Aotearoa Property Prices Continue To Rise

New Zealand’s property prices have recorded an increase for the second month in a row according to Trade Me's Property Price Index for March.

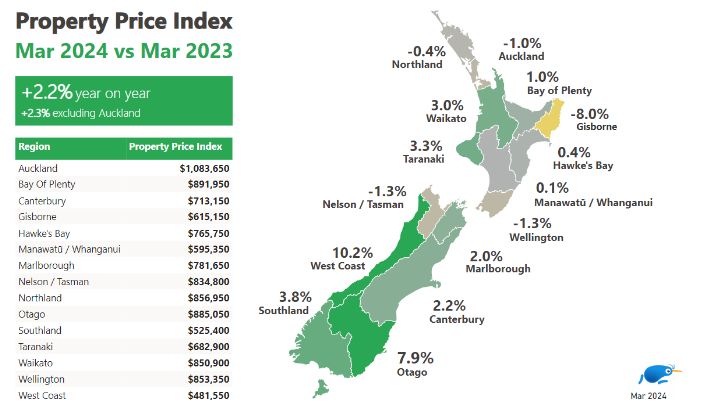

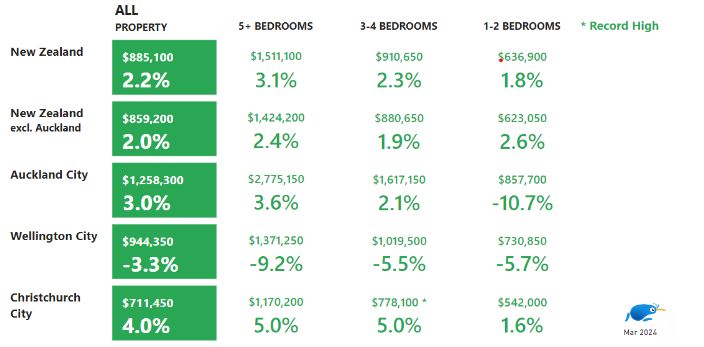

The national average asking price for a property was recorded at $885,100, up 2.2 per cent compared to the same time last year.

"It’s too early to tell if the prices will return to the highs we saw a few years ago, but consecutive months of increases is another positive sign for the property market," said Trade Me spokesperson Casey Wylde.

“We know from our State of the Nation report that 23 per cent of respondents that own a home have intent to sell within the next year and with inflation at its lowest point in almost three years this may also help more Kiwi consider buying a home, if we see interest rates start to come down - so overall this is welcome news for both buyers and sellers,” Wylde added.

Most of South Island records price rise

The increase in the average asking price was led by the South Island, where most regions experienced a hike in prices with the West Coast seeing the biggest increase again, up 10.2 per cent to $481,550.

Otago saw the next biggest increase up 7.9 per cent to $855,959 followed by Southland which recorded an increase of 3.8 per cent to $525,400.

When looking at the North Island, prices in the smaller regions such as Taranaki (3.3%), Waikato (3%), Bay of Plenty (1%) and the Hawkes Bay (0.4%) recorded minor increases while the other areas saw a drop in the average asking price.

“We are still seeing prices come down in the main areas of the North Island, for example in the extended Auckland region, there was a decline of 1 per cent, bringing the average asking price to $1,083,650. Meanwhile, the Wellington region saw a decrease of 1.3 per cent, with the asking price now at $853,350,” Wylde said.

Record high for 3-4 bedroom properties in Christchurch City

When looking at the major urban cities, property prices in Christchurch city are continuing to climb. The average asking price was recorded at $711,450, up 4 per cent year on year.

Properties with 3-4 bedrooms have reached a new record high of $778,100 which is a 5 per cent increase compared to the same time last year. Other sized homes also recorded an increase in the garden city. Properties with over five bedrooms increased by 5 per cent to $1,170,200 and smaller homes with 1-2 bedrooms rose by 1.6 per cent.

All property sizes in Wellington city witnessed a decline, with homes that have over five bedrooms dropping significantly by 9.2 per cent and 3-4 bedroom sized dwellings down by 5.5 per cent.

“Despite this buyers can still expect to pay over a million dollars for a larger property in Pōneke, the average asking price for a 3-4 bedroom house is $1,019,500 and that jumps to $1,371,250 when looking at places that have five or more bedrooms,” said Wylde.

"In Tāmaki Makaurau, buyers will be paying double than those in Wellington for over five bedrooms with the average asking price jumping by 3.6 per cent to $2,775,150,” said Wylde.

“However it could be a good time for those looking to downsize or purchasing a smaller size dwelling, after 1-2 bedroom homes experienced the biggest decline of all the house sizes across the city centres, with the average price now sitting at $857,700 after dropping by 10.7 per cent," highlighted Casey Wilde.

Supply and demand shows signs of narrowing

Interest in properties on the market rose year on year, showing a 7 per cent increase in February compared to the same time last year. This demand has spiked in regional areas such as Gisborne (26%), Northland (20%) and the Hawkes Bay (19%).

The nation’s housing supply has also gone up by eight per cent year on year, helping to balance out the demand for properties on the market. Northland recorded the biggest jump in the amount of properties available compared to March 2023.

“With supply and demand almost at an even point - it’s a really good time for those who are thinking of buying to start seriously looking at securing a property. We know from our recent survey that 27.6 per cent of respondents intend on purchasing a property this year, so it’s better to act sooner rather than later before the market becomes flooded with buyers,” said Wylde.

Mānuka Charitable Trust: Mānuka Charitable Trust Warns Global Buyers Of Misleading Australian Honey Claims

Mānuka Charitable Trust: Mānuka Charitable Trust Warns Global Buyers Of Misleading Australian Honey Claims  Engineering New Zealand: NZ Building System Needs Urgent Improvement

Engineering New Zealand: NZ Building System Needs Urgent Improvement GNS Science: Bioshields Could Help Slow Tsunami Flow

GNS Science: Bioshields Could Help Slow Tsunami Flow Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened

Transport and Infrastructure Committee: Inquiry Into Ports And The Maritime Sector Opened Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults

Netsafe: Netsafe And Chorus Power Up Online Safety For Older Adults RBNZ: 10 Cent Coin With King Charles III Image Now In Production

RBNZ: 10 Cent Coin With King Charles III Image Now In Production