The Real Deal About Enron (Part 1) - Introduction

Mapping the Real Deal…

The Real Deal

About Enron

... an interview with Scoop Real Deal Columnist Catherine Austin Fitts

Part One Of Seven Parts

By Daniel Armstrong*

Originally Published By Sanders Research Associates

[*Daniel Armstrong is a writer and novelist based

in Eugene, Oregon. Mr. Armstrong is a graduate of Princeton

University and attended the University of Oregon School of

Journalism.] What investment banker

Catherine Austin Fitts invariably emphasizes in her

discussion of global money flows is the extent to which

criminal proceeds play a part in the real world economy.

This should come as no surprise to anyone. Not after all

America watched their pension funds stripped away, while

dotcom CEO's pocketed millions of dollars in profits from

stock market "pumpanddump'' schemes. Not after energy

traders like Enron, Dynergy, and Reliant have been accused

of using the California energy crisis to manipulate the

market, causing vicious price hikes, rolling browns out and

power shortages. No. In this past year, our naiveté and

trust in Wall Street, perhaps the world in general, has

collapsed much like the World Trade Center did that fateful

September morning.

The world really isn't any different,

it's just that some of the veils have been shorn away, and

longtime Wall Street insider Fitts figures there's no sense

pretending innocence any longer. Tax evasion, insider

trading, drugs sales, black budgets, and terrorism are a

significant part of global economic dynamics. It's simply

how the money works in a financial system where so-called

creative accounting methods are as transparent as mud and

money laundering is part of the quantum mechanics of

financial law. "The Real Deal,'' as Fitts refers to her

straighton analysis of money flows, "is that financial

fraud, in all its wide variety of deceits, is the most

profitable business on the planet today.'' Based on her

eleven years experience on Wall Street and eight working

with federal agencies cleaning up HUD and several large

banking scandals, my guess is that Ms. Fitts knows what

she's talking about. The United States Department of

Justice estimates that $500 billion to $1 trillion in

criminal proceeds are laundered annually worldwide. It may

be twice that. And the Real Deal is you can't do accurate

economics if this isn't accounted for. Sums this

large---hundreds of billions of dollars, says Fitts, can

only be laundered into the system through Wall Street and

the central banking system. Companies like WorldCom, Tyco,

and Global Crossing. Banks like Citigroup, JP MorganChase and the New York

Fed. This isn't wild talk. We've heard it all in the

unraveling of the Enron web already. The largest banks do

the largest business transactions and they are the only ones

capable of disguising the underside of these vast financial

flows. This is curious and profound commentary from a former

Managing Director and board member for the elite New York

investment firm Dillon Read, Inc. and onetime Assistant

Secretary of HUD. When she looks at the Enron bankruptcy,

with her BCCI and S&L cleanup experiences to draw upon, she

aptly quotes Yogi Berra, not Paul Volcker, to describe what

she sees: "It's déjà vu all over again.'' Catherine

Austin Fitts began her career in 1978 at Dillon Read in

corporate finance and mergers and acquisitions. Eight years

later she became the firm's first woman Managing Director

and board member. Her success raising capital for the

renovation of New York's subway system, City University of

New York, and several other major projects prompted Business

Week to refer to her as a "Wonder Woman'' and generated a

reputation in financial circles that she could fix anything.

Fitts left Dillon Read in 1989 to join the first Bush

Administration, working as Assistant Secretary to Jack Kemp

at the Department of Housing and Urban Development with the

task of "fixing'' HUD and the Federal Housing Administration

and cleaning up the S&L scandals. In 1990, she was named to

the Securities and Exchange Commission's Emerging Market

Advisory Committee. A year later, President Clinton's

Treasury Secretary Nicolas Brady and Chief of Staff John

Sununu, asked her to be a governor on the Federal Reserve

Board and a member of the board of Sallie Mae. This was

heady stuff for a woman of forty. But she'd already started

her own investment bank and software firm, Hamilton

Securities Group, Inc and turned down the Federal Reserve

offer. In 1993, Hamilton Securities, Inc successfully won

a competitive contract bid with HUD to reengineer portions

of its $500 billion portfolio of mortgage insurance,

mortgages, and properties. While fulfilling its contract,

repackaging and auctioning off $10 billion of defaulted FHA

loans, Hamilton developed a package of software tools to

access publicly available online government financial

records. This included an online disclosure and bid

optimization system for the sale of defaulted HUD loans and

an easytooperate program called Community Wizard, which

allowed local users to create "placebased'' data bases to

track government money flows and facilitate business in

their own neighborhoods. Hamilton's efforts and loan sales

software would save the FHA funds billions of dollars and

earned Vice-President Al Gore's Hammer Award for

reengineering government. Also Community Wizard, perhaps

Hamilton's most powerful innovation, became the central

piece in prototyping a computerlearning center and data

processing service in the Edgewood Terrace apartment

building, as part of Fitts' idea to move neighborhoods from

government subsidy to entrepreneurial business through

private markets and investment. Following her very

successful career line, Fitts again was a shining light in

the dark world of federal credit and balance sheets. An

unforeseen sideeffect of online tools like Community

Wizard, however, was that while clearly showing how clean

money worked in neighborhoods, the software also showed how

the dirty money worked, inadvertently, providing a checks

and balances for the use of federal housing monies. Certain

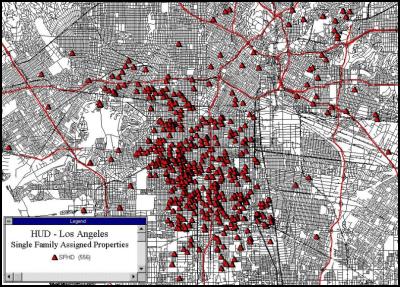

HUD problems became more visible. This included suspicious

patterns of high HUD mortgage defaults in the same areas

that were the target of CIA complicit narcotics trafficking

con firmed by CIA Inspector General investigations into the

so called "Dark Alliance'' allegations published by Gary

Webb and the San Jose Mercury News in the summer of 1996.

"These are the types of HUD mortgage scam that have been

popularized by The Soprano TV show," says Fitts, "and were

instrumental in combination with narcotics trafficking with

destroying my childhood neighborhood." The detailed

"placebased'' data provided the basis to estimate who had

been getting inside sweetheart deals or where fraud was

indicated. There were also many discrepancies in HUD's

books---later it became apparent that they ran into the tens

of billions of dollars. http://www.solari.com/gideon/legal/background/DesidnBk/place.htm

Bada

bing! Tony Soprano reinvents government,

HUDstyle http://stacks.msnbc.com/news/845423.asp?cp1=1

In Tony Soprano's mob

world, HUD exists to facilitate embezzlement, theft, and

extortion. Of course, this isn't what Congress intended when

it passed the Department of Housing and Urban Development

Act of 1965. The next thing Fitts knew she was under investigation by

the DOJ, FBI, and the HUD Inspector General in response to a

series of law suits filed by a HUD contractor Ervin

Associates whose servicing contracts and responsibilities

doing defaulted mortgage workouts had been displaced by

Hamilton's loans sales auctions. This began a process of

eighteen audits, investigations and inquiries as well as a

smear campaign to discredit Fitts personally and

professionally. For all its benefit to accounting clarity

and the efforts of honest people, Community Wizard's open

window to federal money and credit was not what the

politically inbred contractor fraternity wanted. Seven

years and all hell to pay later---she compares her life

during this period to that of the character played by Will

Smith in the movie Enemy of the State---Fitts and Hamilton

Securities, Inc emerged entirely exonerated from all

allegations of wrongdoing. More than that, it was proven she

had done a lot of good for the taxpayers and communities. In

these times, when honesty and accountability must be held at

a premium, Fitts' bold revelations into the holes in HUD's

books and several other federal agencies, as well as her

insights into the relationships between government and

banking syndicates, have made her more respected in serious

financial circles than ever before. Today Catherine

Austin Fitts is Solari, Inc, a pioneering investment

advisory firm aimed at bringing the power of investment

databases and equity finance to neighborhoods. That is,

she's out there with a positive vision, offering to all

communities what she prototyped at Edgewood Terrace in 1994.

Make no mistake about it. Fitts is all Wall Street

experience and straight-ahead common sense. She minces no

words bringing transparency to the now one-yearold Enron

fiasco. "I will bet the last dollar I have that Enron was

part of the largest laundromat of stolen and tax evading

dollars in American history and that the Department of

Justice's primary goal is cover-up.'' And, as the following

interview will attest, she's seen enough in her time to lay

out a pretty convincing

case. Click Here For Part two

In Part Two, the interview transcript

begins. Catherine Austin Fitts is the President of

Solari, Inc. (

http://solari.com) and a former Assistant Secretary of

Housing – Federal Housing Commissioner in Bush I. She is

currently litigating with Ervin and Associates (acting on

behalf of the government ) and the Department of Housing and

Urban Development. If you would like to support her

litigation efforts, you can through Affero/ Venture

Collective:

http://www.solari.com/vote.php ©opyright Daniel

Armstrong, April

2003 If my years working

on the clean up of BCCI and the S&L crisis taught me one

thing that I would communicate today to the shareholders,

retirees and employees who have been harmed, it is this:

people like those on the board of Enron absolutely make

money from insider trading, bid rigging and fraud, and they

do so with help from the highest levels.

-- Catherine Austin Fitts.

IMAGE: Enron

- Click Through To Original

Article

IMAGE: This is not Paul

Volcker

IMAGE: Community

Wizard

IMAGE: South

Central House Repos – Click for Big version

Source:

http://www.solari.com/gideon/legal/background/DesidnBk/lasfhd.jpg

Housing corruption: reality

TV?

James Gandolfini as Tony Soprano,

center, with Steven Van Zandt as Silvio Dante, left, and

Tony Sirico as Paulie Walnuts in HBO's hit television

series, 'The Sopranos'

Dec. 10 Credit Tony Soprano

with doing something no one for the past 37 years has been

able to do. He's taught millions of Americans that there is

a federal Department of Housing and Urban Development. And

he's shown how you can use it.

IMAGE: Enemy Of The

State

http://www.scoop.co.nz/mason/stories/HL0304/S00035.htm

If this “Mapping the

Real Deal” was useful for you, you can leave comments and

send a gift to Catherine Austin Fitts, Scoop Media and

Sanders Research through Affero:

http://svcs.affero.net/rm.php?r=Catherine&p=The_Real_Deal_on_Enron

and receive future columns for free by e-mail -

see... Free My Scoop to sign up. ![]()

Richard S. Ehrlich: Cyber-Spying 'From Lhasa To London' & Tibet Flexing

Richard S. Ehrlich: Cyber-Spying 'From Lhasa To London' & Tibet Flexing Gordon Campbell: On Aussie Election Aftershocks And Life Lessons

Gordon Campbell: On Aussie Election Aftershocks And Life Lessons Martin LeFevre - Meditations: Regarding Popes, Dopes And Hopes

Martin LeFevre - Meditations: Regarding Popes, Dopes And Hopes Binoy Kampmark: Fantasy And Exploitation | The US-Ukraine Minerals Deal

Binoy Kampmark: Fantasy And Exploitation | The US-Ukraine Minerals Deal Gordon Campbell: On The Aussie Election Finale

Gordon Campbell: On The Aussie Election Finale Martin LeFevre - Meditations: The Enlightenment Is Dead; What Is True Enlightenment?

Martin LeFevre - Meditations: The Enlightenment Is Dead; What Is True Enlightenment?