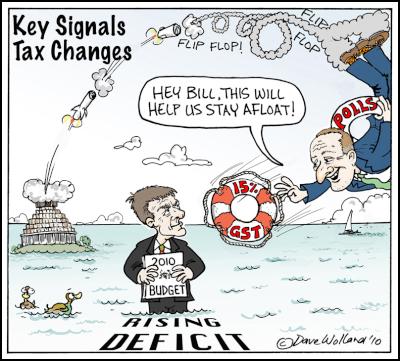

Dave Wolland: The Nat’s Tax

The Nat’s Tax

by Dave WollandMost of us probably realize that taxation is necessary to maintain our society, but I have noticed that very few of us seem to be very willing to pay any more than we need to. Tax is such a grim little word. Perhaps we should call it something like “Social Assurance Payments”. It might ease the pain if you believe that too much of your hard earned income is being sucked into the Government’s coffers and frittered away.

The collecting of taxes in New Zealand is a lot simpler these days than it used to be. When I first started working, taxation was a key part of economic and social management. It was very complex and weighted towards providing incentives and penalties in almost every part of our economy.

When the Lange led Labour Government came to power in the nineteen eighties, they did away with the labyrinth of sales taxes and set up the Goods and Services Tax (GST). It was a consumption tax that few could avoid. Various lobby groups fought hard to be excluded, but the Minister of Finance, Roger Douglas, stuck to his guns and pushed it rapidly through Parliament. He made GST cover almost everything - apart from personally owned houses.

The shift from pay as you earn (PAYE) taxes to a higher consumption tax is again on the agenda it seems. In spite of pre-election pledges not to do so, John Key appears to be signaling a likely rise in GST to 15% and compensating payments to beneficiaries in the next budget. He is well aware that GST hits poor people the hardest.

Roger Douglas is not very impressed with the Prime Minister’s suggestions. He described them as “moving the furniture around on the Titanic”. As an unashamed monetarist, he is still promoting something like a 20% flat income tax and shrinking government services to bare essentials.

I doubt if John Key will take that sort of advice. He must have seen the widespread condemnation of Don Brash’s similar monetarist solutions for the economy and knows the electorate would not wear it. Instead, he is wetting his finger and feeling which way the wind is blowing.

I would like to see him stop playing around with tax reductions. It would surely make more sense to invest in education, research and development and new business incentives. I have seen other countries, like the USA, mess around with taxes and take their eye off the ball long enough to lose the game. We do not need to join them.

ENDS

Martin LeFevre - Meditations: What Being “Inward Looking” Really Means

Martin LeFevre - Meditations: What Being “Inward Looking” Really Means Binoy Kampmark: Blinken Atrocious In A Dangerous World

Binoy Kampmark: Blinken Atrocious In A Dangerous World Jim Mikoz: Look Out Rocks … Oops Too Late

Jim Mikoz: Look Out Rocks … Oops Too Late Peter Dunne: Dunne’s Weekly - National And Labour Combine To Shut Out Greens

Peter Dunne: Dunne’s Weekly - National And Labour Combine To Shut Out Greens Ramzy Baroud: Voting Against Genocide - How Gaza Defeated The Democratic Establishment

Ramzy Baroud: Voting Against Genocide - How Gaza Defeated The Democratic Establishment  Alastair Thompson: Google's Support For Democracy And Media In NZ | Part 2

Alastair Thompson: Google's Support For Democracy And Media In NZ | Part 2