SRA Commentary: Post-National Depression

SRA Commentary: Post-National Depression

By Chris Sanders

June 23,

2003

"The influence of financial capitalism and of the international bankers who created it was exercised on both business and on governments,"...this was only possible if they ..."accept two "axioms" of its own ideology. Both of these were based on the assumption that politicians were too weak and too subject to temporary popular pressures to be trusted with control of the money system; accordingly, the sanctity of all values and the soundness of money must be protected in two ways: by basing the value of money on gold and by allowing the bankers to control the supply of money. To do this it was necessary to conceal, or even to mislead, both governments and people about the nature of money and its methods of operation.- Carroll Quigley, Tragedy and Hope, New York, Macmillan and Co. 1966, p. 53

Leading from the rear

Last week's collapse in international bond prices was a warning, if any were needed, about the fragility of the markets. It was followed late in the week by a drop in the US equity market, which most observers attributed to disappointment with US economic news. This is unlikely. The only reason to prefer equities to government bonds?with the price earnings ratio on the US market over 30?is if one's equity portfolio pays more than one can earn on bonds. Bond yields are capping equity market performance. As if to drive the point home, John Berry, Allen Greenspan's leaky muse at the Washington Post, published an article on the 19th ( http://www.washingtonpost.com/wp-dyn/articles/A10948-2003Jun18.html ) suggesting that the Fed might very well cut rates by a full 50 basis points at this week's meeting. Such a large move would be a signal, he said, that this would be the last rate cut for this cycle. Greenspan has never been one to lead from the front, preferring to give the markets guidance and then ratifying it after they discount the desired outcome. sra's take is that we are very close to the end of this rate cycle. This is not the same as saying that we think that rates are ready to start the inevitable long climb higher, but without the prospect of a capital gain to sweeten returns, bonds as an asset class are going to struggle. Bullish sentiment is higher than at any time since 1987, which should give both bond and equity investors pause for thought.

Both the stock and bond markets are afloat on a torrent of liquidity. The prospect of even a modest decline in the rate of central bank liquidity provision threatens to lower the water level and beach both markets on the shoals. Nor are the American capital markets the only ones at risk here; the dollar is very vulnerable to any letup in Japanese central bank buying. Having purchased well over $30 billion propping the dollar in May, even the Bank of Japan is going to have to pause and consider where it goes from here. At that sort of rate, it would have to increase Japanese reserves by some 50% by year-end. At this point we wouldn't count on that not happening, given that we would never have believed that Japan would so thoroughly subordinate its interests to Washington in the first place. But if the US is to have a prayer of dealing with an economic collapse of its own then it needs dollar devaluation against Asia, and that means that we are within sight of a lower target for the dollar-yen rate.

Outmoded models

One of the biggest pitfalls in economic forecasting and market analysis in recent years has been the habit of expecting national governments and central banks to behave as though they are maximising national welfare. We have, very reluctantly, abandoned our own belief that this is indeed the case. This is as true for the US as it is for Japan. The managers of the American political economy are in the business of maximising their self-interest, not that of the nation. Indications of this have proliferated over years. One basic example has been the practice of allowing dual citizenship. First American Jews were permitted to hold both US and Israeli passports. Then Irish Americans were permitted to do so, and today Anglo-Americans such as this writer are similarly endowed with two passports. If national citizenship is to have any meaning at all, this is internally inconsistent. Logically, if reluctantly, we therefore conclude that it does not.

Similarly, the targets of the New World Order are, without exception, nationalists. As our own John Laughland and the British Helsinki Human Rights Group have tirelessly documented, in country after country in Eastern Europe and the Former Soviet Union nationalists have been targeted for political, if not physical, elimination. Slobodan Milosevic, on trial at The Hague for crimes against humanity, is really on trial for his nationalism. Carla Del Ponte, chief prosecutor, let the cat out of the bag last week in remarks about other Serbian leaders still at large. Their crime, Del Ponte said, is that they are nationalists.

The author of the introductory quote at the beginning of this Commentary, Carroll Quigley, understood better than most that real political power resides with real people, and not abstract institutions such as national states. As he points out elsewhere in the same book, at the turn of the 19th and 20th centuries, no more than 300 people, all of whom knew one another, ran Europe. This is as true today as it was then, with the important proviso that the intervening period experienced two world wars, or three if you are inclined as the neo cons in charge in Washington today are to consider the Cold War as the third. Quigley also understood that the real levers of political power were not held by kings or presidents but by the people who financed them. Indeed, the history of the last three centuries is in many ways the story of finance capitalism. This is a pivotal point, a clear understanding of which is an indispensable prerequisite for good market analysis. The truth is that the national model that underlies the data that we use for describing both economies and markets is not only inadequate but positively misleading. Finance capital knows no borders and holds no national allegiance. Not for nothing did Stalin, who understood this well, purge the Soviet Communist Party of "cosmopolitans."

The old story, Capital versus Labour

In a contemporary context, the establishment of the European currency union requires the dissolution of historical and emotional identification built painstakingly over more than two centuries. Nevertheless, most analysts naturally tend to think and worry about the outcome as the creation of a larger "state" on the national model, with a unifying theme of European identification. A consequence of this mental construction is the implication that such a state exists in opposition to the United States, another super state on the other side of the Atlantic. Ergo, on issues such as the invasion of Iraq or the Doha Round of trade negotiations, the EU is construed as confronting the US. This is too simple a construct.

We say this because the idea of competitive states does not adequately explain the clearly close collaboration of both Europeans and Americans in many spheres. Most important of these is the negotiation of the new Basel Accord, which will underline the consolidation of global finance and institutionalise the dominance of a handful of large firms, both American and European. Quite apart from the micro- and macro- economic implications of this treaty (for it is a treaty, whether or not it is called or treated like one) the political implications are breathtaking: Basel Two will consolidate control of the international financial system in a few transatlantic hands. A better model for understanding contemporary developments is a class model, which of course Marx saw so clearly one hundred and fifty years ago. Competitive nations are not the same thing as competitive individuals or families or corporations.

Nations were constructs made necessary by changes in warfare, which by the 19th century had been transformed by simple and cheap weapons, conscription, and large-scale mobilisation. Today, complex and expensive weapons, volunteer armies and even privatisation of warfare have combined to weaken the social, political and geographic ties that bound nations together. This is a process, not an event, and can be understood without resort to arcane theories of conspiracy. But it has major implications for investors, and not just in deciding whether or not to buy "defence" stocks.

The dustbin of history

The contemporary international financial system is an artifact of the nation state, and appears to be headed to the same place, which is the dustbin of history. It is difficult to look at modern America's balance of payments and conclude anything else. A $500 billion current account deficit is not sustainable even for the "world's sole superpower" as more and more observers are coming to understand. No empire in history has successfully exerted dominance without running a surplus, let alone a deficit as large as the American net foreign debt. Logically, if the Americans are not prepared, willing or able to raise net exports (that is to say savings) then something needs to change. That something, we think, is going to be political. What will change is what it means to be an American, just as currency union in Europe has changed what it means to be a Frenchman, a German, or an Italian.

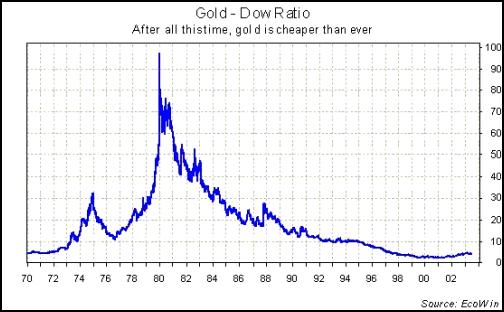

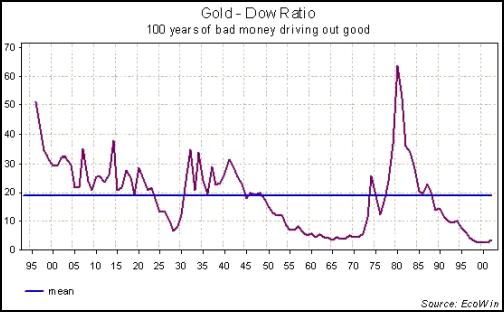

If this changes for these reasons, then the relationship of the US currency to the rest of the world is also likely to change. It is interesting, therefore, that the ratio of gold to the Dow Jones Industrial Average has fallen back to where it was over thirty years ago. For all the hoopla about the bull market of the 80s and the 90s, gold still buys as much of a piece of the action as it did three decades ago. If one looks back even further, one can see that the period of dollar dominance in international finance has seen a steady fall in the purchasing power of gold punctuated by one tremendous surge in the 70s and the 80s in the wake of the US abrogation of its Bretton Woods obligations.

This sort of uncertainty is not really in the interest of capital, unless you really think that the world economy can support an unprecedented and continuous rise in productivity growth for the indefinite future. That is, of course, what we are asked to believe by our rulers, and perhaps that is indeed what will happen. If that is so, however, then one wonders why four of the richest men in the world, Bill Gates, Warren Buffet, George Soros and Ted Turner are all large donors to organisations whose purpose is population control. These men are not stupid. What do they know that their economists do not?

The brave new world of post national world government is going to have to have a new currency order, in which the interests of the newly richer owners of capital are protected against the risk of a fall in the value of their assets. The G3-managed float that we live with today cannot last if only because there is a limit to how many dollars each country in the system can accumulate as a proportion of the whole. Sooner or later a system of managed "stability" is going to come into being. What we are living through now is just the positioning for advantage in advance of the inevitable negotiation. What these charts suggest to us is that the financial asset par excellence, gold, is awfully cheap under the circumstances.

Eugene Doyle: Writing In The Time Of Genocide

Eugene Doyle: Writing In The Time Of Genocide Gordon Campbell: On Wealth Taxes And Capital Flight

Gordon Campbell: On Wealth Taxes And Capital Flight Ian Powell: Why New Zealand Should Recognise Palestine

Ian Powell: Why New Zealand Should Recognise Palestine Binoy Kampmark: Squabbling Siblings - India, Pakistan And Operation Sindoor

Binoy Kampmark: Squabbling Siblings - India, Pakistan And Operation Sindoor Gordon Campbell: On Budget 2025

Gordon Campbell: On Budget 2025 Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship

Keith Rankin: Using Cuba 1962 To Explain Trump's Brinkmanship