Carbon tax could lower emissions and GST

Carbon tax could lower emissions and GST

A new, powerful way of modelling

the impact of carbon pricing has been developed by

University of Auckland doctoral researcher Sina Mashinchi in

collaboration with experts at Cambridge University. It shows

how a carbon tax targeting emissions-intensive industries,

along with a revamped Emissions Trading Scheme (ETS), could

boost economic growth, with the extra tax generated used to

cut GST from 15 percent to 12.5 percent.

“I

wanted to show that we could move closer to our Kyoto

emission targets and still have good economic growth,”

says Mr Mashinchi.

A signatory to the Kyoto Protocol, New Zealand is committed to cutting greenhouse gas emissions by five percent below 1990 levels by 2020, and by half by mid-century. But in 2013, our emissions were up 21 percent from 1990 levels.

Currently, the ETS is the main economic tool in use here to lower carbon emissions. Industries start with a set number of carbon credits, and when they use them up through generating greenhouse gases, they have to buy more. This is meant to encourage practices that will lower emissions.

Critics argue that the ETS is hamstrung by its lenient application. The government gives freebies and two-for-one deals to many industrial emitters. And even though agriculture is responsible for half of New Zealand’s emissions, it’s entirely exempt from the scheme (which is true across the world). New Zealand has also bought many “junk” fraudulent credits from Eastern Europe.

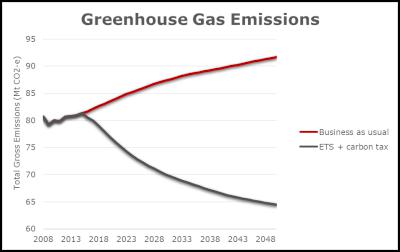

It’s widely recognised that the price of carbon credits, currently sitting around $17 per tonne, is too low to change behaviour. But the new modelling shows that even if the price was gradually raised to $300, we still wouldn’t crack our 2050 target with the ETS alone.

Mr Mashinchi argues there’s another basic problem: the ETS is based on a weak and ill-fitting model. The model he helped develop is more sophisticated and finely tuned to real New Zealand experience. While the model on which the ETS is based used only one year of data, this new model draws on 45 years of economic, environmental and energy data from 1970 to 2014.

“It shows how New Zealand reacted to global events such as the oil shocks and the Great Financial Crisis,” Mr Mashinchi says.

It also shows how New Zealanders responded to past policies, he says – not always as an economist might expect. The model that the ETS is based on assumes people act rationally, responding to policies and trends in predictable ways, “but people don’t always act rationally”.

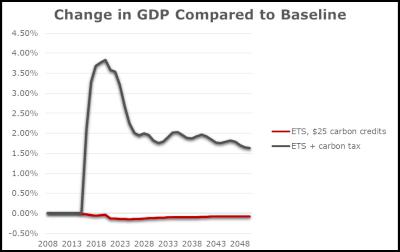

Mr Mashinchi experimented with mixes of a beefed-up ETS and a carbon tax. He found if the price of carbon credits increased to $75 right now, and rose by $20 a year from now on, and a carbon tax for non-ETS sectors was introduced and set at the same levels, the government could use the extra tax take to lower GST by 2.5 percent to 12.5 percent.

A business would either pay for carbon credits or pay a carbon tax – not both.

According to the modelling, this would stimulate the economy, encouraging investment in new technologies, energy efficiencies and public transport, which would create jobs. GDP would rise by an average 2.2 percent per year from 2016-2015, while emissions would fall 14.2 percent from current levels in 2030.

“This still falls short of our Kyoto target, but it’s a lot better than emissions going up,” says Mr Mashinchi.

Introducing a carbon tax is known as Environmental Tax Reform (ETR), something being tried in some form or another in places such as the UK, Germany, and Scandinavian countries.

“The idea behind ETR is very simple,” he says. “It’s about shifting tax from ‘good’ things to ‘bad’ things – from labour, income and investment to pollution and waste. This modelling shows it’s possible to boost GDP and the employment rate, and lower GST, through ETR in New Zealand.”

Despite the challenges ahead, Mr Mashinchi is upbeat. “We can’t blame our government over the ETS failing, because similar policies failed everywhere, and some countries haven’t even started. We should be optimistic about the future. This modelling shows us one economically viable way forward.”

END

Key

points:

• If we continue with business as

usual, greenhouse gas emissions will continue to rise under

the Emissions Trading Scheme

• New, sophisticated

economic and environmental modelling suggests a mix of

carbon tax and ETS set at much higher levels could decrease

emissions, boost growth, and fund a GST cut to 12.5

percent

• An individual business would either trade in

carbon credits or pay the carbon tax – not

both.

GfK Radio: Radio Listening Tops 3.5M Weekly Listeners

GfK Radio: Radio Listening Tops 3.5M Weekly Listeners  Jacob Douglas Motorsport: Douglas Heads To The Oval After Breakthrough Victory

Jacob Douglas Motorsport: Douglas Heads To The Oval After Breakthrough Victory Research For Maori Health and Development: Bridging The Gap In HIV Prevention For Māori - Insights And Resources Now Available

Research For Maori Health and Development: Bridging The Gap In HIV Prevention For Māori - Insights And Resources Now Available Tertiary Education Union: Weltec And Whitireia Cuts A Shocking Blow For Their Communities

Tertiary Education Union: Weltec And Whitireia Cuts A Shocking Blow For Their Communities PHARMAC: Pharmac Proposes To Fully Fund Nutrition Replacements For Some People With Crohn’s Disease

PHARMAC: Pharmac Proposes To Fully Fund Nutrition Replacements For Some People With Crohn’s Disease Nōku Te Ao: Bringing Together Voices On Mental Distress, Stigma And Discrimination Under One Roof

Nōku Te Ao: Bringing Together Voices On Mental Distress, Stigma And Discrimination Under One Roof