SRA Commentary: A Failure of Imagination

A Failure of Imagination

April 14, 2003

Commentary By Chris Sanders

"It is this that is lacking to the Western thinker, the very thinker in whom we might have expected to find it – insight into the historically relative character of his data, which are expressions of one specific existence and one only; knowledge of the necessary limits of their validity; the conviction that his “unshakeable” truths and “eternal” views are simply true for him and eternal for his world-view; the duty of looking beyond them to find out what the men from other Cultures have with equal certainty evolved out of themselves."Oswald Spengler, The Decline of the West, Oxford University Press, Oxford, 1991, pp. 18-19

Bankruptcy Incorporated

The US Federal government released its Financial Report of the United States Government for 2002 on March 31. This annual document is the result of the government’s attempt in recent years to put its financial reporting on a more practical and businesslike footing. It uses accrual, rather than cash-based accounting, with the express intent of presenting a clearer long-term picture of the government’s actual financial position.

The document is not easy to find on the Treasury’s web site. The first time we looked for it, we had to use the site search engine to find it. The following day, we did exactly the same thing and were unsuccessful. Fortunately, the General Accounting Office’s web site has a link on its home page. For those of you so inclined, we would recommend downloading the PDF (over 130 pages) document from the GAO site. The Treasury has never made access to the FRUS easy. A glance at the report may suggest why.

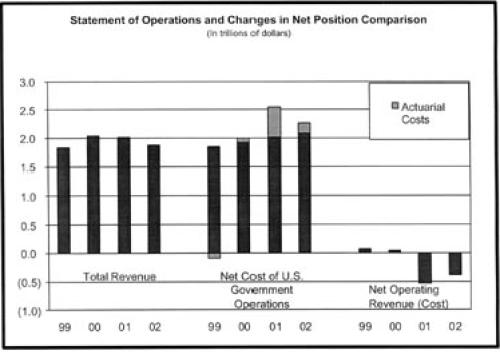

On page four for instance, a clear and simple bar chart shows the dramatic deterioration in the government’s finances in recent years. Although the Treasury Secretary’s terse introductory letter downplays this, making it seem as if it is solely due to the accrual of veteran’s benefits, that is clearly not the case and the bar chart on page 4 shows why. Cash outlays are also increasing rapidly. In any event, the recognition of long-term military benefit liabilities is still a major financial issue. This figure was well over $300 billion in 2001, doubling the cash accounting figure for military spending. That money will have to be raised in the future either by increasing taxes, issuing bonds, or stiffing the veterans. Even the market-challenged economists on Wall Street will have difficulty ignoring the ramifications of using any or all of them. All imply the necessity of raising the national savings rate.

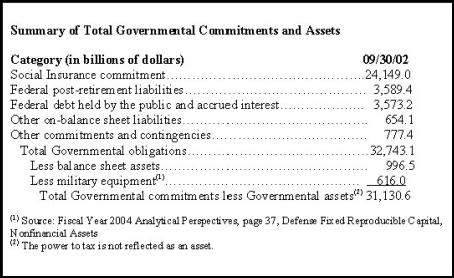

A table on page six called “The Big Picture” puts this matter as starkly as one could imagine. Total government liabilities less assets were more than $31 trillion (that is, over $31 thousand billion) or more than 295% of GDP on September 30, 2002. The report rather coyly says that this does not count the power to tax as an asset, but goes on to point out that discretionary spending aside, the government is obliged to fund a net social security liability of $24 trillion more than anticipated revenue. This is non-discretionary, and makes nonsense of the government’s habitual reporting of its annual deficit gross of the current cash surplus in the social security fund.

Against this background, asking Congress for cumulative tax cuts of $730 billion and starting what former CIA director James Woolsey calls (with relish) World War Four seems odd, if not negligent. It is no wonder that Snow, who stands in shoes several sizes too big for him and is the man who is supposed to find the money, has so little to say in his preamble to the FRUS. What can he say except, “I support my president”? Presumably he is hoping that the Bush family will reward his loyalty in the same way that they have rewarded Messrs. Cheney, Rumsfeld and Powell. Frankly, he would do better to follow the lead of O’Neill, Lindsey and Hubbard and quit.

As if the published numbers are not bad enough, in his commentary on the FRUS, Comptroller General David Walker of the General Accounting Office rubbishes the quality of the numbers themselves. Unfortunately, it is unlikely that any mistakes are likely to result in a more positive picture. Before it was saved by the war, the Department of Defense had actually admitted to some $2.1 trillion in erroneous payments and overpayments. The government as a whole had admitted to $3.3 trillion. In the words of the Comptroller General:

DOD asserted that it is unable to comply with applicable financial reporting requirements for (1) property, plant, and equipment, (2) inventory and operating materials and supplies, (3) military retirement health care, (4) environmental liabilities, (5) intragovernmental eliminations and related accounting adjustments, and (6) cost accounting by suborganization/responsibility segment and major program.

Based largely on DOD’s assertion, the DOD inspector general disclaimed an opinion on DOD’s financial statements for fiscal year 2002 as it had for the previous 6 fiscal years (emphasis mine).

Vassals and tribute

It is no good to protest that other industrial countries also have high levels of debt and poor government accounting and financial control systems. To begin with, other countries do not issue the world’s reserve and transactions unit. For that matter, the one industrial country other than the US with the most disarray in its financial and monetary affairs is Japan, upon whom the US depends to finance a significant proportion of its net foreign debt. As we have argued for years, much of that disarray is due precisely to the lack of fiscal and monetary restraint in the United States. Management of Japan’s fiscal and monetary affairs is a shambles. But the party really threatened by that is America, which depends upon Japan to ensure that the dollar does not collapse as US net foreign debt piles up.

The arithmetic is simple and worrying. The Bank of Japan’s balance sheet has total footings of over $1 trillion, or a quarter of Japanese gross domestic product. Since 1995, the Japanese government has accumulated more than $400 billion in dollar reserves, which it has financed by issuing debt that has been monetised, that is purchased, by the Bank of Japan. This represents nearly half of the Bank of Japan’s assets. If the dollar were only to fall to its 1995 lows, the hole this would blow in the Ministry of Finance’s balance sheet would be enormous. The transfer of wealth that this represents may not be unprecedented in history, but in our experience it is unprecedented for a free country such as Japan to consent to such an irresponsible usurpation of the country’s economic future.

This sort of analysis is presumably thought to be passé by the cadres of the New World Order at the Economist magazine and the US Treasury, but the danger it points to is real enough. The Japanese government has not accumulated gold, at least that anyone knows about, with its foreign exchange reserves. It is therefore in a uniquely exposed position because of its dollar holdings. The system was never intended to work this way, but the dangers of its abuse were understood well enough by Keynes, Harry Dexter White and others who negotiated the Bretton Woods Agreement in the early 40s. The original system envisioned that the IMF would stand ready to provide finance to countries with temporary balance of payments difficulties. It even provided for exchange rate adjustments. It was not designed to deal with the consequences of the systematic refusal of the United States, as issuer of the system’s reserve unit, to manage its role in the system responsibly.

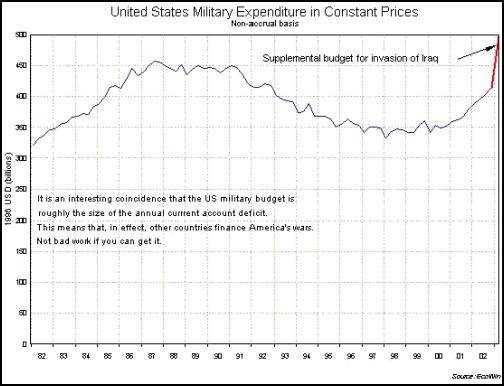

Warfare And Debt, The Terrible Twins

It is striking how intimately related to this problem warfare is. It was ultimately the expense of its global deployments and the Vietnam War that forced the collapse of the Bretton Woods monetary regime. Military spending in the Reagan years delivered a major boost to domestic demand, but by the 90s the strain of paying for the debt that had financed it was being felt. The ensuing recession of 1991 was as much as anything a consequence of the so-called build-down of military expenditure during the administration of Bush the elder.

Never before, however, has the United States embarked on so reckless a course as it has now. Military spending in FY 2002 topped $420 billion. With the increases already approved by Congress in the basic military budget for 2003, the $75 billion supplemental budget for the war will take the cost of America’s military well through $500 billion this year. The open-ended occupation of Iraq that is envisioned, plus publicly contemplated regime change in Iran and Syria, to say nothing of hostilities in central Asia and possibly Korea can only mean that any mistake in this forecast is most likely too low.

Last year we forecast that the Federal budget deficit would probably go as high as 8% of GDP in this cycle. Even this may be optimistic. The impact of this on America’s external payments position will take the current account deficit to unprecedented level. Federal borrowing does tend to crowd out private debt demand resulting in an increase in the private savings rate. But this is not on anything like a dollar for dollar basis. In other words, the increase in private savings historically has not completely offset the increase in government borrowing. Consequently, there is an inflation of the overall economy’s balance sheet. In other words, every marginal dollar in the government deficit will not increase the US economy’s net foreign debt by a dollar, but it is reasonable to assume it increasing the current account deficit by $0.75. Since the current account deficit reached 5% of GDP last year, it is consequently easy to see it rising to over 8% of GDP over the next three years or so.

These sorts of numbers are stupefying, which possibly explains the somnambulistic quality of economic management in Washington today. Gagging on pretzels and conquering the world is far more satisfying than actually paying attention to the public bank account. There is no reason to assume, however, that the rest of the world is not paying attention. After all, the United Sates has put the world on notice that it expects someone else to pay for its war.

This has been greeted with the political equivalent of a two-fingered salute by the rest of the UN Security Council (Britain excepted, of course) who have not unnaturally pointed out that the US has announced that only American firms will be awarded contracts for the “reconstruction” of Iraq. It may have dawned on everyone that the so-called reconstruction is not likely to be anything like what the word implies. Iraq is not going to be reconstructed in the sense of being put back the way it was before its wars began. It will be put into condition to produce and export petroleum, and that‘s that.

The sort of damage that the US and the British are doing is now is simply not all reparable. For example, twelve years of bombing and now more than three weeks of war have left the country seeded with depleted uranium (DU) dust from the thousands of rounds of DU ammunition used by the Anglo-American forces. The cost of cleaning up after this sort of exercise is prohibitive in the best of times, as the government of Montenegro is finding out after having been “liberated” by the Americans, whose aircraft liberally strafed them with DU rounds. In Montenegro’s case, the territory that is being cleaned up is relatively small and contained. In Iraq, the area is neither small nor contained.

Boom Or Bust? That Is Not The Question

Today in the US there are broadly speaking two schools of thought on the economy. One holds that the monetary and fiscal stimulus now in place will result in a

smart expansion, if not a boom after the uncertainty of the war is removed. The second believes that the debt bubble on which the economy is floating will burst, probably led by the implosion of the housing market. The former is conventionally inflationary in its expectation, the latter deflationary.

This divide in expectations is useful analytically because it roughly demarcates the limits open to the government in managing the mess it is in. In our view, the boom view is probably wrong, at least in a general sense, because the economy is not in a position to fully benefit from the fiscal expansion or the increased leverage that is being applied. The composition of enacted and proposed tax cuts is likely to stimulate much increased spending; and private sector balance sheets are already so stretched that more leverage can not produce the desired effect.

But the bust view is also probably wrong, at least in the near term, precisely because the consequences of a housing collapse can be expected to be dire. The economy is increasingly sensitive to liquidity. Every time the Fed has tightened, or more accurately slowed down “the pump” in recent years, the markets have reacted very negatively. The Fed has in turn responded to this with lower rates. Although rates are low now, that needn’t keep the Fed from increasing its purchases of government bonds, or for that matter other assets as well. Our expectation is that housing market weakness will continue to be pre-empted in this fashion.

There is no doubt that this is irresponsible, but that is precisely the point. A war allows Washington to sidestep this charge because, after all, unusual measures are usual in war, are they not?

But this pales in comparison to the rising international tension that is accompanying the American “War on Terror.” American military action threatens the energy security of the rest of the world precisely because it is unilateral and unprovoked. As phase one of the War on Iraq comes to an end, we are discovering what we knew all along: the Iraqi regular army was never going to win a stand up fight with the US in the absence of any effective counter to US air supremacy. The fact that the Iraqis do not possess the alleged weapons of mass destruction that formed the casus belli of the Anglo-American case for war only underlines the illegality and recklessness of the invasion. The rest of the world is taking notice.

Quite apart from the economic cost, there are more ominous straws in the wind. They suggest that the rest of the world is not as passive as the Anglo-American press would like to suggest. In its war against the Serbs, the US destroyed the Chinese embassy in Belgrade. This was portrayed at the time as an accident due to bad maps. As anyone with access to the internet knows, satellite imagery of Belgrade would have given the US up to the minute maps of the city. In the war in Iraq, the US ordered first the Russian diplomatic staff at the embassy in Baghdad to leave, and then attacked their convoy in an air strike that wounded several, including the ambassador. The US has alleged that the Russians had been helping the Iraqis with electronic countermeasures. For all we know it is true and that the Chinese were doing the same for the Serbs would not be surprising either. What would surprise us would be if the rest of the world were to supinely sit back and watch the world’s biggest debtor gobble up the world’s richest petroleum reserves without a fight.

ENDS

Gordon Campbell: On Free Speech And Anti-Semitism

Gordon Campbell: On Free Speech And Anti-Semitism Ian Powell: The Disgrace Of The Hospice Care Funding Scandal

Ian Powell: The Disgrace Of The Hospice Care Funding Scandal Binoy Kampmark: Catching Israel Out - Gaza And The Madleen “Selfie” Protest

Binoy Kampmark: Catching Israel Out - Gaza And The Madleen “Selfie” Protest Ramzy Baroud: Gaza's 'Humanitarian' Façade - A Deceptive Ploy Unravels

Ramzy Baroud: Gaza's 'Humanitarian' Façade - A Deceptive Ploy Unravels Keith Rankin: Remembering New Zealand's Missing Tragedy

Keith Rankin: Remembering New Zealand's Missing Tragedy Gordon Campbell: On Why The Regulatory Standards Bill Should Be Dumped

Gordon Campbell: On Why The Regulatory Standards Bill Should Be Dumped