2009: The Year of the Great Vampire Squid

2009: The Year of the Great Vampire Squid

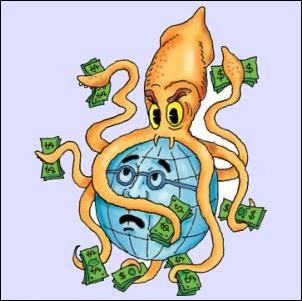

The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.

- Matt Tabbi, “Inside the Great American Bubble Machine”

The Great Vampire Squid

For years, it was hard for many of us to fathom the psychopathic nature of our financial elites, or to expand the meaning of Matt Tabbi’s marvelous description of Goldman Sachs, the great vampire squid. Squid seems a fitting name for the financial cartel that drives what I have traditionally called the Tapeworm.

There were some who saw the danger immediately and tried to warn us, like Sir James Goldsmith. There were some, like myself, who tried to prevent the housing bubble and find alternatives to investing our life savings in it.

While those efforts did not stop the squid, they certainly made it clear that the squid take down of the planet was, indeed, a plan. That’s all documented now.

The Squid Shifts the Money

I often tell the story of my meeting with a group of pension fund leaders in 1997 in which the President of the CalPERs pension fund— he largest in the country—said, “You don’t understand. It’s too late. They have given up on the country. They are moving all the money out in the fall (of 1997). They are moving it to Asia.”

Sure enough, in the fall of 1997 trillions of dollars began to shift out of North America and into the emerging markets, including Asia and China. This included over $4 trillion that went missing from the US government, which I have referred to for years as “the missing money.”

My back of the envelope estimate was that approximately $10 trillion was moved out legally and illegally between that fall of 1997 and 9-11. Given the implications to US pension funds and retirement savings, I have said for years that perhaps the most important question of our generation is where did the money go and how do we get it back?

To the squid’s credit, shifting investment from places with aging populations to places with younger, more dynamic populations makes sense. Problem is that often times the money left by sneaky means, leaving many high and dry to the benefit of the few engineering the moves. Equity owned by the many disappeared out the back door, and turned up in Asia owned by the few.

It is likely that not all the money went to Asia. There are, of course, off shore accounts for all those involved indicated by the extraordinary growth of private banking and offshore havens. It would appear that significant funds went to the black budget, including the high tech weaponry capable of providing enforcement of investment terms and conditions in foreign lands without a friendly legal infrastructure. There are also questions about space investment and whether corporate investment is not just around the globe but on other globes as well.

Squid Crime Pays

The criminality of this massive capital shift was extensive. If there was any doubt of the profound and growing influence of narco dollars, the European Union’s lawsuit against RJR (under the ownership and control of leveraged buyout firm KKR) for global money laundering in partnership with the Russian mafia, Latin American drug cartels and Saddam Hussein’s family told the tale. Economic warfare tactics were used to drain money from those we most feared, such as Russia. (See Financial Coup d’ Etat.)

The squid would justify its actions by saying that consensus in a democracy for forward thinking investment moves was not possible. The reality was that global “pumps and dumps” produced phenomenal returns. The “strong dollar policy,” made possible by the suppression of the gold price, lifted the value of the dollar while convenient “credit crisis” ensured that equity positions could be bought up cheap on the other side of the globe. The genetic reengineering of the seed supply and the industrialization of agriculture would permit central control of the most politically powerful market in the world - one that would support a global digital currency in the way that oil and gas have supported the U.S. dollar.

The US Housing and Derivatives Bubble

However, the most important source of capital was the theft of U.S. retirement savings through the engineering of the U.S. housing and debt bubbles. This involved issuing trillions of securities and derivatives, secured by shoddy or non-existent collateral, representing fraudulent inducement on a massive scale.

In the process, the great vampire squid sold trillions in fraudulently overvalued securities to US investors and pension funds as well as retail and institutional investors around the world.

The Squid Hits the Fan

In 2008, global investors finally realized that they had been stuck with fraudulently issued securities by the great vampire squid. The nature of the collateral fraud and questionable practices in the US mortgage and derivatives markets had been understood. However, millions of investors assumed the squid could be counted on to maintain the global ponzi scheme.

By early 2009, the squid was facing a global financial bloodbath that could potentially cook them into little bits of calamari. Those stuck with bum paper were threatening to pull their money out of the squid and worse.

The squid panicked.

Best

Investment Performance of 2009: $1 Billion to Elect Obama

Riding to the rescue was Barack Obama. Based on what was clearly extensive domestic and global profiling, the great vampire squid spent approximately $1 billion (and likely more covertly) to get Obama elected in November 2008 and adored globally. The squid’s returns make this the single best performing investment of 2009 and the decade, if not the last century.

Bloomberg recently announced that gold was the best performing investment for the decade. They failed to mention that gold’s near 400% rise of the decade could not compare to the exponential multiplication achieved in a much shorter period by the squid’s financing their Presidential candidate into the White House. Electing a Harvard lawyer who inspired the hopes and dreams of those who had been most brutally drained by the housing bubble and drug wars clearly was a stroke of financial genius. While gold had passed the $1,200 per oz. level before the end of the 2009, it’s performance still did not compare to the $10,000 plus per oz. the squid was realizing on the opium flowing from the fields in Afghanistan.

This is not in any way to diminish the importance of the squid’s investment in governmental and private intelligence agencies. However, at times like this, you can’t kill everyone. Although, we admit that there were moments in 2009 when it started to look like someone was trying. (See 1, 2, 3, 4, 5, 6, 7)

From the revolutionary war through 2009, the U.S. government accumulated $12 trillion in debt. And then in one year, President elect and President Obama restored to office the very people who had engineered the fraud. With the squid’s preferred team in place in the White House, at the US Treasury and at the Department of Defense, President Obama lead the gifting and lending of an additional $12 Trillion to the great vampire squid.

Let me underscore the enormity of this number again. An amount equivalent to all the debt we had accumulated in 252 years and numerous wars, we gave or lent to the squid in one year.

And so it was that the banks of Europe were relieved of their fraudulent paper while the Federal Reserve balance sheet ballooned with toxic assets. No doubt in profound gratitude and appreciation for President Obama’s extraordinary political achievement, a grateful Europe bestowed upon him the Nobel Peace Prize.

In the meantime, with strong support from Federal Reserve and U.S Treasury, the great vampire squid was able to engineer extraordinary profits on high-risk speculative investments, sufficient to “pay back” bailout loans and pay their leaders huge and hideous year-end bonuses.

The Squid to Main Street: “Drop Dead!”

Capital it would seem is available only for squid speculation. The real economy is a source of capital for the squid. It is no longer a use of capital. Hence, drain on communities and the failure to reinvest in serious innovation and long term U.S. growth accelerated during 2009.

The political reality is that the U.S. government is deeply dependent on the squid to finance growing deficits, and engineer global economic warfare and manage markets in the precious metals, oil, commodities and financial markets. So with U.S. unemployment over 10% (says the government) or 20% (says John Williams at www.shadowstats.com, a far more reliable source) and significant unemployment around the globe, the great vampire squid could care less what the man in the street thinks. As Dick Cheney said about deficits, “they don’t matter.”

The Squid Bottom Line

In 2009, the great vampire squid finished engineering the single greatest financial shift in the history of the planet. It took two decades and constituted a financial coup d’ etat. Even our hero Congresswoman Kaptur said so.

The year finished with the squid congratulating themselves and paying its members richly for a “job well done.”

Without a doubt, 2009 was the year of the great vampire squid.

The Good News

The good news is that those of you who took to heart the risks and opportunities we discussed in our 2008: Looking Back did a good job of evading the squid. You were energized by the opportunities and not drained by events. I have been heartened throughout the year by your efforts and success stories. Our goal is to help you continue to do so. Indeed, the more who do, the greater the opportunity for us all.

In this week’s Solari Report (Thursday, January 7th), I’m doing my year-end wrap-up looking back at events in 2009 and discussing what they mean to our future. Here are some of the topics I will cover.

- 2009: The Year of the Great Vampire Squid

- 2010: The Road Turns East

- The Grand Chessboard

- USA: The Grinding of the Gears

- Cartel Watch, including Swine Flu, Health Reform, Cap & Trade and Food Safety

- Navigating Markets

- Family and Community Wealth

- Risks and Wildcards

- Opportunities

If you would like to learn more about The Solari Report and subscribe, click here. To sign up for our Solari Report Digest, click here. Subscribers access our full archive of mp3 files.

This week’s Money & Markets Charts will be for the full year and will be part of a special annual review published for subscribers following this week’s Solari Report.

Mapping

The Real Deal is a column on Scoop supervised by

Catherine Austin Fitts. Ms Fitts is the President of Solari,

Inc.

http://www.solari.com/. Ms. Fitts is the former

Assistant Secretary of Housing-Federal Housing Commissioner

during the first Bush Administration, a former managing

director and member of the board of directors of Dillon Read

“ Co. Inc. and President of The Hamilton Securities Group,

Inc.

Mapping

The Real Deal is a column on Scoop supervised by

Catherine Austin Fitts. Ms Fitts is the President of Solari,

Inc.

http://www.solari.com/. Ms. Fitts is the former

Assistant Secretary of Housing-Federal Housing Commissioner

during the first Bush Administration, a former managing

director and member of the board of directors of Dillon Read

“ Co. Inc. and President of The Hamilton Securities Group,

Inc.

Keith Rankin: Equity Rights - UBI, SUI, BUI, HUI, Or GUI?

Keith Rankin: Equity Rights - UBI, SUI, BUI, HUI, Or GUI? Binoy Kampmark: The Inevitable Souring - Elon Musk Falls Out With Donald Trump

Binoy Kampmark: The Inevitable Souring - Elon Musk Falls Out With Donald Trump Ian Powell: Postscript On Ethnic Cleansing, Genocide And New Zealand Recognition Of Palestine

Ian Powell: Postscript On Ethnic Cleansing, Genocide And New Zealand Recognition Of Palestine Gordon Campbell: On Why Leakers Are Essential To The Public Good

Gordon Campbell: On Why Leakers Are Essential To The Public Good Ramzy Baroud: Global Backlash - How The World Could Shift Israel's Gaza Strategy

Ramzy Baroud: Global Backlash - How The World Could Shift Israel's Gaza Strategy DC Harding: In The Spirit Of Natural Justice

DC Harding: In The Spirit Of Natural Justice