Dillon Read And The Aristocracy Of Stock Profits

A Serialised Story - Part 1 of 20 (publishing August/September 2007)

Dillon Read & Co.

Inc.

And the Aristocracy of Stock Profits

By Catherine Austin Fitts

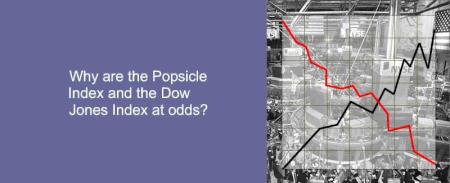

PART 1 -

Why I wrote

This Story, Introduction Graphic & Contents Page

(Bookmark this page and return to find links to new chapters as they are published.)

I made the decision to write “Dillon, Read & Co. Inc. and the Aristocracy of Stock Profits” in the middle of a vegetable garden in Montana during the summer of 2005. I had come to Montana to develop a venture capital model to support a healthier, fresher local food supply. If we want clean water, fresh food, sustainable infrastructure, and healthy communities, we are going to have to finance and govern these resources ourselves. We cannot invest in the stocks and bonds of large corporations, banks and governments that are harming our food, water, environment and all living things and then expect these resources to be available when we need them.

Surviving and thriving as a free people depends on creating and transacting with currencies and investments other than those printed and manipulated by Wall Street and Washington to the eventual end of our rights and assets.

What I found in Montana, however, was what I have found in communities all across America. We are so financially entangled in the federal government and large corporations and banks that we cannot see our complicity in everything we say we abhor. Our social networks are so interwoven with the institutional leadership — government officials, bankers, lawyers, professors, foundation heads, corporate executives, investors, fellow alumni — that we dare not hold our own families, friends, colleagues and neighbors accountable for our very real financial and operational complicity. While we hate "the system," we keep honoring and supporting the people and institutions that are implementing the system when we interact and transact with them in our day-to-day lives. Enjoying the financial benefits and other perks that come from that intimate support ensures our continued complicity and contribution to fueling that which we say we hate.

Standing among the beautiful vegetables and flowers that Montana summer day, I was facing the futility of trying to craft investment solutions without some basic consensus about the economic tapeworm that is killing us and all living things — while we blindly feed the worm. In a world of economic warfare, we have to see the strategy behind each play in the game. We have to see the economic tapeworm and how it works parasitically in our lives. A tapeworm injects chemicals into a host that causes the host to crave what is good for the tapeworm. In America, we despair over our deterioration, but we crave the next injection of chemicals from the tapeworm.

With this in mind, I decided to write “Dillon Read & Co Inc. and the Aristocracy of Stock Profits” as a case study designed to help illuminate the deeper system. It details the story of two teams with two competing visions for America. The first was a vision shared by my old firm on Wall Street — Dillon Read — and the Clinton Administration with the full support of a bipartisan Congress. In this vision, America's aristocracy makes money by ensnaring our youth in a pincer movement of drugs and prisons and wins middle class support for these policies through a steady and growing stream of government funding and contracts for War on Drugs activities at federal, state and local levels. This consensus is made all the more powerful by the gush of growing debt and derivatives used to bubble the housing and mortgage markets, manipulate the stock and precious metals markets and finance trillions missing from the US government in the largest pump and dump in history — the pump and dump of the entire American economy. This is more than a process designed to wipe out the middle class. This is genocide — a much more subtle and lethal version than ever before perpetrated by the scoundrels of our history texts.

This case study provides a detailed example of the financial kickback machinery that makes the process go. It works something like this. A group of executives and investors start a company. Rather than build a business the old fashioned way, company profits are pumped up with government legislation, contracts, regulation, financing, subsidies and/or enforcement. This dramatically increases the value of the company's financial equity. The company and its initial investors then sell their stock at a profit. Such profits replenish contributions made to the kind of politicians who can arrange such government benefits. Such profits also fund philanthropy to foundations and universities that have large endowments that invest along side the investors. These tax-exempt organizations provide graduates to staff positions in the game, intellectual justification to attract popular support and photo opportunities which bestow legitimacy and social stature. Personnel cycle through the management and boards of business, government and academia, as real productivity falls and government deficits grow.

The second vision was shared by my investment bank in Washington — The Hamilton Securities Group — and a small group of excellent government civil servants and appointees who believed in the power of education, hard work and a new partnership between people, land and technology. This vision would allow us to pay down public and private debt and create new business, infrastructure and equity. We believed that new times and new technologies called for a revival that would permit decentralized efforts to go to work on the hard challenges upon us — population, environment, resource management and the rapidly growing cultural gap between the most technologically proficient and the majority of people. We believed that private and public capital should flow to that which was most economically productive rather than be mixed in a complex cocktail of insider deals designed to hollow out the American economy and culture.

My hope is that “Dillon, Read & the Aristocracy of Stock Profits” will help you to see the game sufficiently to recognize the dividing line between two visions. One centralizes power and knowledge in a manner that tears down communities and infrastructure as it dominates wealth and shrinks freedom. The other diversifies power and knowledge to create new wealth through rebuilding infrastructure and communities and nourishing our natural resources in a way that reaffirms our ancient and deepest dream of freedom.

My hope is that as your powers grow to see the financial game and the true dividing lines, you will be better able to build networks of authentic people inventing authentic solutions to the real challenges we face. My hope is that you will no longer invite into your lives and work the people and organizations that sabotage real change. If enough of us come clean and hold true to the intention to transform the game, we invite in the magic that comes in dangerous times.

Yes, there is a better way and, yes, we can create it.

Introduction. Why

I Wrote This Story

Dillon Read’s Chairman, Nicholas F.

Brady, was considered one of George H. W. Bush’s most

intimate friends and advisors ...

.

.

.

.

1. Brady, Bush,

Bechtel & “the Boys”

Dillon Read’s Chairman, Nicholas F. Brady, was considered one of George H. W. Bush’s most intimate friends and advisors ...

.

.

.

.

2. A Rothschild

Man

The French Rothschilds, in response to the nationalization of Banque Rothschild by President Mitterrand, moved significant operations and focus to the U.S. ...

.

.

.

.

3.

RJR Nabisco

In 1984 and 1985, Dillon Read helped RJR merge with Nabisco Brands, making the combined RJR Nabisco one of the world’s largest consumer products corporations ...

.

.

.

.

4. Narco

Dollars in the 1980s — Mena, Arkansas; South Central

L.A.

Gary Webb’s "Dark Alliance" story was persuasive that the U.S. government and their allies were involved in narcotics trafficking ...

.

.

.

.

5.

Leveraged Buyouts

Perhaps KKR had simply sheltered one of the worlds premier money laundering networks and, behind the veil of a private company, taken this network to a whole new level ...

.

.

.

.

6. A Parting of

the Ways

That was when I decided that we might be losing sight of the line between financial engineering and financial fraud. I left the boardroom to make a call to Washington, D.C. There was nothing else to learn at Dillon Read ...

.

.

.

.

7. “HUD is a

Sewer”

When I told Nick Brady in 1989 that I was going to work at HUD, he said, “You can’t go to HUD — HUD is a sewer.”

.

.

.

.

8. Dillon’s

Investment in Cornell

To understand Dillon’s investments in Cornell it is essential to understand who governed Dillon Read, who at Dillon invested personally, as well as who at Dillon helped to govern the venture funds that invested in Cornell ...

.

.

.

.

9.

Cornell Corrections

Cornell arranged for the prison to be constructed by Brown & Root of Houston, Texas, a subsidiary of Halliburton.

.

.

.

.

10. The Clinton

Administration: Progressives for For-Profit Prisons

The Clinton Administration took the groundwork laid by Nixon, Reagan and Bush and embraced the promotion of federal support for police, enforcement and the War on Drugs with a passion that was hard to understand ...

.

.

.

.

11.

Hamilton Securities Group

One of Hamilton Securities’ goals was to map out how the flows of money worked in the U.S. and create software tools that would make this information accessible to communities ...

.

.

.

.

12. A Note on

Protecting the Brand with Dirty Tricks

The supremacy of the central banking-warfare investment model that has ruled our planet for the last 500 years depends on being able to combine the high margin profits of organized crime with a low cost of capital ...

.

.

.

.

13. “You are

Going to Prison” — 1996

One day I was a wealthy entrepreneur with a successful business and money in the bank. The next day I was hunted, business assets seized, living through eighteen audits and investigations, a smear campaign directed not just at me but also members of my family ...

.

.

.

.

14.

Enforcement Terrorism — 1997

My favorite Judge Sporkin quote was his retort from the bench, something to the effect of “I disagree with the law and if you have a problem with that, take it up with Congress.”

.

.

.

.

15. Dillon Read

— Cashing Out on Cornell

These are the kind of profits you get when you buy stock for a price of $3.8 million and several years later sell that stock for $29.9 million — or an almost 800% increase on your investment ...

.

.

.

.

16.

Financial Coup d’Etat — 1998

In June of 1999, Richard Grasso, Chairman of the New York stock exchange, went to Colombia to visit a Revolutionary Armed Forces of Colombia Commander to encourage him to reinvest in the New York Stock Exchange ...

.

.

.

.

17. Private

Banking & the Profitable Liquidation of Every Place

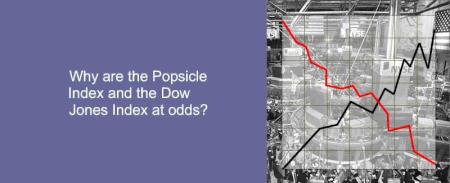

An all-to-familiar impersonal financial mechanism was now in place that created yet another incentive system with global reach, to drive the financial returns of investors up by driving down the Popsicle Index of faceless people and communities, far removed.

.

.

.

.

18. Through the

Via Dolorosa

The Via Dolorosa is the street in the Old City of Jerusalem which Jesus is said to have walked on the way to his crucifixion. It means “the way of grief.”

.

.

.

.

Mapping The Real Deal is a column on

Scoop supervised by Catherine Austin Fitts. Ms Fitts is the

President of Solari, Inc. http://www.solari.com/. Ms. Fitts is

the former Assistant Secretary of Housing-Federal Housing

Commissioner during the first Bush Administration, a former

managing director and member of the board of directors of

Dillon Read & Co. Inc. and President of The Hamilton

Securities Group,

Inc.

Mapping The Real Deal is a column on

Scoop supervised by Catherine Austin Fitts. Ms Fitts is the

President of Solari, Inc. http://www.solari.com/. Ms. Fitts is

the former Assistant Secretary of Housing-Federal Housing

Commissioner during the first Bush Administration, a former

managing director and member of the board of directors of

Dillon Read & Co. Inc. and President of The Hamilton

Securities Group,

Inc.

Keith Rankin: The Aratere And The New Zealand Main Trunk Line

Keith Rankin: The Aratere And The New Zealand Main Trunk Line Gordon Campbell: On The Mock Horror Over Political Profanity

Gordon Campbell: On The Mock Horror Over Political Profanity Ian Powell: Predictable Smear On Senior Doctors

Ian Powell: Predictable Smear On Senior Doctors Binoy Kampmark: Trump, Planes And The Arabian Gulf Tour

Binoy Kampmark: Trump, Planes And The Arabian Gulf Tour Ramzy Baroud: Gaza's Graveyard Of Illusions - How Israel's Narrative Collides With Military Failure

Ramzy Baroud: Gaza's Graveyard Of Illusions - How Israel's Narrative Collides With Military Failure Jeremy Rose, Eugene Doyle, Ramon Das: Radio New Zealand’s Report On Its Israel-Gaza Coverage Is Not Credible

Jeremy Rose, Eugene Doyle, Ramon Das: Radio New Zealand’s Report On Its Israel-Gaza Coverage Is Not Credible