SRA Commentary: Servile Politics

SRA Commentary: Servile Politics

By Chris Sanders

February

16, 2004

It is…a truth, indeed a truism, that nothing exists in the public world, and nothing happens in the public world, apart from the deeds of men.

- Walter Karp, Indispensable Enemies, 1993, New York, Franklin Square Press, p.3

To attribute the results of political action to immanent “laws” is a corrupt politician’s first line of defense.

- Ibid. p. 191

One country’s

terrorist is another country’s foreign

minister

German foreign minister Joschka Fischer gave a speech over the weekend at the annual Munich Conference on Security Policy. He created a minor sensation by proposing a joint EU/NATO “greater Middle East” initiative for the purpose of eradicating “Jihadist terrorism,” which he termed “totalitarian.” Leaving aside the absurdity of Fischer’s statement and his own youthful flirtation with terrorism in Europe during the 60s[i] , what seems to have interested people most about this initiative is that EU/NATO appears to mean “not controlled by NATO,” i.e. the United States.

Fischer emphasised that although his government had opposed the coalition invasion of Iraq, the important thing now is to make sure that the coalition “succeeded.” This is a useful clarification on the foreign minister’s part, putting to rest any lingering ideas that European opposition to the war was anything more than trying to preserve a perceived advantage in relations with Saddam Hussein’s regime.

Fischer’s Munich gambit represents another step in Europe’s attempts to gain some sort of freedom of action independent of American control. The new Anglo-French-German rapid deployment battle groups, independent but not separate from NATO (or is it separate but not independent?) are part of the same strategy. How independent of the Americans any rapid deployment battle group that includes the British can be of the Americans is unclear to us, considering that Britain does not even possess the right to independently target its own nuclear warheads.

Japan, an American Colony

Japan, which has just sent troops to Iraq (pictured recently armed to the teeth in the international Herald Tribune at the start of their “humanitarian” mission), is also doing interesting things. It agreed late last year to purchase a missile defence system from the US that is nominally intended to protect Japan from North Korea. Japan, which builds the world’s largest lift vehicle and could produce nukes in a trice if it has not already done so, is no more threatened by North Korea than Guatemala is, but Japan is a close American ally. The Patriot system that it is buying is, like all existing missile defence technology, expensive and unreliable, but American allies need them. Just ask Israel and Saudi Arabia.

The first point here is that the G7 are basically united in their need for energy in the age of peak oil, and no one is going to willingly opt out of cooperation with the occupier of the biggest pools whose aim is, or ought to be, to become the world’s price setter for petroleum. The second point follows logically from the first. The United States is for the time being in a position to dictate behaviour to a wide spectrum of states.

For this reason the outcome of the last G8 economic meeting in Boca Raton is bemusing. Most market journalists and many traders assume that Washington wants dollar devaluation. As our regular readers know, we think that could not be further from the truth. Falling against the euro is one thing, because it does not upset anything fundamental to the ability of the US to fund its debt. On the other hand, a significant devaluation against Asia would upset things mightily. The Japan that is sending troops to Iraq and buying Patriot missile systems is unlikely to stop mobilising its savings system to fund the American borrowing that is financing increased military spending.

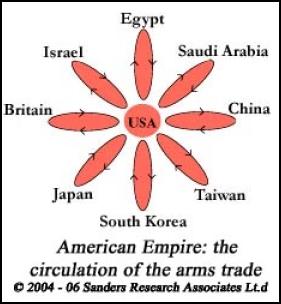

The American colonial system (beats the British hands down)

The US has ever since the Second World War traded access to its economy for cheap financing and for political and strategic collaboration. It is a simple system; the US buys the exports of its allies who lend it the money with which to make the purchases. The mechanism of the lending at the macro economic level is also simple: the US simply creates the dollars with which to settle its net international obligations. It is able to do this becausethere are no credible alternatives to American system,[ii] at least yet.[iii] Rising American net foreign indebtedness is the inevitable consequence of this ordering of affairs. The US current account deficit represents the annual increase in foreign borrowing required to keep things going. And Japan’s behaviour in recent years is nothing more or less than the manifestation of its determination to be a good citizen of the contemporary international order. Private sector economists tend to focus naturally on the private sector’s demand for imports, but the military is also an important part of this circular flow of goods and capital. Military exports from the United States, both arms and the “services” component (troops based abroad and paid for under nation to nation “status of forces agreements,” i.e. largely by the host nation) have historically been an important source of US export earnings. Increasingly, this largesse is being shared with allies in the form of joint venture agreements, particularly on big-ticket items such as aircraft and missiles and so on. But it includes less glamorous items too such as the manufacture of berets and uniforms in China for export to the United States.

Hence the proliferation of international “security” conferences such as the Munich conference referenced above and hence also the need for a enemies, the existence of whom is necessary as a fig leaf to cover what amounts to a complex international system of graft and political patronage. A few moments reflection makes clear that the conventional way we have of looking at the international system as nation states is wholly inadequate to understanding and analysing the real political economy. Countries in such a system are important for many reasons but less so as entities in their own right and more so as what we might term tax farms that proved a basis for financing a seat at the negotiating table. Understood in this way, for example, the raison d’etre of the Eurozone is very clear, and the confusion of Britain’s international behaviour – not in the Eurozone and acting as an American surrogate on the one hand but doing side deals with Germany and France on the other – becomes easier to understand.

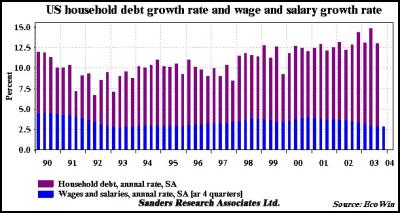

Debt up, wages down

The inflationary implications of such a system are obvious, given the absence of any check to money creation. The preferred way to keep inflation in the system from exploding is to get the cost of labour down, the better to keep profits up. And the way to do this is to promote the idea of one global economy with freely mobile capital, trade, and all factor inputs, most importantly including labour. It is no accident that US unit labour costs from 1990 have fallen further and longer than in any period since the Second World War. The drive to push the cost of labour down is international, and embraces most, if not all, of the industrial world. In the EU and in Japan as well as the United States, workers are being forced to bear the cost of adjustment to the post Cold War order. There is certainly not much national fellow feeling here. And it is likewise no accident that over time the countries that have been the most ardent proponents of free trade are those like the United States that have had financial and political structures heavily dependent on the ability to generate debt.[iv]

Click For Big Version

The result of all this is expressed in the formula: debt up, labour costs down.[v] There is nothing new about this; it is a time-tested and true management technique. Indebted labour is supplicant labour and more dependent on favour and consequently harder to organise. And holding wage growth down to approximately the level of inflation (the measurement of which is both arbitrary and controlled) ensures that profits are monopolised by those that own the system. Thus, the importance of internationally free labour markets is clear. Not only must workers be allowed to move across borders[vi] but companies must be allowed to locate production wherever the cost of labour is lowest. This replicates on a global scale an old fault line in American politics. Since almost the beginning of the original colonisation of the eastern seaboard, a division has existed between the treatment of labour in the south, and later the west, as opposed to the north and central parts of the country. In the latter, unions grew (and were quickly controlled) while in the former “right to work” laws prohibiting union closed shops ensured that wages stayed low. In the 60s, 70s and 80s company after company migrated south and west precisely because of this, contributing greatly to the increasingly “conservative” and right wing drift in American politics. This has been nothing so much as a migration of interests, gutting in the process the tax base of the old north east and north central industrial and manufacturing heartland of the country, and proving in the process that there is no such thing as community in the division of profit, only interest. And now, what was done regionally is being dome nationally.

Diana Farrell, thought slave

This leads to some astonishing circumlocutions on the part of economists paid to rationalise a simple exercise in monopolising profit. Diana Farrell, director of the Mckinsey Global Institute, and co-author of Market Unbound: Unleashing Global Capitalism, wrote an admirably well written if conventional apologia for monopoly capital’s treatment of labour in the International Herald Tribune of February 6th. She was presumably straight-faced when she wrote, “For example, firms pass on savings to consumers through lower prices and to investors through higher profits.” I must confess that I at least found it impossible to keep a straight face when reading this risible piece of puffery, but then she works for the owners, not the workers. Much more interesting was the reaction of readers, who were not fooled for an instant. Investors wiped out in the stock collapse of 2000 and similar pump and dumps may take issue with Farrell, never mind that firms over the last thirty years have distributed less and less of their earnings stream in the way of dividends. Owners have far preferred to control the price action of the stocks themselves, with the entire market today being run more closely in line with Jay Gould’s management of the Erie Railroad in the 1860s and 1870s. As for workers, the IHT reader who, responding to Farrell’s piece, wrote, “We forget at our peril that a country is more than its economy,” was only speaking truth.

Worried Greenspan

In his testimony

before the House Committee on Financial Services on February

11, Federal Reserve Chairman Alan Greenspan delivered an

astonishingly belligerent diatribe on behalf of free

markets. “Creeping protectionism must be thwarted and

reversed,” intoned the Chairman. He made it clear that the

reason for this is the large and growing US dependence on

foreign finance. If anyone is in a position to know, it is

him. The US Treasury this week managed to float another of

its stupendous bond offerings at near record low yields

largely thanks to the Chairman’s timely address to the House

committee on Wednesday just before the 10 year note auction

the following day. But more important, it is the Asian

countries that the US is transferring jobs and wealth to

that are recycling that wealth back to the US by buying

Treasury and agency debt.[vii] Globalisation has

already occurred and Greenspan is right to worry about the

political backlash, for it will surely come. The Diana

Farrells of the world can vaporise all they like about the

impersonal economic forces at work that make all this

“inevitable,” but Greenspan certainly understands, as do we,

that at bottom it is men who act and it is men who

react.

In other words, they will fight.

- Chris Sanders

[i]Fischer’s early political career as a leftist tough has bee written about extensively in Paul Berman’s New Republic article The Passion of Joschka Fischer. Also see BBC Online, Joschka Fischer’s three lives.

[ii]The Communist bloc offered an alternative for many decades. Its collapse made possible the creation for the first time in history of a closed global monetary system. This significant development is recognised mainly in the breach and by the creation of the euro as an embryonic competitive alternative to the dollar system. The massive benefits conferred on the country at the centre of the system are a cause of international instability and conflict. The problem is brilliantly described by Robert Skidelsky in the third volume of his biography of John Maynard Keynes, Fighting for Britain. Britain enjoyed the ability to borrow cheaply from its colonial “allies” Egypt and Britain by creating the “sterling area,” which simply meant that they had to keep the proceeds of their exports to Britain in sterling. This was completely unworkable because of the existence of the dollar alternative backed by a substantial American gold reserves and a huge industrial base. The book is basically the story of Keynes’s losing fight to keep British financial and economic independence from the Americans.

[iii]Obviously the euro represents an attempt to create such an alternative.

[iv]Venice, Holland, and Britain are the most obvious examples to come to mind.

[v]Current reported consumer price inflation in the United States is well below the rate of wage and salary growth, and that benefits compensation growth rates are much higher still. This has led some economists to opine that labour is doing quite well enough. As the chart shows, however, the real growth rate of household debt has grown much faster than the wage and salary income that services it. As we have pointed out recently (Commentary, February 2, 2004) it is cash compensation that really counts; swapping work for paper promises is a poor second. Household’s balance sheets have deteriorated greatly and are now much more sensitive to any rise in interest rates.

[vi]Immigration has been used since earliest colonial days in the US to render organised labour impotent. Today it is impossible to take seriously government protestations about controlling the tide of workers from Mexico and Central America into the United States. Likewise in Britain, however much anti-immigration feeling there may be, the government still is pushing for a relaxation of immigration from Central and Eastern Europe.

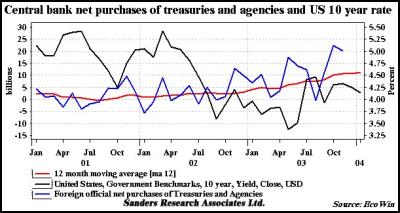

[vii]As the following chart shows clearly, the US debt market has become highly dependent on Japanese and other Asian official purchases of Treasury and Agency debt. With current projections forecasting deficits into the indefinite future, this dependence can only be expected to increase.

Click For Big Version

© 2003-5. Sanders Research Associates. All rights reserved.

Eugene Doyle: Writing In The Time Of Genocide

Eugene Doyle: Writing In The Time Of Genocide Gordon Campbell: On Wealth Taxes And Capital Flight

Gordon Campbell: On Wealth Taxes And Capital Flight Ian Powell: Why New Zealand Should Recognise Palestine

Ian Powell: Why New Zealand Should Recognise Palestine Binoy Kampmark: Squabbling Siblings - India, Pakistan And Operation Sindoor

Binoy Kampmark: Squabbling Siblings - India, Pakistan And Operation Sindoor Gordon Campbell: On Budget 2025

Gordon Campbell: On Budget 2025 Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship

Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship