Freddie and Fannie Become Penny Stocks

Freddie and Fannie Become Penny Stocks

An Analysis by Catherine Austin Fitts

Originally published in our Blog in seven parts (I) (II) (III) (IV) (V) (VI) (VII)

Everybody knows that the boat is leaking

Everybody knows that the captain lied

Everybody got this broken feeling

Like their father or their dog just died

- Leonard Cohen

Part I

Overwhelming American communities with mortgage, auto and credit card debt as we shift manufacturing and research capacity, jobs and approximately $10 trillion of capital offshore-much of it by illegal means-has been the US economic strategy since 1996.

This was a strategy that depended on massive government spending and market intervention. It was intentionally designed to leave us where we are now. There clearly is a plan. I am not privy too it. However, what is happening is not an accident. The people who run the world are plenty smart. Originating a great deal more debt than anyone could carry, let alone pay back always ends in failure and bankruptcy of someone or something. So Fannie and Freddie's failure or nationalization was always in the cards - it was a matter of when.

If your goal is total centralized control, this is a great way to achieve it. Between Freddie, Fannie, Ginnie Mae, FHA, VA and the Federal Home Loan Bank Board, the federal government no longer regulates or provides credit to the residential mortgage market - it is the market.

Combined with the digitization of the mortgage credit scoring, origination and servicing process, the implications for privacy and personal freedom are simply stupefying. And the best part is that this can be described as the government "helping."

I have described the fundamental US strategy on numerous occasions over the years. It was my misfortune to try to propose an alternative strategy. When that made me a target of a legal and economic "hit," I attempted to warn people of the dangers. Those who heeded those warnings avoided direct harm from the burst in the housing bubble, including the drop in Freddie and Fannie shares to penny stocks. While living with the horror and grief of realizing that most would not heed those warnings, I concluded that we were experiencing a financial coup d'etat.

Here is a sample of pieces that I have written which describe the intentional lack of sustainability in the US mortgage market and economy: The Story of Edgewood Technology Services (Oct 1999)

- The Hamilton Litigation (Dec 1999)

- The Myth of the Rule of Law (Nov 2001)

- Personal Experience with FHA-HUD (June 2003)

- America's Black Budget and Manipulation of Mortgage and Financial Markets (May 2004)

- Dillon, Read “ Co. Inc. and the Aristocracy of Stock Profits (April 2006)

- The Housing and Economic Recovery Act of 2008 (Aug 2008)

- The Stanley Sporkin Hotseat

- The Missing Money (2000)

Here are two pieces that also describe my personal process:

I describe the history of governmental mortgage fraud in Part I of Solari Audio Seminar Navigate the Housing Bubble. If you are interested in the deeper story, I recommend this one.

Part II

Who were the

lobbyists on Fannie Mae and Freddie Mac's payroll? Who were

the politicians who enjoyed their financial support? Here is

where you can learn more:

Who were the

lobbyists on Fannie Mae and Freddie Mac's payroll? Who were

the politicians who enjoyed their financial support? Here is

where you can learn more:

Freddie's and Fannie's Favors By Matthew Lewis - The Center for Public Integrity (15 Jul 2008)

Powerful Voices on Hill Are Abruptly Muffled By Jessica Holzer “ Damian Paletta - Wall Street Journal (10 Sep 2008)

Fannie Mae - OpenSecrets.org

Freddie Mac - OpenSecrets.org

The bailout will have a significant impact on the law firms that have business relationships with Freddie and Fannie.

Local Businesses Assess Fannie Mae, Freddie Mac Fallout By Bryant Ruiz Switzky - Baltimore Business Journal (9 Sep 2008)

Legal

Times and the Wall Street Journal Law Blog report

there were plenty of law firms in on the bailout:

Legal

Times and the Wall Street Journal Law Blog report

there were plenty of law firms in on the bailout:

Fannie/Freddie Bailout Pulled in Dozens of Lawyers The BLT: The Blog of LegalTimes (8 Sep 2008)

Fannie “ Freddie: The Legal Edition By Dan Slater - Wall Street Journal (8 Sep 2008)

They include:

- Cleary Gottlieb Steen “ Hamilton represented Morgan Stanley, which advised the Treasury Department on the bailout.

- Wachtell, Lipton, Rosen “ Katz advised the Treasury Department.

- Covington “ Burling and Davis Polk were outside counsel for Freddie Mac, report the BLT and the Wall Street Journal Law Blog.

- Cravath, Swaine “ Moore and Sullivan “ Cromwell were outside counsel to Fannie Mae and its board, the BLT and Law Blog report.

Advising Freddie’s independent directors were Cahill Gordon’s Bart Friedman, Jonathan Mark, David Kelley and Charles Gilman. For more on Bart Friedman, who in the past represented Dillon Read, Hamilton Securities Group and Cornell Corrections, see Dillon Read “ the Aristocracy of Stock Profits.

Advising the Federal Housing Finance Agency were Arnold “ Porter’s A. Patrick Doyle, Richard Alexander, Michael Mierzewski, Brian McCormally and John Hawke.

For more on John Hawke, see Dillon Read “ the Aristocracy of Stock Profits and Mortgage Bubble Names and Faces.

Also see:

- Fannie Mae, Freddie Mac Takeover Costs Congressmen Who Were Invested By Lindsay Renick Mayer - OpenSecrets.org (10 Sep 2008)

- Update: Fannie Mae and Freddie Mac Invest in Lawmakers By Lindsay Renick Mayer - OpenSecrets.org (11 Sep 2008)

Part III

On July 23, when I and my Community Business segment were spiked from KPFA radio, Fannie Mae stock was trading at $15 and Freddie Mac stock was trading at $10.80, having both dropped from highs in the $60's earlier this year. Fannie and Freddie at the time were both government sponsored enterprises.

In the segment that was scheduled on July 23, KPFA was going to use my new audio seminar, Positioning Your Assets for Growth in Uncertain Times for its fundraising. In our preparation, Dennis Bernstein had specifically asked me to address what was happening with Fannie Mae and Freddie Mac and the Congressional debate on the Housing and Economic Recovery Act of 2008.

The Positioning Your Assets audio seminar has a sample before and after portfolio. In the "before" portfolio, I show a portfolio that is invested in the "bubble economy" with significant investments in mortgage government sponsored enterprises. The "after" portfolio has no investments in mortgage government sponsored enterprises and represents an effort to shift out of unsustainable enterprises into investments in the "real economy" that are not dependent on federal government support.

When I was finally allowed back on KPFA radio on September 8th, Fannie Mae stock was trading at $0.73 and Freddie Mac was trading at $0.88.

Hence, from July 23 to September 8th, Fannie Mae and Freddie Mac common stock shareholders lost $15.3 billion and $6.4 billion, respectively. This includes CalPers, the largest California pension fund which held 4.2 million shares of of Fannie Mae and 3.9 million shares of Freddie Mac, losing approximately $100 million during this period. The California Teachers Retirement System does not publish their holdings. However, their losses on Fannie Mae and Freddie Mac's failure were also likely to be significant.

During this period, Fannie Mae and Freddie Mac were far from the only "bubble" economy or "real economy" investments to fall in value. Indeed, we are in a deflationary credit crunch, with many assets and investments falling in value. However, very few fell more than 90% in that six + week period—just the ones that I was being asked to talk about.

In the last 12 months, common stockholders have lost $100+ billion on Fannie Mae and Freddie Mac stock. Regional and small banks have also lost additional amounts on Fannie Mae and Freddie Mac preferred stock. It does make you wonder what smart money got out of these stocks while the uninformed money stayed invested.

If you think a free press is expensive to fund and maintain, count up the costs to you, your assets and your retirement savings of trying to live without one.

Part IV

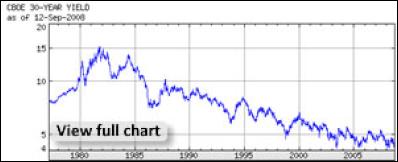

Whether you want to attribute the Federal Reserve and US Treasury's success to the deflationary effects of globalization and new technology or the miracles of advanced weaponry, you must admit it is pretty amazing. The worse we behave, the lower our cost of capital.

This situation presents extraordinary governance and management challenges. As supply and demand stop serving as a healthy feedback mechanism to encourage people and enterprises to behave in productive ways, entire industries and communities embrace politics and bad behavior.

I experienced this problem in a small way when I served as Assistant Secretary of Housing—FHA Commissioner. At the time, the Federal Housing Administration (FHA) was originating $5—10 billion a year of multifamily mortgage insurance offered at insurance premiums that were well below market. Consequently, FHA had $25 billion of demand for the multifamily mortgage insurance product. How to allocate $5 billion?

One method would have been to create clear criteria and allocate the mortgage insurance on an open, competitive basis. That, of course, was not politically feasible in America.

The solution was gridlock. Let $25 billion of applications pile into various processes that take foreover and mysteriously go in circles. Terrorize the bureaucrats so they do not dare process anything. Then send in the right lawyers and other fixers to engineer the applications through that are politically desirable.

This is a type of productivity challenge that has continually plagued centralized systems throughout history.

It is, however, the basis of rich fees for Washington law firms and lobbyists.

Part V

The financial

press this morning reports that Daniel Mudd, the retiring

CEO of Fannie Mae, is leaving with a severance package of

approximately $9.2 million. Richard Syron, the retiring CEO

of Freddie Mac, is leaving with a severance package of

approximately $14.9 million.

The financial

press this morning reports that Daniel Mudd, the retiring

CEO of Fannie Mae, is leaving with a severance package of

approximately $9.2 million. Richard Syron, the retiring CEO

of Freddie Mac, is leaving with a severance package of

approximately $14.9 million.

It would appear

that the federal government intends to honor these

contracts.

It would appear

that the federal government intends to honor these

contracts.

In these situations, observing when the federal government honors its contracts and when it does not often provides a clue to the deeper story.

For example, my company, Hamilton Securities Group, had a contract that the federal government canceled for convenience in 1997. At that time, the federal government owed us $2.1 million. Rather than honor their debts, they claimed the common law right to assert an "offset."

The offset that they claimed was a theoretical opportunity cost. We might have made another $3 million in profits on two auctions that made several hundred millions in profit in a series of mortgage auctions that made $2.2 billion for the Federal Housing Administration. The auction recovery performances were significantly higher than what they achieved before they hired us and what they got after they fired us and canceled the auctions.

Sure enough, we were right that the government had to honor its contract. But it took seven years for a judge in the U.S. Court of Claims to remind the government that was so, and nine years to get paid. At that point, all the monies went to the lawyers and administrative costs of proving the point.

The Department of Justice was perfectly happy to argue their rights to assert common law right of offsets to abrogate government contractual obligations in court, year in and year out. They spent a great deal of time and money doing so -- all about an issue for which the government's own expert says there was no money lost.

This was not my first experience with the federal government abrogating contracts. Indeed, I had named my company after Alexander Hamilton, the first Secretary of the Treasury, known for his successful efforts to ensure that the federal government kept its word on financial matters. When I was Assistant Secretary in the first Bush Administration, my staff often referred to him as I spent day in, day out, doing everything I could to stop senior political officials from abrogating contracts because it with get us a great headline as being tough on financial fraud. We had programs marked by fraud that also involved honest companies and legitimate transactions. It was politically expedient to cancel things across the board, rather than take responsibility and clean up the real fraud.

I remember sitting in a meeting at HUD when the coinsurance program was being canceled. One senior official expressed concern when the general counsel suggested that we abrogate our contracts to companies that were performing well. His point was that the agency had legally valid and binding contracts with these companies. The general counsel said something like, "F*ck 'em. Let 'em sue us. By the time they win in court, we will be gone."

So if Mudd and Syron are being allowed to keep their severance packages while thousands, if not millions, of Americans are losing their jobs and their homes, there is a reason. Given that Fannie Mae and Freddie Mac have now cost shareholders $100 billion, bankrupted households and communities through the country, terrorized investors globally and stuck the U.S. government with responsibility for $5.4 trillion in debt, you would think there would be a basis for a few offsets against severance agreement payouts.

Or...perhaps Mudd and Syron are being paid for a job well done, which would include remaining silent about what exactly that job really was.

Part VI

Oh, boy. The Solari network does it again.

It turns out that David Hisey, the Chief Financial Officer of Fannie Mae appointed on August 27, 2008 after the government takeover, once worked at KPMG. And who were they? They were the auditors for HUD and FHA under Andrew Cuomo when the housing bubble got going and $59 billion plus went missing from the agency. (See our Missing Money page for more.)

So here is the latest tidbit in from a network member. Hisey was an audit partner and worked on the HUD/FHA audit account at KPMG during all the shenanigans. Remember, just because Fannie Mae is in conservatorship does not mean that more assets can not disappear.

Thanks, Solari network member. Good catch!

Part VII

Dodge “ Cox is one of the most respected mutual funds managers in the country.

As of March 31, 2008, Dodge “

Cox’s filings with the U.S. Securities “ Exchange

![]() Commission

indicate that their combined funds held 12,058,212 shares of

Fannie Mae. On that day, Fannie Mae’s stock closed at

$26.32, for a total position value of $317.4MM. By August

8th, Dodge “ Cox held 119,814,881 shares of Fannie Mae, or

12.2% of the outstanding shares. Closing that day at $9.05 a

share, their total position was valued at $1.1BB.

Commission

indicate that their combined funds held 12,058,212 shares of

Fannie Mae. On that day, Fannie Mae’s stock closed at

$26.32, for a total position value of $317.4MM. By August

8th, Dodge “ Cox held 119,814,881 shares of Fannie Mae, or

12.2% of the outstanding shares. Closing that day at $9.05 a

share, their total position was valued at $1.1BB.

Dodge “ Cox Discloses 12.2% Stake in Fannie Mae (FNM)

Today, Fannie Mae’s stock closed at $0.43. Assuming Dodge “ Cox has not disposed of the shares, they have lost over $1BB investing in Fannie Mae, most of it on shares purchased in the last six months. After Fannie Mae was moved into government conservatorship, Dodge and Cox issued the following statement:

Dodge “ Cox: Commentary Regarding U.S. Government Takeover of Fannie Mae

Here is my interpretation of what happened.

Fannie Mae and Freddie Mac essentially had a monopoly position in securitizing mortgages originated in the U.S. In addition, they had special benefits by reason of their position as government sponsored enterprises. Finally, they had a line of credit at the US Treasury and implied access (now realized) to the U.S. credit, assuring broad, low cost access to capital globally.

Given those facts, it was reasonable for Dodge “ Cox to assume that buying into Fannie Mae after it had dropped more than 50% from its year high of $68.60 was a good bet. The business model was one that would appear to be as good as the U.S. Treasury. The company had the market share, the product pricing power and the access to capital to manage its way through a serious housing recession, even depression.

Unless, however, deep within its portfolio and the mortgage system there was significant criminal fraud – mortgages issued fraudulently, collateral fraud resulting in non-existent or double counted mortgages, and complex derivatives piled on top of that fraud, meaning even more fraud.

Now if you and I were to stop for a cup of coffee at any truck stop in America and for some reason the truckers felt like speaking openly, they would know how bad the fraud was. They would not know the details - they would know the gist of it. As would people close to the situation in communities throughout the country.

For seven years, I as the former Assistant Secretary of Housing and former lead financial advisor to the Federal Housing Administration had spoken and appeared on the radio in the San Francisco Bay area where Dodge “ Cox is based, describing systemic criminal fraud in the U.S. mortgage system. My website and writings, supported by extensive documentation, have been widely published and disseminated throughout the Internet.

Yes, somehow, what is obvious to anyone who drives around communities and can add up the numbers on the ground could not be heard or computed by Dodge “ Cox. In theory, it is possible that someone put a gun to their head and they bought the shares because they had no choice. However, it is more likely that they simply could not fathom that the corruption and the criminality in the US mortgage system is as deep and serious as it is. Even if they were aware of what I was saying and writing, they could not fathom that what I was saying was true. How could it have gotten that bad without their knowing? If it were that bad, why were more people not saying something? If it were true, the criminality was deeply institutionalized. It was widespread and went to the very top.

When Fannie Mae was taken over by the U.S. government, Dodge “ Cox was given a deeply shocking message. There was indeed a deeper rot in the system. Given Fannie Mae’s size and role, what is true for Fannie Mae is true for the whole financial system. Systemic criminality at Fannie Mae can only exist with the complicity of the U.S. Treasury, the Federal Reserve banks and the leading law firms, banks and investment banks.

This realization is the crack in the dam. It begins the shift of a paradigm. Suddenly those responsible for managing trillions of dollars in an economy propped up by a matrix of lies are faced with the urgency of managing a significant shift.

Assets are shifting out of activities which drain real wealth, such as complex financial assets, like derivatives layered on top of fraudulent mortgage pools dependent on mortgage payments from people with falling incomes. They are shifting into basic goods and services that create real wealth, like high speed railroads and solar panels that help lower expenses and make us more efficient, and promises to pay by organizations that have a history of honest collateral arrangements, sound fundamental economics and keeping their promises, or, alas, a powerful military.

Whatever the specifics of this week's stock market meltdown, it is important to understand that it is just the beginning.

Mapping

The Real Deal is a column on Scoop supervised by

Catherine Austin Fitts. Ms Fitts is the President of

Solari, Inc.

http://www.solari.com/. Ms. Fitts is the former

Assistant Secretary of Housing-Federal Housing Commissioner

during the first Bush Administration, a former managing

director and member of the board of directors of Dillon Read

“ Co. Inc. and President of The Hamilton Securities Group,

Inc.

Mapping

The Real Deal is a column on Scoop supervised by

Catherine Austin Fitts. Ms Fitts is the President of

Solari, Inc.

http://www.solari.com/. Ms. Fitts is the former

Assistant Secretary of Housing-Federal Housing Commissioner

during the first Bush Administration, a former managing

director and member of the board of directors of Dillon Read

“ Co. Inc. and President of The Hamilton Securities Group,

Inc.

Binoy Kampmark: Righteous, Confused And Unwilling - Europe’s Ukrainian Predicament

Binoy Kampmark: Righteous, Confused And Unwilling - Europe’s Ukrainian Predicament Gordon Campbell: On School Lunches, And The Coalition Government Eating The Young

Gordon Campbell: On School Lunches, And The Coalition Government Eating The Young Binoy Kampmark: Zelensky - Victim Of Colosseum Politics

Binoy Kampmark: Zelensky - Victim Of Colosseum Politics Martin LeFevre - Meditations: California Psychologically Secedes From The Union

Martin LeFevre - Meditations: California Psychologically Secedes From The Union Ramzy Baroud: The Lost 'Arab' - Gaza And The Evolving Language Of The Palestinian Struggle

Ramzy Baroud: The Lost 'Arab' - Gaza And The Evolving Language Of The Palestinian Struggle Ian Powell: Private Versus Public Health Systems

Ian Powell: Private Versus Public Health Systems