Graphs Predicted the US Economic Crisis

Graphs Predicted the US Economic Crisis

by Dan Lieberman

Alternative Insight

A few graphed statistics, which charted the direction of the U.S. economy during the last years, predicted an eventual economic crisis.

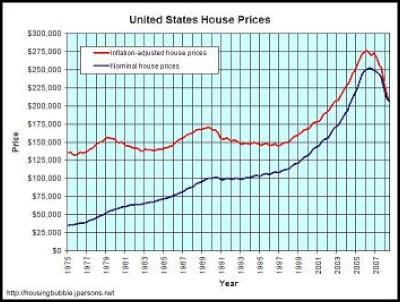

The average increase of housing prices adjusted for inflation (red curve) rose slowly until about 1999. Its dramatic rise indicates an equally dramatic readjustment still has a way to go.

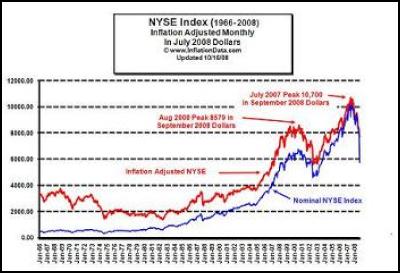

The average increase of stock prices adjusted for inflation rose slowly until about 1995. Its dramatic rise indicates an equally dramatic readjustment still has a way to go.

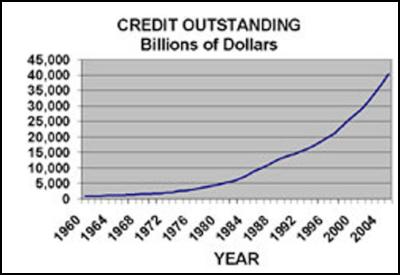

The abrupt rise in

credit, due to lax credit restrictions, fueled the housing

bubble and the rapid increases in Gross National Product.

Both followed similar trends. The steep slow of the curves

indicates the trends are not sustainable.

Data from U.S. Department of Commerce, Bureau of Economic Analysis.

The future of the U.S. might follow past occurrences where disinflation leading to deflation were eventually overcome by wartime inflation. The U.S. Rate of Inflation increased greatly during wartime periods of WWI, WWII, Korean War and Vietnam War. It has not increased during the engagements in Iraq and Afghanistan (not shown).

The militaristic and totalitarian nations of Germany, Italy and Japan emerged more quickly from the Great Depression.

The statistics told the story and are still telling it.

Will the US follow a pattern by which it becomes totalitarian and more militaristic in order to emerge from a depression? Hopefully Obama's team will read the charts with more ability and conviction.

Dan Lieberman is the editor of Alternative Insight, a monthly web based

newsletter.

Dan has written many articles on national

issues, which have circulated on websites and media

throughout the world. He can be reached at alternativeinsight@earthlink.net

Keith Rankin: Zero-Sum Fiscal Narratives

Keith Rankin: Zero-Sum Fiscal Narratives Eugene Doyle: Chinese Jet Shoots Down France’s Best Fighter; NZ And Australia Should Pay Attention

Eugene Doyle: Chinese Jet Shoots Down France’s Best Fighter; NZ And Australia Should Pay Attention Ian Powell: “I Can Confirm They Are Hypotheticals Drawn Largely From Anecdotes And Issues The Minister Has Heard About.”

Ian Powell: “I Can Confirm They Are Hypotheticals Drawn Largely From Anecdotes And Issues The Minister Has Heard About.” Gordon Campbell: On NZ’s Silence Over Gaza, And Creeping Health Privatisation

Gordon Campbell: On NZ’s Silence Over Gaza, And Creeping Health Privatisation Richard S. Ehrlich: Pakistan & China Down 6 Indian Warplanes

Richard S. Ehrlich: Pakistan & China Down 6 Indian Warplanes Keith Rankin: War In Sudan

Keith Rankin: War In Sudan