The Open Polytechnic of New Zealand Ltd, the nation’s specialist provider of online and distance learning, has developed interactive learning scenarios for secondary school pupils in a partnership with the Government-backed financial education programme Sorted in Schools.

Sorted in Schools, produced by the Commission for Financial Capability (CFFC), which also runs the sorted.org website, is a financial capability hub for secondary school students around New Zealand. Sorted in Schools aims to equip young New Zealanders with the knowledge and tools to make good decisions around money and money management.

Open Polytechnic was selected by the CFFC to turn three paper-based resources into interactive online resources for the Sorted in Schools programme to teach high school students about financial literacy topics such as budgeting and retirement saving.

Open Polytechnic Chief Executive, Dr Caroline Seelig, says the project is a good example of the way the organisation’s expertise in developing interactive digital courseware can be utilised for the benefit of New Zealanders.

“Sorted in Schools delivers key financial literacy resources for young New Zealanders. We are pleased we could offer our experience and skills in learning design and online learning delivery so Sorted in Schools can further the reach of their resources to engage young New Zealanders in learning about financial capability,” she says.

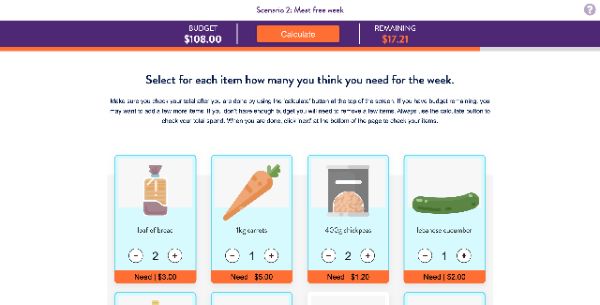

Open Polytechnic’s Digital Experience team has created two visually-engaging interactive learning tools for the Sorted for Schools website so far – Supermarket Shopper and Party Planner.

Both resources allow users to explore different pathways with the user’s decisions resulting in a positive reaction on their decision making or providing the user with a range of information to think through before their next attempt. This helps create an ongoing engaging experience for learners beyond the first or second attempts so that they can learn to achieve their goals within their budgets.

A third tool, the retirement savings online interactive, is under development and will teach schools pupils about how NZ Super and KiwiSaver work and the benefit of saving for the future. It will be created in both English and te reo Māori so it can be used for both the New Zealand Curriculum and Māori Medium Education.

The Commission for Financial Capability’s Director of Learning, Nick Thomson, says CFFC was impressed with the Open Polytechnic’s creative approach to the task of turning a paper-based exercise into an interactive digital resource.

“They brought to the table a lot of ideas that made our original resources even better. We’re confident that the interactives will enable students to not only learn about budgeting and saving, but how making good choices around money will improve their long term wellbeing,” he says.

The interactives will be included in teaching material for NCEA Levels 1 and 2 from June this year, enabling students to use them to gain credits toward NCEA.

The Supermarket Shopper tool and Party Planner tool are now available on the Sorted in Schools website, while the retirement savings tool will be available in mid-2020. To view the Supermarket Shopper tool go to https://bit.ly/3frZN4O to see the Party Planner tool go to https://bit.ly/3bkIz61

These tools are primarily aimed at a high school students and teachers but are useful for anyone interested in learning about how to manage money.

For more information on the range of education and digital services Open Polytechnic offers, head to http://bit.ly/2VsrpiG.

E tū: Bupa Roster Changes Put Residents And Caregivers At Risk

E tū: Bupa Roster Changes Put Residents And Caregivers At Risk Democratic Voice of Burma: The Resilience And Hope Of Myanmar’s People On Screen In Auckland Sat April 5

Democratic Voice of Burma: The Resilience And Hope Of Myanmar’s People On Screen In Auckland Sat April 5 NZSEG: Powering The Future - NZSE College And Royal New Zealand Navy Forge Educational Partnership

NZSEG: Powering The Future - NZSE College And Royal New Zealand Navy Forge Educational Partnership Courtney Duncan: Illness Prevents Duncan From Contesting First Round Of 2025 World Women’s Motocross Championship

Courtney Duncan: Illness Prevents Duncan From Contesting First Round Of 2025 World Women’s Motocross Championship GPNZ: Extended Skill Mix In Primary Care Teams Improves Patient Access And Outcomes

GPNZ: Extended Skill Mix In Primary Care Teams Improves Patient Access And Outcomes New Zealand Symphony Orchestra: Music Legend To Conduct Bach, Beethoven And Mozart With NZSO

New Zealand Symphony Orchestra: Music Legend To Conduct Bach, Beethoven And Mozart With NZSO