SRA Comment: When In Doubt, Blow A Bigger Bubble

SRA Commentary: When in doubt, blow a bigger bubble while bombing

By Chris Sanders

November

2003

The sense of free choice people enjoy is partly illusory when viewed against deeper influences that are normally hidden. Bureaucracies and societies, just like the psyche, have their own inertias that impel them in sordid, unjustifiable directions.

- Peter Dale Scott, Drugs, Oil and War, 2003 Rowman & Littlefield Publishers, Inc., p.11.

Freddie Mac: $5 billion in fraud and counting

It is testimony to the ubiquity of crime in the modern American economy that the criminal investigation of one of the country’s largest corporations and lending institutions has been greeted with the equivalent of a bored yawn. David Glenn, the president and Chief Operating Officer of the Federal Home Loan Banking Corporation (Freddie Mac) has agreed to cooperate with the OFHEO investigation of Freddie and has been assessed a civil fine of $125,000. This sounds a lot to us like a plea bargain – he agrees to cooperate in return for protection from the full force of the law. The investigation is widening as well; as of this writing, both Citigroup and Morgan Stanley have been drawn into the web. Louisiana Representative Richard Baker said, “We’ve now entered Enron territory, and we should all be gravely concerned.”

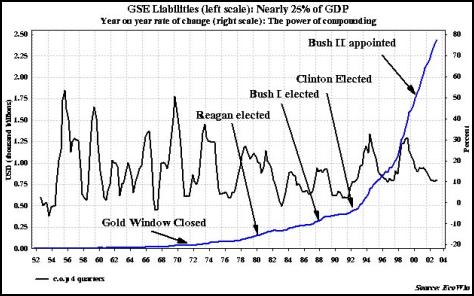

He is right, we should. The problem is systemic. The Federal National Mortgage Association (Fannie Mae) now finds its accounting practices under investigation. As we have discussed from time to time in the past, the Government Sponsored Enterprises at the heart of the US housing market and mortgage finance and guarantee industry have been wildly successful money machines, largely due to their privileged position, and have inevitably made enemies in the process. Prominent in the line up of those who would like to cut them down to size are other institutions that would like a piece of the action in the mortgage repackaging and guarantee business. Indeed, for anyone with ambitions of competing with Fannie and Freddie, this may well take on an existential character. The funding advantage that the GSEs enjoy thanks to their line of credit with the US Treasury and the implicit guarantee of the US taxpayer gives them pricing power that simply is out of reach of mere mortals not so blessed.

The GSEs contend that they pass the financial benefit of all this on to their retail mortgage borrowers, a claim so risible it might derail the investigation for all the laughing. The truth that the mortgage market has become emblematic of what ails the economy at large. The financial rewards go to those best positioned to game the system rather than to those with the best product and highest productivity. The markets’ belief that the GSEs are federally backed, coupled with the existence of those lines of credit with the Treasury, have meant that they can pile huge amounts of liabilities onto their capital base. Indeed, the logic of their position requires them to do just that during any expansion. The bigger they are, the more expensive both politically and financially is the cost of letting them fail. In a word, their risk profile is asymmetric. No other bank in the country would be allowed by its regulators to have a liability to capital ration of 33 to 1, never mind their derivatives exposure that is off balance sheet. When you consider that the GSEs collectively have balance sheets worth more than $2 trillion, or more than 20% of GDP, any politician contemplating letting them fail is likely to think hard and twice before allowing it to happen.

An asymmetric bias toward fraud (that is, as long as we can get away with it)

This asymmetric bias built into the GSE “model” is also, as it happens, built into the entire financial system. For all the huffing and puffing about the “implicit” guarantee afforded the GSEs by the Treasury, the truth is that this is also accorded to other financial institutions under the rubric “too big to fail.” Citibank would have collapsed in the early 90s were it not for the loving consideration afforded it by the Federal Reserve. John Reed, CEO at the time, not only did not lose his job but went on to sell out to Sandy Weill of Travellers, making a fortune thanks to the subsidy of the taxpayers. Basically, the taxpaying citizens of the United States have been drafted into a socialised corporate welfare scheme to save the banks from themselves, and to underwrite the mistakes of management. What is conspicuously lacking is any disincentive to management from taking ever-bigger risks. This is the issue that is worthy of informed public debate. Unsurprisingly, the debate is not occurring because the system is money for old rope.

What is interesting is the question, “Why now?” As of this writing, six Federal Home Loan Banks (half of the FHLB system) have been downgraded or assigned a negative outlook. Freddie Mac is the target of a criminal investigation, and Fannie Mae may well follow. That would be news. Fannie Chairman and CEO Franklin Delano Raines is a Harvard University and Harvard Law graduate, Rhodes Scholar, and held jobs in the Office of management and Budget and Assistant Director of the White House Domestic Policy Staff during the Carter administration. Through the 80s he camped at Lazard Freres, to return to Washington with the Democrats when Bill Clinton won the Presidency in 1992. At Fannie Mae from 1991 to 1996 as Vice Chairman, he left to run the Office of Management and Budget under Clinton, where he is credited with balancing the Federal Budget. A member of the Council on Foreign Relations, he sits on the boards of AOL Time Warner, PepsiCo and Pfizer. The point, obvious from his resume, is that Raines is a democrat, next year is an election year, and importantly, Fannies, Freddie and the FHLB were vital players in the last administration’s fiscal strategy. The debt bubble pumped up by Rubin and Summers with Asian capital and the balance sheets of the Democrat Party-controlled GSEs made politically feasible the “balancing” of the Federal budget. There was no austerity in the US, nor was there any increase in the national savings rate. Is this payback time?

We don’t think for a minute that “payback time” has anything to do with making the GSEs more responsible. What is more at issue is perhaps control. Under the Bush administration Ginnie Mae, ensconced in its cocoon of no audits and no accountability at the Federal Housing Administration in HUD, has been allowed to compete with the publicly traded GSEs for private loan origination and insurance business. This means that the administration can take on the democrats without losing the ability to keep the housing bubble inflated.

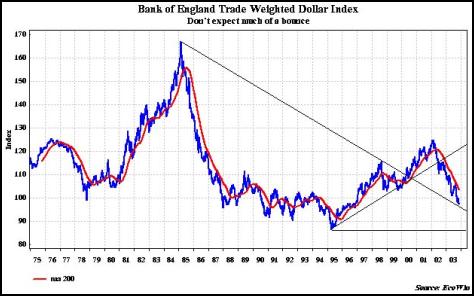

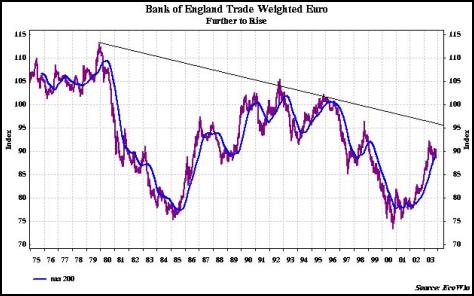

Dollar down, stocks down, gold up

The dollar is breaking to new lows, in a bear market that will certainly break all records for magnitude and duration. The stock markets are also, on the face of it, beginning to discount a long and unpleasant war in the Middle East. Gold is testing $400 and will almost certainly break it decisively before the end of the year. Timing, though, is of less importance than the trend, which is up.

Thirty two years ago when the US government closed the gold window at the New York Federal Reserve, it embarked on a campaign of lawlessness by virtue of its abrogation of the Bretton Woods Treaty. It is testimony to the degraded state of both the markets and the economics profession today that law is so seldom discussed, except insofar as it is used as a pretext to loot another country or company. Nevertheless, the Bretton Woods Agreement had one real virtue: it compelled the United States to operate openly, which meant that it was impossible to disguise the outflow of gold from its vaults as foreign governments accelerated their sales of dollars for gold.

Today there is no such legal foundation for the operation of either the Fed or any of the other central banks. This does not, however, mean that the operation of supply and demand in markets has been repealed. All it means is that the central banks and their associates in the finance ministries of the developed world and the economics faculties of the “leading” universities have become agents of deception. Gold is still flowing to economies with positive net exports such as China and Japan, and to those with sufficient capital to be able to buy it. No amount of derivative issuance, secret Treasury underwriting of short positions, or even illegal activity can stop this. All it can do is stop taxpayers from seeing where their reserves have gone and are going.

Central bank independence: not from politics, but certainly from oversight

This consensus that accepts this state of affairs used to be justified on the basis of central bank “independence” from political control. Independence is not discussed so often these days; I suppose because otherwise no one would be able to talk for laughing. Instead the precedent of currency intervention has dulled the critical faculties of market participants and the economists who follow such matters. Secret intervention to suppress the gold price is viewed on this basis as qualitatively no different than intervention to support the Argentine peso, the pound or any other paper currency.

It is of course not the same, either economically, politically, or morally. Economically, because gold is, after all, the sine qua non of value, and the storage of value across time. Central banks have the power to create paper currencies: they do not have the power to create gold. Politically, because in the effort to pretend that economic matters are otherwise than they really are, it is inevitable that government itself dissemble and operate in secrecy. No such secrecy is necessary in the case of currency intervention. Money supply numbers are freely available; but just try to find out who is really the beneficial owner of the gold that is labelled with the Orwellian rubric “Deep Storage” by the Federal Reserve.

And finally, there is the moral difference, which is the same moral difference that exists between law and crime, between truth and falsehood, and between freedom and tyranny. Every adult knows that there are some matters on which it is sometimes preferable to be vague, if for no other reason than the fact that none of us can really know for sure whether or no we are absolutely right about this or that matter. On the other hand, when such relativism becomes the norm, it invites relativism in other matters as well. When the Federal Reserve was established ninety years ago, it was promoted ostensibly as a means coping with the banking crises that had been a part of the 18th and 19th century American economy. Fresh from the crisis of 1907, in which JP Morgan, as the folk memory has it, stood alone between order and chaos, it was argued that society needed a public institution to do the same, rather than depending on one man. What the country got was a private institution, owned by the banks that it regulated, which is to say largely by JP Morgan, who thus was granted a monopoly to create currency. This he most certainly did not have before the creation of the Fed.

Perhaps this is why it was possible for the Roosevelt administration to repudiate the gold clause in its bond contracts in 1933 and to get away with it. After all, if one is prepared to grant such a lucrative monopoly as currency creation to such a small coterie of men on the basis of such a bald deception as to the nature of the deal, why not just accept lawbreaking on the basis that there is a national emergency, declared at the sole discretion of the lawbreakers? And having managed to get away with this, by intimidating the Supreme Court into refusing to rule, it is not too big a step to create a slush fund for the lawbreakers, to be used at their sole discretion, which is surely what the Exchange Stabilisation Fund created by Roosevelt and his Treasury Secretary Hans Morgenthau is.

Permanent War Economy = Permanent Peacetime Deficits

Having had some practice with the creation of secret vehicles such as the ESF, the establishment of the C IA in 1947 was child’s play, the debate about creating a secret intelligence apparatus allowed to break the law by the passage of the law creating it being minimal. With the passage of time, the playful comparison made by Dean Acheson between the CIA and the NKVD no longer seems the joke it undoubtedly seemed to his interlocutors.

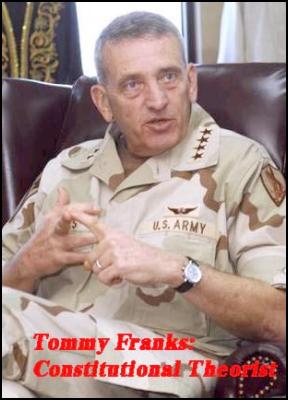

This may seem an odd departure in a market commentary, but it is important because all this was necessary to create the basis for a permanent war economy, which would otherwise not be possible to sustain. Secrecy, subterfuge, and mendacity are all prerequisites, whether premeditated or not. It is thus with more than a little trepidation that we read General Tommy Franks, who commanded the assault on Iraq, wondering aloud about whether or not the US constitution could possibly survive the use on American soil or weapons of mass destruction. His answer is no, it could not, a disturbing belief from an officer whose oath of allegiance is to that very same Constitution – not to his president, not to the army, not to anything other than the Constitution and the system of law, order and accountability that it represents.

General Franks is a representative of a military that has demanded in recent years that its budget be fixed by law at somewhere between 4% and 5% of GDP. In effect, what is on the table here is a carte blanche to the military to set its own spending by diktat, and indeed, in the aftermath of 911 this is exactly what has already happened. No wonder he muses about the Constitution. It has already been suspended, and one is left wondering about General Franks and his fellow officers who are bound by oath to defend it: if they are still in uniform, does this mean that they will not defend it?

- Chris Sanders

© Sanders Research Associates 2003

Gordon Campbell: On The West’s War Against Iran

Gordon Campbell: On The West’s War Against Iran Binoy Kampmark: Condemning The Right To Self-Defence - Iran’s Retaliation And Israel’s Privilege

Binoy Kampmark: Condemning The Right To Self-Defence - Iran’s Retaliation And Israel’s Privilege Gordon Campbell: On The Making Of King Donald

Gordon Campbell: On The Making Of King Donald Binoy Kampmark: Rogue States And Thought Crimes - Israel Strikes Iran

Binoy Kampmark: Rogue States And Thought Crimes - Israel Strikes Iran Eugene Doyle: The West’s War On Iran

Eugene Doyle: The West’s War On Iran Richard S. Ehrlich: Deadly Border Feud Between Thailand & Cambodia

Richard S. Ehrlich: Deadly Border Feud Between Thailand & Cambodia