Dr Bollard and the First Law of Holes -

Addendum

On Tuesday 29 November (Scoop Wednesday 30 November www.scoop.co.nz/stories/HL0511/S00373.htm) I wrote that New Zealand faces the possibility of a serious financial crisis that could spread to Australia, given that (i) our banks are Australian, (ii) overseas investors see New Zealand and Australia as parts of a greater whole, and (iii) Australia is also facing similar balance of trade problems.

I also placed the blame for New Zealand's current economic predicament fairly and squarely on the shoulders of the Reserve Bank, and its governor Dr Alan Bollard. The Reserve Bank could, like the universal soldier, defend itself by saying that it's operating under orders. Such a "no choice" defence would be unconvincing, however. Our Reserve Bank believes in what it is doing.

Most likely, it will only stop digging an ever bigger high interest hole for itself (and for us) if it is ordered to stop by government. That in itself would normally be a major drama. This month however, a new set of instructions is due, in line with the regular triennial timetable. The Government would be foolish not to take this opportunity to change the policy objectives mandated to the Reserve Bank.

We have a case in which the "patient" has several illnesses. Currently, we ignore the more serious problems, and prescribe for the less serious condition a medicine that doesn't cure the problem it's prescribed to cure, and that does much more harm to the patient than the problem it's prescribed for. In particular, this high interest medicine makes the most serious of these untreated illnesses – the balance of trade deficit – much worse.

In this follow-up article, I wish to make three main points.

First we have to consider just what the objective of the Reserve Bank's policy is, and whether it is a sensible objective.

My second main point is that raising interest rates is an ineffective method of reducing inflation. The corollary of this point is that reducing interest rates is an ineffective method of raising inflation. So, if we want to avoid increased inflation, reducing interest rates is unlikely to be a problem; it may even be helpful.

Thirdly, even if we believe we must raise interest rates to fix a real or perceived inflation problem, we can do so without raising the $NZ exchange rate.

The government sets the Reserve Bank's monetary policy objective through its "Policy Targets Agreement" (PTA). The principal objective, as set out in all PTAs since the 1989 Reserve Bank Act, is to maintain "stable prices". The most recent definition of stable prices is that the rate of inflation should be between one and three percent.

We must be more questioning of the meanings of "stable" and "unstable" prices. Inflation is compulsory in New Zealand. (Indeed, if inflation falls below one percent the Reserve Bank is expected to raise it.) Yet inflation of more than three percent is deemed to be so bad for us that low economic growth, rising unemployment, and a massively negative trade balance are acceptable prices to pay in the fight to get inflation back down below that three percent mark. Common sense tells us that a maximum of "three percent inflation" is an arbitrary criterion, and that inflation at four or more percent may cost the economy very little.

Further, an average inflation rate of say two percent does not necessarily represent stable prices. In some cases an average of two percent will be less "stable" than an average of four percent. What matters is the variation around that average. For an example, let's say there are two kinds of products. If type A products rise in price by five percent every year, and type B products fall in price every year (deflation), then the average may well be a rise of two percent a year. But nobody actually experiences this average. Rather, our experiences are of either five percent inflation, or of deflation. Variability around the average rate of inflation can be more unstable than variation of the average rate of inflation.

We can consider the second point from an intuitive standpoint, from a purely statistical standpoint, or from the standpoint of basic microeconomic theory.

Intuition – or common sense – tells us that raising the cost of something is unlikely to be a recipe for bringing down the price of most things. While common sense can occasionally mislead us, more often is does not. In this case, our gut feeling is that raising interest rates is a stupid way to reduce prices. And our gut feeling is correct.

The Reserve Bank recognises that 45 percent of New Zealand's GDP (gross domestic product) represents "tradable" goods and services, whereas the remaining 55 percent represents "non-tradable" goods (eg houses) and services (eg retailing). Tradable products – eg butter, shoes, language education, aircraft maintenance – are priced internationally. Non-tradable products are priced locally.

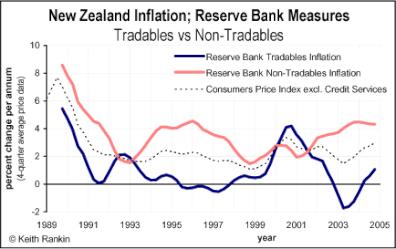

If we graph inflation in the tradable and non-tradable sectors separately, using Reserve Bank data, we get the following:

The $NZ exchange rate was falling in the years 1991-1992 and 1997-2000 (see www.nbnz.co.nz/economics/exchange/nzdtwi.htm). Not surprisingly, the prices of tradable goods started to rise in those years. This is because world prices would translate into greater numbers of New Zealand dollars. What is more interesting, and somewhat unexpected, is that the prices of non-tradable goods and services were falling for much of the time that tradable prices were rising.

If we now consider years of currency appreciation, 1994-1997 and 2002-2005, we note that the more usual experience is one of falling tradable prices, and rising non-tradable prices. Certainly, it is by no means clear that periods of rising exchange rates are periods of falling inflation. And, while the average inflation rate reached 3.5 percent in 2000 (when the $NZ exchange rate was at its lowest), that's hardly a level of inflation to panic about.

Both periods of exchange rate depreciation were preceded by substantial falls in interest rates (see www.nbnz.co.nz/economics/interest/90dbill.htm). Yet average inflation was never a problem, thanks to reduced inflation in the non-tradable sector during these periods of reduced interest rates. Further, the variation around the average was less after interest rates had fallen. Prices were considerably less stable in periods of rising interest and exchange rates.

From the point of view of basic microeconomic theory, interest rates are analogous to wages. Both represent "factor costs" (ie resource costs). Yet conventional macroeconomic theory sees rising wages (labour costs) as highly inflationary, whereas for no obvious reason it treats rising interest (capital cost) as being deflationary.

In fact, in a modern capitalist economy, rising capital costs are inflationary. And in ways that are not always obvious. For example, when interest rates are rising, company shareholders require higher dividends. Otherwise shareholders will sell their shares and put their money in the bank. Dividends, like wages, are a cost of running a business.

It is very clear – to me anyway – that inflation in the non-tradable sectors is closely and positively associated with interest rates. Thus rising interest rates lead to rising inflation in the non-tradable sector. This is offset by falling inflation in the tradable sector, caused by the rising exchange rate which in turn is caused by rising interest. Raising interest rates therefore has little impact on the average inflation rate but causes more price instability, as tradable and non-tradable prices diverge.

New Zealand's low inflation of the 1991-2004 period has been a bit of a myth. What matters is the domestically generated non-tradable sector's inflation. Instead of facing up to this problem, we have masked it by averaging it against the much lower (on average) inflation in the tradable sector.

New Zealand's price instability problem has been aggravated by high interest rates. Domestic inflation in other countries with much lower interest rates has been much less.

My final theme here is to note that, when interest rates are raised by the Reserve Bank, money flows into the country to purchase mainly financial assets. This inflow is called "capital imports".

When there are increased capital imports, the $NZ exchange rate will rise unless there is an equal and opposite outflow of capital.

The Reserve Bank is easily able to generate such an equal and opposite outflow. It cannot "print" foreign money, but it can certainly create as many New Zealand dollars as it likes. It can set up an "exchange stabilisation" account, by creating (at virtually no cost) new New Zealand dollars. These new dollars are converted into foreign currency and banked in the financial centres of the world. When the outflow matches the inflow, the exchange rate barely changes. These new dollars represent foreign currency reserves that can be withdrawn at a later date to arrest an excessive fall in the exchange rate.

In 2006, our Reserve Bank will in fact be quite unable to respond to a crash of the $NZ. It's only trick has been to raise interest rates. Instead of increasing our financial reserves overseas, it has required us to balance our capital inflows with imports of increasingly cheap consumer goods, and with reduced exports.

Monetary policy in New Zealand lacks common sense and imagination.

We would probably be better off without any monetary policy, or at least to allow the money markets to set interest rates at all times except genuine crises. The whole project of trying to create a stable economy through the manipulation of interest rates misses the point of how prices work in market economy.

Sustainable economic growth actually requires an economic environment with some instability. Balanced growth means more of the same. That's always unsustainable given that many of our resources are non-renewable. Only unbalanced growth, which generates and is generated by structural change and productivity gains, is sustainable. Historically, our growth experience has been unbalanced, and could not have happened otherwise. That's why western countries no longer experience many of the environmental problems that were commonplace from the 1820s to the 1960s.

There is much to be said for a non-interventionist approach to day-to-day economic management. Activist monetary and fiscal policies could be saved for genuine crises. Fine-tuning with a blunt instrument is an oxymoron. Yet that is what the Reserve Bank is trying to do.

Today in New Zealand, the unimaginative and inappropriate implementation of monetary policy is creating a potentially devastating crisis for New Zealand. A country's tradable sector can survive one or two difficult years on reduced margins and forward exchange cover. After two years of excessive exchange rate torture, a country's tradable sector withers as that sector's reserves disappear. Recent trade statistics suggest that that withering is well underway.

I will remind Dr Bollard once again of the importance of the First Law of Holes. Stop digging.

ENDS

Gordon Campbell: On Budget 2025

Gordon Campbell: On Budget 2025 Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship

Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship Binoy Kampmark: The Killing Of Israeli Embassy Staffers - Netanyahu’s Antisemitism Canard

Binoy Kampmark: The Killing Of Israeli Embassy Staffers - Netanyahu’s Antisemitism Canard Keith Rankin: Zero-Sum Fiscal Narratives

Keith Rankin: Zero-Sum Fiscal Narratives Eugene Doyle: Chinese Jet Shoots Down France’s Best Fighter; NZ And Australia Should Pay Attention

Eugene Doyle: Chinese Jet Shoots Down France’s Best Fighter; NZ And Australia Should Pay Attention Ian Powell: “I Can Confirm They Are Hypotheticals Drawn Largely From Anecdotes And Issues The Minister Has Heard About.”

Ian Powell: “I Can Confirm They Are Hypotheticals Drawn Largely From Anecdotes And Issues The Minister Has Heard About.”