, especially when it’s deployed in ‘shock-doctrine’ fashion to push through otherwise-unsaleable policies. There is a good case to be made for several big shifts in policy direction, but consensus-building among policy elites and the general public has to come first. High on the agenda in my view are income and wealth distribution, employment and real wages, getting momentum into the whanau-ora approach to social policy, fending off US attacks on Pharmac and local software developers under cover of the TPP, moving energy and climate change policy out of the greenwash bog in which they are currently stuck, reviving the ability and the will to regulate effectively, sorting out the role of an offshore-owned banking sector in a small open economy, and addressing the perennial issue of exchange rate overvaluation. Today I’m focusing on the last two of these, but I’ll start with some background points about the wider New Zealand economic scene.

Key elements of strength on the sustainability front:

• The freely floating exchange rate, for all its negative aspects (discussed below) is a great shock absorber which saves us from the prospect of getting stuck in the sort of corner encountered by Greece (with its destructive peg to the euro) and Argentina (before it gave up its dollar peg back in 2000). The shock absorber comes at a price in terms of potentially destabilising wide swings, and an incipient upward creep that pleases financial interests but puts a millstone around the productive economy.

Click for big version

RBNZ http://www.rbnz.govt.nz/keygraphs/Fig8.html

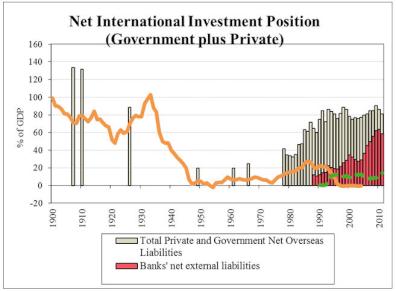

• A manageable level of net international indebtedness, which (to my surprise) has not risen relative to GDP over the past decade, holding steady at about 80% following the big debt run-up of the 1980s and early 1990s.

Click for big version

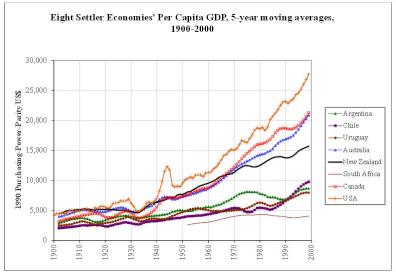

• A long-established position as one of the high-income settler economies of the world with social capital and physical infrastructure to match, which means that despite a falling ranking relative to the world’s lead economies New Zealand is still a long way off the breadline

Click for big version

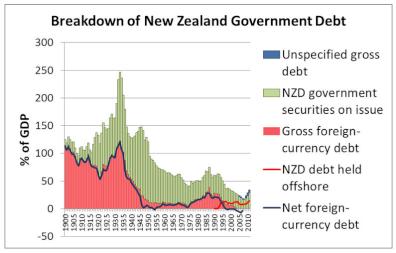

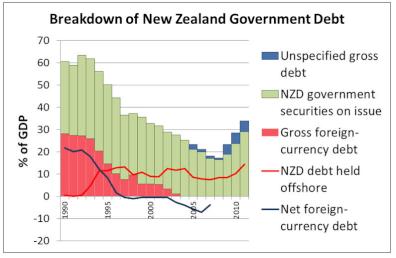

• A strong fiscal position as the fruit of past austerity in the 1990s extending to countercyclical restraint in the 2000s, notwithstanding the enormous pressure on Michael Cullen to imitate George W. Bush’s blowing-away of the US fiscal surplus of 2000 by slashing taxes rather than strengthening the Crown balance sheet. The Government now has plenty of fiscal headroom if it chooses to use it. Asset sales would have to be justified on their merits - not as desperation measures with a gun to anyone’s head.

Click for big version

Click for big version

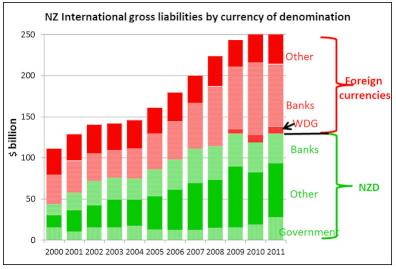

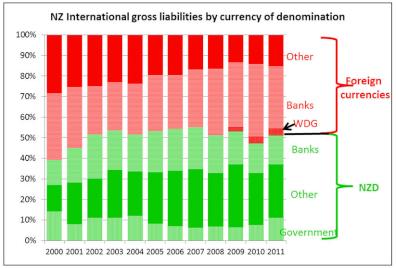

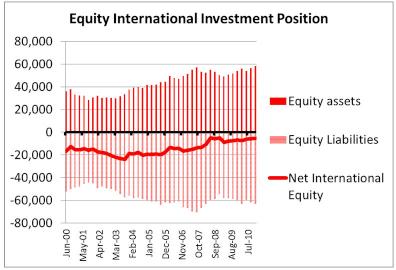

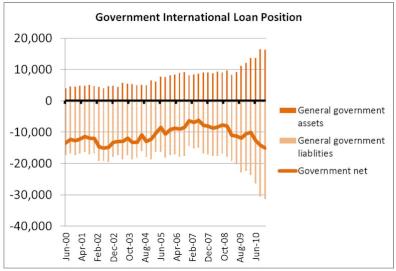

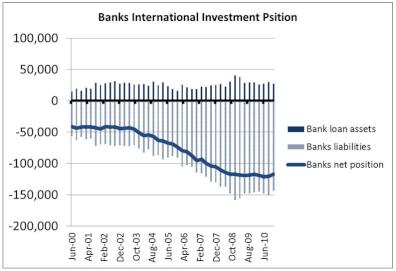

• Escape from “original sin” [1]in global financial markets, which means that debt instruments denominated in NZD can be sold to overseas investors, removing the exchange-rate risk that hangs over most emerging-economy debt. Effectively all the Government’s official international indebtedness is now in NZD, and quite a big slab of private-sector overseas debt is also denominated in NZD. The black spot in the international investment position record is the banks, noting that $8 billion of the banks’ $80 billion of foreign-currency debt underwritten by taxpayers under the Wholesale Deposit Guarantee. (The Government’s current intention to push Auckland into raising foreign-currency debt to finance its infrastructure projects would add another black spot)..

Click for big version

Click for big version

Click for big version

The areas for dissatisfaction are familiar and long-standing. They include

• A steady drift towards a low-wage economy, pushed along by continual erosion by policymakers and business organisations of the organisation and morale of labour, leaving the economy lacking countervailing strong vested interests to balance the strong tide of neoconservative policy and policy discourse, and the dominance of financial-sector ideology in the key policy arenas [2].

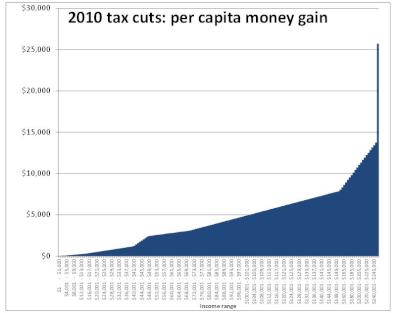

• Steadily worsening income and wealth distribution, encouraged by deregulation, absence of capital-gains taxation, income tax policy (especially the 2009 income tax cuts which gave $25,000 per year cash in the hand on average to people earning over $250,000):

Click for big version

Data from Mike Smith.

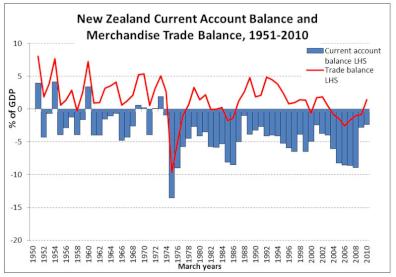

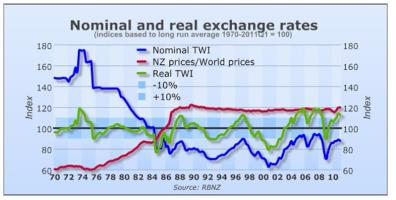

• Persistent overvaluation of the real and nominal exchange rates keeping the brakes on tradable production and continually sustaining a substantial current account deficit (the past two years’ improvement reflects recession, not rebalancing)

Click for big version

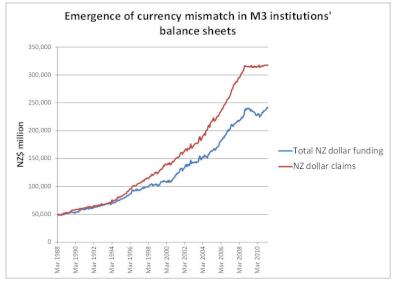

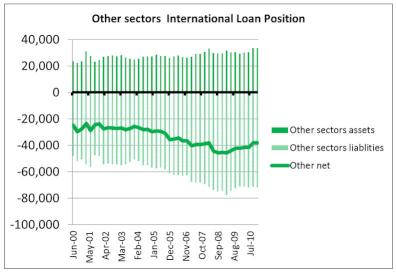

• The serious weakening of the nation’s balance sheet combined with upward pressure on the nominal exchange rate due to the behaviour of the banks in using offshore funding to finance NZD lending and the related housing bubble. Balance-sheet trends by sector:

Click for big version

Click for big version

Click for big version

Click for big version

• Pervasive and generally unthinking acceptance of neoconservative assumptions and ideological preferences, producing group-think in policy discourse and the media (even now that the Murdoch era of newspaper ownership in the 1980s and 1990s has ended). Flowing from this, a climate of ineffective, often wilfully blind, ‘regulation’ of financial operations and monopolies in general, rewards for speculative behaviour accounting manipulation, and tolerance of rent-seeking behaviour in business. These things have become so much in the wallpaper of economic life that they mostly escape serious comment.

Since the theme of the seminar is the productive economy, I shall focus in the remainder of the paper on exchange-rate overvaluation, its causes and its consequences, and how one might think about reorienting policy settings to achieve a sustained downward adjustment in the TWI and an upward shift in real competitiveness.

The exchange rate is one of the key relative-prices driving macroeconomic structure and behaviour in a small open economy. It has two dimensions:

• The nominal exchange rate (e.g. the TWI)

which is an important driver of tradable-goods

competitiveness, and changes in which produce capital gains

and losses for international investors

• The real

exchange rate which is the ratio of tradables prices to

non-tradables prices – in other words, the relative-price

incentive to allocate resources between the two sectors.

Click for big version

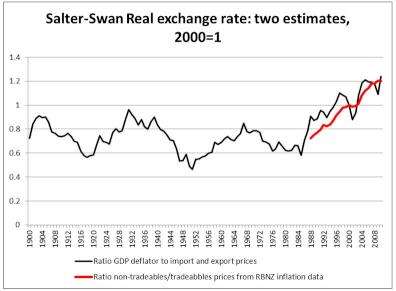

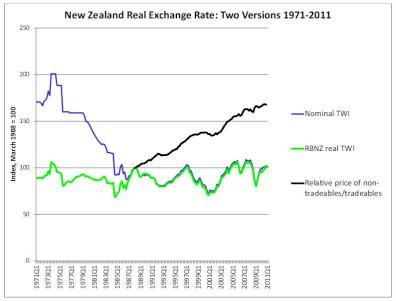

The RBNZ produces a conventional estimate of the “real exchange rate” calculated as the nominal exchange rate adjusted for relative inflation rates in New Zealand and its trading partners.

Click for big version

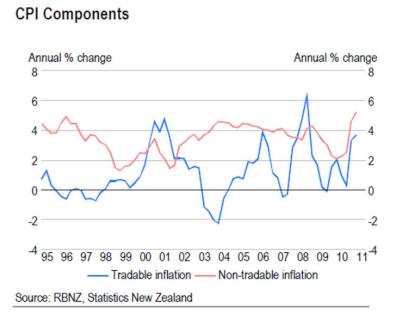

This provides a direct measure of the competitiveness of New Zealand exporters and import-substituters in confronting their overseas competitors, on the assumption that the inflation rates in the various countries are uniform across tradables and non-tradables. In practice the sector-specific inflation rates differ; in the New Zealand case, non-tradables inflation runs ahead of tradables inflation, so that the average inflation rate gives an underestimate of the extent to which tradables profitability is squeezed as the RBNZ measure of the real exchange rate appreciates. There is only limited research on the extent to which comparable relative-price trends have occurred in the trading partners, [3]which means that the best estimate of the real exchange rate trend will be somewhere between the two versions n the chart.

Click for big version

The long-run record shows up a number of features.

• First, the onset of persistent large current-account deficits in the mid-1970s brought to the fore a widely-recognised need to lower the exchange rate – but (i) the crawling-peg experiments of the early 1980s failed to improve ‘RBNZ competitiveness’ because inflation was not contained; (ii) the 1984 devaluation did so only briefly; and (iii) the 1985 clean float was followed by a perverse rise in the exchange rate and consequent loss of competitiveness, with devastating consequences for manufacturing industry and some agriculture in the late 1980s. Since then politicians have fund it wise to hide behind the claim that nothing can be done about the exchange rate, so their hand are clean.

• Second, within the New Zealand economy a relative-price shift against tradables, measured by cumulative inflation of tradables versus non-tradables prices, has been underway for several decades and although it is clearly affected by cycles in the nominal exchange rate, it rests upon the greater persistence of non-tradables inflation relative to tradables inflation.

Click for big version

The era of inflation targeting by the RBNZ since 1990 has contributed to holding the nominal exchange rate up, and has relied on this to restrain domestic average inflation. Whenever the nominal exchange rate drops this feeds through to a rise in tradables prices, raising the average inflation rate and putting downward pressure on real wages. The inflation-targeting response is to raise interest rates, which attracts capital inflow and brings the nominal exchange rate back up.

The theory of inflation targeting is that inflation control falls neutrally, leaving relative prices to work efficiently on allocation. But in practice in an open economy the interest-rate mechanism puts the squeeze on only one part of the economy, which happens to be the part that is of greatest importance for long-run creation of employment and productivity growth.

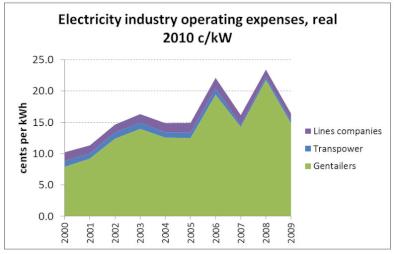

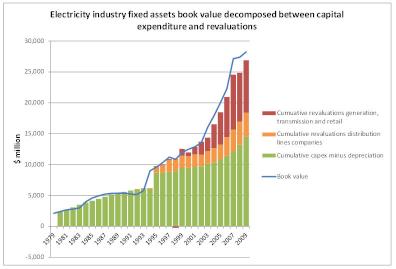

One lesson from two decades of experience with inflation targeting is that its application to a small open economy needs to be supported by other measures to suppress non-tradable inflation, given that the interest-rate instrument works primarily on tradables prices. This includes both the need for some way of slowing or halting asset bubbles, and the need for effective regulatory interventions in those non-tradables sectors where exercise of market power produces cost push, margin push, and asset-value inflation.

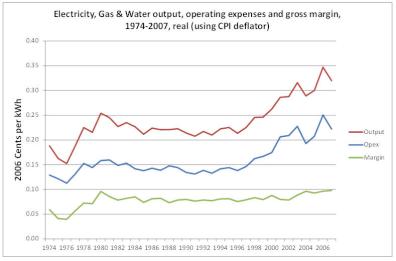

Just to give an example of these forces from my own work on electricity, consider these charts:

Click for big version

Source: Statistics NZ national accounts

Click for big version

Source: Geoff Bertram, “A Stocktake of Profitability and Investment Performance in the New Zealand Electricity Market After Two Decades”, IAEE conference Stockholm, June 2011.

Click for big version

Source: Geoff Bertram, “A Stocktake of Profitability and Investment Performance in the New Zealand Electricity Market After Two Decades”, IAEE conference Stockholm, June 2011.

This leaves the issue of whether the long-run path of the nominal exchange rate can be influenced, by monetary policy or otherwise, hopefully generating a sustained improvement in the real competitiveness of tradables. If the RBNZ’s mandate were revised as often suggested, to include some target relating to the balance-of-payments current account or the long-run average exchange rate, it would be interesting to see what new ideas the bank’s economists would come up with.

Commonsense says that the nominal exchange rate does respond in a predictable and understandable, if not orderly, way to developments and stresses in the real economy. We are, however, now far from the days when a floating exchange rate could be expected to move automatically and smoothly to equate imports and exports. The exchange rate these days is determined in asset markets where investor sentiment is only indirectly related to developments and stresses in the real economy, and where the value of a currency depends on the arbitrage relation between the currency itself and financial instruments denominated in that currency.

Having said that, it is still possible to think of policy leaning against the wind of overvaluation. A lot of ideas in this area come from the literature on “Dutch disease” in economies with booming sectors which dump foreign-currency bonanzas into the market, driving up the exchange rate and crowding-out other tradables. In the original setting, Dutch disease involved current-account surpluses driven by the booming sector rather than current-account deficits sustained by a high exchange rate driven off capital flows. But since the US Federal Reserve embarked on quantitative easing and thereby expanded the volume of the world reserve currency looking for safe-haven investments, numerous countries have seen their exchange rates driven up and their current accounts pushed into the red by exogenously-driven financial-capital inflows, and the question of how to confront foreign currency bonanzas has returned to the fore in the context of capital inflows crowding out tradable production.

• One option is outright capital control, effectively putting up a “not for sale” sign on all real assets in the home economy and preventing the offshore sale of financial assets.

• A second is taxation of capital inflows, confronting the parties to any capital-flow transaction with an effective exchange rate below the prevailing market exchange rate

• A third is sterilisation, with the foreign-currency inflow captured by the central bank or other government agency and put into reserves, with only a domestic-currency fow reaching the home-economy participant in the deal. This basically how East Asian governments have kept the IMF at bay, while simultaneously preventing exchange-rate appreciation, since the Asian crisis of the late 1990s. It was also how Norway handled bonanza revenues from its state-owned oil industry, given that the foreign-currency funds arrived directly into the government’s hands and could be stowed in a sovereign wealth fund – a novel argument in favour of state ownership of a commanding height, since capturing private-sector bonanzas presents a raft of problems to be overcome.

• A fourth is to work on market sentiment to increase the frequency of negative views on the longer-run value of home-currency financial instruments, and thus to arbitrage down the market nominal exchange rate even as capital flows in.

None of these stands out as the single silver-bullet solution to New Zealand’s overvaluation, but all of them contain kernels of ideas about how policymakers could approach economic decisions as they arise, and all deserve to be worked through.

• The “not for sale” approach immediately calls to mind the present Government’s planned sale of shares in state-owned assets to offshore investors. The inflow of foreign currency from asset sales can be expected to provide an unhelpful short-term boost to the nominal exchange rate over a period of a year or two. Best not to proceed with the sales at all under present circumstances, unless somebody really can think of a way of restricting the holding of shares to New Zealand residents – I see no prospect of doing that without quite stringent regulatory intervention to control the share register. If the sales proceed, given that the shares will end up in foreign hands it could be, ironically, better to sell them direct rather than have them go first into the hands of local investors and then to foreign buyers in a second round, since at that stage the foreign currency inflow will be diffuse and hard to capture.

• Taxation has attractions, especially if it could be calibrated to capture the negative externality component of asset sales to offshore buyers – by, for example, taxing away the component of the sales proceeds that is estimated to derive from currency over-valuation. Apart from the fact that a tax instrument would have to be devised, the setting and declaration of the optimal exchange rate would be pretty controversial and inherently a bit arbitrary. Both of these are valid problems but not in themselves reasons to walk away from thinking about the tax option.

• The forthcoming bonanza of reinsurance funds following the Christchurch earthquake might be a prime case for sterilisation. The funds will be arriving through well-defined channels, and the expenditures they are to finance will be mainly within the New Zealand economy on locally-produced gods and services – concrete, wood, steel, labour, design services. Simply letting the bonanza flow through the foreign exchange market is, again a recipe for upward pressure on the nominal exchange rate. Terilising the foreign currency component, and letting the import content of the earthquake reconstruction be financed as a claim on the regular foreign exchange market, might not bring the exchange rate down much, but would prevent it drfting up.

• As for market sentiment more generally, there is one possibility that I have canvassed occasionally in the past couple of years relating to the balance sheets of the banks. These have a conspicuous currency mismatch that exposes New Zealand taxpayers, and possibly the economy in general, to substantial losses in the event of another global financial crisis. The problem is partly that depreciation of the NZD implies capital losses for the banks’ shareholders (and so is resisted stoutly by the banks through their policy lobbying and market manipulation) and partly that closure of offshore markets (as occurred in late 2008) can place the banks into a crisis of liquidity given that they must repay maturing debt in foreign currency but can realise assets and central bank support financing only in NZD, conversion of which into the required foreign currencies would clearly put downward pressure on the exchange rate. There seems to me a good case for prudential supervision of the banks to be extended to a progressive requirement for them to convert their foreign-currency liabilities into NZD denominated liabilities, even if these are to be held by overseas investors. The idea would be simultaneously to reduce the New Zealand financial sector’s exposure to financial crisis and exchange risk, and to nudge the nominal exchange rate down as bank liabilities are repatriated to NZD.

I list these four not as a fully-worked-through policy package but as suggested starting points for more policy discussion. I am not holding my breath in expectation, because the first step towards bringing the exchange rate down on a sustained basis is that the political parties, the officials in key ministries (especially Treasury), and a solid number of media commentators, would have to agree at the outset that bringing the rate down is a good idea and make a serious, credible commitment to seek out ways of achieving this. Once there is a will, there will probably be a way – indeed the very emergence of a will, and of some generally-agreed target exchange rate consistent with an end to overvaluation, might well achieve the required shift in market sentiment and consequent re-valuation of NZD-denominated instruments including the currency.

At present, however, the great NZ clobbering machine lies in wait for anyone in political life venturing down these paths.

In addition it has to be borne in mind that one consequence of sustained depreciation will be higher domestic prices of tradables relative to wages, which means the real consumption wage will be reduced; it is therefore important not to treat exchange-rate policy in isolation from wages policy and employment creation. But in my ten minutes I don’t have time to venture there!

Footnotes:1. See Barry Eichengreen and Ricardo Hausman (eds), Other People’s Money: Debt Denomination and Financial Instability in Emerging Market Economies, University of Chicago Press 2005, and in particular Chapter 5 by Michael Bordo et al, “How Original Sin was Overcome: the Evolution of Debt Denominated in Domestic Currencies in the United States and the British Dominions, 1800-2000”, pp.122-153.

2. On the distributional consequences of the erosion of the power of organised labour in economies where organised business interests remain powerful see, e.g., Michael Kumhof and Romain Rancièr, Inequality, Leverage and Crises, IMF Working Paper WP/10/268, November 2010,

3. See, though, Andew Coleman, “Tradables and non-tradables inflation in Australia and New Zealand”, RBNZ Bulletin 70(1): 45-53, 2007.

Geoff Bertram is an

economist and senior associate at the Institute of Policy

Studies at Victoria University. He was until June 2009 a

Senior Lecturer in Economics at Victoria. He is Director and

Research Principal, Simon Terry Associates Ltd, Wellington,

and Senior Adviser, The Brattle Group, Boston and London.

His research interests include regulation of public utility

industries such as electricity, gas and telecommunications;

economic and political development of small island societies

with a particular focus on the Pacific; the design of

policies to address climate change; and the long-run

evolution of the New Zealand economy. He has over 100

publications including more than 50 peer-reviewed journal

articles, books, and book chapters. He served on the Council

of the International Association for Energy Economics from

2005 to 2007 and convened the Association's annual

conference in Wellington in 2007. He has been a member of

the editorial boards of a number of international journals

including World Development 1992-97, Environment and

Development Economics 1996-2006, and Asia Pacific Viewpoint

since 1976. He speaks regularly at international conferences

on energy, climate change and small-island

issues.

Geoff Bertram is an

economist and senior associate at the Institute of Policy

Studies at Victoria University. He was until June 2009 a

Senior Lecturer in Economics at Victoria. He is Director and

Research Principal, Simon Terry Associates Ltd, Wellington,

and Senior Adviser, The Brattle Group, Boston and London.

His research interests include regulation of public utility

industries such as electricity, gas and telecommunications;

economic and political development of small island societies

with a particular focus on the Pacific; the design of

policies to address climate change; and the long-run

evolution of the New Zealand economy. He has over 100

publications including more than 50 peer-reviewed journal

articles, books, and book chapters. He served on the Council

of the International Association for Energy Economics from

2005 to 2007 and convened the Association's annual

conference in Wellington in 2007. He has been a member of

the editorial boards of a number of international journals

including World Development 1992-97, Environment and

Development Economics 1996-2006, and Asia Pacific Viewpoint

since 1976. He speaks regularly at international conferences

on energy, climate change and small-island

issues.

Richard S. Ehrlich: Deadly Border Feud Between Thailand & Cambodia

Richard S. Ehrlich: Deadly Border Feud Between Thailand & Cambodia Gordon Campbell: On Free Speech And Anti-Semitism

Gordon Campbell: On Free Speech And Anti-Semitism Ian Powell: The Disgrace Of The Hospice Care Funding Scandal

Ian Powell: The Disgrace Of The Hospice Care Funding Scandal Binoy Kampmark: Catching Israel Out - Gaza And The Madleen “Selfie” Protest

Binoy Kampmark: Catching Israel Out - Gaza And The Madleen “Selfie” Protest Ramzy Baroud: Gaza's 'Humanitarian' Façade - A Deceptive Ploy Unravels

Ramzy Baroud: Gaza's 'Humanitarian' Façade - A Deceptive Ploy Unravels Keith Rankin: Remembering New Zealand's Missing Tragedy

Keith Rankin: Remembering New Zealand's Missing Tragedy