SRA Commentary: Made In China - Election 2004

SRA Commentary: Made in China - The Presidential Election 2004

By Chris Sanders

December 8,

2003

Small amounts are obtainable, large amounts are confusing

- Tao Teh Ching

Captive voters

Steel duties: Bush had no choice

Last week the American government announced that it would drop the tariffs on steel that it imposed in early 2002. The move was welcomed in Europe and Japan. The 11th hour move by the US was simply an acknowledgment of the inevitable. The WTO had ruled that the US duties were illegal, and Europe had prepared a list of US products and services for retaliatory sanctions to be imposed scarcely a week from the US announcement.[i]

The Supreme Warlord, in making the announcement, averred that the duties were no longer necessary, having done the job of getting the US steel industry back on its feet. Like almost everything else that the man says, this was quite risible. His “bariffs and terriers” have not been in place long enough to affect much. If anything has happened to help US steelmakers, it is the falling dollar, but even that observation must be qualified. The falling dollar may support US steel exports to Europe, but it is highly doubtful that it will make any difference with respect to the rest of the world. The problem is that the dollar has fallen over the course of the last two years against the euro and a handful of other currencies such as the Canadian and Australian dollars, but hardly at all against anything else. Asia, where the real competition in international steel manufacturing is located, will be virtually unaffected. The US move is therefore rather good news for Asian steel makers, as it is for other producers in the developing world. It should be especially welcomed in Brazil. It is, in short, a signal to the markets to sell the dollar and buy emerging market currencies which have not appreciated against the US currency over the last two years, and which .have actually weakened in 2003.[ii]

Click to view big version

The dollar: still down after all these years

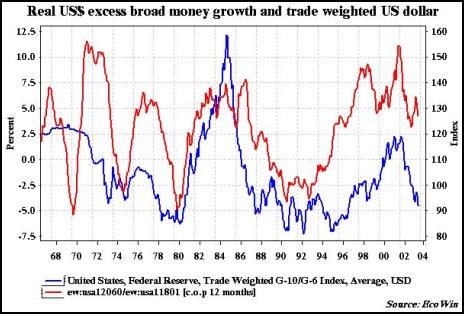

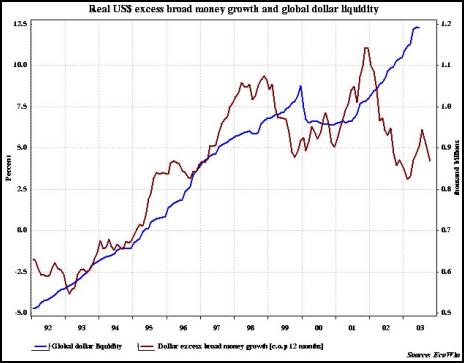

The dollar’s fall has by now become statistically significant, with the Fed’s broadest dollar[iii] index now closing in on its 38.2% Fibonacci retracement of the dollar bull market that began in 1995. This level is a logical place for the dollar to stabilise for a little while against a broad basket of currencies, which ought to mean that it should recover somewhat against the yen, euro and other trans-Atlantic currencies. Against the currencies of America’s major trading partners, is within less than 11% of its 1995 lows having retraced more than 73% of the rally that began in 1995. It should easily revisit those levels in 2004. So this is not an endorsement of the dollar - not even tactically. Rather, this it seems a good time to begin to think about rolling dollar shorts out of the European bloc and into emerging market currencies, which as can be seen above have not participated in the rally against the dollar, rather than increasing dollar exposure. The reasons for this are several. From a portfolio perspective, buying high yield emerging markets increases income at a time when the outlook for bonds is worsening. Buying a range of such currencies in Asia, Latin America, South Africa and Eastern Europe delivers a diversified exposure that is highly resistant to event risk. And most of all, the US has boxed itself into a position from which it has very little policy flexibility. It is very close to the point where a policy tightening by the Fed is going to be necessary to anchor longer term bond rates. On the other hand, the US economy is so highly geared that such a tightening is highly likely to seriously hurt the stock and real estate markets, never mind the likely associated losses along the bond curve. The Fed is therefore very likely to begin a long Kabuki dance with the markets. The first stage of this, which is already in train, is to acquiesce in the fall of excess money growth.[iv] The second stage, which will likely begin at this week’s policy meeting, will be to fine tune its policy pronouncements without actually doing anything overt with respect to rates. The third stage will be to actually try to push the price of money up. This will be a lengthy process, which will last at least two quarters, we think, and maybe longer. The real threat to emerging market economies therefore, which would be a fall in global dollar liquidity, is therefore unlikely to occur anytime soon.

Click to view big version

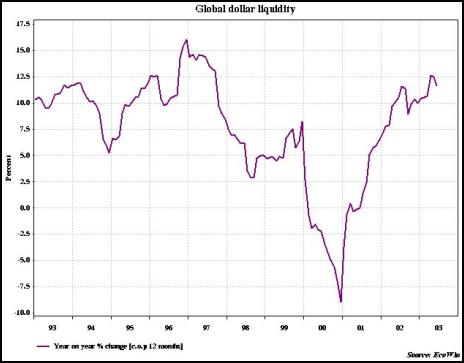

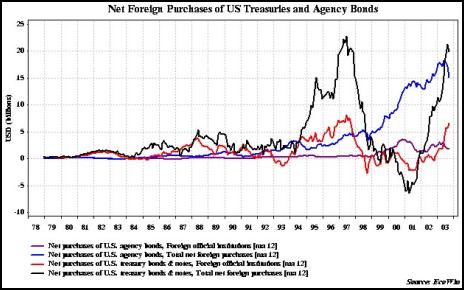

Why this is the case can be seen from the chart. The last time global dollar liquidity fell sharply it collapsed, beginning with the Asian crisis in 1997 and accelerating following the dollar’s collapse in early 1998. The reason for this, as we can see from the following chart, was massive divestment by foreign owners of US official and quasi-official assets.[v] Today there is a sharp drop in Agency demand from both official and private sources, which is being offset largely by an increase in foreign official purchases of Treasuries.

Click to view big version

GSE debt: no longer a store of value

Government Sponsored Enterprises in the United States are a key tool for the management of demand in the American economy. They have grown to occupy an oligopolistic position at the heart of the US housing market. Their mortgage purchase and repackaging business is the key conduit of liquidity to the national housing market generally. In this they function as a pipeline of national and international investor savings direct to house buyers, which on the face of it is no bad thing.

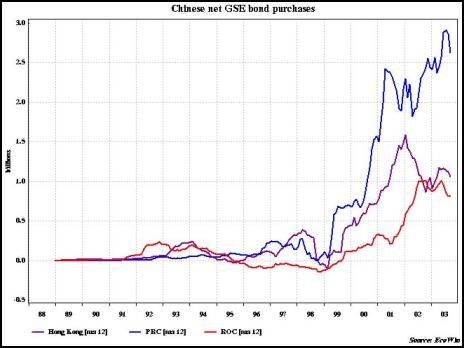

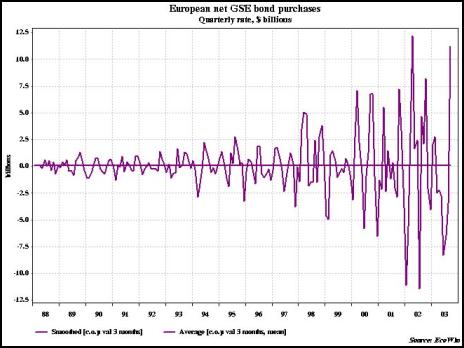

Good or bad, it has had consequences. One of these has arisen from the fact of the government’s implicit and explicit backing for the GSEs, because this has accorded them a price advantage in raising capital. They enjoy a direct advantage because the market buys their debt at higher prices (i.e. lower yields) than their commercial competitors enjoy. There is also the indirect advantage that the extraordinarily high leverage that they are consequently able to carry affords them. They have become so large that they have become almost like a central bank, a point that they are quite ready to make to actual and potential foreign buyers of their debt. Fannie Mae, indeed, in the last ten years has marketed its debt explicitly on this basis: a regular issuance schedule across the yield curve, with benchmark bonds, has aped the Treasury’s borrowing program in an attempt to attract liquidity conscious investors. And attract them they have. China[vi] for instance has vastly increased its net purchases of GSE debt in recent years, as have Japan and the UK. Each of these has in the last year increased its net purchases to average monthly levels of around $3 billion each.[vii] Interestingly, Europe has not followed suit. European net demand for GSE paper is negligible by comparison[viii]

“Globalisation” of capital markets has become such a cliché in recent years that this is hardly surprising, but it is interesting nevertheless. The huge increase in foreign demand for GSE paper would be worth noting if for no other reason than what it implies about the importance of foreign savings for activity in the US housing market. But that sort of dependence in America’s IMF world in fact cuts both ways. The more net exposure they accumulate to the US housing market through the medium of the GSEs, the more dependent they become on the monetary system that accommodates the increase in credit demand that requires foreign funding in the first place.

It is important to recognise how different the situation would be were the US running a balance of payments surplus rather than the large and growing deficit that it is actually running. In the former situation, foreigners might lend to the GSEs or to other US borrowers, bun not needing them, the US might as well ignore them. The reality today is that no US administration can ignore them. What this implies about the freedom of action of the “world’s only superpower” is quite clear. It has very little room for manoeuvre.

Click to view big version

As can be seen from the above graphic comparing global dollar liquidity and excess money growth, there appears to be a clear correlation between the two operating with a two year lag. From what we know about Asian currency intervention to support the dollar in the third quarter of 2003, global dollar liquidity will have risen further in that period, further stretching the divergence that has manifested for the last two years. The clear inference is that 2004 is likely to be an important inflection point. The interest of any administration with an election to win would be to keep this from happening, or at least to have it happen in a gradual, staged fashion.

Not for the first or last time: the Fed’s dilemma

This then, is a graphic representation of the sharp edge that the Fed is balancing on. Stock markets do not generally fall during election years, but there are exceptions, most notably being the 2000 presidential election year. Another was 1984, when Ronald Reagan won a second term in office running against Walter Mondale.[ix]

1984 was, of course, during the heyday of Iran Contra narcotics trafficking, Savings and Loan fraud, and the leveraged buyout boom. Things have not changed much since, whether or not the administration of the day is Republican or Democrat. But today, many of the personalities from the old Iran Contra days are back in power and are exercising it. The point here is that markets do work – they are only interfered with. The Dow should have been down in 1984 given what we now know about the massive damage being done at the time to the US economy. What is anomalous are the successive years of outsized gains since.

Today similar damage is being done, or more accurately, continues to be done. The Supreme Warlord’s chances of re-lection are best the lower the voter turnout and the better controlled the voting results in marginal districts; in other words, a replay of 2000. Even that may not help him much if foreign governments stop buying Treasuries and Agencies, because today it will be the middle class constituency that has been the bedrock of Republican support since Nixon that is going to feel the impact most. Foreign governments have seldom exercised such control over the outcome of a US election as they potentially exercise over this one.

- Chris Sanders

[i] See Reuters December 4, 2003, Chronology of WTO decision on US steel tariffs.

[ii] See Q4 Economic and Market Strategy Update

[iii] Ditto

[iv] That is, real money growth: the difference between the rate of money growth and the headline inflation rate.

[v] Global dollar liquidity = US monetary base + foreign official holding of US Treasury bonds and bills. GSE liabilities held by foreigners are not included in the calculation, although a good argument can be made for doing so. In any event, as the data presented here suggests, for foreign governments that hold Agency debt as well as Treasuries as reserves, the impact is to inflate the figures, not to change the message. Whether or not agency debt will continue to be used as a component of foreign reserves after the inception of the Basel II Accord is open to question. With Basel II GSEs will no longer be treated as government non-reservable assets for the world banking sector.

[vi] China has become important as the marginal buyer of last resort for US Agency debt.

Click to view big version

[vii] Also of interest is the importance of the private sector in demand for GSE paper. It is hard to avoid comparison with the CMO market of the late 80s and the early 90s, when marginal demand for the high risk Z , or residual, tranches of collateralised mortgage obligations was filled by US savings and loans and Arab and Japanese banking institutions..

[viii]While volatile, European demand for GSE paper has oscillated around a long term average net purchase level of scarcely $100 million.

Click to view big version

[ix] Using average monthly prices

instead of month end closes. This factors out to some extent

any untoward market manipulation, not that such could happen

in America.

****** ENDS *******

Eugene Doyle: Chinese Jet Shoots Down France’s Best Fighter; NZ And Australia Should Pay Attention

Eugene Doyle: Chinese Jet Shoots Down France’s Best Fighter; NZ And Australia Should Pay Attention Ian Powell: “I Can Confirm They Are Hypotheticals Drawn Largely From Anecdotes And Issues The Minister Has Heard About.”

Ian Powell: “I Can Confirm They Are Hypotheticals Drawn Largely From Anecdotes And Issues The Minister Has Heard About.” Gordon Campbell: On NZ’s Silence Over Gaza, And Creeping Health Privatisation

Gordon Campbell: On NZ’s Silence Over Gaza, And Creeping Health Privatisation Richard S. Ehrlich: Pakistan & China Down 6 Indian Warplanes

Richard S. Ehrlich: Pakistan & China Down 6 Indian Warplanes Keith Rankin: War In Sudan

Keith Rankin: War In Sudan Ramzy Baroud: Netanyahu's Endgame - Isolation And The Shattered Illusion Of Power

Ramzy Baroud: Netanyahu's Endgame - Isolation And The Shattered Illusion Of Power