Too Little Too Late?

The Money Party at Work

Wash. DC, Feb. 19 -- President Obama announced a $75 billion assistance package to address home foreclosures yesterday. He also promised a $200 billion infusion into Freddie Mac and Fannie Mae, the nation's underlying lenders. That's exactly $275 billion more dollars than the previous administration committed to citizens to help ease their very human crises surrounding foreclosure.

Is this enough to stem the tide for those losing their homes? Will those "who have played by the rules," as Obama calls them, be salvaged the indignities and financial oblivion that begin in earnest if they're thrown onto the street? Or will those who broke all the rules profit immeasurably?

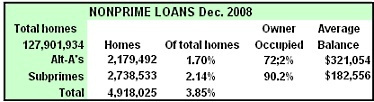

In order to understand the current situation, it's necessary to take a hard look at some really ugly numbers from 2008 summarizing the "nonprime" home lending situation. (The data in this article is from Federal Reserve Bank of New York Dec. 2008 summary of "nonprime" lending).

The nonprime home lending market consists of 2.2 million "Alt-A" home loans to those with good credit who chose "innovative" adjustable rate mortgages plus 2.7 million subprime home loans to those with marginal credit who, often times, used funds to purchase a first home. The total 4.9 million nonprime loans were used to purchase homes that house around 12 to 15 million people.

The total balance due for the five million "nonprime" loans is $1.2 trillion as of December 2008. The loans at risk (60 days overdue) have a balance due of $160 billion (40% for Alt-A's, 60% for subprimes). Preserving home ownership for those at risk in just the nonprime financed homes will eat up the proposed $75 billion package and reduce the Fannie-Freddie funding increase from $200 to $115 billion dollars.

That presumes every cent pledged today was used for these 714,000 loans. What about the six million additional home foreclosures anticipated over the next two years? More will be needed or a comprehensive approach like a national cramdown may gain the attention of our public servants.

To understand how the future will look, let's examine what happened in the nonprime market in 2008. The following graph shows the risk in just the nonprime loans. Traditional fixed interest loans are less vulnerable at the moment but when GM and Chrysler implode and as small businesses disappear, traditional loans will show up at risk in droves.

The nonprime lone market has 1.2 million loans at risk of entering foreclosure due to substantial arrears in payment. What will change to allow these people to catch up? There's no credit line left, in most cases, and no room for a "second" in a home loan where the current value is less than the loan value.

If anyone tells you that we're finished with the "subprime" crisis, recall these figures above. Over 800,000 subprime loan holders are currently at substantial risk for defaults and foreclosure.

The next wave of loan defaults and eviction risks will come from the Alt-A loans. They are, "typically higher-balance loans made to borrowers who might have past credit problems-but not severe enough to drop them into subprime territory--or who, for some reason (such as a desire not to document income) chose not to obtain a prime mortgage" (NY Federal Reserve) These are often borrowers who took Alan Greenspan's 2004 advice seriously when he pitched borrowing through a "mortgage product alternative," (e.g., ARMs), take some cash out, and spend that money (all to "help" the economy).

Small business owners, professionals, and corporate employees from generation X forward used the ARMs, and interest only loans to move into more suitable homes. Why not? Home prices were increasing exponentially. It looked like a good investment. And "the man" Greenspan said so.

The advice and loan programs have turned sour and many are now trapped in loans that will soon change dramatically. In the first few years of an Alt-A or subprimes, interest rates are kept low. In fact, some loans allowed substantially reduced "interest only" payments. It was all about getting people in homes to fuel a housing boom. The "affordability" of new homes pushed the market up in general and created artificial wealth. Now the party is over and these Arthur Geeenspan specials are "resetting."

When a nonprime loan "resets," it adds an average of three to six points to the loan payment for Alt-A's and subprimes respectively. It's quite a shock.

"Average Margin" is a specified amount added to the

rate of the mortgage when it "resets" a few years into the loan.

This chart shows the percent of nonprimes resetting in the coming years. In 2009, 630,000 combined nonprime loans will reset to a substantially higher interest, 320,000 in 2010. By 2011, all but 3% the subprimes will have reset. However, starting in 2011, nearly 40% of the Alt-A's, 850,000 in all, are scheduled to reset. Families and individuals in these homes will have a home loan well over the assessed home value and a substantial increase in interest payments. They'll be in a recession economy.

The loss of homes is not the sole manifestation of rampant fiscal mismanagement and systemic corruption. It's a symptom of an economy going in to a steep decline after years of looting by insiders.

Why are we going through all of these gyrations and special programs to prop up a financial system that clearly created this exposure with full knowledge of the substantial risks? Why are we diverting funds to cover bad loans by U.S. banks and bad investments in securities based on those loans by financial interests overseas?

A partial answer is that the U.S. banks that knowingly made these bad loans must be preserved and have their investments preserved. Overseas banks and others who invested in special stock offerings based on this high risk housing bubble must see their investments preserved in some profitable form. (See the next installment of "The Money Party at Work" for a broader explanation.)

We may not know how this crisis will end but it's clear how it started. Despite warnings from some of the most respected housing experts in the public and private sector, the die was cast by failed financial guru and Wall Street promoter Alan Greenspan in 2004 when he offered uncharacteristically clear advice to home buyers.

From Money Party to Citizens: Drop Dead! Feb.1, 2008

In 2004, Greenspan told a credit union association crowd that "the refinancing phenomenon" had been supportive for the economy and that the use of home equity "helped cushion" declining stock prices. Then Greenspan showed his supposed genius with this advice to home buyers and owners:

"American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage. To the degree that households are driven by fears of payment shocks but are willing to manage their own interest rate risks, the traditional fixed-rate mortgage may be an expensive method of financing a home." Understanding household debt obligations, Federal Reserve Board, Feb. 23, 2004

This article may be reproduced in whole or in part with attribution of authorship and a link to this article.

Information

Sources:

The Federal Reserve Bank of New York

Nonprime Loans Dec. 2008

Subprime Home Loan Market as of Dec. 2008 xls

Alt-A Home Loan Market as of Dec. 2008 xls

Interactive Maps of Loan Status Data by Zip, County, State, Nation

Binoy Kampmark: Bratty Royal - Prince Harry And Bespoke Security Protection

Binoy Kampmark: Bratty Royal - Prince Harry And Bespoke Security Protection Keith Rankin: Make Deficits Great Again - Maintaining A Pragmatic Balance

Keith Rankin: Make Deficits Great Again - Maintaining A Pragmatic Balance Richard S. Ehrlich: China's Great Wall & Egypt's Pyramids

Richard S. Ehrlich: China's Great Wall & Egypt's Pyramids Gordon Campbell: On Surviving Trump’s Trip To La La Land

Gordon Campbell: On Surviving Trump’s Trip To La La Land Ramzy Baroud: Famine In Gaza - Will We Continue To Watch As Gaza Starves To Death?

Ramzy Baroud: Famine In Gaza - Will We Continue To Watch As Gaza Starves To Death? Peter Dunne: Dunne's Weekly - A Government Backbencher's Lot Not Always A Happy One

Peter Dunne: Dunne's Weekly - A Government Backbencher's Lot Not Always A Happy One