The Real Deal About Enron (Part 5) – Interview

Mapping the Real Deal…

The Real Deal

About Enron

... an interview with Scoop Real Deal Columnist Catherine Austin Fitts

Part Five Of Seven Parts

By Daniel Armstrong*

Originally Published By Sanders Research Associates

[*Daniel Armstrong is a writer and novelist based

in Eugene, Oregon. Mr. Armstrong is a graduate of Princeton

University and attended the University of Oregon School of

Journalism.] (Click Here for Part One

In

Part One, we introduced Catherine Austin Fitts and

described some of her experiences in taking on the criminal

powers who lie behind the modern U.S. Governmental

apparatus. The Interview transcript follows in DA: While, in the case of Hamilton,

you experienced the Clinton Administration DOJ acting to

this very purpose---canceling contracts and seizing monies.

In fact, HUD still owes you somewhere between two and three

million dollars for work completed on contracts you had with

them. CAF: The Hamilton case proves indisputably that

when there is a will, federal investigators can quickly and

aggressively assert control over records of an investigative

target. They can do so even when their own investigators

take the position that there was no wrongdoing. They can do

so when they have strong assurances as to subpoena

compliance and protection of documents, and they know that

their combined actions will shut down the company, smear the

reputations of its founders, management, and investors and

cause employees to lose their jobs and the value of their

company stock. DA: But the DOJ dropped their

investigation of Hamilton, and you were proven innocent of

the allegations made by Ervin & Associates. How in the world

did you win your battle? CAF: There were many reasons. I

think the principle reason was the extraordinary support of

literally hundreds of decent men and women throughout

government and among the many people who had worked with me

and the people who stayed on to help. This group tried to do

the right thing or to support us in whatever ways they

could---as did my family and friends. We did not have the

support of the rich and powerful, but we had the support of

the "little people.'' When the little people work together,

we are far more powerful than we know. As the support of the

"little people'' allowed the truth to come out, numerous

former colleagues and associates returned to support after

they realized that very prestigious and powerful sources had

misled or lied to them. There is an old saying, "truth comes

together and lies fall apart.'' That is what happened. The

full story of our success is a story of miracles, big and

small. I believe that our freedom comes to us from divine

authority, and my story provides a concrete example. One of

the miracles was that our attorneys included a few fighting

Irishmen who stuck with it when the going got tough. DA:

Are you still hounded by the DOJ? CAF: Managing the

liquidation of Hamilton remains a full time job. DA: What

do you mean? CAF: The DOJ has not moved to dismiss the

qui tam against us, nor, as you mentioned, have we been paid

monies owed Hamilton. We are in litigation between Hamilton,

DOJ and Ervin & Associates with two cases in disco very now

and scheduled for trial next September and one case not yet

scheduled despite years of effort. I think the absence of

any DOJ action to pay us versus generous settlements and

sole source contracts unnecessarily awarded to Ervin speak

for themselves. I anticipate I will spend years in

litigation defending Hamilton against Ervin and holding both

Ervin & Associates and John Ervin personally accountable and

collecting monies owed by the government to Hamilton over

DOJ's opposition. My estimate is that the federal

enforcement establishment may have spent more to target me

over the last six years in this litigation then they spent

to get Bin Laden before September 11th. The fact that they

have provided generous inside deals to Ervin who helped

drive honest people out of government and ensure that

billions were lost by government is particularly disturbing.

DA: What does this mean to you? That

is, compare the treatment you received and the treatment

presently being given to Enron? CAF: Congress did all this

screaming and ranting and raving that really makes it seem

like they are doing something significant. Now what's

happening? I'm sitting there, watching this unfold---then

nothing. As far as I'm concerned, it's "deja vu all over

again.'' They are covering Enron up, exactly the way they

covered up the S&L stuff, which was a very similar

situation. It was a bunch of guys from Houston and New York

Fed member banks and Wall Street who got together and stole

a couple of hundred billion dollars. It is the same private

syndicate---so here we go again---and Congress is playing

the same cover-up game, again. So, basically, the comparison

becomes an out and out contradiction of values. Hamilton was

wrongly accused and its assets were destroyed. Enron is

getting kid-glove treatment, while the stolen money is

getting away. DA: Okay, Catherine, you've laid out your

argument. You've seen this from the inside. You've seen this

from the outside. At the very least, the congressional

investigation has been lax, inefficient, and disturbingly

slow. Mistakes and omission have occurred. But you keep

calling it a cover-up. You've said Enron management provided

the fall guys and that the big winners are really outside

the company, the second and third party Enron investors and

banks that were able to get huge sums of money out before

the collapse. These are the real inside traders. You've also

mentioned Enron and the S&L crisis in the same breath as

though Enron was to some extent an intentional play from the

outside---not just endemic greed in a few members of Enron

management. You've even suggested that some of the same

players were involved across the span of the S&L fraud,

BCCI/IranContra, and Enron. I struggle here. I think most

of us want to reject this idea of systemic syndicated

crime---especially at the level you're talking. But you are

one of the few people in the entire world, who has seen all

of this up close as an inside investigator. Now, it could be

said, that because of what the DOJ and HUD did to you,

you're just slinging mud at the U.S. government and certain

HUD contractors. From talking to you many times over several

months, I have to say, however, I don't get that feeling

from you at all. This is simply my opinion. In the end, I

don't like what you're telling me, but your argument is

compelling. So let's have it. You mentioned a "bunch of guys

from Houston and the New York Fed and Wall Street.'' Clarify

this as best you can. Who or what's at the bottom of Enron?

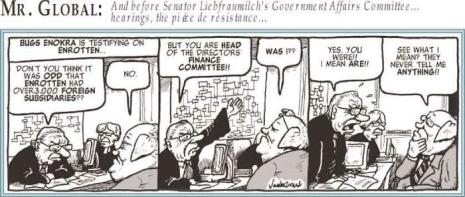

In your opinion, what is the Real Deal? CAF: My

recommendation is to start by studying Herbert "Pug''

Winokur, who, I mentioned earlier, chaired the finance

committee of Enron's board. He is the top guy responsible on

the board to know how the money works and to make sure it is

working in the way that it is supposed to. Pug was a member

of the Powers investigation, the committee set up to

investigate the financial operation that Pug himself

oversaw. He was a board member of Harvard,

overseeing the Harvard Endowment that invested heavily in

Enron, as well as a co investor active with Harvard. He is

also on the board as the former Chairman, lead outside

investor and cur rent Chairman of the Compensation

Committee of DynCorp. It is important to ask the question as

to why our congressman and senators, when they have had

Winokur in front of them and he was saying yahyah, they let

him get away with it? DA: I heard your comments on

Winokur in your interview with KPFA's Dennis Bernstein. The

DynCorp connection is big. With DynCorp providing

information via PROMIS to the DOJ---including the US

Attorney's offices, the FBI, and the SEC, Winokur,

presumably, has access to huge amounts of information,

including banking records and email, for all the members of

Congress. The suggestion here is he's the twentyfirst

century J. Edgar Hoover. Everyone is afraid of him. CAF:

Bingo! In later testimony, Winokur asserted ignorance of how

Enron's trading strategies were generating so much profit on

the California energy crisis. Winokur never mentioned that

as Finance Chairman he was required by the dictates of board

responsibilities---and the handsome sum of money he is

paid--to understand where significant profits are coming

from. He also failed to mention that he has a PHD from

Harvard in math specializing in complex systems theories, so

the implication that this stuff was all too complicated for

him and he can't be bothered to understand it is another dog

that won't hunt. DA: I saw a letter on the Internet to

William Powers from Congressmen John Dingell and Peter

Deutsch dated February 2, 2002. They are not blind to this.

They do question Powers about Winokur: And yet, Winokur was not taken off Power's committee.

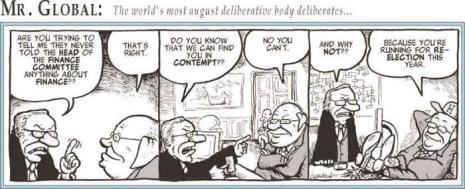

CAF: And throughout his testimony before Congress he

pleaded ignorance of everything---and for the most part

received only puffball questions. DA: In another excerpt

from this same letter, Dingell and Deutsch clearly place

Winokur in the mix with Michael Kopper and Andrew Fastow:

It is curious that Mr.

Winokur has received so little attention in the mainstream

press. His name is virtually never mentioned anymore.

CAF: Pug is a key player, but ultimately he is simply a

member of a syndicate that works together to make money.

Financial fraud---including insidertrading---is the most

profitable business on the planet. A fraud of this magnitude

can buy a lot of cooperation in any market. Perhaps we will

come to learn more about the syndicate as more links are

discovered between Enron, Tyco, Imclone, Global Crossing,

WorldCom, and other failed giants. Another player who is

worth studying is Jerry Hawke, the leading US bank

regulator. He worked for Robert Rubin as Jerry Hawke and

friend Secretary of Treasury, now, as we mentioned, cochair

of Citibank and a member of the Harvard Corporation. He also

worked for Larry Summers, Rubin's successor at the Treasury,

who is now President of Harvard. Jerry Hawke was promoted to

Comptroller of the Currency in 1998, which is the lead

regulator permitting all this offshore bank fraud to occur

uninterrupted by government regulation. But having Winokur

on the Power's Committee was like putting the fox in on the

early investigation--- just in time to review all the most

damning materials and the most damning employee testimony.

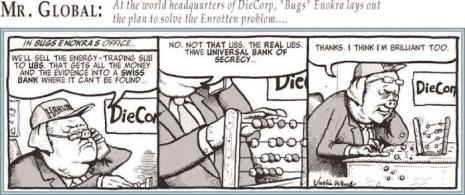

It's possible for a process like this to organize the

critical information necessary to perform the right

"surgery'' on Enron's institutional memory so that the cover

up design works. For example, this stuff gets shredded, this

witness dies mysteriously. In Part Six we learn about "Standard

Operating Procedure" for DOJ frame-ups, and are introduced

to the motherload of corporate malfeasance, $Billions

missing at HUD and $3.3 trillion dollars missing at the

Department of Defense.

Catherine Austin Fitts is the President of Solari, Inc. ( http://solari.com) and a former

Assistant Secretary of Housing – Federal Housing

Commissioner in Bush I. She is currently litigating with

Ervin and Associates (acting on behalf of the government )

and the Department of Housing and Urban Development. If you

would like to support her litigation efforts, you can

through Affero/ Venture Collective:

http://www.solari.com/vote.php ©opyright Daniel

Armstrong, March

2003 If my years working

on the clean up of BCCI and the S&L crisis taught me one

thing that I would communicate today to the shareholders,

retirees and employees who have been harmed, it is this:

people like those on the board of Enron absolutely make

money from insider trading, bid rigging and fraud, and they

do so with help from the highest levels.

-- Catherine Austin Fitts.

IMAGE: Enron

- Click Through To Original

Article

http://www.scoop.co.nz/mason/stories/HL0304/S00031.htm

Click Here for Part Two

http://www.scoop.co.nz/mason/stories/HL0304/S00035.htm

Click

Here for Part Three

http://www.scoop.co.nz/mason/stories/HL0304/S00063.htm

Click

Here for Part Four

http://www.scoop.co.nz/mason/stories/HL0304/S00088.htm)

Part

Two , Part

Three and Part

Four

)

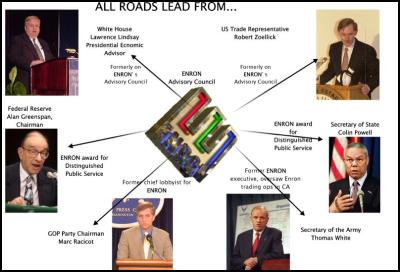

IMAGE: All

Road's Lead To Enron – Click To Enlarge

Graphic: J.

Ward

Click To

Enlarge

Click To

Enlarge

Click To

Enlarge

Click To

Enlarge

Click To

Enlarge As a

member of the special committee now responsible for

investigating the related party transactions between Enron

and the LJM1/LJM2 and other related partnerships, Mr.

Winokur is essentially investigating his own actions and

approving or disapproving the resulting report. You can

understand why disinterested observers might conclude that

the report's independence, or at least the appearance of

independence, has been compromised. [16]

Today's Wall Street Journal (Feb. 2)

reported that Mr. Winokur was also a member of Enron's

executive committee that approved the financial structure of

CHEWCO, an allegedly independent entity which would be run

by Michael Koppers, an Enron executive. The consolidation of

CHEWCO's debt onto Enron's balance sheet in 2001, due to the

fact that it was actually an affiliated entity, was one of

the reasons Enron had to write down $1.2 billion in equity

last October. [17]

IMAGE: Jerry

Hawke And Friend

ENDNOTES:

16 http://www.house.gov/commerce_democrats/press/107ltr132.htm

17

Ibid.

If this “Mapping the

Real Deal” was useful for you, you can leave comments and

send a gift to Catherine Austin Fitts and Scoop Media

through Affer:

http://svcs.affero.net/rm.php?skid=sp0

and receive

future columns for free by e-mail - see... Free My Scoop to sign up. ![]()

Eugene Doyle: The West’s War On Iran

Eugene Doyle: The West’s War On Iran Richard S. Ehrlich: Deadly Border Feud Between Thailand & Cambodia

Richard S. Ehrlich: Deadly Border Feud Between Thailand & Cambodia Gordon Campbell: On Free Speech And Anti-Semitism

Gordon Campbell: On Free Speech And Anti-Semitism Ian Powell: The Disgrace Of The Hospice Care Funding Scandal

Ian Powell: The Disgrace Of The Hospice Care Funding Scandal Binoy Kampmark: Catching Israel Out - Gaza And The Madleen “Selfie” Protest

Binoy Kampmark: Catching Israel Out - Gaza And The Madleen “Selfie” Protest Ramzy Baroud: Gaza's 'Humanitarian' Façade - A Deceptive Ploy Unravels

Ramzy Baroud: Gaza's 'Humanitarian' Façade - A Deceptive Ploy Unravels