Catherine Austin Fitts: NZ Banking System Overview

A Solari Report on New Zealand Banking

by Carolyn Betts and Catherine Austin Fitts

New Zealand Banking System Overview

New Zealand banks and non-bank

deposit-taking institutions are registered, supervised and

monitored for compliance with New Zealand banking

supervision policies by the Reserve Bank of New Zealand (“Reserve

Bank”).

New Zealand banks and non-bank

deposit-taking institutions are registered, supervised and

monitored for compliance with New Zealand banking

supervision policies by the Reserve Bank of New Zealand (“Reserve

Bank”).

The Reserve Bank’s supervisory

authority over banks arises under fairly recent

legislation—the Reserve Bank of New Zealand Act 1989

(“1989 Act”). Even more recent legislation, adopted

since the start of the current worldwide recession

(effective September, 2008), gives the Reserve Bank

regulatory authority over “non-bank deposit takers,”

which include companies that issue debt securities to the

public and:

• are engaged in borrowing and lending money or

• providing financial services.

New Zealand, like the United States and most countries that have banks doing significant business internationally, is a signatory of the Basel Accord put forth by the Basel Committee on Banking Supervision, which sets forth a framework for determining bank capital requirements based upon the risk of the bank’s assets. Under the current Basel II capital adequacy framework, bank capital is set at 8% of risk-weighted assets. Under this framework, higher-risk assets are weighted more heavily (i.e., require more capital) than are lower-risk assets.

The four largest banks in New

Zealand according to asset size, accounting for 80% of New

Zealand bank assets (ANZ, Bank of New Zealand, Westpac and ASB) have been accredited by the Reserve

Bank to calculate their required minimum capital under Basel

II under the “internal model,” which allows the banks to

adjust their methodology for calculating risk-based capital

to more closely align with their individual risk profiles.

Under the IM methodology adopted by the Reserve Bank, 87% of

risk weighting adjusts for credit (borrower-related) risk,

while 8% is due to operational (bank internal and external

factors) risk and 5% is due to market (trading) risk. For

more information on this subject, see the Reserve Bank of New Zealand Bulletin,

September 2009.

The four largest banks in New

Zealand according to asset size, accounting for 80% of New

Zealand bank assets (ANZ, Bank of New Zealand, Westpac and ASB) have been accredited by the Reserve

Bank to calculate their required minimum capital under Basel

II under the “internal model,” which allows the banks to

adjust their methodology for calculating risk-based capital

to more closely align with their individual risk profiles.

Under the IM methodology adopted by the Reserve Bank, 87% of

risk weighting adjusts for credit (borrower-related) risk,

while 8% is due to operational (bank internal and external

factors) risk and 5% is due to market (trading) risk. For

more information on this subject, see the Reserve Bank of New Zealand Bulletin,

September 2009.

According to the Reserve Bank, its capital standards are conservative by international standards. Consistent with this observation is the fact that since 2001, two New Zealand Banks (Westpac 2001–2007 and ANZ 2007-08) have been ranked as the most sustainable banks in the world according to the Dow Jones Sustainability Index. An IMF working paper “New Zealand Bank Vulnerabilities in International Perspective” published in October 2009 summarizes the authors’ findings on the vulnerabilities of the New Zealand banking system as follows:

The global financial crisis is creating stress on banking systems across the world through funding and asset quality shocks. This paper combines different stress scenarios, as well as cross-country analysis, to assess New Zealand bank vulnerabilities to the global crisis and the domestic recession. It finds that a sharp worsening of asset quality would be required to reduce bank capital below the regulatory minimum. On the funding side, a disruption to banks’ offshore funding may put pressure on the exchange rate, but would not trigger a systemic liquidity problem. See: IMF Working Paper: New Zealand Bank Vulnerabilities in International Perspective.

Unlike the central bank in the United States, which is privately owed by member banks, the Reserve Bank is 100% owned by the government of New Zealand. Initially privately owned, the bank was nationalized in 1935. Proposals have existed to integrate the New Zealand and Australian bank regulation systems, but they were not adopted. Nevertheless, Section 68 of the 1989 Act requires the Reserve Bank to support Australian authorities in pursuit of Australian financial stability and, “where reasonably practicable” to avoid actions that might be detrimental to Australian financial stability. On December 2, 2009 the Reserve Bank announced it wasconducting discussions with the New Zealand Exchange for the joint provision of clearing and settlement functions.

Quarterly disclosure requirements for New Zealand-registered banks are set forth in four “Orders of Council” also referred to as disclosure statement orders (see item 15.) In compliance with these orders, banks in New Zealand make available to the public various detailed disclosures, which are generally available on their websites.

New Zealand Registered Banks

Nineteen banks are registered with the Reserve Bank, but ten of these are branch banks of the following foreign banks:

• Australia and New Zealand Banking Group

• Bank of Tokyo-Mitsubishi UFJ

• Citibank NA

• Commonwealth Bank of Australia

• Deutsche Bank A G

• JPMorgan Chase

• Kookmin Bank

• Hongkong and Shanghai Banking Corp.

• Robobank Nederaland

• Westpac Banking Corporation

Of the remainder, six are owned by foreign banks or otherwise part of foreign banking conglomerates:

• ANZ National Bank Limited—NZD 121.896B total assets—after merging with National Bank of New Zealand, became the largest bank in New Zealand with a 40% market share. It is owned by Commonwealth Bank, of Australia.

• Bank of New Zealand—NZD 70.175B total assets, formerly owned by Lloyds of England, is now a subsidiary of the National Bank of Australia. Bank of New Zealand is the banker to the New Zealand government and operates under the name Bank of New Zealand in Singapore. A New Zealand Herald article in September, 2009 reported rumors of a split-off of the New Zealand assets of the bank into a separate, NZ exchange-listed New Zealand bank with assets of more than $3.5B.

• ASB Bank Limited—NZD 62.239B total assets

• Westpac New Zealand Limited—NZD 54.584B total assets Westpac is the second largest New Zealand-incorporated bank.

• Rabobank New Zealand Limited—NZD 6.582B total assets is owned by the Dutch Rabobank, a triple-A-rated food- and agriculture-focused international bank founded in 1898 that operates on coop principles.

• Bank of Baroda (New Zealand) Limited—unknown total assets—is a newly formed and newly registered New Zealand subsidiary of a $50B Indian bank.

This leaves three registered New Zealand banks that are not owned by or branches of foreign banks:

• Kiwibank Limited (est. 2002)—NZD 10.371B total assets Kiwibank is owned by New Zealand Postal Ltd., the New Zealand post office, and has branches in some 600 “postshops.” It was formed as a result of a resistance movement against increasing foreign ownership of New Zealand banks, a phenomenon that started to occur following deregulation of the New Zealand financial sector when the Labour government was voted into power in 1984.

• TSB Bank Limited (Taranaki Savings Bank, est. 1850)–NZD 3.924B total assets. TSB Bank advertises that it is 100% New Zealand-owned.

• Southland Building Society (est. 1869)—NZD—2.565B total assets.

See G1 Information Extracted From the Key Information Summaries of Locally Incorporated Banks for key information summaries of New Zealand-incorporated banks.

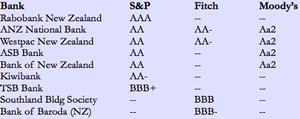

New Zealand Bank Ratings

See List of Registered Banks in New Zealand for detailed ratings of all New Zealand registered banks by Standard & Poor’s, Fitch and Moody’s ratings services and links to web pages of each registered bank.

Following is a summary of such ratings for New Zealand-incorporated registered banks:

In a New Zealand Herald

article in September, 2009, a managing director of the Bank

of New Zealand is quoted as saying that although banks

operating in New Zealand are less leveraged than are

overseas banks, they have become heavily reliant on overseas

funding.

In a New Zealand Herald

article in September, 2009, a managing director of the Bank

of New Zealand is quoted as saying that although banks

operating in New Zealand are less leveraged than are

overseas banks, they have become heavily reliant on overseas

funding.

In 1990, New Zealand had $10 billion in overseas funding, according to the Reserve Bank’s financial stability report. By 2000, that had grown to $65 billion and last year it stood at $130 billion, he said. See NZ Herald article.

In a 2005 address, Alan Bollard, Governor of the Reserve Bank said that foreign banks then owned 98 per cent of New Zealand banking system assets, with 85 per cent being Australian-owned, making the New Zealand financial system particularly vulnerable to external economic forces. See Background to Reserve Bank Consent to ANZ/National Bank Amalgamation for more information on the Reserve Bank’s policies on foreign ownership of New Zealand banks.

Deposit Insurance

Before October 2008, New Zealand banks had not been covered by government-provided deposit insurance. Some foreign-owned banks had and have private deposit insurance provided by their foreign affiliates for some types of accounts and securities. In October 2008, in response to the turbulence in the international financial markets, the Treasury of New Zealand announced that it would provide an opt-in Crown-guaranteed deposit guarantee scheme covering retail deposits in New Zealand registered banks. This initial plan expires October 12, 2010.

All New Zealand-incorporated banks except the newly created Bank of Baroda New Zealand have opted in to this deposit insurance, at least for retail bank accounts.

Non-bank deposit takers and collective investment schemes are also eligible for coverage. Since what investments are covered will vary from institution to institution, investors in bank debt securities are advised to consult the investment statements or prospectuses required for such investments as to whether their investments are covered by Crown deposit insurance. Participating institutions are listed at the New Zealand Government Treasury website.

Under the initial retail deposit insurance plan, eligible depositors in eligible accounts are guaranteed up to $NZD 500,000 per depositor per bank (non-bank deposit-taking institutions being covered only up to $NZD 250,000). Eligible deposits include deposits, term deposits, current accounts, bonds, bank bills and debentures. Subordinated debt is not covered. All depositors are eligible depositors except financial institutions, related parties to them those acting as trustees for either. The guarantee covers principal and interests due up to the date of default. Unlike deposit insurance in some countries (Canada, for example), retail debt securities denominated in foreign currency and issued by financial institutions participating in the extended guarantee scheme will be guaranteed under the Crown guarantee in the same way as deposits denominated in New Zealand dollars. The amount guaranteed will be the New Zealand dollar equivalent of the foreign currency amount. [see depositor Q&A the New Zealand Government Treasury website.

The New Zealand government announced on August 25, 2009 that it would extend the retail deposit guarantee scheme to December 31, 2011 and change some of its terms and conditions. Among the changes is that collective investment schemes (such as portfolio investment entities [PIEs], unit trusts and superannuation schemes) are not eligible for the extended guarantee scheme. For the extension period, banks will be permitted to offer both guaranteed and non-guaranteed accounts.

Term Deposits for Non-New Zealanders

New Zealand-incorporated banks generally will open foreign investment accounts for non-citizens of New Zealand, but a majority require that the customer actually be physically present himself or herself at a branch of the bank in New Zealand before withdrawing deposited funds. A customer opening an account the banks that have no such requirement must provide original copies of identification documents (passport or driver’s license) notarized or certified by a notary or attorney to the bank in New Zealand.

Mapping

The Real Deal is a column on Scoop supervised by

Catherine Austin Fitts. Ms Fitts is the President of Solari,

Inc.

http://www.solari.com/. Ms. Fitts is the former

Assistant Secretary of Housing-Federal Housing Commissioner

during the first Bush Administration, a former managing

director and member of the board of directors of Dillon Read

“ Co. Inc. and President of The Hamilton Securities Group,

Inc.

Mapping

The Real Deal is a column on Scoop supervised by

Catherine Austin Fitts. Ms Fitts is the President of Solari,

Inc.

http://www.solari.com/. Ms. Fitts is the former

Assistant Secretary of Housing-Federal Housing Commissioner

during the first Bush Administration, a former managing

director and member of the board of directors of Dillon Read

“ Co. Inc. and President of The Hamilton Securities Group,

Inc.

Richard S. Ehrlich: China's Great Wall & Egypt's Pyramids

Richard S. Ehrlich: China's Great Wall & Egypt's Pyramids Gordon Campbell: On Surviving Trump’s Trip To La La Land

Gordon Campbell: On Surviving Trump’s Trip To La La Land Ramzy Baroud: Famine In Gaza - Will We Continue To Watch As Gaza Starves To Death?

Ramzy Baroud: Famine In Gaza - Will We Continue To Watch As Gaza Starves To Death? Peter Dunne: Dunne's Weekly - A Government Backbencher's Lot Not Always A Happy One

Peter Dunne: Dunne's Weekly - A Government Backbencher's Lot Not Always A Happy One Richard S. Ehrlich: Cyber-Spying 'From Lhasa To London' & Tibet Flexing

Richard S. Ehrlich: Cyber-Spying 'From Lhasa To London' & Tibet Flexing Gordon Campbell: On Aussie Election Aftershocks And Life Lessons

Gordon Campbell: On Aussie Election Aftershocks And Life Lessons