Smoking Prevalence Falling Too Slowly

Smoking Prevalence Falling Too Slowly Says Smokefree Coalition

19 December 2006

The Smokefree Coalition is calling for an urgent increase in tobacco tax to speed-up reductions in smoking prevalence in New Zealand. The Ministry of Health today released its annual Tobacco Trends publication, which showed smoking prevalence at 23.5 percent compared with 23.4 percent last year. Large ethnic differences persist, with Maori and Pacific peoples having higher smoking rates than other New Zealanders.

Director Mark Peck says it is well known that people smoke more when tobacco and cigarettes are affordable.

"Despite strong tobacco control measures in this country - such as smokefree bars and restaurants - smoking prevalence is not reducing fast enough. This is because tobacco products have become relatively more affordable over the past six years - we haven't had a one-off increase in tobacco taxation since 2000. Meanwhile, real disposable incomes have increased, making cigarettes more affordable.

"The Coalition would like to see an immediate substantial increase in the taxation of tobacco, as well as regular annual increases in tobacco taxation. These increases must be significantly greater than any rise in the consumer price index. A significant proportion of the taxation revenue raised should go back into tobacco control to help people to quit and discourage young people from starting to smoke."

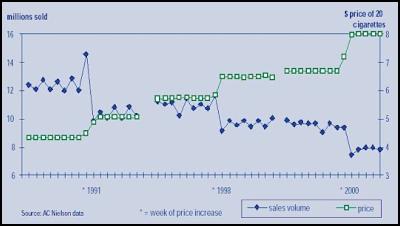

Mark Peck says past tobacco tax increases have had quick and dramatic results.

"There were large drops in the sales of cigarettes after the price increases of 1991, 1998 and 2000.

"On average, a price rise of 10 percent would be expected to reduce demand for tobacco products by about four percent in a country like New Zealand.

"Every year at Christmas time we have a big focus on the road toll - with around 400 people tragically dying on the roads each year. But let's not forget that over 10 times that many die annually from tobacco use - around 5000 people, many of them in middle age.

"The Government needs to put up tobacco tax or we will continue to see this massive loss of life."

--

Manufactured cigarette sales before and

after the Budgets of 1991, 1998 and 2000 (using data from

supermarket checkouts). From Tobacco Tax - The New Zealand

Experience.

The above graph clearly shows the large drop in the sales of cigarettes after tobacco tax increases in New Zealand in 1991, 1998 and 2000.

ENDS

NZFC: Apply For The New Zealand Film Commission’s He Kauahi Catalyst

NZFC: Apply For The New Zealand Film Commission’s He Kauahi Catalyst  Organ Donation NZ: Organ And Tissue Donation Helped Save And Improve The Lives Of Hundreds Of People In 2024

Organ Donation NZ: Organ And Tissue Donation Helped Save And Improve The Lives Of Hundreds Of People In 2024 Taupo District Council: Punarua Exhibition Arrives At Taupō Museum

Taupo District Council: Punarua Exhibition Arrives At Taupō Museum Office of Early Childhood Education: Teachers Are Paying The Price For Lack Of ECE Funding In The Budget

Office of Early Childhood Education: Teachers Are Paying The Price For Lack Of ECE Funding In The Budget Science Media Centre: Teen Dies After Controversial Tackle Game – Expert Reaction

Science Media Centre: Teen Dies After Controversial Tackle Game – Expert Reaction Howard Davis: The Amici Ensemble Provide A Master Class In Françaix, Fauré, & Brahms

Howard Davis: The Amici Ensemble Provide A Master Class In Françaix, Fauré, & Brahms