Tony Baldwin: Electricity Price Volatility No Flaw

Electricity Market: Price Volatility No Flaw

By Tony Baldwin

January 2004

When electricity spot prices spiked earlier this month, the Major Users Group (which includes Comalco, Carter Holt, Pan Pac Forest Products and Winstone Pulp) protested: “The market is inherently flawed. Generators are price-gouging.”

It is an easy catch-cry, but closer analysis shows the Major Users are likely to be wrong.

Over the weekend of 9 January 04, a section of the main North-South transmission line was blown over in a storm. Cheap hydro electricity from the South Island was temporarily unavailable in the North Island. In addition, some power stations in the North Island were out for maintenance. The result was a temporary power shortage in the North Island.

Spot prices in the North Island jumped sharply. For five hours on 12 January, prices spiked from 3c to $1.04 a unit. However, as soon as the damaged transmission line was repaired and hydro electricity from the South Island could once again flow north, North Island spot prices dropped back to around 3c per unit.

Spot prices jumped for two reasons. First, to reflect the higher cost of generating replacement power in the North Island. Second, to ensure that total consumption reduced to equal available supply. In any electricity system, supply and demand must always be equal.

The last units of available generation capacity are typically offered at high prices. This signals that supply is about to run out. For example, in December 03 the last increments of supply from Huntly (gas-fired) and Clyde (hydro) were offered at $2 a unit.

Generators are unlikely to have jacked-up their prices to exploit the temporary shortage. Publication of their pricing schedules is expected to show they were consistent with prices offered before the transmission outage occurred.

In short, the spot market worked well. The Major Users’ claims appear to be unfounded. Volatility is an inherent part of an efficient electricity spot market. It is not a flaw.

The flaw is failing to hedge against it. Purchasing power on a fixed-price contract avoids spot market volatility.

Too many large electricity buyers appear not to understand price risk in relation to electricity. They do not seem to have digested how and why prices move, and do not accept that volatility in power prices is a business risk, like interest and exchange rates, which they have to manage – not the Government.

Generation costs vary dramatically. Key drivers are fuel costs (oil is more expensive than gas and coal), scarcity of water (the value of hydro increases sharply in ‘dry periods’), transmission constraints (congested power lines can isolate some generation capacity) and consumer demand which varies with the time of day, weather and changing levels of economic growth.

The purpose of a spot market is to ensure that cheaper generation is used ahead of more expensive sources.

Many people believe the notion of an electricity market is simply a misnomer. No doubt, Jane Clifton spoke for most in saying: “…the mischief lies in the idea that electricity can be marketised...a benevolent, efficient state monopoly would be preferable.” (Listener, May 2003)

Certainly, many Major Users prefer Government-controlled electricity systems as they find it much easier to win taxpayers subsidises in their power prices.

The main reason for moving to a market is to improve economic and environmental performance. Corner-stone aims include more efficient investment in new generation, and electricity consumption based on efficient price signals. The old Government monopoly fell well short on these objectives.

Over the past 15 years, a standard model has emerged around the world. Prof Stephen Littlechild, the former regulator of the UK electricity market, points out that it has five essential elements:

- A separate transmission company, which may be privately owned, providing non-discriminatory access;

- Privately owned and competing generation companies bidding into a spot market;

- Privately owned distribution networks providing non-discriminatory access;

- The retail market open to competition; and

- An independent regulatory body.

New Zealand’s electricity market design is consistent with this model, which has been applied in the UK, Australia, the USA, Sweden, Norway and several other countries.

On a technical level, our spot market is leading-edge in the world. Indeed, as Prof Bill Hogan of Harvard University has observed: “…the NZ electricity market design has been at the forefront of best practice…[and] involved extensive consideration of the experience of other countries.”

Overall, the NZ market is still in transition. It has under-performed in several areas. Government-owned generators have failed to cross-hedge. Generators have vertically-integrated (balancing their output with retail customers), which has reduced their incentives to offer hedges. Major Users have been reluctant to purchase hedges. There is no competitive market reference point for longer-term electricity prices. And the retail market is less competitive than it could be.

These weakness are caused by five missing key elements. The first three are:

- A liquid market for buying and selling electricity hedges;

- An efficient demand-side response mechanism; and

- A financial mechanism for hedging against transmission constraints;

With careful guidance from the new Electricity Commission, these absent elements can be mitigated. While the Commission’s potential powers are extremely wide and, if used unwisely, capable of imposing net costs, the Commission’s new role also creates an opportunity for positive action that industry division has previously prevented.

Several options should be avoided, in particular an artificial cap on spot prices. This would almost certainly fail, as in California, and cause all sorts of perverse outcomes.

The other two key elements

missing from the current market are:

- Real commercial disciplines on Government-owned electricity companies; and

- A deep and durable belief among market participants that the Government will not intervene for political reasons.

Only the Government can deliver these two. With out them, the other three absent elements mentioned above cannot be remedied effectively.

Last autumn’s power ‘crisis’ highlighted the lack of commercial disciplines on the SOE electricity companies, particularly when it surfaced that Meridian and Genesis had not addressed a ‘dry year’ scenario in a proper commercial manner.

The SOEs face no equity market pressures. Capital market monitoring is limited to SOE debt. In addition, the electricity SOEs adopted conservative risk positions, keeping their debt levels low and balancing their production with retail consumers in de facto franchise areas.

When combined with the problem of fickle ownership oversight of SOE boards, the case for improving commercial disciplines on SOEs is compelling. Without it, the Government’s aim of a fair and efficient electricity market will be extremely difficult to achieve.

The Government should also consider the option of separating the Huntly power station as a stand-alone company. This would significantly improve the quality of competition and kick-start an active hedge market. This option was recommended by officials and independent experts in 1997.

It was a mistake to allow the electricity SOEs to build such large retail businesses before an efficient market had taken hold. The Government should also now consider requiring some SOEs to sell part of their retail businesses so an effective hedge market can develop.

Without some degree of further SOE break-up, concerns relating to market power, which have arisen in several countries, are likely to paralyse and ultimately defeat the transition to an efficient electricity market in NZ. Regulatory proxies, such as requiring generators to offer certain volumes of hedge contracts, are likely to be too technical and too hard to enforce.

Electricity reform is hard. On a political level, everyone gets a power bill, but few industry leaders or politicians can explain why prices go up. Most duck for cover, blaming the other party.

On a technical level, electricity is complex. It also has special features that make it different from markets for other goods and services. Pure ideology is therefore a weak foundation for reform.

To make matters even more challenging, vested interested groups work hard to retain and expand their implicit subsidies. A recent example is the Major Users’ win last year with the Government’s ‘reserve generation’ scheme, under which it seems likely that ordinary consumers will subsidise Major Users’ power costs in a dry year.

Despite these challenges, moving to a more competitive electricity market that delivers net gains to the economy and the environment is still achievable. The industry was given a chance to lead the change. It got so far, but stumbled. The question is, can the Government and the new Commission tread the remaining distance?

Attachment:

CLICK FOR BIG

VERSION

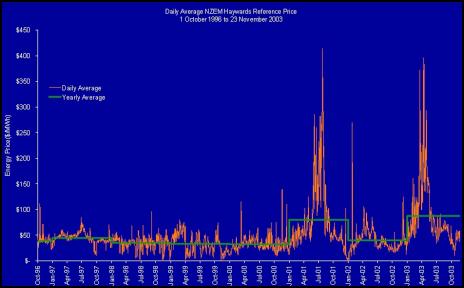

Graph of electricity spot prices since 1996

Tony

Baldwin

Chair

Officials Committee on Energy Policy

1991-98

Eugene Doyle: Writing In The Time Of Genocide

Eugene Doyle: Writing In The Time Of Genocide Gordon Campbell: On Wealth Taxes And Capital Flight

Gordon Campbell: On Wealth Taxes And Capital Flight Ian Powell: Why New Zealand Should Recognise Palestine

Ian Powell: Why New Zealand Should Recognise Palestine Binoy Kampmark: Squabbling Siblings - India, Pakistan And Operation Sindoor

Binoy Kampmark: Squabbling Siblings - India, Pakistan And Operation Sindoor Gordon Campbell: On Budget 2025

Gordon Campbell: On Budget 2025 Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship

Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship