The Real Deal: The Money Lords Of Harvard

Presented by... http://www.unansweredquestions.org /

THE MONEY LORDS OF HARVARD: HOW THE MONEY WORKS AT THE WORLD'S RICHEST UNIVERSITY

by Catherine Austin Fitts

FROM: http://www.newsmakingnews.com/catharvardgazette9,23,00.htm

Our task is to look at the world and see it whole. - E.F. Schumacher

I.WHO RUNS HARVARD? How the Harvard Governance System Works.

We have not journeyed all this way across the centuries, across the oceans, across the mountains, across the prairies, because we are made of sugar candy. - Winston Churchill

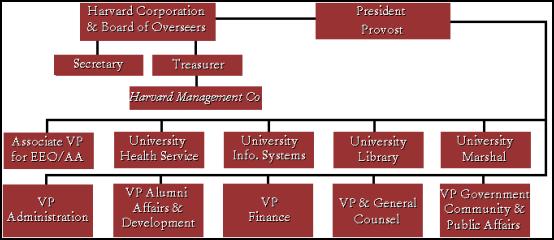

The governance of Harvard and its endowment are described on the University's web page by the following chart. Harvard University is governed by two boards: The President and seven Fellows of Harvard College, or the Harvard Corporation and the Board of Overseers. The Corporation is self-perpetuating, filling its vacancies itself, with the consent of the Board of Overseers. Overseers are elected by the alumni at large. Harvard Corporation oversees the Harvard Management, the company that manages the endowment, and Harvard College.

Departments in italics are separately incorporated. The President of Harvard is also a member of the board of the Harvard Corporation. The University Administration includes those departments under the President, Provost and Vice Presidents in support of University-wide functions.

Sources: http://vpf-web.harvard.edu/factbook/95-96/page2.htm and http://www.harvard.edu

II.

WHO'S WHO: THE PRESIDENT AND SEVEN HARVARD

FELLOWS.

Remember, remember always, that all of us . . . are descended from immigrants and revolutionists. — Franklin D. Roosevelt

Based on the last available list on the website, and updates, the President and seven fellows are:

Mr. Neil L. Rudenstine, BA (summa cum laude), Princeton, 1956; BA (Rhodes Scholar), 1959, M.A., Oxford University, 1963; Ph.D., Harvard, 1964. President, Harvard University.

Mr. D. Ronald Daniel, BA, Wesleyan, 1952; MBA, Harvard, 1954, DHL (Honorary) Wesleyan, 1988 Treasurer, Harvard College, 1989-present Member, Corporation Committee on Shareholder Responsibility Chairman, Harvard Management Company Member, the Executive Committee, Committee on University Resources Chairman, Board of Fellows, Harvard Medical School.

Professor Hanna H. Gray, BA, Bryn Mawr College, 1950; PhD, Harvard, 1957; Fellow of Harvard College, 1997-present; Overseer, Harvard, 1988-1994; Chair, Advisory Committee on Honorary Degrees, Harvard, 1997-present; Member, Joint Committee on Appointments, 1997-present; former Member, Committee to Review the Visitation Process; former Member, Committee to Visit the Department of History, 1989-1994 ; Judson Distinguished Service Professor of History, the University of Chicago; President , University of Chicago, 1978 -1993 .

Conrad K. Harper, BA, Howard University, 1962, Harvard Law 1965. Attorney with NAACP Legal Defense and Educational Fund , Simpson Thacher & Bartlett, associate (1971-74) and then partner (1974-93 ; 1996-date ). Legal advisor, U.S. Department of State , 1993-96 Former President , Association of the Bar of the City of New York (1990-92), Harper is a fellow of the American College of Trial Lawyers, a council member and second vice president of the American Law Institute, a member of the executive committee of the American Arbitration Association, and a trustee and former co-chair of the Lawyers' Committee for Civil Rights Under Law. He also has been closely associated with a number of international law organizations, serving, for example, as a member of the Permanent Court of Arbitration at The Hague.

Over the years, Harper has remained closely connected to the world of higher education. He has at various times served as a visiting lecturer at Yale Law School and at Rutgers Law School, as a member of the board of visitors at Fordham Law School and at the City University of New York, as a member of the board of the Institute of International Education, as a director of Phi Beta Kappa Associates, as a member of the board of managers of Yale's Lewis Walpole Library (18th-century British collections), and as a trustee of the William Nelson Cromwell Foundation (legal history). He is a trustee of the Metropolitan Museum of Art, and he served in the early 1990s as chairman of the executive committee and vice chairman of the board of the New York Public Library. From 1987 to 1992 he was chancellor of the Episcopal Diocese of New York.

James R. Houghton, AB, Harvard, 1958 ; MBA, Harvard, 1962 ; Fellow of Harvard College, 1995-present . Member, Joint Committee on Inspection, Harvard, 1995-present . Member, Committee on University Resources, Harvard, 1976-present . Member, the Executive Committee of the Committee on University Resources , Harvard. Former Member, Committee to Visit The College, Harvard, 1980-86 . Treasurer, Class of 1958, Harvard, 1958-present. Chairman Emeritus of Corning, Inc., where he served as Chairman and CEO from 1983 to 1996 .

Robert G. Stone Jr., AB, Harvard, 1945 (47) ; Fellow of Harvard College, 1975-present . Chairman, Joint Committee on Inspection, Harvard, 1985-95. Member, Corporation Committee on Shareholder Responsibility, Harvard, 1985-present (Chair, 1995-present.; Chairman, Committee on University Resources, Harvard, 1975-present . Member, 1945 Permanent Class Committee, Harvard. Former Chairman and CEO of the Kirby Corporation;

Herbert S. “Pug” Winokur, Jr. AB 1965 ('64) ; AM, 1965, PhD, 1967, Harvard. Fellow of Harvard College and Chairman and CEO of Capricorn Holdings, Inc. (See more detailed bibliography below.)

Source: Various pages at Harvard's website at http:www.harvard.edu

III.

WHO GETS TO PICK THE NEW PRESIDENT OF

HARVARD?

I've found that you don't need to wear a necktie if you can hit. — Ted Williams

On July 13, 2000, Harvard announced that it was starting a search for a new President. The press release follows:

The Harvard Corporation has announced the start of the search for a successor to President Neil L. Rudenstine, who recently announced his intention to conclude his service at the close of the 2000-01 academic year, after a decade in office.

Under the University charter, a new President is elected by the Corporation, with the counsel and consent of the Board of Overseers. As in the 1990-91 search that culminated in the selection of President Rudenstine, the search committee will consist of the six members of the Corporation other than the President, together with three Overseers.

The search will include broad outreach to solicit advice and nominations from members of the Harvard community and the wider world of higher education. Before and during the academic year that starts in September, it is expected that more than 300,000 letters will be sent to faculty, students, staff, alumni, and others soliciting their views of the University and its future as well as their counsel regarding the search. In addition, the committee plans to meet with a variety of individuals and groups, both within and beyond Harvard, in the months ahead.

“Our hope is to benefit from the perspectives and thoughtful counsel of a very broad cross-section of the University community as we undertake this task of extraordinary importance to Harvard's future,” said Robert G. Stone Jr., the senior member of the Harvard Corporation and chair of the search committee. “We encourage everyone who wishes to express a view to write to us. Your advice will be a vital element of the process.”

Correspondence regarding the search may be addressed to the Harvard University Presidential Search Committee, Loeb House, 17 Quincy St., Cambridge, MA 02138. The search committee will hold the letters in strict confidence.

The members of the search committee are:

Robert G. Stone, Jr., '45 ('47), chair, Senior Fellow of Harvard College and former Chairman and CEO of the Kirby Corporation;

D. Ronald Daniel, MBA '54, Treasurer of the University and a Director of McKinsey & Company, where he served as Managing Partner from 1976 to 1988;

Thomas E. Everhart, AB '53, Harvard Overseer and President Emeritus of the California Institute of Technology;

Sharon Elliott Gagnon, PhD '72, President of the Harvard Board of Overseers and former President of the Board of Regents of the University of Alaska;

Hanna Holborn Gray, PhD '57, Fellow of Harvard College and Judson Distinguished Service Professor of History at the University of Chicago, where she served as President from 1978 to 1993;

Conrad K. Harper, JD '65, Fellow of Harvard College, Partner at Simpson Thacher & Bartlett, and former Legal Adviser to the U.S. State Department;

James R. Houghton, AB '58, MBA '62, Fellow of Harvard College and Chairman Emeritus of Corning, Inc., where he served as Chairman and CEO from 1983 to 1996;

Richard E. Oldenburg, AB '54, Harvard Overseer, Honorary Chairman of Sotheby's North and South America, and Director Emeritus of the Museum of Modern Art; and

Herbert S. Winokur Jr., AB '65 ('64), AM '65, PhD '67, Fellow of Harvard College and Chairman and CEO of Capricorn Holdings, Inc. [Author's note: see detailed biography below.]

Source: Press release at Harvard's website at www.harvard.edu

IV.

WHO MANAGES HARVARD'S $$$$$

Omission is the most powerful form of lie. —George Orwell

Governance and Size: The Harvard Fellows oversee the Treasurer and the Harvard Management Company, which manage the investment of Harvard's endowment. The Endowment had a value of $14.5 billion as of June 1999. Click here.

(URL: http://vpf-web.harvard.edu/factbook/99-00/page38a.htm)

Harvard' s Endowment makes Harvard the richest university in the world.

Harvard Management Company has a board, members of which are not disclosed on the University website that we were able to locate, nor is there a link to a website for Harvard Management. Disclosure on the Endowment is limited to size and overall historical performance. The Endowment's investment activities and how these investments relate to a series of issues are not disclosed or discussed that we could identify. No provisions are described as to how investments relate to whom is donating money to the University, whom influences substantial government and private grants and contracts to the university and its affiliates, or the various public and private policy issues that the University and its faculty and staff are taking as its members cycle in and out of government or advising those who do.

Robert G. Stone, Jr. is chair of the Committee on University Resources and a former member of the Corporation Committee on Shareholder Responsibility.

The current Treasurer of the Harvard Corporation overseeing Harvard Management Company is Ronald Daniel, MBA '54, who is a Director of McKinsey & Company, where he served as Managing Partner from 1976 to 1988. ( http://www.mckinsey.com )

Because of Herbert (“Pug”) Winokur's role as a Fellow as well as a member of the board of Harvard Management, while co-investing with Harvard's Endowment, a more detailed biography regarding Pug, his company Capricorn Holdings, and his investment activities is provided several sections below.

Performance and Compensation: A 1998 article about Harvard's Endowment by the Boston Globe described Harvard's fundraising, investment operations and conservative payout of endowment earnings (that means a large portion of investment earnings and capital gains are reinvested in the endowment and available for new investments rather than being spent on ongoing educational activities of the University). A look at Harvard's payout ratio compared to that of other universities and endowments illuminates the degree to which the Fellows of Harvard are running both a university and an investment operation of influence in the capital markets globally. In an endowment operation, donations are tax-deductible and earnings can be compounded tax-free over the years in a powerful way, amassing great wealth over time. Click to read the article.

The Harvard Gazette in its September 23, 1999 article described the Endowment's performance over the prior period. Click to read the article. The endowment's overall historical performance information is also available. Click to view.

(URL: http://vpf-web.harvard.edu/factbook/99-00/page39.htm)

No information appears to be available on Harvard's website as to how Harvard Management compensates its in-house or out-of-house money managers, with the exception of one article describing the departure of equity manager Jonathon S. Jacobson, M.B.A. '87 (after he had been paid $6.1 million the prior year) along with the departure of Harvard Management Company's PrivateCapital Group. This article provides some information on performance based compensation policies at the time. Click to read the article.

(URL: http://www.harvard-magazine.com/issues/so96/jhj.millions.html)

Michael “The Insider” Eisenson

Alternative Investments: At that time, Michael Eisenson, head of Harvard's “PrivateCapital Group,” and about 30 colleagues formed a separate firm, Charlesbank Capital Partners. Mike Eisenson was the Harvard representative on the Harken Energy board and, and along with Harvard Fellow Pug Winokur, served on the boards of the National Housing Partnership (“NHP”) and WMF Group, Inc. (“WMF”) (the latter two companies representing investments in HUD housing and mortgage finance related assets -- see descriptions of NHP and WMF below) . A later posting for interns at the Harvard employment office states:

Charlesbank Capital Partners has recently been set up by the Harvard Management Company to invest in alternative investments including real estate. Charlesbank oversees $1.8 billion in real estate and private equities on behalf of the Harvard Management Company which invests on behalf of Harvard Endowment.

While Eisenson and Pug Winokur in their capacities as directors of these private corporations appear to have divested their respective portfolios of HUD housing and mortgage banking investments (selling NHP, Inc. to AIMCO in 1997 and selling the mortgage company, WMF Group, Inc to Prudential this year), Harvard appears to continue to be invested in Harken Energy.

Relationships with Policies Promoted by Harvard and Harvard Faculty: Harvard's Kennedy School has been active in housing and similar policy issues in Washington and with media leaders just as it has been with respect to Russian policies. At the same time, Harvard's endowment was investing in assets whose values were impacted by such policies. (Click to view the Kennedy School web site (URL: http://www.ksg.harvard.edu/ )

Let's Use Case Studies to Help Assess Performance: Harvard Business School has made famous the case study method of teaching. The idea is that to learn what is really going on, one should look at a few real events in detail. Below are three suggestions for potential case studies that students and faculty at Harvard Business and Harvard Law could research and use to look at the various issues related to the investment of a large endowment of a large and active University

Sources: Various articles provided at Harvard's website at URL: www.harvard.edu; see the Boston Globe article referenced above, Click , and Securities & Exchange Commission filings for Harken Energy, NHP, Inc. and WMF Group, Inc. Click here for SEC documents at Free Edgar, URL: http://www.freeedgar.com/ and, for subscribers, view Edgar-On Line at URL: http://www.edgar-online.com/

V.

CASE STUDY #1: GEORGE W. BUSH'S CONNECTION TO THE HARVARD

ENDOWMENT.

Image Source BartCop.com

Those who are awake live in a state of constant amazement. — The Buddha

The Harvard connections to the Bush family fortune through Harken Energy were revealed by Joe Conason in Harper's Magazine (February 2000) Notes On A Native Son: The George W. Bush Story. Click to read the article. (URL: (http://www.harpers.org/)

In his article, The Buying of the President 2000, Charles Lewis, at the Center for Public Integrity, also noted Harvard's role in Bush's success in the oil industry, adding new information on Harvard's possible role in facilitating George W. Bush's sale of his Harken stock: Click to read the article. (URL: http://www.publicintegrity.org/)

VI.

CASE STUDY #2: PUG WINOKUR AND HARVARD, HUD, THE WAR ON

DRUGS IN THE US AND COLUMBIA

Smug Pug (Herbert Winokur) – a.k.a The Cancer Man

The reputation of a thousand years may be determined by the conduct of one hour. - Japanese proverb

How I Met Pug: I met Mike Eisenson and Pug Winokur in the early 1990s when my company was performing financial advisory work with respect to the HUD related housing investments of NHP, Inc. and NHP's mortgage banking subsidiary, WMF Group, Inc. Their roles were members of the board and investors.

Some of my dealings with NHP -- and its opposition to community access to technology and private equity capital -- have been described in the first three parts of a four part series on one of my investments during that period, Edgewood Technology Services. See “The Story of Edgewood Technology Services - or How I Lost $100 Million Discovering Who Makes Money Making Sure the Popsicle Index Does Not Go Up” (http://www.scoop.co.nz/mason/stories/HL0207/S00101.htm ).

Community Access Down: The Edgewood story tells of an opportunity missed to make education, entrepreneurship and equity capital accessible at low cost to 63,000 communities in a manner that would benefit taxpayers, homeowners, communities and pension fund beneficiaries and other large and small investors alike. If ever there was a demonstration of why wealth is shifting to elites, this intentional effort to use taxpayers resources to deny citizens access to their own tools and knowledge was it.

HUD housing was my first experience in seeing what I thought to be highly professional equity investors ensure that harmful government policies were implemented to guarantee them capital gains.

Harvard Endowment Profits Up:

Harvard's capital gains, first on the sale of its interest in NHP in 1997, and then on the operation and sale of WMF, their HUD mortgage banking operation, were wonderful for Harvard and Pug Winokur's company Capricorn Holdings. However, it came at the cost of government policies harmful ---and unnecessarily so---to both taxpayers, homeowners and communities. What was most surprising to me was how much money taxpayers and homeowners had to lose to satisfy the private housing industry's appetite for short term capital gains, when alternative policies and business plans were available that could have ensured success for all concerned.

A review of the Harvard Endowment's performance in 1997, when Harvard and Pug Winokur's company Capricorn sold NHP, Inc., shows the highest capital gains increase (22.1%) in the Harvard Endowment since 1986. Click to view.

(URL: http://vpf-web.harvard.edu/factbook/99-00/page39.htm)

Given Harvard's description of its performance based compensation plan, the NHP sale would have generated generous bonuses for Mike Eisenson and his group. Since Capricorn is private, no information is available as to what impact the sale had for Pug and his partners individual compensation. Pug was also a member of the board of Harvard Management during this period.

Since we have no information as to whether Harvard is one of the investors funding Pug Winokur's investment partnerships at Capricorn, we do not know if additional profits flowed to Harvard or its affiliates through any investment they may have in Pug's investment partnerships.

Potential Conflicts of Interest Disturbing:

Each of t he regulators overseeing these operations (i.e., HUD investments) on behalf of taxpayers during this period, HUD Assistant Secretaries of Housing/FHA Commissioners Nicolas Retsinas and William Apgar, held a position at Harvard's Kennedy School of Government, in one case before service at HUD and in one case after leaving HUD. The relationships and exchange s of personnel among HUD, the Office of Management and Budget, which oversaw the HUD policies closely, the Clinton Administration and Harvard were numerous. Click to view HUD's website. URL: http://www.hud.gov) Click to view the OMB's website. URL: http://www.whitehouse.gov/OMB/

Potential Connections to Covert Operations Disturbing:

My surprise at Harvard's and Pug's conduct regarding their HUD investments was nothing compared to my surprise at the attempts of the Department of Justice (DOJ) and HUD to seize back $4.7 billion of HUD loan sales from Goldman Sachs and PNC, on an allegation that my company as financial advisor had engaged in insider trading with these bidders. This allegation had been found baseless by HUD's own auditors and was not mechanically possible given the design of the loan sales bidding process. Click to view the DOJ's web site. URL: http://www.usdoj.gov/

This situation offered me the opportunity to learn about the growing DOJ and HUD revenue generating enforcement operations through asset forfeiture and civil money penalties associated with the War on Drugs in neighborhoods financed and subsidized by HUD.

Is Harvard

Promoting Intentional Policies to Make the Rich Richer and

the Poor Poorer in North and South America?:

Pug Winokur through his position as Chairman of the board of directors of DynCorp and lead outside investor (Click. URL: http://www.dyncorp.com), played a leadership role in the “War on Drugs” at the Department of Justice because --among other things -- DynCorp served as the lead contractor to the Department of Justice's Asset Forfeiture Fund (Click. URL: http://www.usdoj.gov/criminal/publicdocs/11-1asof/11-1asof.htm ). This occurred while Pug was DynCorp's Chairman and the lead investor. See When Feds Say Seize and Desist by Kelly O'Meara published in Insight Magazine. Click. URL: http://207.238.36.125/archive/200008075.shtml

DynCorp has a $600 million government contract to provide support to the War on Drugs in Colombia, Peru and Bolivia. A year ago I attended a presentation of three women from Bolivia, Columbia and Peru who had come with a Philadelphia Women's group to meet with Congress to tell them the truth of what was happening in the War on Drugs in these countries. I asked them many questions about who got control of the land as they were moved off it by the US financed and advised military. Finally, one of the women asked me how I understood so clearly what was going on in their countries when I had never been there. My response: because apparently the War on Drugs and asset forfeiture process as it related to land and real estate accumulation by private investors worked the same in their countries as in mine.

That was before I learned that DynCorp was doing the knowledge management for enforcement and forfeiture operations as part of the War on Drugs in all four countries.

DynCorp had numerous contracts at DOJ. DynCorp had been one of the contractors who assumed responsibility for the PROMIS case management system at DOJ when the DOJ breached its contract with INSLAW.

PROMIS Allegation #1:

The use of Promis software to access worldwide banking records -- bypassing most if not all privacy laws and contractual agreements -- is alleged to have given the intelligence and enforcement agencies the power to stop most illegal drugs trafficking long ago.

If true, the Promis allegations raise powerful questions about the real purpose behind the “ War on Drugs” both in the US and Latin America. For more on use of drugs and HUD investment and enforcement to promote ethnic cleansing and real estate gentrification in the US, see my article “Former Bush Assistant Secretary for HUD Reveals “Ethnic Cleansing” Connected to CIA Drug Dealing in Los Angeles: Government Spends Millions in Campaign to Silence Former Wall Street Banker, Cover Up Connections to Dark Alliance Stories & CIA Inspector General Report on Drug Trafficking” in the May 1999 From the Wilderness. (http://www.solari.com/action/articles/index.htm#Former Bush Assistant Secretary)

All of Congressional and Administration failure to keep their promises to hold open hearings on the CIA's Inspector General's own admissions of drug trafficking in 1998 underscore the challenge before us to face how the money really works on some of America's most profitable businesses---drug trafficking, money laundering and arms trafficking. The Reagan-Bush Administration was systematically targeting homeowners and taxpayers to finance covert operations during Iran-Contra.

PROMIS Allegation #2:

The Promis allegations also raise powerful questions about who is accessing the HUD databases and systems and for what purpose as well as whether or not the Privacy Act is respected. As disturbing, is the question of what other government agencies are being accessed and by whom.

PROMIS Allegation #3:

The Promis allegations also raise serious questions about the transactional and ethical integrity of the global banking and financial system. (Click to read the Electronic Freedom Foundation's Archive re: INSLAW.

URL: http://www.eff.org/pub/Legal/Cases/INSLAW/ ).

Promis Allegation #4:

Finally, the Promis allegations raise whole new questions about Executive Order 12333 and the shift during the Reagan and Bush years of our national security intelligence infrastructure and technology into private hands through government contracting with firms such as DynCorp, as part of the events that have come to be referred to as “Iran-Contra.” (For a review of some of these events, see the Solari chronology at http://www.solari.com/action/chronology.html ).

Dyncorp's Role on HUD Information Systems:

DynCorp's role at DOJ in enforcement support and asset forfeiture was complemented by DynCorp's contracts at HUD:

- a subcontractor to Lockheed Martin

(Lockheed is listed as the largest defense contractor

in the US; DynCorp is listed as the 22nd largest by

Alexander Cockburn) (Click to view the

description of Lockheed) Lockheed manages the HUD

computer and information systems; and

- as of the year 2000, in charge of knowledge management and systems for the HUD Inspector General, who, through Operation Safe Home, is active with the DOJ asset forfeiture operations and those of the various US Attorney's offices that are active in this area around the country. This contract was awarded to DynCorp shortly after Harvard and Capricorn announced the sale of their HUD mortgage banking operation, WMF, Inc., to Prudential.

Is Harvard an Investor in DynCorp?

For those interested in seeing the relationship of the stock market, the federal government and our financial economic addiction to “cocaine capital” and warfare, Pug's career and many responsibilities and roles make for an interesting case study. Indeed, if Harvard Endowment is a investor in Capricorn, this raise powerful moral question about the University's role in the War on Drugs and possible role in the management and use of Promis software for Endowment gain.

Click here to read the “WHO IS PUG WINOKUR” DATA DUMP

Topics included:

I. PUG WINOKUR'S BACKGROUND. Click.

II. MORE ON THE PLAYERS IN PUG'S BACKGROUND. Click.

III. AREAS WORTH RESEARCHING. Click.

Sources: Securities & Exchange filings available at Edgar On-Line, Edgewood Articles available at www.solari.com, various articles on the Harvard Website at www.harvard.edu and websites of companies listed on Corporate Watch's website at www.corpwatch.org.

VII.

CASE STUDY #3: HARVARD, RUSSIA, BONY & THE RUSSIAN

MOB

FIRST you get the money, THEN you get the power, THEN you get the women. — Al Pacino in “Scarface”

Read Mike Ruppert's wonderful article in From the Wilderness on money laundering of Russian IMF funding and organized crime profits through the Bank of New York, “The Bank of New York Laundromat.” It is excellent background regarding US policies in Russia and US/Russia mutual money laundering in recent years.

(Click. URL: http://www.copvcia.com/bony.htm ).

For an overview of money laundering in America, one of America's most profitable financial sector, see Kelly O'Meara's recent article, Dirty Dollars. Click.URL: http://www.insightmag.com/archive/200005150.shtml

Anne Williamson's recent writings and testimony have spoken specifically to Harvard (Click to read. URL: http://www.zolatimes.com/V4.31/williamson_russia.html), to the Harvard Endowment's role (Click to read.) and to the extraordinary outflow of capital from Russia to the US during this period. The search function on Harvard's website can provide additional information on the specific Harvard faculty and staff mentioned. (Click to search Harvard's website. URL: http://search.harvard.edu:8765/).

Sources: From the Wilderness publications, Kelly O'Meara at Insight Magazine, Zola Times and The Wanderer of the National Catholic Weekly.

VIII.

SOLARI VOTING: WHAT CAN YOU DO

Leadership is a spiritual indication of the proper course of action.— Old Quaker Saying

As to the history of the Revolution, my ideas may be peculiar, perhaps singular. What do We Mean by the Revolution? The War? That was no part of the Revolution. It was only an Effect and Consequence of it. The Revolution was in the minds of the People... — John Adams

Did you go to Harvard?

Did a family member or friend or neighbor attend Harvard? Send him or her this NewsMakingNews' series on Harvard.

Do you participate in Harvard related lists servers or alumni or email networks? Send them this NewsMakingNews' series on Harvard.

What Harvard grads do you know who worked at DOJ, HUD, IMF, WTO, or the Bank of New York, or in the Clinton Administration or on Congressional Oversight Committees during this period? Send the NewsMakingNews' series on Harvard to them.

Do you or your family or your friends donate money or participate in alumni activities? Does your company recruit at Harvard? Does your agency or foundation invest in grants or contracts or subsidies with Harvard, whether the College, Harvard Business School, Harvard Law School, or the Kennedy School of Government or Harvard' s numerous affiliates?

If you engage with Harvard in any way, this gives you the ability to “vote” with your resources and to ask Harvard for the information you need to understand and make wise choices about how you can best invest in and support both Harvard and your values. Forward this NewMakingNews' series on Harvard on to those who participate with you in these activities.

At Solari we believe that we vote with our resources: how we spend our time, who we pay attention to, whom we give money to, whom we invest in, where we deposit our money , and so forth. Harvard University is a large network that receives support from --- and engages with --- many different places and people. That means it has many activities --- and often complex and both independent and interdependent operations --- and its leadership will value feedback on how it is doing.

If you would like to encourage Harvard to provide greater disclosure on how the money works at Harvard and Harvard Endowment, or to provide more information about the proposed Case Studies described above, or to provide mechanisms to help Harvard's leadership and staff ensure that Harvard's Endowment is managed according to what you believe to be the highest standards of fiduciary principles and stewardship, there are numerous avenues to express your thoughts and provide the Harvard leadership with useful feedback or requests in a positive manner.

For example, the decisions and actions of the President and the Fellows of Harvard are reviewed and approved by the Board of Overseers who---with 30 members--- are elected by the Harvard's graduates. As a result, they have the authority to influence policy based on alumnae initiatives and wishes. Why not email them a copy of the NewsMakingNews' series on Harvard?

For a description of the Board's Overseers structure and scope of governance, see http://www.news.harvard.edu/gazette/1999/02.25/overseers.html.

Based on various announcements on Harvard's website, we believe members of the Board of Overseers include:

Sharon Elliott Gagnon, A.M. '65, Ph.D. '72, President, a civic leader who is the former president of the board of regents of the University of Alaska, and of the Harvard Alumni Association.

Joan Morthland Hutchins (Past President)

Steven A. Schroeder,

M. Lee Pelton

Aida M. Alvarez,

Franklin W. Hobbs IV, former President, Dillon Read & Company

Patti B. Saris

Barbara Shultz Robinson

Thomas E. Everhart, AB '53, Harvard Overseer and President Emeritus of the California Institute of Technology;

Richard E. Oldenburg, AB '54, Harvard Overseer, Honorary Chairman of Sotheby's North and South America;

Doris Kearns Goodwin

Robert D. Reischauer

J. Michael Bishop

Woodrow A. Myers Jr.

Updated information on the Board of Overseers and its activities and meetings are available to all the Harvard graduates. Email addresses may also be available.

For communications with the various leaders of the University, including those responsible for fundraising, coordinating government grants and support and communication with alumnae, here are the most commonly requested addresses at Harvard: http://www.harvard.edu/help/noframes/faq12_nf.html

The only e-mail address I found posted on the Harvard website for any of the fellows or management involved in Harvard Endowment policies or investments was for Pug Winokur for those of you feel it is appropriate to e-mail Pug directly at bgrizzle@capricornholdings.com

Remember the first step in all opportunities is an open and honest conversation.

Harvard has a rich website that provides a great deal of information about Harvard and its operations and affiliations. Some time at their website would provide readers with lots of ideas on understanding and engaging with the many parts of the Harvard community. Our thanks and compliments to the Harvard webmaster for the large amount of disclosure that Harvard provides on the school and the Harvard community.

If you did not go to Harvard or connect with Harvard in any way, now may be a good time to take a look at the use of endowments and trusts at the school that you attended as well as those to which you have donated or those based in your area. You can do this by yourself, or with a book or investment club you participate in, or even link up with the many groups and list servers on the web focused on integrating our investment decisions with other aspects of our life and values.

In Leviticus in the Old Testament, it is said that we must take care of the land, of each other and of ourselves. Solari's mission is to help you find a way to make money and improve your performance goals by doing just that -- transforming your resources and the resources under your stewardship through alignment with a more integrated approach to our neighbors, our world and ourselves. If Solari can help you do that, let me know at catherine@solari.com.

Author: Catherine Austin Fitts © 2000 (All rights reserved) http://www.solari.com

Catherine Austin Fitts is the President of Solari, Inc. She is a former member of the Board of Directors and partner of Dillon Read & Company, a former Assistant Secretary of Housing in the Bush Administration, and President of The Hamilton Securities Group. Ms. Fitts is a member of The Economics Club of New York and the board of the Friends Select School. She is a graduate of the University of Pennsylvania (BA) and the Wharton School (MBA).

Jeremy Rose: Starvation Of Gaza A Continuation Of A Decades-old Plan

Jeremy Rose: Starvation Of Gaza A Continuation Of A Decades-old Plan Keith Rankin: The Aratere And The New Zealand Main Trunk Line

Keith Rankin: The Aratere And The New Zealand Main Trunk Line Gordon Campbell: On The Mock Horror Over Political Profanity

Gordon Campbell: On The Mock Horror Over Political Profanity Ian Powell: Predictable Smear On Senior Doctors

Ian Powell: Predictable Smear On Senior Doctors Binoy Kampmark: Trump, Planes And The Arabian Gulf Tour

Binoy Kampmark: Trump, Planes And The Arabian Gulf Tour Ramzy Baroud: Gaza's Graveyard Of Illusions - How Israel's Narrative Collides With Military Failure

Ramzy Baroud: Gaza's Graveyard Of Illusions - How Israel's Narrative Collides With Military Failure