THROW THE BUMS OUT - ALL OF THEM

Senate

Millionaires Kill Mortgage Assistance for

Citizens

By Michael Collins

The United States Senate took a swipe at the spirit of May Day in a spectacular show of callous indifference when it voted down a bill to provide limited assistance to citizens at risk for losing their homes. The final vote was 45 in favor, 51 opposed to Senator Richard Durbin's (D-IL) mortgage assistance bill. The original version of the bill covered some but not all of those requiring assistance. The final version was even more restricted. It applied to only homeowners currently in foreclosure as a result of actions prior to the start of 2009.

The denial of assistance to citizens by Senators is ironic given the fact that the origins of the current economic crisis came from Senate legislative actions in 1999 and 2000.

While their avarice knows no bounds, their memory suffers.

Apparently these multimillionaire aristocrats of the Senate "gentlemen's club" haven't been watching the news. The International Monetary Fund declared that the United States is in a depression almost three months ago. Delinquency and foreclosure rates around the country are rising at spectacular rates. Unemployment has jumped by 3.3 million in the last five months. Economic growth has declined at a rate of 6.3% in the first quarter of 2009.

What part of economic crisis can't they understand? Apparently all of it.

Memo to stingy Senators: Workers and their families are in serious trouble or about to be in trouble. That means they lack the money to pay for their homes (also known as shelter, a basic human need). These citizens did nothing to bring on this crisis.

You, the members of the Senate, are largely to blame and you know it.

One of the most

revealing remarks came from Democrat Ben Nelson (D-NE) who

said:

“Do I want to have my rate go up so that somebody

else might be able to cram down” their mortgage payment?"

asked Sen. Ben Nelson, D-Neb., who voted against the bill.

Associated Press, Apr. 30,

2009

Nelson has never been regarded as the sharpest

tool in the shed but he's set a new standard for ignorance

with this remark. Nelson was worth at least $7.0 million as of reporting in

2008. Obviously he needs to skimp on every penny to stay

afloat. He'll offer no breaks for financially strapped

citizens on the brink of ruin even if they are in trouble as

a result of his support of Wall Street welfare. The bill

would have no impact on his or anybody else's mortgage rate

unless they qualified for help. In those cases, the rate

would go down.

The Durbin bill offered a reasonable change in bankruptcy law that would allow those in foreclosure to ask (simply ask) bankruptcy judges to invoke a "cramdown." In that process, the bankruptcy court would set a lower interest rates and longer terms on loans. This takes the case out of foreclosure and allows citizens to keep their homes and the lets banks collect the money owed at a lower rate over an extended period. (See this for a real cramdown to benefit all citizens)

The Durbin bill provided limited options since it presumed that homeowners at risk had the money to get in bankruptcy court; that the courts would be able to handle all those in need; and that the judge would accept the request for a cramdown to keep people in their homes. But the bill might have helped as many as 1.7 million homeowners.

Even with those limitations, Sen. Durbin was forced against the wall and had to negotiate the bill to a lower level of protection. The final bill rejected by the Senate. Associated Press reported: "The latest proposal would have restricted eligibility to homeowners already in foreclosure whose lender had not offered better terms. Homes would also have to be worth less than $729,000 and apply to mortgage loans originated before 2009." Apr 30, 2009

Durbin's last stand would have provided protection some homeowners but no there's now protection for anyone.

William K. Black is the chief fraud

investigator who untangled the 1980's Savings and Loan

fiasco. His comments on the current economic meltdown are

instructive and assign blame:

William K. Black: 'We need

some chairmen or chairwomen … in Congress, to hold the

necessary hearings (on banking fraud) and we can blast this

out. But if you leave the failed CEOs in place, it isn't

just that they're terrible business people, though they are.

It isn't just that they lack integrity, though they do.

Because they were engaged in these frauds … they're not

going to disclose the truth about the assets." Bill Moyers Journal, Apr 3,

2009

Senators, you allowed changes in banking

regulations that turned Wall Street in to a big casino for

the "in crowd" and wiped out millions of small investors and

retirement funds.

You failed to monitor the new freedoms you gave the banks and Wall Street after you stripped away citizen protections in law since the Great Depression.

You created the current depression.

And now, you're so stingy you won't even help a few of the many people victimized by the massive corporate fraud schemes, Ponzi schemes according to Black.

Is there any reason why even one single Senator of the 51 who voted down this assistance should remain in office to complete his or her term?

Is there any reason to hold back from recalling them where allowed or demanding their resignations in every state that they represent?

I can't think of one. Can you?

Permission to reproduce this article in whole or part with attribution of authorship to Michael Collins and a link to this article

Hall of Shame

The votes lined up in the

usual way, with the majority of citizens losing out on

positive action. Of note, the "moderate" Republicans

Collins and Snow of Maine both opposed the bill. The new

Senator from Montana, Democrat Tester, voted no. And

Democrat "changling" Specter said no also.

Things to Come

See: Too Little Too Late - The Money Party at

Work Feb. 18, 2009

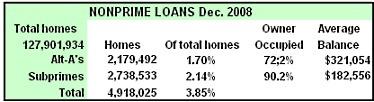

There are 4.9 million Alt-A and

subprime loans. Alt-A's are loans to those with higher

credit ratings that have special introductory features.

Subprimes are loans to people with marginal credit.

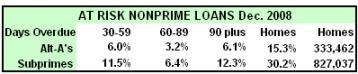

15% of Alt-A loans were at risk

in at the start of the year. 30% of subprimes were at

risk.

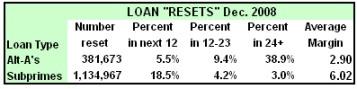

A majority of Alt-A loans will

"reset," increase interest, in the next 2 plus years. 25%

of subprimes will do the same at a much higher rate. That

spells disaster since the "resets" are a major trigger for

bankruptcy.

http://img.photobucket.com/albums/v474/autorank/Articles/np2.jpg

Some

Resources

Bill Moyers Journal - Interview with William K Black Bill Moyers Journal, Apr 3, 2009 (Transcripts: PBS pdf Word.doc)

Stiglitz: Capitalist Fools (Essential

Reading"

Economic Disaster -- Are You Next? Feb. 5,

2009

Too Little Too Late - The Money Party at

Work Feb. 18, 2009

Enough of Everything But Dollars Mar. 2,

2009

Enabling Acts for an Era of Greed - The

Money Party at Work Apr. 14, 2009

Keith Rankin: Make Deficits Great Again - Maintaining A Pragmatic Balance

Keith Rankin: Make Deficits Great Again - Maintaining A Pragmatic Balance Richard S. Ehrlich: China's Great Wall & Egypt's Pyramids

Richard S. Ehrlich: China's Great Wall & Egypt's Pyramids Gordon Campbell: On Surviving Trump’s Trip To La La Land

Gordon Campbell: On Surviving Trump’s Trip To La La Land Ramzy Baroud: Famine In Gaza - Will We Continue To Watch As Gaza Starves To Death?

Ramzy Baroud: Famine In Gaza - Will We Continue To Watch As Gaza Starves To Death? Peter Dunne: Dunne's Weekly - A Government Backbencher's Lot Not Always A Happy One

Peter Dunne: Dunne's Weekly - A Government Backbencher's Lot Not Always A Happy One Richard S. Ehrlich: Cyber-Spying 'From Lhasa To London' & Tibet Flexing

Richard S. Ehrlich: Cyber-Spying 'From Lhasa To London' & Tibet Flexing